- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO vs. FAKO – Share your FAKO stories

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO vs. FAKO – Share your FAKO stories

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

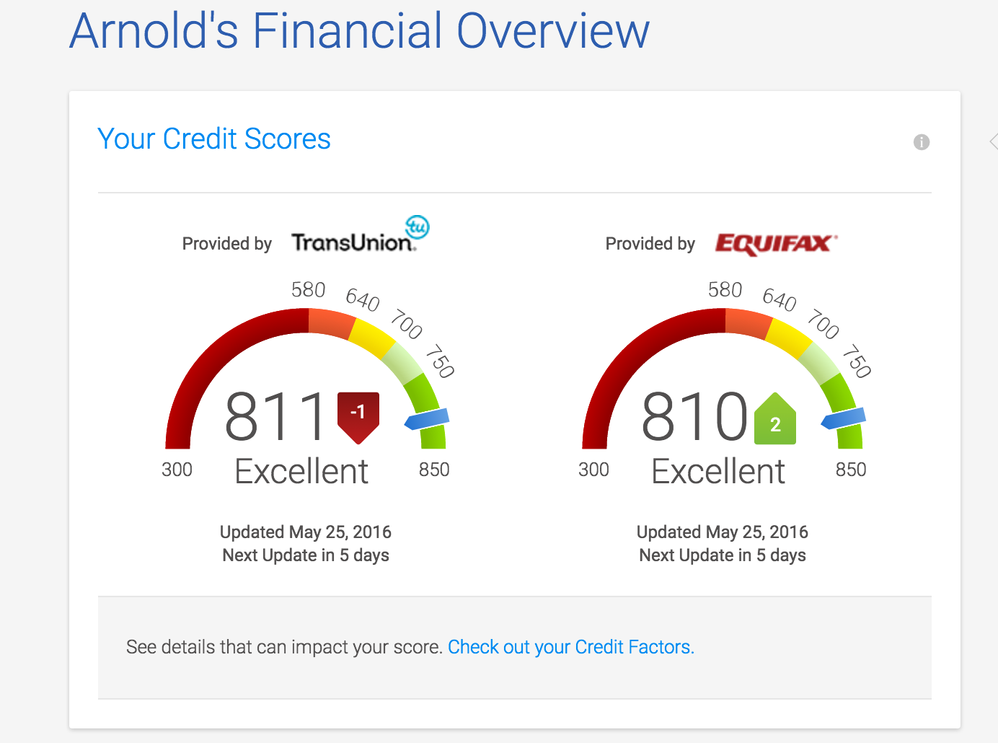

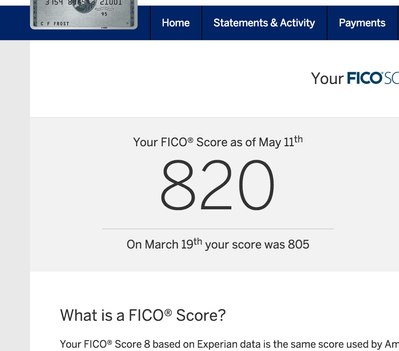

I don't have access to my FICO 8 EQ, but my FAKO and FICO are pretty comparible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

I've been using CK to learn more about credit scoring, and relying on that score (I know) I applied for a credit card and got denied, twice. OUCH.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

My FAKO and FICO are pretty far apart.

Credit Karma

TU - 702

EQ - 608

MY FICO

EX - 640

TU - 631

EQ - 593

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

I must be an anomaly. My CK/CS scores (esp the last 5-6 months) has been almost spot on to my fico score from citi, walmart and discover. Quizzle, at least for me, has always been (and still is) a joke. It is normally about 40-50 points off my fico.

EQ

Citi - 793

CK - 799

TU

Walmart -802

Discover - 804

CK - 804

CS- 807

EX

Amex - 774

Quizzle - 799

Current Score: 766 EX 734 EQ 780 TU 6/30/2015Starting Score/Goal Score: 580s/780s across the board

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

quick one. FAKO VS3 doesn't really care much about my SSL/installment loan (from Alliant CU).

while i gained 37-40 pts on my FICO 08, VS3 deducted 10-11 pts.

current VS3 score:

TU 743 was 754 before SSL

EX 744 was 729 *well this one actually went up.

EQ 745 was 755

current FICO 08:

TU 805 was 765 *ditto

EX 797 was 763 *huge jump coz of SSL

EQ ??? but probably same as TU

needless to say, a wide margin between my fako and my fico scores. *50+ pts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

I'm laughing because after months of my Vantage scores being close to 100 points higher than FICO scores, my EQ Vantage dropped 24 points about 48 hours before my FICO EQ score increased by 24 points. I'm sure that makes sense in some parallel universe. I'm just happy to have my FICOs getting close to where the useless VS numbers have been.

Current EQ711 TU704 EX696

Chase Sapphire Preferred- $12,000; Chase Freedom Unlimited - $5,000; Chase Slate - $12,000; AmEx Blue Cash Preferred - $3,000; Citi Double Cash - $3,600; CapOne Quicksilver - $3,200; BofA Cash Rewards - $15,000; BofA Platinum - $10,000; J. Crew - $8,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

Experian

Myfico - 639

CCT - 639

Equifax

Myfico - 630

CK - 646

Transunion

Myfico - 630

CK - 705

I guess credit karma isn't too far off on my EQ, but right now I can only dream of my transunion in the 705 area

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

Nice thoughts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

Reason for that is.

advantage looks at your picture for last 2 years or so and any recent activity in your credit.

Fico looks at your all credit history .

so if you applied and open accounts recently In Advantage it will bounce more than your Fico

hope that kind of helps.

Starting TU: 536

Starting TU: 536