- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO SCORE GOES DOWN 30 TO 40 POINTS

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

@Anonymous wrote:My FICO score went down today. EQ- 770 to 735 for no reason. TU- 752 to 713 again for no reason.

Nothing changed on my reports. Can anyone help me understand this. I have not had any changes at all for over 6 months and all of a sudden today it dropped 35 and 40 points.

Thanks.

The only thing that happened over the weekend was that a vendor tried to put a charge on my Cap One account. It was supposed to be $ 600 but they put it through as $ 60,000 so Cap One declined the charge. I called Cap one and the vendor and told them that it was supposed to be $ 600 and that the charge was OK.

Could the $ 60,000 declined charge have caused the drop??

Your score won't change unless your reports change. You need to look at the reports and look for differences. If you look hard enough, you should find a difference.

A declined charge won't change your score unless it resulted in a change on your reports.

Trying to guess at causes without any details will be impossible.

Lets start with some facts. Compare the two reports line by line and report the differences.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

I reviewed the two credit reports side by side and there were no changes to the report.

I have been reviewing my credit reports for over 5 years and I know when something changes.

There were no changes, so I have no idea why the 35 point drop.

I dont know what else to think.

I do not understand this rebucketing people are talking about.

The only change in the last 30 days was I paid off an installment loan from $ 2,670 to $ 0. But even then that was 30 days ago and I can't see why that would make my score go down.

I paid off the installment loan in late May. On June 3 it reported to the CRA. My score went from 773 to 770. My AAofA went from 5 years 9 months to 5 years 4 months.

Then on July 3rd my AAofA went from 5 years 4 months to 5 years 5 months and my score went from 770 to 735.

There were no other changes on my CR.

Like I said I have no idea what happened.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

@Anonymous wrote:I paid off the installment loan in late May. On June 3 it reported to the CRA. My score went from 773 to 770. My AAofA went from 5 years 9 months to 5 years 4 months.

Then on July 3rd my AAofA went from 5 years 4 months to 5 years 5 months and my score went from 770 to 735.

There were no other changes on my CR.

Like I said I have no idea what happened.

It has to be asked: Where are you getting your scores from?

I ask because FICO doesn't read X Years and Y Months for AAoA. FICO rounds AAoA down to the nearest whole number. And paying off a loan or closing an account will never ever make your AAoA drop because AAoA factors in all reporting OC accounts, opened or closed, good or bad.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

Those AAofA figures are from Equifax Score Watch CR. My scores are from Equifax and from My Fico so I know they are correct.

Don't know what else to do.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

Why would your AAoA drop, though? Even EQ's listing of AAoA includes all opened and closed TLs. I'd review your reports per the number of TLs reporting. I'd hazard a guess and say either an account was added or one fell off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

I went back and checked. 10 TLs on the prior report and 10 TLs on subsequent report. Same number of inquiries, same utilization, everything else the same.

I cannot figure out what happened. I'm at a loss. I anyone else can offer any advice I would appreciate it.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

I believe that a FICO score will always show AAoA as a whole number of years, rounded down. My AAoA is 9 years 7 months, which displays on a EQ FICO report as "9 years". Other credit reports (non FICO) that also use data from EQ will show AAoA as "9 years 7 months". I am guessing that you are not using the same EQ FICO reports to get all the data. It does seem that you are using EQ Scorewatch for at least the score part of some of this. Is it possible that you are using EQ Scorewatch to get your scores but not the full report?

Do you have a full EQ FICO report showing the 770/773 score and a later one showing 735?

I notice that you quoted an EX score, where you listed that all three scores (770, 752, 758). Were those from an EQ product other than Scorewatch that gave you "EQ scores" for all three CRAs?

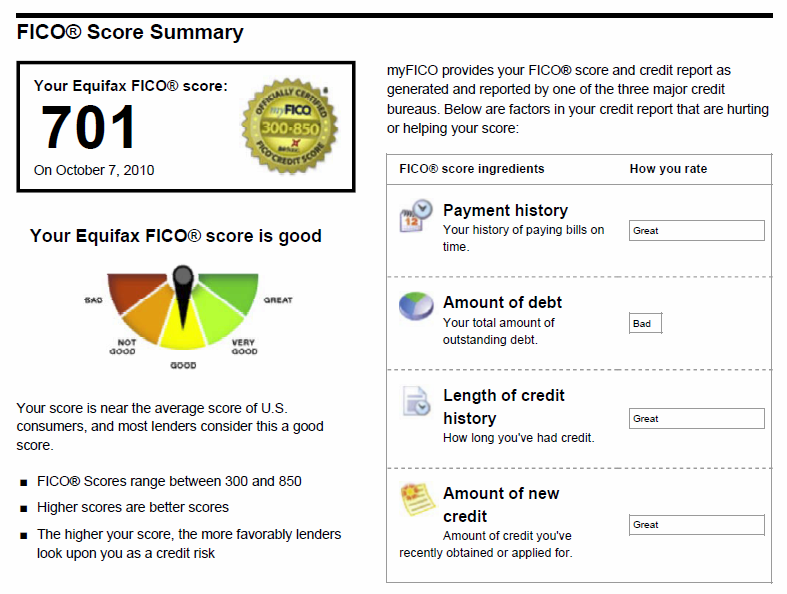

Can you post a snip of the title page of each that looks something like this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

I dont have the EQ My Fico sheet because I got those scores directly from Equifax. I assume its the same score as here correct?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

@Anonymous wrote:I dont have the EQ My Fico sheet because I got those scores directly from Equifax. I assume its the same score as here correct?

Maybe. Several months ago Equifax started selling their own proprietary "Equifax Credit Score" and that is NOT an EQ FICO score.

Equifax will still sell you a FICO score but you have to look very hard to find it. You can get to it here: www.equifax.com/web-myfico-products/

From a BK years ago to:

EX - 3/11 pulled by lender- 835, EQ - 2/11-816, TU - 2/11-782

"Some people spend an entire lifetime wondering if they've made a difference. The Marines don't have that problem".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE GOES DOWN 30 TO 40 POINTS

I believe OP indicated they have ScorePower, which is a product direct from Equifax which includes a true Fico score and report.

Hard to say what happened, but could have been a time-delay between the installment loan being paid off and finally being included in the Fico scoring. Having no installment loans any longer could have put you in a bucket with other individuals with a similar credit mix.