- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO vs. FAKO – Share your FAKO stories

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO vs. FAKO – Share your FAKO stories

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

Credit Karma

611 TU <---- wat?

646 EQ

Sesame/Creditwise/any other vantage site that pulls TU

611 TU <--- again, wat?

FICO8s from here

651 EX (confirmed by discover scorecard)

657 TU (confirmed by synchrony on my walmart and amazon cards)

650 EQ (yet to be confirmed but is in line with the vantagescore from CK)

I consider the score "confirmed" if it is within 5-10 points of another source. (since a payment might not have yet posted affectng Util, on the monthly discover pull that i get 2 weeks before myFico's pull, etc)

I am baffled about that 611 (it dropped like a rock when a chargeoff got changed from open to closed status... its legit miscalculating AAoA, it was counting the old collections as an open revolving account for some insane reason, thats the only explanation I have, and furthermore it has yet to come back up after a month and four new updates), Either way the account has been in collections for over 2 years, and is due to drop off in about 24 months at any rate (original deliquency was back in 2012, wasnt reported until 2015).

Every other score i have access to except for vantage scores TU in the 650 range like the rest of my scores. The really weird part is after my meticulous spree of disputes and so on, all three reports are pretty homogenous. Only one account is different from TU to EX (EQ doesnt list it at all, never has), but in FICO there is no difference (that one chargeoff), but in vantage its like LOLWTFBBQ.

I dont get it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

Below is a list of Non-Fico score ranges by model.

| Equifax (4/2017) | Credit | Real World | Model |

| Score Description | Model Version | Score Range | Score Range |

| VantageScore 3.0 | VS 3.0 | 300 - 839 | 300 - 850 |

| VantageScore 2.0 | VS 2.0 | 501 - 990 | 501 - 990 |

| EQ Equifax credit score | Proprietary from EQ | 280 - 850 | |

| EQ Auto Insurance Risk | LexisNexis CBIS | 300 - 997 | |

| EQ Property Insurance Risk | LexisNexis CBIS | 300 - 997 | |

| EQ PrivacyGuard | CreditXpert | 350 - 850 | |

| TransUnion (4/2017) | Credit | Real World | Model |

| Score Description | Model Version | Score Range | Score Range |

| TU VantageScore 3.0 | VS 3.0 | 300 - 839 | 300 - 850 |

| TU VantageScore 2.0 | VS 2.0 | 501 - 990 | 501 - 990 |

| TU Equifax Credit Score | Proprietary from EQ | 280 - 850 | |

| TU Home Insurance Risk | TU CBIS model | 150 - 950 | 150 - 950 |

| TU Auto Insurance Risk | TU CBIS model | 150 - 950 | 150 - 950 |

| TU PrivacyGuard | CreditXpert | 350 - 850 | |

| Experian (4/2017) | Credit | Real World | Model |

| Score Description | Model Version | Score Range | Score Range |

| EX VantageScore 3.0 | VS 3.0 | 300 - 850 | 300 - 850 |

| EX VantageScore 2.0 | VS 2.0 | 5?? - 990 | 501 - 990 |

| EX Equifax Credit Score | Proprietary from EQ | 280 - 850 | |

| EX National Equivalency | Proprietary from EX | 360 - 840 | |

| EX Plus Score | Proprietary from EX | 330 - 830 | |

| EX PrivacyGuard | CreditXpert | 350 - 850 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

My Walmart FICO says tu 770 and it's FICO score 8.0

It would seem ck is usually lower.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

@Anonymous wrote:It's not enough to know that FICO is more used than any other scoring company (the answer is obvious). Your own FICO can vary by more than 100 pts depending on which credit bureau you're looking at as well as which scoring model. The variance is just as high as when comparing FAKO to any of your FICO scores, and hence cannot be relied upon. The best you can do is know which specific scoring model is mostly used and then use that as a guideline. If you're concerned about getting a mortgage, this scoring model is much different than for credit cards, or an auto, etc. The point is, everything is in context and a specific FAKO score has roughly equal informational value as any random FICO specific model score, as each one can be just as innacurate when it comes to what you're applying for. If you really want to know your overall credit health, its not enough to pay attention to only one scoring model/methodology.

^ Quite true. Fico scores can and do vary substantially among the various models. Each CRA was granted the ability to tweak the varoius Fico scoring algorithms to suit their specific taste up to and including Fico 8. For the most part this "tweaking" was eliminated with the Fico 9 rollout. The VantageScore algorithm is applied uniformly by the CRAs. No surprise here as the three CRAs jointly developed the model.

The older Fico models used for mortgages typically treat collections and lates more harshly than the newer Fico 8 and Fico 9 models. In some cases newer models may ignore a collection if it is paid and/or a small $$$ amount. As a result, it is not uncommon for profiles a small collection and possibly an islotaed 30 day late to score 100 points lower on the older Fico 04 and Fico 98 models (relative to Fico 8 or Fico 9).

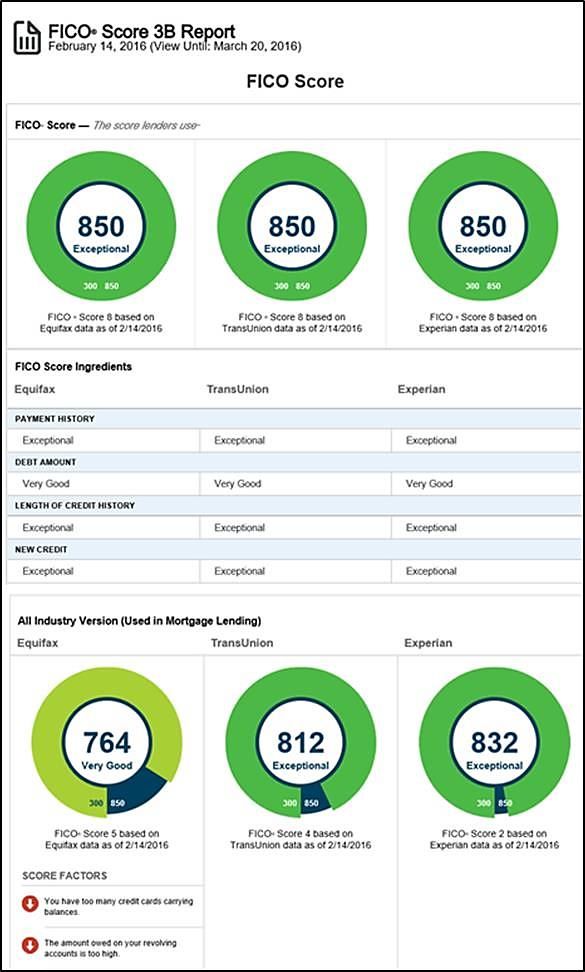

Even those with clean files and identical information on all three CRA reports can experience large differences in Fico scores. This happened to me when I let all six of my cards report small balances - result pasted below. [for reference VantageScore 3.0 scores remained stready in the low 830s]. Key point is to know what flavor of Fico and what CRA (or CRAs) your creditor plans to pull your score/report from.

Pre qualification letters for credit cards are generally not the same as pre-approvals. If you get a pre-qual letter and then apply for a card, there is usually a HP for a credit check as part of the approval process which includes a Fico score "review". Best I can tell is VS3 is used for establishing pre-qual solicitation lists but Fico and/or internal models along with income info are used for approvals.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

I started really looking at my credit in May 2017, and my Vantage scores were in the LOW 600s. They peaked around 713 in July-August and have settled in around 677-678, per Capital One (TU Vantage 3.0) and WalletHub (TU V3) with very little movement. They will drop 13-14 points one day and rebound by the same amount a day or two later and that's IT.

Meanwhile CreditKarma's Vantage scores are 664 TU and 571 EQ?!?

AMEX has me at 710 with Experian FICO 8 and MABT has me at 733 on Experian Bankcard 9.0

My mortgage banker pulled scores on me in October that were as follows:

EXP 687 FICO 2.0

TU 663 Classic 4.0

EQ 616 Beacon 5.0

The FICO scores keep climbing steadily, while the Vantage scores are stagnant. This whole process is maddening. In the interest of not driving myself nuts, I think I just need to concentrate on keeping balances low, paying accounts down and paying them off completely and as long as my FICO scores keep nudging upward we're good to go.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

My CK scores haven’t changed in the past week, but in one day, my CK approval odds have changed radically across almost all of the credit cards for which they provide odds. Many cards that yesterday CK said I had Very Good odds for approval shifted to Fair. I subscribe to all 3 credit bureaus and my scores with them have also not changed in the past week. Has anyone else had this happen? Is something going on that may have caused this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

My FICO scores and my FAKO scores are pretty close. Close enough for the chance of reporting time errors. One of the places that I get a FAKO score is from Experian. Somehow I won the prize a few years and I get a free daily credit report and a CS. The problem is that the score seldom changes. It's been stuck at 735 for over six months. This has happened before and I em'd EX. It went up slightly a few days later. It's nice getting the free CR. Other scores have me in the 765 range, both FICO and FAKO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

Welp my Fico8 EQ is up to 717

CK is still bound and determined to keep me at 620 forever

Seems legit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

My EQ score provided by my EQ subscription has also become equal to the EQ score provided by myFico, but I’ve never been sure that the score provided by EQ is truly a V3 score.

My TU scores provided on CK and TU subscription have always been identical, but the EQ subscription score has always been about 60 points less than the CK EQ score. And EQ has never been the same as the EQ on myFico, until last Oct. The two have been identical since.

Is it possible that EQ has begun providing FICO instead of whatever it was they were using previously?