- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

All,

I hjave to get a mid score of 700 to get my Conventional Loan in January. I was there a few months back but opened up new accounts and inquries and took a dive below. I have went through the ingredients of MyFico model and I need your advice or input on where the point loss lies and if I can expect it to come back up.

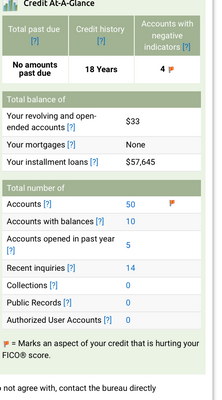

The first set is when I was at 701. Although every other score was lower..the mortgage score was higher.

Here I had 1 more negative account indicator. I had more than 1 revolver showing balances. I had 14 inquiries, 10 accounts with balances and 5 accounts opened within the year. All the factors were better with the exception of the 5 accounts opened within the year.

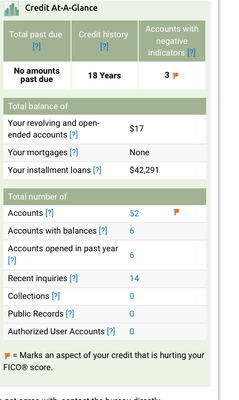

Here is the drop to 699

AZEO, Exceptional on Amount of Debt, Account with Balances down to 6.(3 student Loans, 2 Auto Installments, 1 Revolver), Removed a Negative account indicator, NEW ACCOUNT INCREASE to 6

Am I to assume with all the positive upticks over the two reports.. That 1 more Account opened in Past year will cause only Mortgage Fico to drop. At the turn of the December I will be back down to 5 accounts opened in past year as the 11/2019 account will have aged past a year. Interstingly, I have a report when my Accounts opened within the last year was 7 and midscore was 684. Does accounts within the past year hold that much weight????

@AllZero @Anonymous @AndySoCal

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

OP - new accounts are definitely discouraged if you are aiming for a mortgage for at least 1 year. Mortgage scores hate them. 2 years is ideal, but 1 year should be sufficient for scores to climb. They also hate high revolving utilization and that is something easier to fix if you have money and less time to work with, but based on what you shown above, it looks like that is not an option, as your utilization is low. I would steer clear from any more hard inquiries or new accounts until after you get your mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

@UpAndComing74 wrote:All,

I hjave to get a mid score of 700 to get my Conventional Loan in January. I was there a few months back but opened up new accounts and inquries and took a dive below. I have went through the ingredients of MyFico model and I need your advice or input on where the point loss lies and if I can expect it to come back up.

The first set is when I was at 701. Although every other score was lower..the mortgage score was higher.

Here I had 1 more negative account indicator. I had more than 1 revolver showing balances. I had 14 inquiries, 10 accounts with balances and 5 accounts opened within the year. All the factors were better with the exception of the 5 accounts opened within the year.

Here is the drop to 699

AZEO, Exceptional on Amount of Debt, Account with Balances down to 6.(3 student Loans, 2 Auto Installments, 1 Revolver), Removed a Negative account indicator, NEW ACCOUNT INCREASE to 6

Am I to assume with all the positive upticks over the two reports.. That 1 more Account opened in Past year will cause only Mortgage Fico to drop. At the turn of the December I will be back down to 5 accounts opened in past year as the 11/2019 account will have aged past a year. Interstingly, I have a report when my Accounts opened within the last year was 7 and midscore was 684. Does accounts within the past year hold that much weight????

@AllZero @Anonymous @AndySoCal

If you stop applying for things, your mortgage scores will creep up.

Whether it will happen by January or not, nobody knows.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

@AllZero wrote:Excellent advice as mentioned up thread.

How many open revolvers do you have?

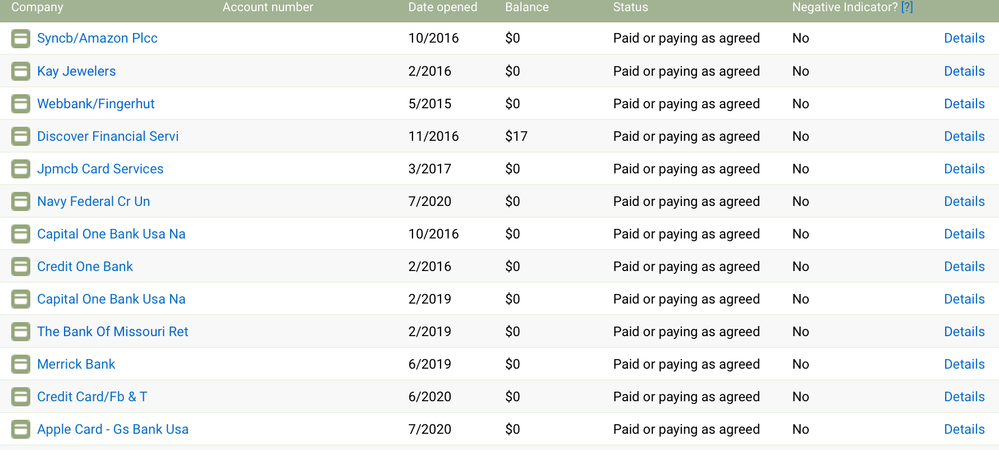

I have 12 open revolving accounts

How many are reporting a balance?

1 is reporting a balance(Discover. $17)

You may want to initiate AZEO or get to ~25% or below of revolvers reporting a balance.

Im there but went down to 699 with 3 new accounts opened. Just wondering if when they get to a year old..(Next month) should i get my points back.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

As I have stated in other posts there are two ways you can change your middle score. First forget the bureau with the highest score. Of the two bureaus that remain either raise score the bureau that has the middle score or raise the bureau with the lowest score above the bureau with the middle score.

My first focus would be on the first score reason about missing payments and or derogatory indicators there are three accounts. This score factor that is impacting your score the most. Is the reporting of those account(s) incorrect then address the issue with proof to support your point would be preferred. If I was going to start I would look at the account with the most recent missed payment first. The more recent the derogatory information is the more it impacts the score.

The fourth score factor regarding about the length of your revolving credit history is either score factor 12 or 30 in the link below.

The mostly likely score for that score factor is all the recently opened new accounts.

Discover 09/90 19,000, JCPenney 10/2008 4,700 US Bank Cash 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 15,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 Banking: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican CU

Pelican State CU Redstone FCU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

@UpAndComing74 I overlooked the first post were you stated you are at AZEO. So you are optimized on the utilization.

You mentioned you needed a mid score of 700. The image shows TU4 699. What are your EX2 and EQ5 scores? Based on your other post, are they EX2 729, EQ5 696?

You stated January 2021 is your application date. You will have to look at your reports to see if you can get points back from ageing thresholds:

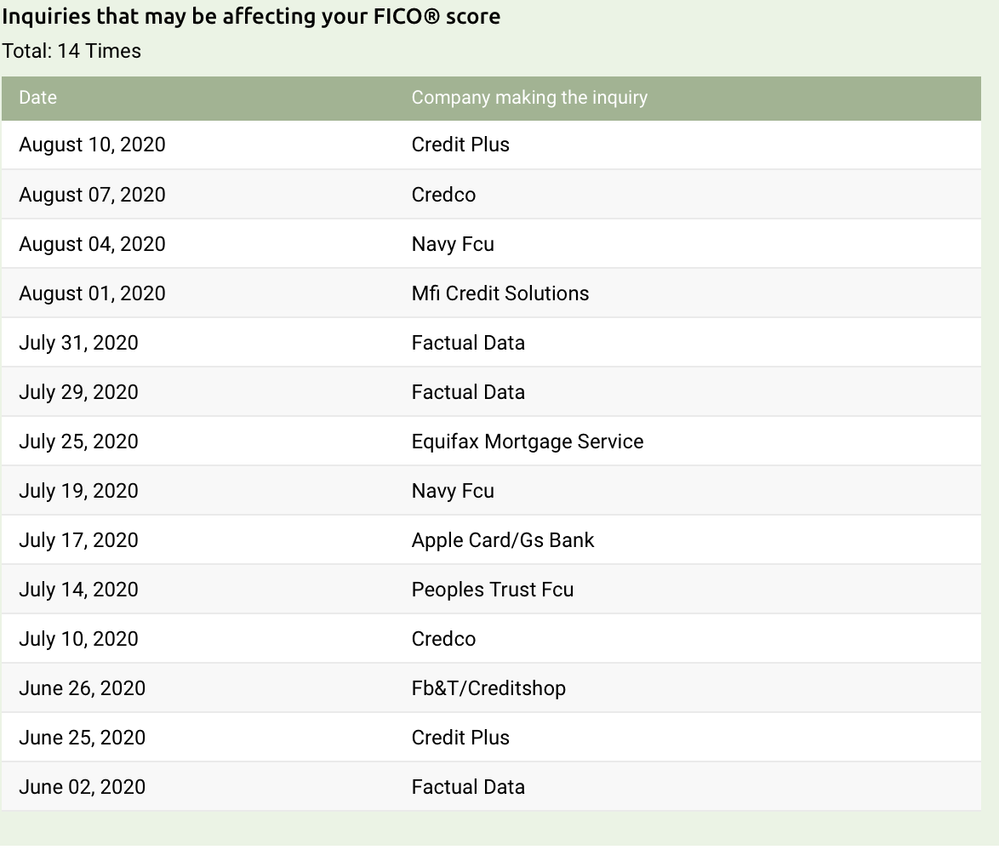

Hard Pull Inquiries - Depending on the bureau, do you have that are ageing to 365 days on or before your application date?

AoYRA - What is your AoYRA Age of Youngest Revolving Account?

@Anonymous mentioned, you may see score gain when you reach 6 months AoYRA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

@UpAndComing74 wrote:

@AllZero wrote:Excellent advice as mentioned up thread.

How many open revolvers do you have?

I have 12 open revolving accounts

How many are reporting a balance?

1 is reporting a balance(Discover. $17)

You may want to initiate AZEO or get to ~25% or below of revolvers reporting a balance.

Im there but went down to 699 with 3 new accounts opened. Just wondering if when they get to a year old..(Next month) should i get my points back.

Then you're in good shape in the AZEO Department ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

Thank you for your reply!!

@AllZero wrote:@UpAndComing74 I overlooked the first post were you stated you are at AZEO. So you are optimized on the utilization.

You mentioned you needed a mid score of 700. The image shows TU4 699. What are your EX2 and EQ5 scores? Based on your other post, are they EX2 729, EQ5 696?

Yes. Scores are 696. 699. 729.

Equifax still has a BK on it while the other two bureaus do not. So My goal is to try and attack the TU score and get ONE just ONE point!!

You stated January 2021 is your application date. You will have to look at your reports to see if you can get points back from ageing thresholds:

Yes, 1/102021 is when my BK has been discharged for 4 years and I apply Conventional. The ageing thresholds I see changing are Accounts opened in the last year. Currently at 5, Next month will be at 4. When at 4 in July I was at 701.

Hard Pull Inquiries - Depending on the bureau, do you have that are ageing to 365 days on or before your application date?

Unfortunately. Not 365 days. All Mortgage inquires(Except for 2 credit Card Inquiries within the last 6 months.

AoYRA - What is your AoYRA Age of Youngest Revolving Account?

I have:

Navy Federal opened 7/2020

Apple Card. opened 7/2020

Mercury Credt openeed 6/2020

Is 6 months 12/2020 or 01/2021. Do we count the month of opening?

All open Revolvers...

@Anonymous @AllZero

@Anonymous mentioned, you may see score gain when you reach 6 months AoYRA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SCORE SURGEON NEEDED! Gotta Get Mid Score of 700

@UpAndComing74 wrote:

AoYRA - What is your AoYRA Age of Youngest Revolving Account?

I have:

Navy Federal opened 7/2020

Apple Card. opened 7/2020

Mercury Credt openeed 6/2020

Is 6 months 12/2020 or 01/2021. Do we count the month of opening?

Jan 1st all the 2 most recent accounts will hit 6 months, meaning then your AoYRA will hit 6 months and you should hopefully see some points then. Stay at AZEO.

While your 3rd account that ages to 6 months on Dec 1st, it is not your youngest account, so you will likely not see points then since your AoYRA will still only be 5 months, points will be rewarded when you hit 6 months.

Maybe @Anonymous has some pointers for you.