- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Experian FICO 2 (Mortgage) Score Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian FICO 2 (Mortgage) Score Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Yesterday I paid off:

CitiBank M/C

Barlcays Bank American Airlines M/C

Bank of America AAA VISA

Langley Federal CU VISA

I now only have a balance on a single credit card - a 22% usage on a Starwood/Marriott Bonvoy American Express.

Does anyone know if CitiBank, Bank of America, or Barclays Bank report "zero balance" credit cards overnight to the credit bureaus as Chase Bank does?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

However, You can request an off cycle update from Citibank. Frontline CSR may not be aware or willing, but a supervisor can or the account specialist team or credit bureau team can. As for the other two, idk, other members will have to chime in.

OK I counted those up for you. At both Equifax and TransUnion your inquiries from May 18, June 20, June 26, and July 2 should’ve been De-duplicated into one inquiry. And, you should’ve lost the points (if any) for the those on June 17th.

Then you should’ve been dinged for a second inquiry for the one taken on July 10 on Aug 9.

Experian is a different story and only has a 14 day de-duplication window. Consequently there you will be penalized for three inquiries. The one on May 18 counts by itself as one, then the inquiries from June 20, June 26, and July 2 will count as one, making two. And then the July 10 inquiry will count as the third. You should be penalized on June 17, July 20, and August 9 if at all.

So you’re getting dinged for two inquiries at Equifax and Trans Union and for three at Experian. This is if everything behaves as expected and published.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

The Experian FICO Score 2 (mortgage score) learning curve continues......

As my credit cards continue to be reported at zero balance (there are 2 left that were 50+% usage that are now zero that have not hit the bureaus yet), my Experian FICO 8 score continues to soar - it is now at 828 !!!

That being said, the Experian FICO 2 is still stuck at 719. From what others have hypothesized on this forum, and from what I can garner from the Experian site, the reason is that I have two large HELOC's that were used to purchase rental property back in 2005. The HELOC's are on those properties, i.e., used those properties as collateral. They are well outside the draw period - they are functioning now as amortized second mortgage installment loans - but they are stills being classified as "revolving accounts" per the 1998 algorithm. The balances are almost $200K each - so they are not candidates for a pay off. I wish I could re-fi them, but I am still upside down on those properties due to the crash of 2008.

So I guess I could conceivably end up with an Experian FICO 8 Score at or near 850, but still be stuck with a FICO 2 of 719. Very frustrating.

Just wanted to share this data point in case it helps anyone now or in the future.

BTW, the EquiFax FICO 5 is now at 764 and the TU FICO 4 is at 747 (with FICO 8's of 805 and 785, respectively).

I continue to be amazed at the difference in algorithms.

Also, for what it's worth, there is a small CU named TruWest that uses the HIGHEST of your 3 mortgage scores for its mortgage (incl. HELOC and traditional first and second notes) loans. This could some in handy if you have only one of the 3 mortgage scores that stands out (in a good way).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

I agree that the EQ5 and TU4 are heavily correlated (although not identical) due to the FICO 4 base and the EX2 is somewhat independent based on the FICO 98 base.

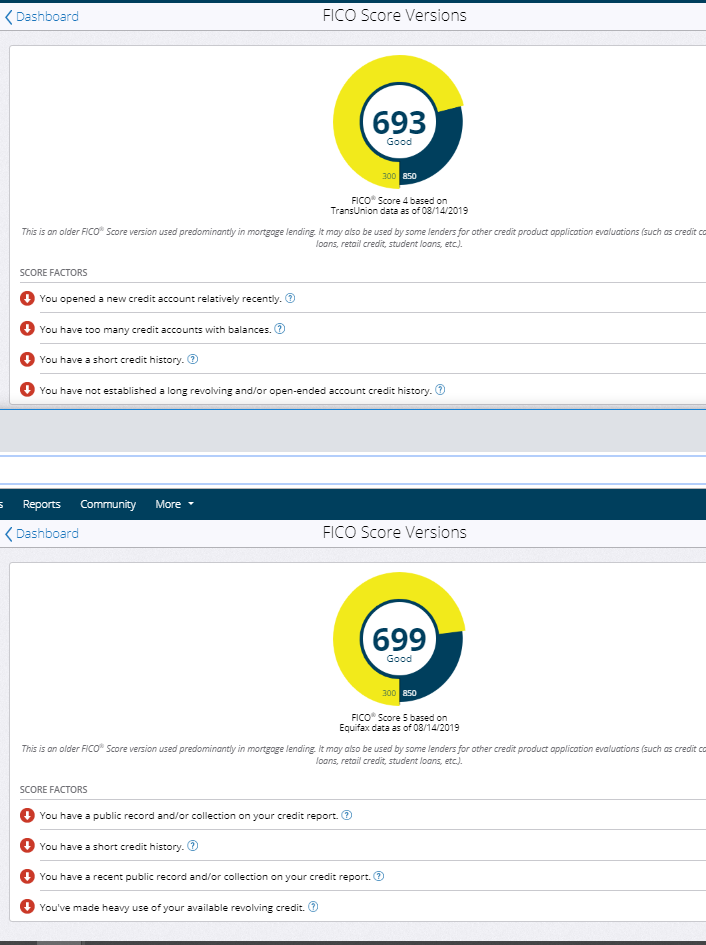

For what it's worth, a key difference I've noticed by reading other threads is that student loans in deferment are cosidered closed with EX2 but considered active with a monthly payment of $0 for EQ5 and TU4. I'm fighting this same battle as we speak. My TU4 is at 724 while my EQ5 is 699 and my TU4 is 693 (and I need mid-mortgage of 700). I will post more details shortly in a separate post.

By looking at your screenshots, I don't see any student loans but this could be a driver of the difference. I suspect that this would affect # of lines reporting $0, AAoA, installment utilization, etc.

The real driver for you is that EX2 is hardly effected by installment utilization (this excludes revolvers, such as credit cards). I know that EQ5 and TU4 are more harsh in their negative impact for high installment utilization. I wonder if there is a similar positive impact for favorable installment utilization % and something in your file is getting you some positive points with EQ5 and TU4. It seems somewhat plausible that if EX2 doesn't penalize as heavily for high installment utilization, then they perhaps would be as rewarding for favorable installment utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Here is another "need 1-more point" challenge for everyone. Go!:

I've read nearly every single post on all of these boards related to FICO 8/9 vs. Mortgage and FICO 98(EX2) vs. FICO 04 (EQ5 & TU4). I'm still stumped and need a bump on EQ5 or TU4.

As of 8/14/19:

FICO 5/4/2 FICO 5/4/2 Auto FICO 5/4/2 BankCard FICO 8 FICO 9

- Equifax: 699 710 723 729 748

- TransUnion: 693 669 697 730 749

- Experian: 724 726 719 730 746

Crucial information:

- Equifax has a <$100 collection ($87) that simply will not go away. This isn't present on TU or Experian.

- I have 3 closed auto loans that were paid off in April 2014, July 2018, and June 2019. TU provices a "Closed Date" for each of them but EQ and EX are blank. I can't tell if these closed installment accounts should be factored in to determine the denominator in calculating my % of accounts showing a balance.

- Auto Loan 30-day late payment(s):

- On EQ and TU, I have 2 older 30-day late payments from Dec. 2015 and Jan. 2016 on the auto loan listed above as paid off in July 2018.

- EX only shows a single 30-day late payment on this account in the "Older Derogatory Events" section from Jan. 2016. But, under "Payment Status", EX states "Paid account was 3 days past due two or three times."

- Under "Worst Delinquency"; EQ - "30 days past due", TU - "None Reported", EX - "30 days delinquent"

- I understand and can confirm that the mortgage scores are more sensitive to old activity whereas the newer scores are more affected by recent activity and aging activity is less impactful.

- I have several student loans that are in deferment.

- I understand that EX2 consideres these as "closed", where as they are active with TU4 and EQ5 and this is reflecting in my higher EX2 score.

- They are way above 100% of their original balance because I am pursuing a part-time, long-term Phd. The long period of deferral causes interest to accrue and increase the balance each month.

- If I took out a single student loan for an academic year, it is showing up as 3 separate student loans due to 3 different disbursements (fall, spring and summer). This wreaks havoc on my AAOA because I was opening a new installment loan 3 times a year. I'm in my capstone course now and there will be no more new student loans going forward, although the existing loans will continue to be deferred for at least another 18 months+.

- I have several AU cards because my wife and I try to prevent having separate finances to provide full transparency. Also, we both benefit in terms of FICO 8/9. For purposes of this discussion, I understand that these AU cards do not factor at all into the mortgage scores.

- I opened a Nebraska Furniture Mart card back in May of 2016 to take advantage of 0% financing. It was dumb. The loan type is listed as "charge account" and I'm not sure how this type of account in the file affects mortgage scores. I suppose it is considered a consumer finance account. The balance is $0, limit is $750, payment history is perfect and it is 38 months old. I'm not sure if closing this account would help mitigate any impact of it being a consumer finance account. I also wouldn't want to throw away the age, payment history and 0% utilization. I'm not sure if closing it would make any difference, good or bad.

Credit File:

Current Bal. Limit Util. % Age Payment History

Revolvers (Non-AU)

- Capital One Quicksilver 1 $195 (AZEO) $8,800 2.2% 23 mos. (1.9 yrs.) Perfect

- Capital One Quicksilver $0 $2,900 0% 41 mos. (3.4 yrs.) Perfect

- US Bank Skypass $0 $500 0% 51 mos. (4.25 yrs) Perfect

AU Revolvers

- AMEX $9,010 $20,000 45% 7 mos. Perfect

- Bank of America $0 $5,300 0% 180 mos. (15 yrs.) Perfect

- Citi Simplicity Card $0 $14,000 0% 35 mos. (2.9 yrs) Perfect

- Chase Slate Card $0 $11,800 0% 20 mos. (1.7 yrs) Perfect

Installment Loans

- Quicken Loans (Mortgage) $340,303 $346,750 98.1% 15 mos. (1.25 yrs) Perfect

- Capital One Auto $24,755 $25,425 97.4% 2 mos. Perfect

- Capital One Auto (Closed 6/19) $0 $14,721 0% 12 mos. Perfect

- Reg. Acc./BB&T (Closed 7/18) $0 $19,343 0% 63 mos. (5.25 yrs) 30-days late (twice)

- Santander Auto (Closed 4/14) $0 $20,902 0% 75 mos. (6.25) Perfect

- FedLoan (Student Loan) $7,287 $6,514 111.9% 23 mos. (1.9 yrs.) Perfect (Deferred)

- FedLoan (Student Loan) $8,921 $8,175 109.1% 18 mos. (1.5 yrs.) Perfect (Deferred)

- FedLoan (Student Loan) $85,277 $56,809 150.1% 137 mos. (11.4 yrs.) Perfect (Deferred)

- FedLoan (Student Loan) $12,539 $12,378 101.3 % 2 mos. Perfect (Deferred)

- FedLoan (Student Loan) $4,023 $3,751 107.3 % 14 mos. (1.2 yrs.) Perfect (Deferred)

Charge Accounts (Assumed to be "Consumer Finance Accounts")

- Nebraska Furniture Mart $0 $750 0% 38 mos. (3.2 yrs.) Perfect

Collections (Equifax Only)

- Elephant Auto Insurance - $87 $67 129.9% 36 mos. (3.0 yrs.) Unpaid; Cust. Disputes

Self-Reported Telecom (Experian Only)

- AT&T - 24 months perfect payment history w/ $231 Balance; Good Standing

Credit Inquiries

- One on 5/15/19 from Capital One Auto (~3 months old)

Summary

By my calculations (all exclude AU):

- My revolving (non-AU) utilization is 1.51% w/ AZEO.

- My installment utilization with closed accounts factored in as $0 bal due is 93.85%

- My installment utilization if I removed the close accounts from the equation is 105.07%

- My total utilization (revolver + install) including closed accounts is 91.58%

- My total open account utilization (revolver + install) excluding the closed accounts is 102.23%

- My number of accounts with balances excluding closed accounts is 8 of 11.

- My number of accounts with balances including closed accounts is 8 of 14.

- My negative mortgage score factors are in the attached photo.

Questions

Any suggestions on getting to 700 middle mortgage?

Are closed installment accounts considered in # of accounts with balances? AAoA?

If I paid off my lowest balance installment account to try to hit 7 of 14 (50%), would that give me the needed boost?

I'm quite certain that paying off all revolvers to get to 7 of 14 accounts with balances would hurt by eliminating any AZEO gains, correct?

Are there any known age breakpoints where my 3.5 year old 30-day late payment might become less impactful?

Do you think the $87 collection on EQ has my on a dirty card that is capped at 699

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

I believe collections under $100 do not count on version 9.

Where are you getting your data from that you can’t tell whether the loans are open or closed?

I can’t remember how charge accounts are factored on EX2, I think the credit limit is considered the highest balance reported. Hopefully other members will chime in.

The number of accounts with a balance is killing your mortgage scores.

Suggestions:

-Lower number of accounts with a balance.

-All accounts, open and closed, are calculated in AAOA.

-Yes, if you paid off all revolvers, the “no revolving balance penalty” would probably trump the one less account with a balance. -Ideally, I think you want 20% or less of accounts with a balance reporting, but there are multiple breakpoints, so even though you can’t reach that, you need to get as low as you can. Going under 50% would probably help.

-I do not think closed installment accounts with a balance are counted towards accounts with a balance, but I think they are counted toward utilization. I am not certain of that though.

- Again don’t quote me, but I believe breakpoints on lates are two years and then seven, I don’t know what versions that applies to or if all.

- It is possible your scorecard is capping your top score, yes.

- what is your AoYA at TU?

- do you have more than one public record on your Equifax CR?

- why is it saying high use of revolving credit at Equifax? I thought your revolving utilization was low?

- what is your revolving utilization including AU accounts? And yes those AU accounts are counting on your mortgage scores, so you need to zero them.

- i’m pretty tired and exhausted, I hope I got all that right, if not forgive me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Revolving utilization including AU is 14.37%. I need to get that to 8.9 if possible.

I’m 99.9 % that statement about collections under $100 counting only on mortgage scores.

No public records. There is only the $87 collection on EQ. There are no collections or public records on TU or EX. That negative impact statement is from that $87 only.

My AoYA on all 3 bureaus is my cap one Auto loan from May of this year (2 or 3 months). It sucks. My car was totaled and the other driver was at fault. Their insurance paid off my loan and I had to buy a new car. This is another, of many, reasons why FICO scoring is so dumb.

I need to research the following 2 items. I’ve read them in the forums somewhere but can’t recall.

-are closed, paid off installment loans included in # of accounts with a balance for TU4 and EQ5?

-what are the # of accounts with a balance breakpoints to TU4 and EQ5. Revelate had some great data points in a different thread. I’ll have to go find them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian FICO 2 (Mortgage) Score Question

Yes, under 8.9%.

No, the collection still counts on version 8. Version 8 discounts PAID collections; version 9 ignores "nuisance" collections, those under $100. Can you try a PFD?

What is your AoYA (not counting installment loans, revolver only)?

No, closed clean paid accounts don't count anywhere except AAoA and Thick/thin. Now if there's a balance, thats different.

Yes, Rev has done awesome work on that and I was helping test that recently, actually, among other things. Haven't had time to analyze all my data, but bottom one (optimized) was looking like 20% or 25%, I believe. I can't say exactly where they are, but every extra zero helps.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content