- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Experian always has a lower score!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian always has a lower score!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

OK well it would be hypocritical of me to say that others are not open minded if I myself do not exhibit the same attributes, so I tell you what. It's simple enough for me to go ahead and pay off all my balances because they're already very low and I purposely leave crumbs in there for my system and let's see if what you're saying is correct!

I will pick any random card I doubt that it matters and report back here in 30 days how's that? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

Payment history doesn't care, as long as you show at least one revolving balance (and in FICO 9 this needs to be a credit card explicitly) it simply doesn't matter.

Actually letting a balance report on all your revolving tradelines is a negative, I actually lose points in the algorithm if I have 1/3 of my cards reporting on EQ FICO 8, or 1/2 of my cards on EX FICO 8/TU FICO 8 (at least on my old scorecard, haven't tested it since some of my negatives have been whacked); even if you don't believe the copious amounts of data presented here and a few other places on the net, look at the mortgage industry giants (Fannie and Freddie) and their coming up with solutions to identify transactors to fix this: namely those that have balances on everything but are PIFing anyway... as they're being punished for no real reason credit wise, instead of than manipulating the FICO algorithm like I and many others on this forum ruthlessly do by having almost all of our revolving tradelines report $0. The lenders at least are aware that the risk difference between you and I is probably near zero (on the assumption we aren't missing payments) but if I have only a few revolvers reporting a balance, and you have say all of them, even if everything is absolutely line item identical, FICO will reward me. It's a bit silly, but it's basically as near as fact as we have given the large amount of anecdotal data around it... or test it if you don't believe me heh.

The current generation of algorithms doesn't look at any sort of trended data, your payments or balances in the past don't matter... it's whether or not you've missed two payments in a row or worse (30D+ late). VantageScore 4 reportedly looks at trended data, presumably to allievate the transactor issue the GSE's have lamented about and given the lockstep VS and FICO move in, FICO will probably implement it in FICO 10. The marketing release for VS 4 was actually pretty funny on that point.

Anyway throwing away all of the data as it exists on the net here and a few other places is beyond silly to the point of troll-like behavior: without data which hasn't been presented yet, color me skeptical.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

Always irritable when someone has an opinion different from everyone else's and as such labels them a troll.... or troll like... because they don't agree with everyone else.

Trolls don't write NOVELS as a reply or make dozens of posts, trolls enjoy bouncing in and out with crappy remarks and leave as abruptly as they joined, so I would think it would be absolutely ludicrous for anyone to read all my long winded posts and even come close to the conclusion that I am a troll!

Trolls also normally don't pay monthly fees so they can do such things...for MONTHS prior before making their first post.

Revelate I am not ignoring all of this data that you say exist, I am simply stating factual events that have taken place with my own personal credit scores and FICO scores and if the results happen to go against this data that you say exist, then so be it it goes against it, but the fact that there exists data that conflicts my results doesn't change or alter my actual results and it still happened all the same!

Everything that I wrote was based on my own personal credit experiences and to be honest I'm not really interested in what others have done with their own scores IF they're going to use it as some kind of proof that what took place with mine was not accurate and didn't actually take place, as I only know for an absolute fact what I have done with mine.

I will conclude in saying this last thing before disappearing for 30 days to see what is what, as

from this point it would just be more talk and speculation about something that we are going to find out shortly once and for all!

But I say this. Nobody but nobody actually KNOWS what's in those algorithms and I promise you they were written by near geniuses and programmers and software writers and mathematical wizards that are above ALL of our collective heads put together and when I hear someone dance and prance around acting as if they've got this down to a science, I immediately have a tendency to lean towards not believing them as I am smart enough to know that I don't really know what is in those things.

I am not smarter than the individuals who put those algorithms together and I am sure that like any other program there are constant updates, constant changes, constant tweaks and constant manipulation and based upon that I would not be sure of nor will I trust any existing data that could change in a heartbeat if the people who are manipulating the algorithms happen to make changes to them.

My way is the only system that I trust, is the one that I actually implemented, is the one that I actually used, is the one that actually produced my results and I know what I did to max out and fine-tune my scores so that they would peek at their highest peak and nothing that I read or hear or learn about from this point forward will, even if it's overwhelming data, will not override my actual results, because they were actual.

And I believe it's silly for me to produce positive results and then have overwhelming data come through that tells me those results should not have resulted the way they did... as I know for a fact that they really did... God that was confusing LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

??? Revelate did you delete your last post? I was responding to it but when I came up for air it was gone! Wish now had taken a screen shot...LOL Off to bed this time for real!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

@Anonymous wrote:??? Revelate did you delete your last post? I was responding to it but when I came up for air it was gone! Wish now had taken a screen shot...LOL Off to bed this time for real!

Yes. Until you post data and stop labelling us all as idiots presumably to pick fights, I will not be responding unless this clearly goes off the rails.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

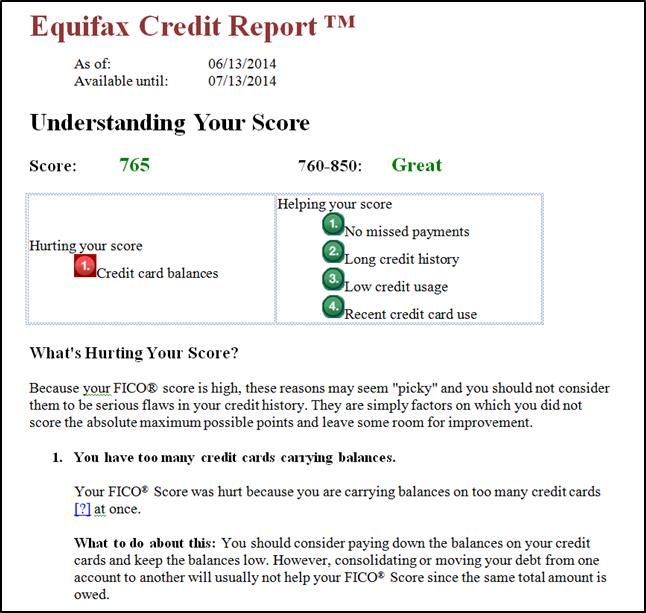

Pasted below is a summary of how my Classic Fico 04 and Bankcard Fico 8 scores react to # cards reporting balances. As shown, EQ Fico 04 shows a dramatic drop in Feb 2016 due to all cards reporting balances. In mid 2014 I also had 6 of 6 cards reporting balances and captured the impact on EQ Fico 04 in a Scorepower report. No question the nose dive relates to #/% cards reporting a balance as AG UT was under 6% both times.

Side note: When I report balances on 100% of cards (5 of 5) cards, Classic Fico 8 scores do not drop from 850.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

Plumber, if your scores went UP in going from AZEO or AZE2 to none zero (all with balances reported) then it was a coincidence and there were other variables at play that caused your score increase. Perhaps the timing of the score change gave your the perception that it was all your cards with balances resulting in the score increase. I and many others here however can assure you that isn't the case.

As you said, you're doing a test yourself and will have the answer in 30 days. Remember that these things should be tested a few times, probably in both directions a few times to get solid data, as again other variables at play could impact score a few points here and there which could skew data related specifically to number of cards reporting balances.

Using CCT, you can pull your scores each time a balance change reports and take note of any score change and how many cards at that time in your stack had a reported balance. We all look forward to hearing your results.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

This thread is locked and is under moderator review.

--UncleB

myFICO Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian always has a lower score!

@Revelate wrote:

@Anonymous wrote:??? Revelate did you delete your last post? I was responding to it but when I came up for air it was gone! Wish now had taken a screen shot...LOL Off to bed this time for real!

Yes. Until you post data and stop labelling us all as idiots presumably to pick fights, I will not be responding unless this clearly goes off the rails.

Since this comment has generated such a negative response, I will endeavor to explain it:

"But I say this. Nobody but nobody actually KNOWS what's in those algorithms and I promise you they were written by near geniuses and programmers and software writers and mathematical wizards that are above ALL of our collective heads put together and when I hear someone dance and prance around acting as if they've got this down to a science, I immediately have a tendency to lean towards not believing them as I am smart enough to know that I don't really know what is in those things."

That is a direct statement that others (and to be fair yourself as well in a self-deprecating fashion) are incapable of understanding the algorithm, presumably by being intellectually incompetent compared against the people who designed the algorithm. There may be no intellectual upper bound on human ingenuity or creativity, but the assumption that the rest of us are deficient (and therefore idiots) in comparison to the "near geniuses" is a nasty bit of sophistry. I'm not certain what you do for a living, but given I work around both software developers and individuals who have created similar algorithms for internal lender scores, I can assure you they're human just like the rest of us.

I will admit it was harsh and likely over the top and I apologize for that, but you've repeatedly simply dismissed other members' comments and continued to promote your own version of the narrative. It's possible you're Copernicus and the rest of us are still preaching the equivalent of the sun's orbiting the earth; however, statistically with the amount of data found here and elsewhere, that's an incredibly small chance. Possible, but I think you'll find we're not relying on faith as much as those promoting heliocentrism did.