- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO scoring on installment loans is anal

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO scoring on installment loans is anal

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Anonymous wrote:

I'm not 100% on this but I think One Main Financial codes as a "consumer finance company" and not a bank.

FICO unfortunately tends to penalize those companies because they're commonly payday loan or subprime interest companies.

Might want to see if others had a similar hit and if anyone can confirm they're a consumer finance company.

I think you might be right. Fico penalizes score for consumer finance loans because they see it as risk. This can also happen if a mortgage is re-financed. Both suggest, often mistakenly, that a person's funds are limited. Store cards that have 0% interest for 12 months based on a payment plan can fall in that category.

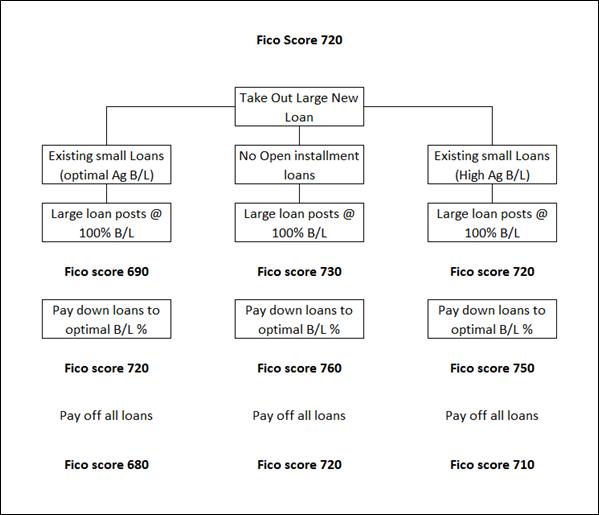

Below is an illustration of what might happen if someone takes out a prime installment loan. The impact on score is highly dependent on profile status before the loan. Don't count on these specific point changes. Other profile attributes have an influence.

Clarifications for the below chart:

1) The below behavior is based on the Fico 8 model.

2) When a loan 1st reports, a slight score drop may occur even if you had no installment loans on file. However, after 2 or 3 standard installment payments score should rebound and be slightly above pre-loan level (all other things being equal).

@3) The scores directly below large loan @ 100% are after making 2 or 3 initial payments

4) If existing small loans (high Ag B/L) was in the 50% to 70% range, adding a new large loan at near 100% B/L may actually result in a score drop to say, 710 as opposed to being neutral.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Anonymous wrote:Just a quick note here to add to the discussion. From what I've seen, maximum scoring benefit from having a current installment loan is realized (or nearly realized) far sooner than the loan reaching 9% utilization. This number could be somewhere in the 75%-80% utilization range. Once my installment loan utilization hit in the upper 70s percentage wise, I started getting positive reason codes stating, "substantial installment loan repayment."

My EQ FICO 08 score sits at 841 currently and that's with my AAoA being 7 years, AoYA of less than 1 year and 2 scoreable inquiries (less than a year old). I'm at 74% installment loan utilization right now. I would think with AAoA passing 7 years 8 months, AoYA crossing 1 year and scoreable inquiries dropping off that there's a chance I could hit 850... and that would be with 74% installment loan utilization.

I know it's difficult to try and quantify these things, but if going from having no installment loan present to having one appear on your report at 9% or less utilization (SSL technique) results in a 30 point gain, I'd venture to guess that paying down utilization to 75% or so may yield around 20 of those points.

What data points do we have out there on someone going from no installment loan present to having one report at 100%... or 99% (one payment made for example)? I would think the presence of the installment loan at 99% would yield a better score than no loan present at all, maybe 10 points gained? I wasn't into score tracking back when my installment loans first hit so I honestly have no idea about this.

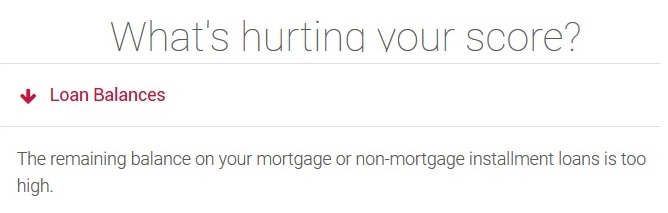

Well, here's what I see on my EX Fico, which prompted me to start this thread:

An here are the details of that "non-mortgage installment loan (my local small CU reports it as a secured loan, not specifically a car loan):

Payment Status Current

Status Updated Apr 1, 2017

Balance $5,617

Balance Updated Apr 30, 2017

Original Balance $10,000

Monthly Payment $175

Past Due Amount -

Highest Balance -

Terms 60 Months

Account Type Secured Loan

Date Opened Feb 1, 2015

Account Status Open

So, as of April 1 I had made 25 of the 60 payments and already have the balance down to only 56% of the original amount. But FICO 08 still considers the balance "too high". So, just a couple more years until I get that balance down to where it is acceptable. And that's my point: For the large majority of time in its existence an installment loan hurts your score, then you get a brief time when FICO likes the remaining balance and it helps your score, before your score is hurt again when paid off and you have no installment loans. As Mr. Spock would say: "That is not logical". .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@DaveInAZ wrote:

@Anonymous wrote:Just a quick note here to add to the discussion. From what I've seen, maximum scoring benefit from having a current installment loan is realized (or nearly realized) far sooner than the loan reaching 9% utilization. This number could be somewhere in the 75%-80% utilization range. Once my installment loan utilization hit in the upper 70s percentage wise, I started getting positive reason codes stating, "substantial installment loan repayment."

My EQ FICO 08 score sits at 841 currently and that's with my AAoA being 7 years, AoYA of less than 1 year and 2 scoreable inquiries (less than a year old). I'm at 74% installment loan utilization right now. I would think with AAoA passing 7 years 8 months, AoYA crossing 1 year and scoreable inquiries dropping off that there's a chance I could hit 850... and that would be with 74% installment loan utilization.

I know it's difficult to try and quantify these things, but if going from having no installment loan present to having one appear on your report at 9% or less utilization (SSL technique) results in a 30 point gain, I'd venture to guess that paying down utilization to 75% or so may yield around 20 of those points.

What data points do we have out there on someone going from no installment loan present to having one report at 100%... or 99% (one payment made for example)? I would think the presence of the installment loan at 99% would yield a better score than no loan present at all, maybe 10 points gained? I wasn't into score tracking back when my installment loans first hit so I honestly have no idea about this.

Well, here's what I see on my EX Fico, which prompted me to start this thread:

An here are the details of that "non-mortgage installment loan (my local small CU reports it as a secured loan, not specifically a car loan):

Payment Status Current

Status Updated Apr 1, 2017

Balance $5,617

Balance Updated Apr 30, 2017

Original Balance $10,000

Monthly Payment $175

Past Due Amount -

Highest Balance -

Terms 60 MonthsAccount Type Secured Loan

Date Opened Feb 1, 2015

Account Status Open

So, as of April 1 I had made 25 of the 60 payments and already have the balance down to only 56% of the original amount. But FICO 08 still considers the balance "too high". So, just a couple more years until I get that balance down to where it is acceptable. And that's my point: For the large majority of time in its existence an installment loan hurts your score, then you get a brief time when FICO likes the remaining balance and it helps your score, before your score is hurt again when paid off and you have no installment loans. As Mr. Spock would say: "That is not logical". .

Yes, 56% B/L for non mortgage loans is high. You may have received some points when your B/L dropped below 70%. However, there are still points to be had by further reducing B/L. The magic B/L for auto loans is under 9% at which time you should get all available points for that category.

Given you have 25 months of payments and B/L is below 70%, your score should already benefit from the installment loan.If you have no other open installment loans, paying off the loan now may drop your score 15 to 20 points. However, continuing to pay down the loan will boost score further - possibly an additional 20 points once your B/L is below 9%.

The takeaway from "Too high" should be there are additional points available on the table to be had, not that the loan is hurting your score (relative to not having an open loan).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

Yeah, my installement loan utilization includes a mortgage. 1 mortgage, 2 auto loans. Both of the autos are paid down to about 50% and 30% utilization, where the mortgage is around 79%. Since the autos represent a very small percentage of dollars relative to the mortgage, aggregate utilization lands at about 74% utilization. Paying down the 30 year mortgage to 79% though took about 8 years. As TT was saying above, perhaps length of time is somehow factored into the equation. Certainly a large portion of principle balance was paid down [relative to auto loans] on that mortgage over those 8 years, about $40k or so, which I suppose can be considered a "significant" amount of installment loans being paid back.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Thomas_Thumb wrote:There is zero likelihood that thresholds for installment loan B/L above 9% do not exist. Poster reporting non trivial score increases when thresholds above 50% are crossed are not uncommon. Links to those posts have been provided in prior threads. Frankly, I have yet to see anyone report a score increase when an open mortgage with multi-year payments is part of aggregate B/L and the aggregate B/L crosses below 9%.

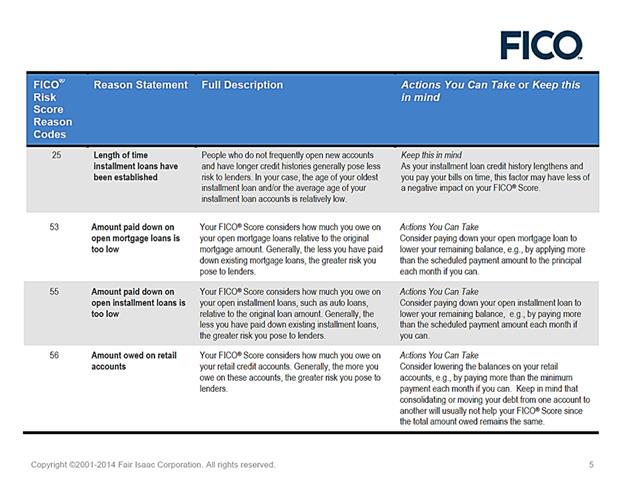

Pasted below is my thought on how payment history may come into play for Fico 8 non mortgage installment loans. The point changes are for representation only. The takeaway is rapid paydown of a loan is a shortcut to gaining points that may otherwise come from a prolonged payment history.

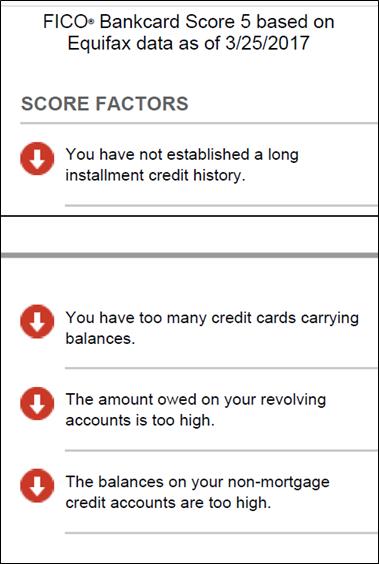

It is also clear that installment loans are differentiated by type as indicated by specific reason codes and on 3B reports where there is a mortgage accounts section separate from the installment accounts section. [I have a 15 year mortgage with 11 years payment history but NO installment category credit history due to not having any other type installment loans. Also of interest is balance on your NON-MORTGAGE credit accounts is too high. I pretty sure the 3rd and 4th reasons relate to my AMEX B/HB and my AU card.]

More than a few posters have reported 850 scores with open mortgages & aggregate B/L above 50%, myself included. This again supports the presence of higher thresholds.

Here is what I see based on MyFico posts and other sources of data:

1) The presence of an open mortgage influences scoring associated with crossing aggregate B/L thresholds.

2) Open loans with "long term" payment history impact points available relating to B/L thresholds. In other words, if someone had only one loan - say a 5 year Auto or SSL loan with 3 years payment history, paying outstanding B/L to below 9% would garner substantially fewer points than if the loan had 3 months payment history and were paid down to below 9%. Two years of payment history could be a milestone.

In the James Rickards book: THE ROAD TO RUIN, Rickards discusses using behavioral psychology, complexity theory and Bayesian statistics to formulate and refine hypothesis when limited data is available. The below quote speaks to how I like to evaluate Fico related information/data.

" Bayesian probability posits that certain events are path dependent. This means some future events are influenced by what precedes them.... Bayesian probability is solid science, not mere guesswork, because the prior hypothesis is tested by subsequent data This approach begins with a prior hypothesis formed inductively from a mixture of scarce data and common sense. Then new data is used to either confirm or to repute the hypothesis. The ratio of the two types of data is updated continually as new data arrive. Based on the updated ratios, the hypothesis is either discarded (and a new hypothesis formed) or accepted with greater confidence".

- James Rickards

The interaction of attributes on Fico score are more complex than readily apparent looking at data sets in a linear fashion and provide opportunities for casual inference.. See below example of casual inference.

- X can cause Y even if there is no “causal path” connecting X and Y.

Sometimes we think of causal chains of the form: A causes Z by causing B which in turn causes C which causes D and so on, where each pair of elements in the chain are connected to each other in time and space. You can gain confidence that A causes Z by seeing the effects on B, C, and D along the way. . . This way of thinking can however be very misleading. Consider an example given in [2]. Person A is planning some action Y; Person B sets out to stop them; person C intervenes and prevents person B from stopping person A. In this case Person A may complete their action, producing Y, without any knowledge that B and C even exist; in particular B and C need not be anywhere close to the action. Nevertheless, C caused Y since without C, Y would not have occurred. And this despite the fact that there is no “spatiotemporally continuous sequence of causal intermediates” between C and Y

Ah, well there's the rub I think.

Installment utilization != installment loan history, those are two seperate things to my knowledge when it comes to reason codes, just like revolving utilization and short revolving history. Both of those are seperate from short credit history.

I think it's vanishingly unlikely from an algorithm standpoint to have a secondary chain vis a vis:

if longestInstallmentTradelineLength < X

calculate short Installment Utilization

else

calculate long Installment Utilization

More likely is that it's just the same as the revolving side as we understand it, where length of revolving history isn't tied into the utilization... guess on this one it would be nice to get more than 3-4 reason codes heh.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Anonymous wrote:

I'm not 100% on this but I think One Main Financial codes as a "consumer finance company" and not a bank.

FICO unfortunately tends to penalize those companies because they're commonly payday loan or subprime interest companies.

Might want to see if others had a similar hit and if anyone can confirm they're a consumer finance company.

I suspect this is likely the case, and CFA's I'm really starting to hate as much as CO's as nearly any lending company can get that tag; reports that both LC and Prosper were flagged as such too.

I haven't seen the CFA reason code under FICO 8 for either EX or EQ (my sole CFA reports to these two not TU, finally figured out what it was) but it's always been there on EQ FICO 5, and it just recently popped up on EX FICO 3. I don't have good comparison data right now as I know I'm not on the same scorecard, other than to say my EQ FICO 5 and EX FICO 3 has always lagged my TU FICO 4 by about 30-40 points, and the only difference besides inquiry distribution is that one stupid loan... extra 2 months AAOA, and that damned CFA tag.

AFAIK the only way to tell is by reason code analysis and process of elimination, which is a seriously fustruating state of affairs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Revelate wrote:

@Thomas_Thumb wrote:There is zero likelihood that thresholds for installment loan B/L above 9% do not exist. Poster reporting non trivial score increases when thresholds above 50% are crossed are not uncommon. Links to those posts have been provided in prior threads. Frankly, I have yet to see anyone report a score increase when an open mortgage with multi-year payments is part of aggregate B/L and the aggregate B/L crosses below 9%.

Pasted below is my thought on how payment history may come into play for Fico 8 non mortgage installment loans. The point changes are for representation only. The takeaway is rapid paydown of a loan is a shortcut to gaining points that may otherwise come from a prolonged payment history.

It is also clear that installment loans are differentiated by type as indicated by specific reason codes and on 3B reports where there is a mortgage accounts section separate from the installment accounts section. [I have a 15 year mortgage with 11 years payment history but NO installment category credit history due to not having any other type installment loans. Also of interest is balance on your NON-MORTGAGE credit accounts is too high. I pretty sure the 3rd and 4th reasons relate to my AMEX B/HB and my AU card.]

More than a few posters have reported 850 scores with open mortgages & aggregate B/L above 50%, myself included. This again supports the presence of higher thresholds.

Here is what I see based on MyFico posts and other sources of data:

1) The presence of an open mortgage influences scoring associated with crossing aggregate B/L thresholds.

2) Open loans with "long term" payment history impact points available relating to B/L thresholds. In other words, if someone had only one loan - say a 5 year Auto or SSL loan with 3 years payment history, paying outstanding B/L to below 9% would garner substantially fewer points than if the loan had 3 months payment history and were paid down to below 9%. Two years of payment history could be a milestone.

Ah, well there's the rub I think.

Installment utilization != installment loan history, those are two seperate things to my knowledge when it comes to reason codes, just like revolving utilization and short revolving history. Both of those are seperate from short credit history.

I think it's vanishingly unlikely from an algorithm standpoint to have a secondary chain vis a vis:

if longestInstallmentTradelineLength < X

calculate short Installment Utilization

else

calculate long Installment Utilization

More likely is that it's just the same as the revolving side as we understand it, where length of revolving history isn't tied into the utilization... guess on this one it would be nice to get more than 3-4 reason codes heh.

As mentioned up thread and shown by a graph, loan age is an actor that influences score outside of B/L ratio on installment loans. The data differentiating mortgages from installment loans is rather substantial as well. If score is only impacted by aggregate B/L of all open installment loans, then the presence of an open mortgage has an influence on B/L thresholds.

It should again be noted that certain attributes are associated with subsets of scorecards and Fico has stated the existance of 400 attributes. Reason cosed are not able to convey a complete picture because:

1) The number of published reason codes is far less than the number of attributes.

2) Reason codes are simplistic and unable to communicate conditional interactions.

Regardless, below is a paste of a few reason statements from Experian that clearly indicate:

1) Length of time installment loans are open can influence score.

2) Mortgages are differentiated from other types of installment loans for B/L and B/L has thresholds.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

While I agree with your premise on attributes vs reason codes, what EX model was that from?

FICO 8:

The remaining balance on your mortgage or non-mortgage installment loans is too high.

FICO 9:

The remaining balance on your mortgage or non-mortgage installment loans is too high.

Possibly scorecard dependent... but looking at that reason code list it strikes me as NextGen which is not useful to modern algorithm discussion unfortunately. I have concrete data that suggests that mortgages are counted identically at least for my current and former buckets under both FICO 8 and FICO 98 as far as EX goes: I will be surprised if that changes when I'm clean on EX in a few months but will of course see.

NextGen broke out a whole slew of things from each other, including retail vs. bankcards and that simply hasn't been seen in reason codes or in testing anywhere else so I suggest that document from Experian is indeed regarding FICO NG, which is only reference for that algorithm.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

FICO 8:

The remaining balance on your mortgage or non-mortgage installment loans is too high.

FICO 9:

The remaining balance on your mortgage or non-mortgage installment loans is too high.

The break out of mortgage from non-mortgage for installment loans suggests differentiation to me in the above statements. Frankly, there is quite a bit of poster data for clean files with mortgages that points to B/L thresholds above 50%. This, either with mortgages only or in combination with other installment loans. I really have not seen any data that contradicts this. What I see supports mortgage differentiation.

Pasted below is what Experian shows at the top of the reason code article. No mention of specific model other than Fico Open Access. However, looking at other articles I do see Open Access and Fico NextGen mentioned together. So if Open Access = Fico NextGen, then as you suggest, these must be Fico NextGen.

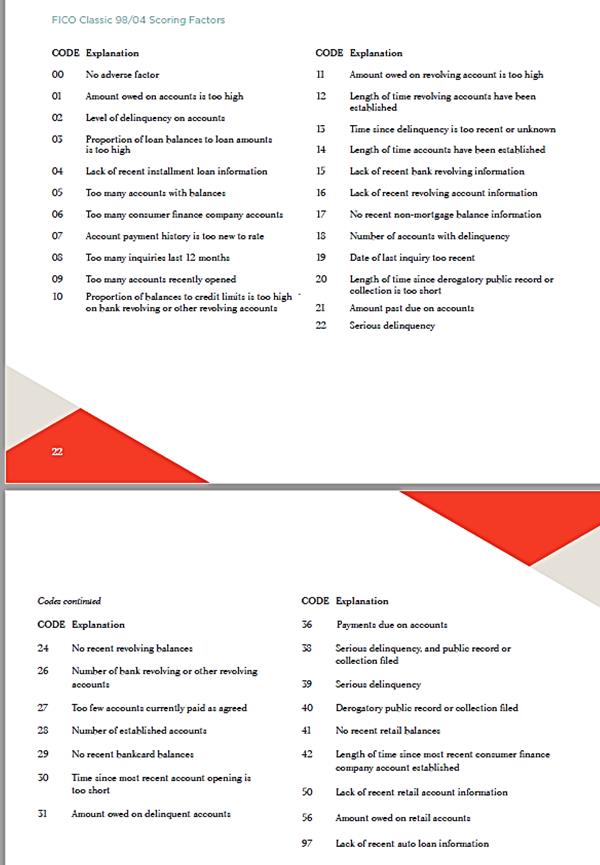

As an FYI, here is a paste of TU Fico 98/Fico 04 as presented by Credco.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

I don’t see installment utilization being applied much to my mortgage. There’s 95% left on it (is that what B/L means, balance to loan?), and my scores are normally 850. Recently, they have been dropping up to 35 points from the mortgage temporarily falling off due to a change of servicer (that was with no credit card balances, likely to be less with one card balance).