- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Experian FICO 2 (Mortgage) Score Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian FICO 2 (Mortgage) Score Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

@Anonymous wrote:I just called Chase and asked how I could request that they report the new "zero balances" to the credit bureaus.

I was told that it could not be done manually - that I would have to wait until the normal credit card reporting cycle hit - which is 2+ weeks from now.

I have also called Experian 3 times today to try to take to a customer service rep there for some help/explanation. Each time I was put on hold and the call was dropped/terminated after a 15-minute wait. Very frustrating.

Bummer.

It's not true. Chase reports the zero balances AUTOMATICALLY within a day or two. The CSR was ignorant.

You're not going to be able to get Experian to change. If you have their Credit Watch or Credit Watch Premium, just pull your report daily. You'll get a nice surprise one day.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

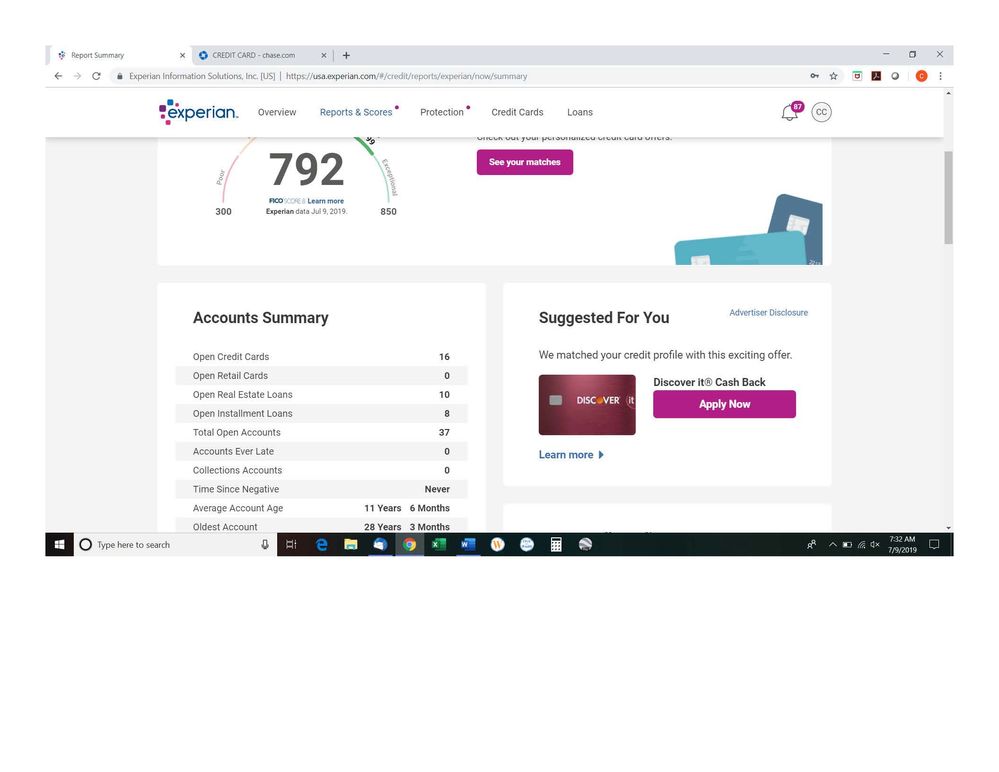

As the expert posters here suggested, the Experian credit reported updated overnight with 3 paid-off Chase credit cards.

My EX FICO 8 score is not up to 792 - but that darn EX FICO 2 score is still stuck at 719 - that is still 1point from what I need.

In case it provides any more insight, I have attached a summary shot of my EX CreditWatch page.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

I just called EQ. They told me that once they receive the "zero balance" data from Chase that it will take 30-90 days to show up in my EQ credit report. That sounds like misinformation, but who knows?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

@Anonymous wrote:I just called EQ. They told me that once they receive the "zero balance" data from Chase that it will take 30-90 days to show up in my EQ credit report. That sounds like misinformation, but who knows?

LMAO!!! That's just the sillyest response ever from a CSR that doesn't know anyhing about how credit works.

I mean your CR is spotless other than normal day to day activities. Scores are calculated based on the data provided at the time of the pull. No magic timeline of when updated data gets crunched as the CSR suggested.

There has to be some undderlying reason why... it's usually something silly like .01% being paid down on a TL to bring it into ideal range or switching up the scorecard from one to another by hitting a threshold of some sort.

So, SJ has already posted the more accounts reporting $0 adds points. Now, it's not realistic to payoff your balances but, hopefully the ones you did will be enough to get over that 720 hurdle.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

O-E and SJ,

Thanks for your help.

I still can't fathom that paying 3 Chase cards down to zero overnight didn't at least garner me 1 point in FICO Score 2.

I'll keep pushing until either I get across the line or until time runs out on me. LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

@Anonymous wrote:O-E and SJ,

Thanks for your help.

I still can't fathom that paying 3 Chase cards down to zero overnight didn't at least garner me 1 point in FICO Score 2.

I'll keep pushing until either I get across the line or until time runds out on me. LOL

Patience.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Bring some more accounts to zero if you can and try to lower the percentages on those cards below 48.9% below 28.9 if you can.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Looking back at some mortgage score you had in October 2018, 730+, 755, 719. Unless there has been way more utilization or new accounts, are you now down to 719 as your "middle" mortgage score, and need one point to qualify, or is the middle score (toss out highest and lowest to obtain) already over 720? This is what lenders will use in a tri-merge on your reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Yes, my current 3 mortgage scores are 713-747-719 - I need to get my middle score to 720.

My credit card utilization is much lower than it was back in October 2018 when I was at 732-755-719.

The last number (719) is Experian Score 2. In the past 10ish months it dropped once from 719 down to 709 and back up once to 719. I can't believe it doesn't change more often. The EX and TU mortage scores have changed dozens of times during that same time period.