- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Experian FICO 2 (Mortgage) Score Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian FICO 2 (Mortgage) Score Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

@Anonymous wrote:Yeah!!!!

Just obtained the new FICO 5-4-2 from myfico.com and they are confirmed as: 722-755-719.

That's what I need to get the deal I've been working for.

Thanks again to all here for your help!!!

Now life can go on and inadvertantly you got a middle of 720+ by killing the balance on the 2 Chase cards as surely the 3rd card didn't report yet. Once you're done with the deal it's a decision to either dig into EX and see why it's "frozen" at 719 or just leave it alone and just work with the other 2 and keep them up to snuff where they need to be.

Congrats and happy financing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

@Anonymous wrote:SJ - I'm fine paying for it.

Where do I go to do that? I can't do it at myfico.com - what other site should I go to in order to get the EQ FICO 5 score?

Thanks in advance.

MyFICO.com is where. Why can't you do it there?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

@Anonymous wrote:Yeah!!!!

Just obtained the new FICO 5-4-2 from myfico.com and they are confirmed as: 722-755-719.

That's what I need to get the deal I've been working for.

Thanks again to all here for your help!!!

Great.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Congratulations again I’m glad it worked out!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

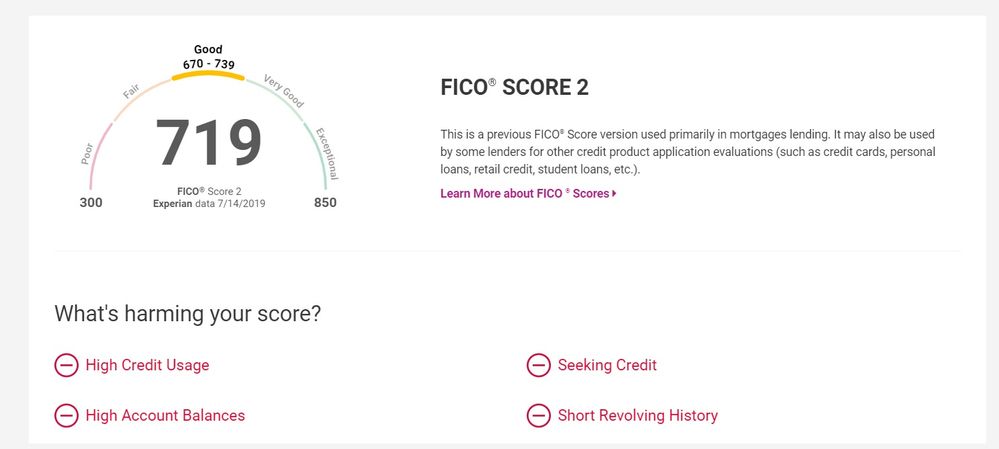

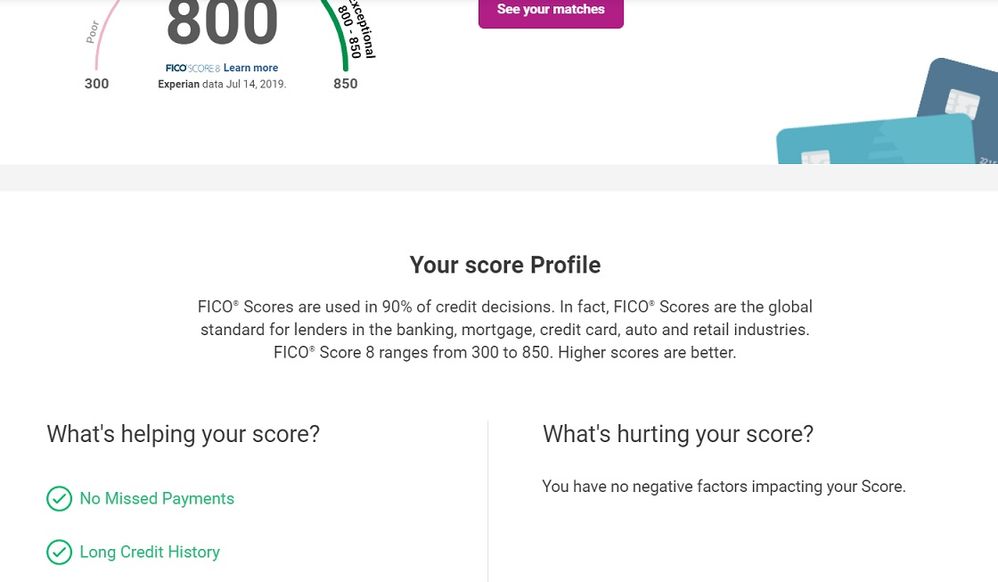

A quick update: As I continue to pay down credit card debit, my EX FICO 8 score is now up to 800 - and one of the top 4 postiive reasons for this is my "long credit history". The EX FICO 2 score, however, is still stuck at 719 - and one of the top 4 negative reasons for this my "short credit history". How in the world does that happen? Is EX possibly using a different data set to feed into their Score 8 algorithm that they feed to their Score 2 algorithm? I would be almost certain it has to be the same data - but, if so, how can the interpretation be so different?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

OK a couple pointers. First off, positive reason statements are meaningless. Ignore them. BBS would call them fluff. Plus, from my understanding, the negative reason statements for FICO 8 are nowhere near as good as the ones for the older models.

Exact same data set is fed into both algorithms, but the algorithms weigh things differently. What are your negative reason codes for EX2 in order please?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

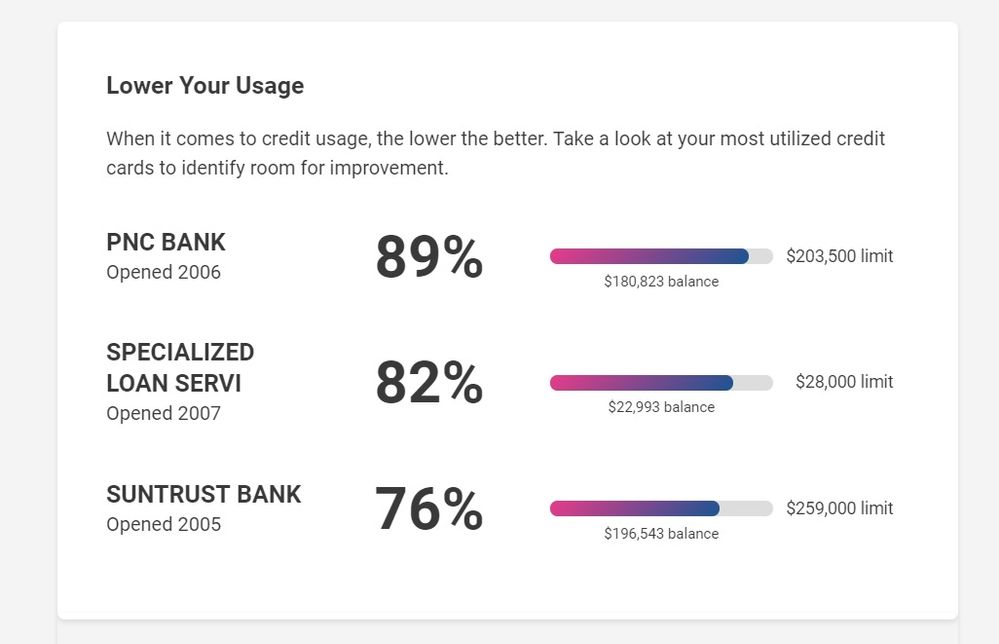

Birdman7 - Attached please find screen shots from experian.com addressing both my FICO 8 and my FICO 2 scores. Please note that, per experian.com, my oldest credit card account was opened in 1991, i.e., 28 years ago. That's a pretty long history.

A couple of notes:

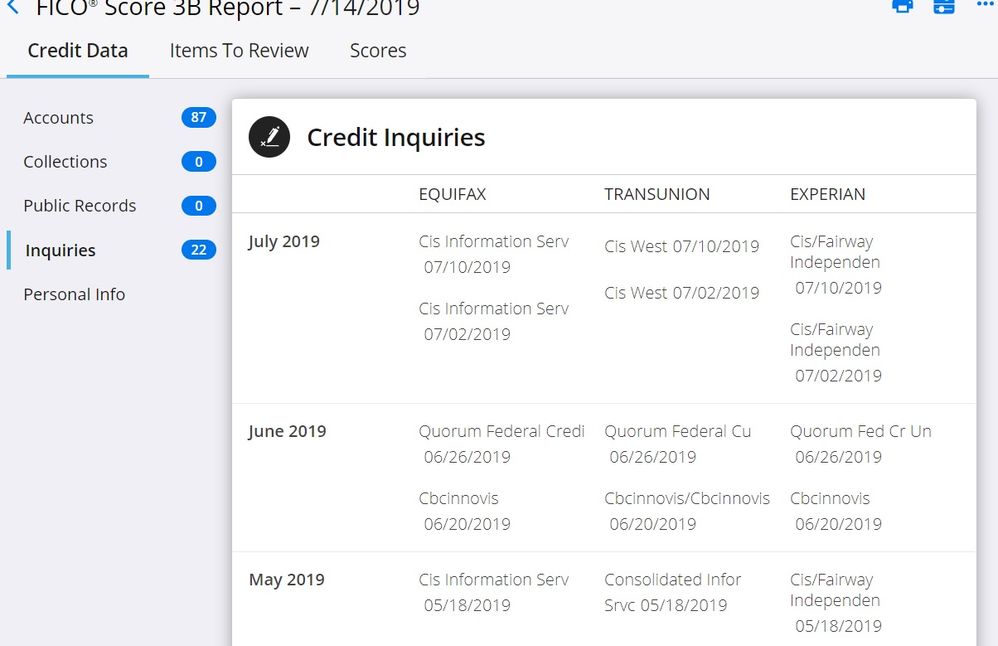

(1) There have been multiple inquiries over the past 60 days in reference to the mortage I am trying to close on this Friday - probably 6 inquiries at EX alone. Since those are all for the same mortgage and they all are withing a confined time period, how do they factor into the FICO 2 score? Seems like they hurt it pretty bad.

(2) Per one of the attachments, I have 3 HELOC accounts that were all opened 12-14 years ago (note they are all refered to as "credit cards". They were all opened as the 2nd "note" used to purchase real estate. No other drawas were ever made against them. Due to their age, no draws can be made. They are in a pay-down schedule now with a fixed interest rate, a fixed monthly payment, and a fixed duration - so they are functioning as a normally amortized 2nd mortgage. Yet, they are being treated/scored as credit cards. Is there a way to get the credit bureaus to score them as "real estate" loans and not "credit cards"?

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Here’s how it works about the mortgage inquiries. First there is a 30 day buffer before the inquiries are scored against your profile. In addition, there’s something called de-duplication that combines all the inquiries taken within a certain period of time. The Equifax and TransUnion mortgage scores have a 45 day window, but Experian only has a 14 day window. (It’s a 98 model.)

So, how many inquiries did you take where? And how far apart were they? Hopefully the credit pulls that you’re using for your mortgage were done before the buffer hit 30 days after the first inquiry on each bureau! If not, hopefully they were all done during the appropriate time frame so they only counted as only one inquiry each at each bureau.

As to your second question, I don’t know of any way of having the bureaus recognize those as installment loans, but maybe a more experienced member can chime in. But I can tell you this, that’s what was killing your scores probably.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Attached is my inquiry history - all those credit pulls are for this one real estate purchase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

@Anonymous wrote:A quick update: As I continue to pay down credit card debit, my EX FICO 8 score is now up to 800 - and one of the top 4 postiive reasons for this is my "long credit history". The EX FICO 2 score, however, is still stuck at 719 - and one of the top 4 negative reasons for this my "short credit history". How in the world does that happen? Is EX possibly using a different data set to feed into their Score 8 algorithm that they feed to their Score 2 algorithm? I would be almost certain it has to be the same data - but, if so, how can the interpretation be so different?

Yes the data is the same.

It's my understanding that positive reason codes (as opposed to negative reason codes) are not meaningful.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691