- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Fico 8 Ex score 56+ points lower than F8 EQ & ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

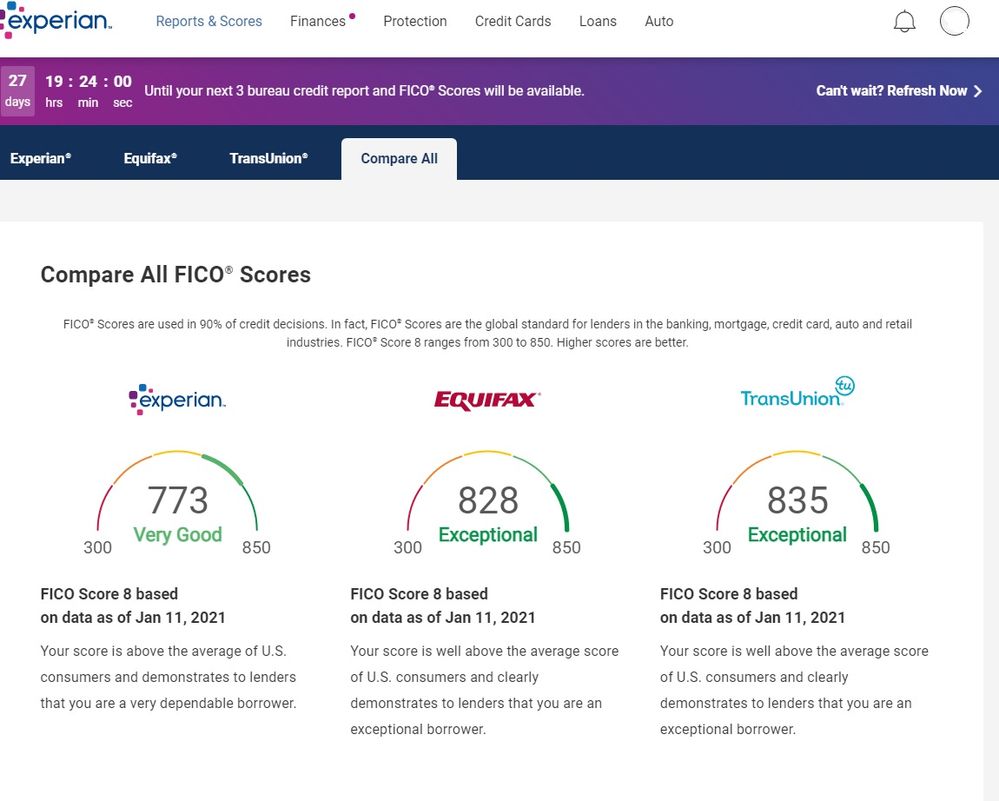

Fico 8 Ex score 56+ points lower than F8 EQ & TU..

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fico 8 Ex score 56+ points lower than F8 EQ & TU..

Hey all, like to understand what's plaguing my lowest score and how it might be fixed, before I do another app to start building my thin file..

The screenshots are within the Ex site "ingredient" breakdown.

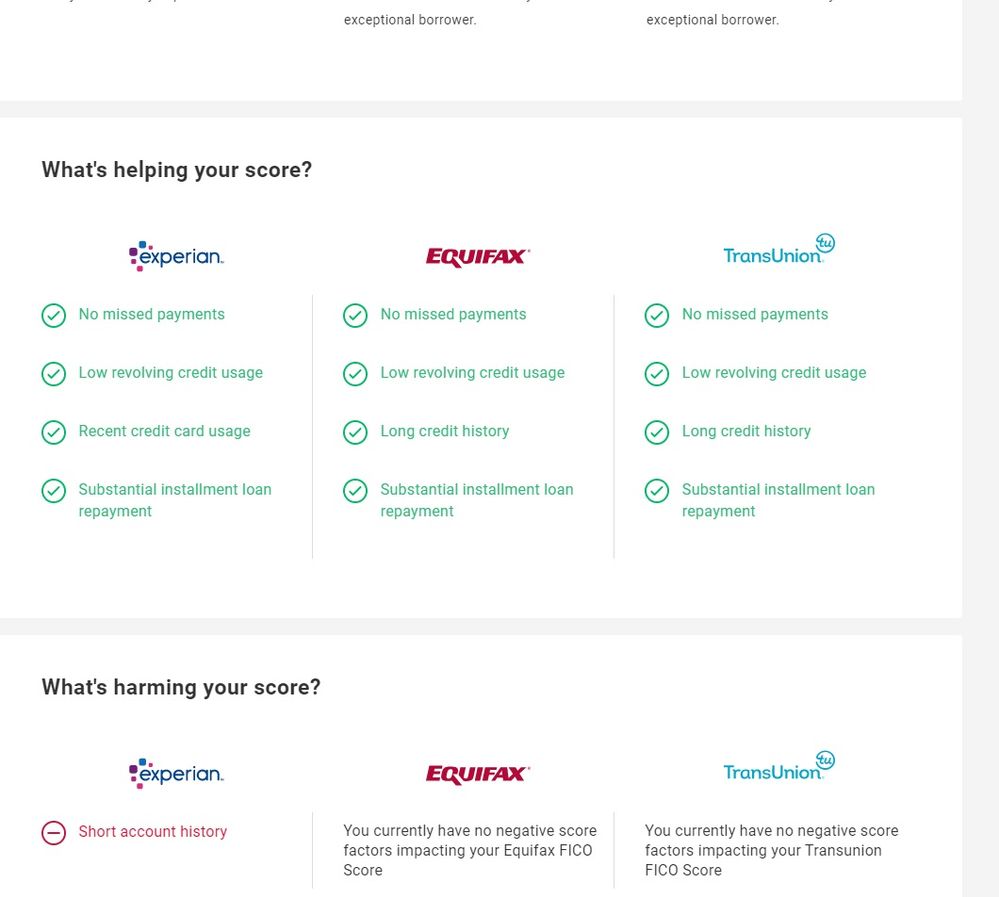

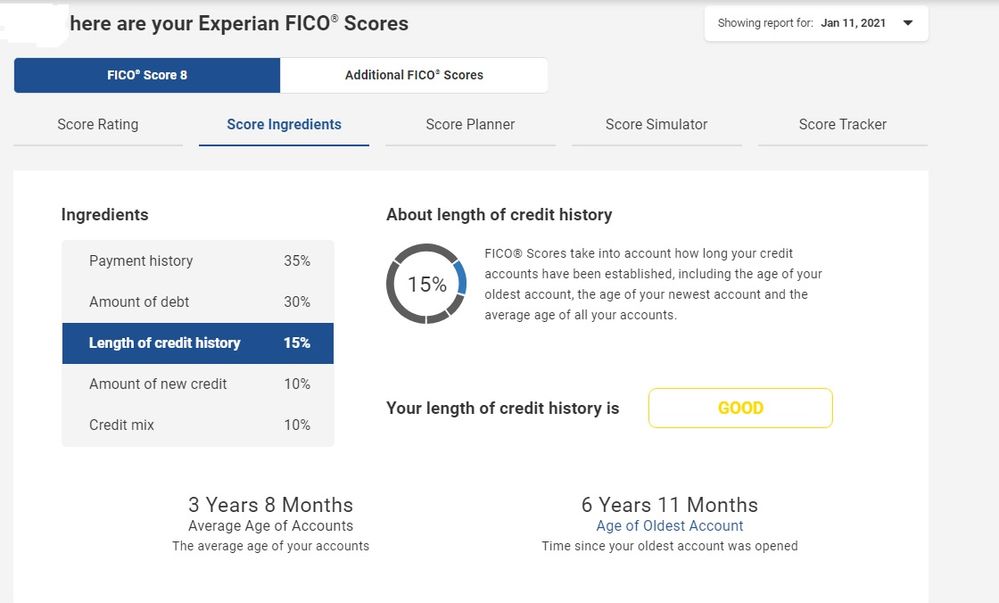

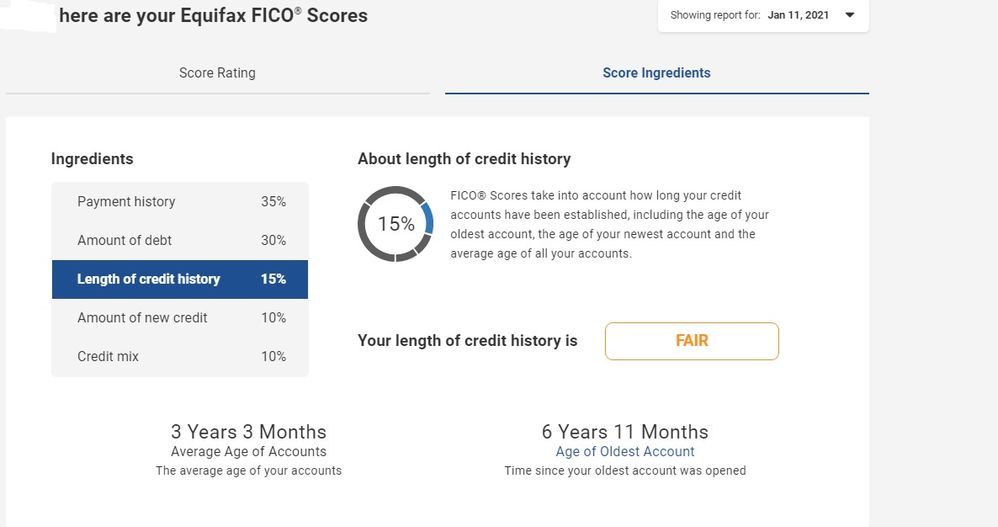

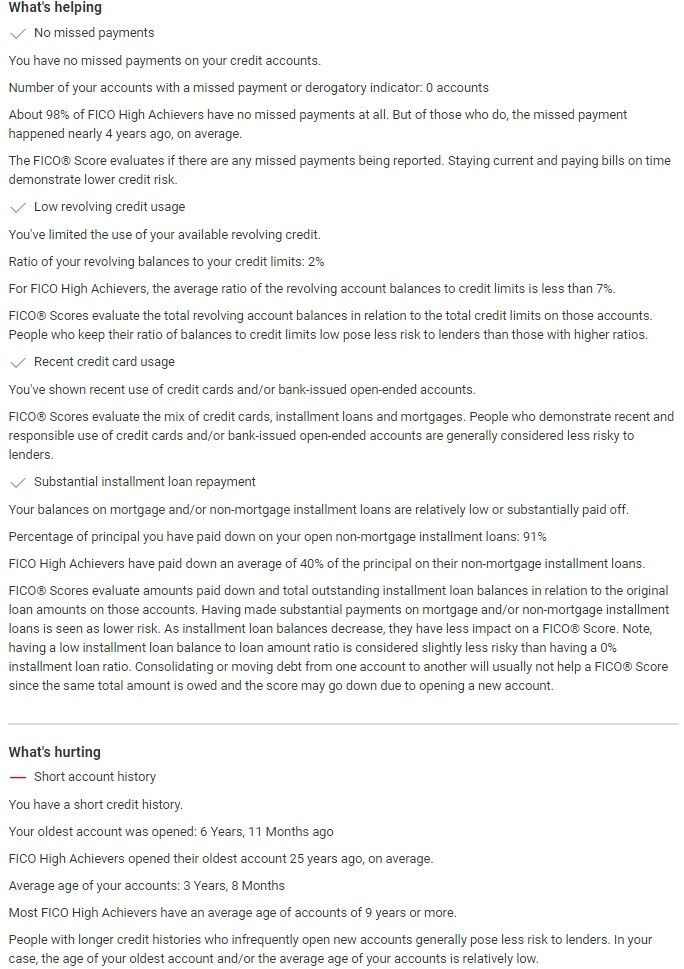

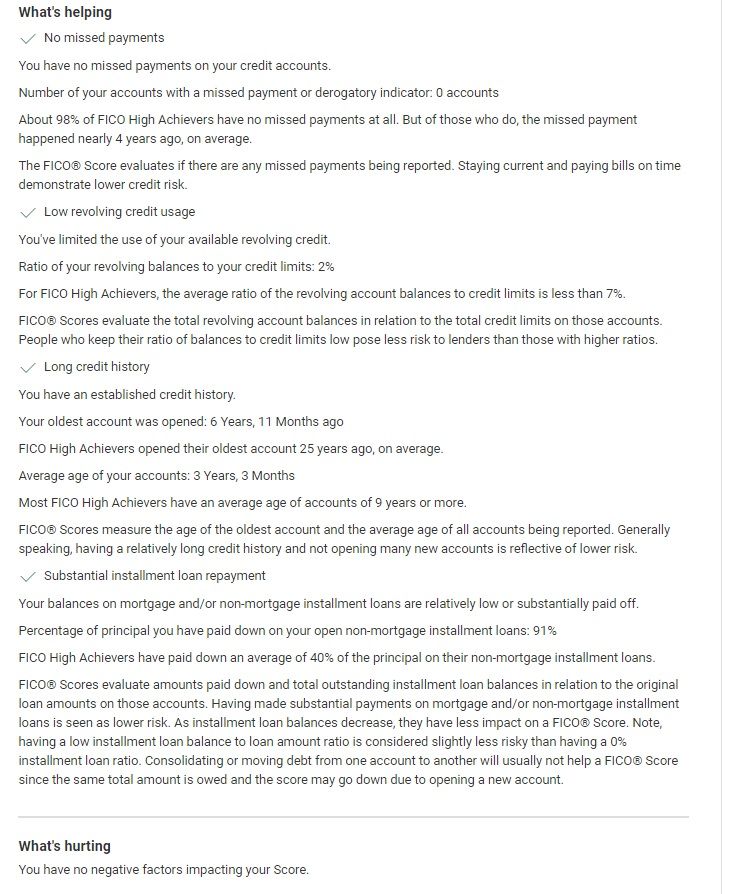

-I get hit for lack of credit history differently- a worse score where I have more recorded, and better score with less reported.

-I have a cc app 4.5 months ago and an ssl last month.

-The cc hp's were on TU (highest) and Ex, the lowest.

-There are a couple closed accounts depending on the report, all are "closed" by the issuing bank, when the card/product I was using expired and they issued me something new, once when it was compromised. All the same bank/card/credit limit/no hp's, all with perfect payment history and "pays as agreed."

-Are years of payment history on the closed card with the same bank/credit line/record that do NOT appear under the "active" accounts history on the report visibly, hurting? Not sure if the algo cares how they're sorted for the report. They all record the same age for my oldest account, not sure how the average is different...

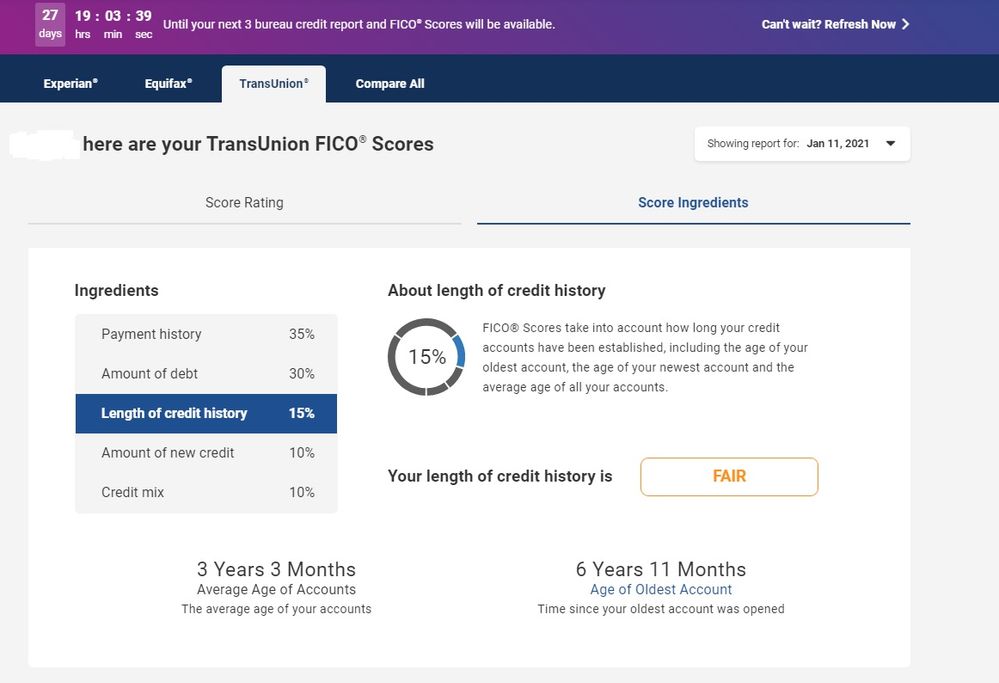

Length of history is shown-

-The amount of new credit is only "good" in Eq. TU and Ex are "fair."

-All other categories are the same on this tool.

I think the case could be made that my other scores are too high.. my recent ssl seems to have put them there and would've helped my credit mix (all very good). Since two of them are there though, I'd like to know why the 3rd isn't.

What other areas of sections of their tools or the report need to be seen for help in pinpointing this..?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 8 Ex score 56+ points lower than F8 EQ & TU..

A variance like that points to different report data. Your negative reason statement points to that as well regarding length of your credit history. Something account-wise must be different on your EX report relative to your TU/EQ reports in terms of age of accounts impact. How about your AoYA and AoYRA?

If you opened a revolver within the last 12 months and for some reason it was only showing up on your EX report, that scorecard reassignment could cause a big gap between scores when comparing a "new account" versees "no new account" file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 8 Ex score 56+ points lower than F8 EQ & TU..

@Anonymous wrote:A variance like that points to different report data. Your negative reason statement points to that as well regarding length of your credit history. Something account-wise must be different on your EX report relative to your TU/EQ reports in terms of age of accounts impact. How about your AoYA and AoYRA?

That's what I can't figure out from the report, outside of the impact of closed/paid accounts or payment history available for my oldest "open" account.

My AAoA is highest on Ex, my lowest score.

@Anonymous wrote:If you opened a revolver within the last 12 months and for some reason it was only showing up on your EX report, that scorecard reassignment could cause a big gap between scores when comparing a "new account" versees "no new account" file.

AoYA is the SSL, opened a month ago, showing on all reports. For cc's, AoYA and AoYRA are the same card, opened 4 months ago, present on all reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 8 Ex score 56+ points lower than F8 EQ & TU..

Prior to opening that new revolver 4 months ago, what were your scores at that time and did they have a similar variance across them?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 8 Ex score 56+ points lower than F8 EQ & TU..

@Anonymous wrote:Prior to opening that new revolver 4 months ago, what were your scores at that time and did they have a similar variance across them?

Unfortunately, I only followed vantage score versions of each, from CK. All 3 were right about at the Ex score, then dropped 15 points after the hp. Recovered last month. The recent ssl non-effect on my vantage scores is when forum members advised me to get fico 8 scores.

Do you think there was always a ~25 pt variance between them? Then the ssl took TU/EQ much higher and while Ex reflects a very good credit mix and says my loan is well paid down, it remains unaffected by the ssl + an original variance? All a theory, not sure how far fetched..

Here's the weakness section broken down in the report pdf- EQ/TU don't penalize AAoA for being substantially younger than their average for the category, Ex does. Thought I'd read a 3 vs 4 yrs AAoA was significant, if that was true, Ex would have more in its favor, with the higher average. I'm missing something.. @Aim_High , any takeaways?

#1 Ex #2 EQ/TU read the same

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 8 Ex score 56+ points lower than F8 EQ & TU..

@lowspender wrote:

I'm missing something ... @Aim_High , any takeaways?

I don't consider myself a FICO scoring expert so I'm a little puzzled too, @lowspender. I have a few basic questions and maybe we can rewind and recap some differences.

FICO Scoring models can and do vary between bureaus, even with identical reports. How much variation is minor and where does it become significant enough to indicate some underlying causal factor? I'm not sure. I do know that 56 points is a variation that is large enough to indicate something is affecting it beyond scoring models.

Do you just wonder what is causing the variation or do you "need" to raise your EX score for some reason, such as planning an application to a lender who relies on EX scores? I honestly don't know if I would worry too much about the difference. You have three very high scores already, even with the low one being EX 773. Those TU 835 and EQ 828 are both awesome, especially with your modest age of credit at less than seven years. Regarding that, though, I find it amusing that EX says your age of credit is "good" but they give you the lowest scores and TU/EQ both say your age of credit is "fair" but they give you the highest scores!! ![]()

I notice that Experian is the only one docking you for "Short Account History" on the negative items. I mentioned on the other thread you posted about this topic that my EX seems to be a more conservative model. While my EX scores have tended to lag, my account history is much longer than yours and my EX variation is much less than 56 points. So it's entirely possible that as your accounts age and file thickens, it will just slowly rise if you don't continue to seek new credit. From my observation, credit-seeking can be much more detrimental to scores on young/thin files than older and established files. For example, I added many new accounts in the past three years and my scores have stayed above 800, even at their worst. You can't get away with that with a young profile.

Now lets' dive back into the details. I see a lot of data but sometimes generalities instead of numbers, so maybe some specific answers would be helpful for the community to identify the causal factors at play.

What is your total number of new accounts within 6/12/24 months?

Are all the new accounts reporting on all three reports?

How many inquiries are on your report by 12/24 month periods, and list each bureau separately. For example, you see in my signature, "Total Inquiries (TU:3 ~ EQ:4 ~ EX:7); Scorable Inquiries (TU:1 ~ EQ:2 ~ EX:4)" with the "total inquiries" being within 24 months.

Look at each bureau's report and tell us how many open and how many closed accounts you show, and tell us what the difference is between each report. (For example, TU shows Bankcard A and EQ/EX don't.)

Do you have any late payments, collections, judgements, or other derogatories reporting on any report? If so, do they report equally across all bureaus or are they only selectively reporting?

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 8 Ex score 56+ points lower than F8 EQ & TU..

@Aim_High wrote:

I do know that 56 points is a variation that is large enough to indicate something is affecting it beyond scoring models.Do you just wonder what is causing the variation or do you "need" to raise your EX score for some reason, such as planning an application to a lender who relies on EX scores? You have three very high scores already, even with the low one being EX 773. Those TU 835 and EQ 828 are both awesome, especially with your modest age of credit at less than seven years. Regarding that, though, I find it amusing that EX says your age of credit is "good" but they give you the lowest scores and TU/EQ both say your age of credit is "fair" but they give you the highest scores!!

First off, appreciate all this detail, thanks! Yeah, I do like those scores in the 8's.. now if I could have some semblance of uniformity!

Planning an app for a lender that will hit my Ex, yes. Even if I knew they would only hp TU though.. that much difference would still bug me.

Yes, Ex's interpretation of the algo is definitely.. amusing, to me. In an annoying way.. ![]() I expected them all to punish me for that, after reading Ex comparing ~7 yrs to 25.. and the rest say.. the opposite.

I expected them all to punish me for that, after reading Ex comparing ~7 yrs to 25.. and the rest say.. the opposite.

If an app hp's a 770 and an 828.. does that go up for manual review or what kind of result am I likely to get?

@Aim_High wrote:

Do you have any late payments, collections, judgements, or other derogatories reporting on any report? If so, do they report equally across all bureaus or are they only selectively reporting?

None, ever.

@Aim_High wrote:I notice that Experian is the only one docking you for "Short Account History" on the negative items. I mentioned on the other thread you posted about this topic that my EX seems to be a more conservative model. So it's entirely possible that as your accounts age and file thickens, it will just slowly rise if you don't continue to seek new credit. From my observation, credit-seeking can be much more detrimental to scores on young/thin files than older and established files. For example, I added many new accounts in the past three years and my scores have stayed above 800, even at their worst. You can't get away with that with a young profile.

Thickening the file is next on my list- that will hurt my scores, but will rebound within 2 years. Definitely less leeway than someone with substantial credit history like yourself has. Being penalized for a thin file and for credit inquiries is the paradox I'm about to jump into. Rather do it with scores starting in the Eq range.

My CK vantage score has been right around the Ex score for awhile. Now that's no fico.. knew I was close though. So I'd hoped to break into the 8's with some recent credit changes (ssl). Unless I got the biggest increase from an ssl ever.. seems my bureau scores were closer to 800 than I knew (now that I have a 3 bureau report). So either the ssl had no effect on my Ex (unlikely) or I'm really getting hurt somewhere..

@Aim_High wrote:What is your total number of new accounts within 6/12/24 months?

Are all the new accounts reporting on all three reports?

2 in the last 6 months (only hp's ever). 1 ssl 1 cc. reporting on all 3.

@Aim_High wrote:How many inquiries are on your report by 12/24 month periods, and list each bureau separately. For example, you see in my signature, "Total Inquiries (TU:3 ~ EQ:4 ~ EX:7); Scorable Inquiries (TU:1 ~ EQ:2 ~ EX:4)" with the "total inquiries" being within 24 months.

Look at each bureau's report and tell us how many open and how many closed accounts you show, and tell us what the difference is between each report. (For example, TU shows Bankcard A and EQ/EX don't.)

My total and scorable inquiries are the same here, as all are in the last 12 months.

Total: TU: 1 EQ: 0 EX: 1

Open Accounts: 3 on all bureaus

Closed: TU: 1 EQ:1 Ex: 2 (all referring to the same cc the bank reports differently- closed by them. Had read paid off accts don't hurt- should I pursue fixing that?

This must be the difference, I thought 1 report was just incomplete..

Eq & TU shows Fico 8 only.

Exp shows 8 and Bankcard 2, Fico 3, Bankcard 8, Auto 2, Auto 8 and Fico 2.

Those aren't helping my average at all. The score negatives for each are mostly inaccurate, also. Like few accounts paid on time (all are), no established installment loan history (just got a bump for that), not using revolving credit (both of my only cards are revolving)..

Am I considered so risky by Exp that.. they pulled a smattering of everything on me?

These are all much lower scores, 730-790..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 8 Ex score 56+ points lower than F8 EQ & TU..

@lowspender wrote:

If an app hp's a 770 and an 828.. does that go up for manual review or what kind of result am I likely to get?If a lender pulls multiple CRB scores, how they process that would be an internal underwriting policy which could vary. They might default to the low score or the high score, or they might average. Or it could go to manual review. In the case of 770 versus 828, those are both high scores so maybe not a manual review in that case, but if you were talking one bureau showed 680 and another was 770, they would probably want to know why. And that would likely put the scores across approval parameters for APR and possibly credit limits. The high score might qualify for a more generous limit and/or lower APR.

@Aim_High wrote:What is your total number of new accounts within 6/12/24 months?

2 in the last 6 months (only hp's ever). 1 ssl 1 cc. reporting on all 3.

So 2/6 ... but also 2/12 and 2/24 ??

@Aim_High wrote:How many inquiries are on your report by 12/24 month periods

My total and scorable inquiries are the same here, as all are in the last 12 months.

Total: TU: 1 EQ: 0 EX: 1Open Accounts: 3 on all bureaus

Closed: TU: 1 EQ:1 Ex: 2 (all referring to the same cc the bank reports differently- closed by them. Had read paid off accts don't hurt- should I pursue fixing that? This must be the difference, I thought 1 report was just incomplete..

I'm confused. What is the extra account showing closed on EX? And when you say all referring to same cc and making a correction, is EX showing the same account twice? If it's a satisfactory account ("paid as agreed"), there's no need to reconcile it. It anything, it could help to have an extra closed account. And whether it reports "closed at consumer's request" or "closed by creditor" really doesn't matter in FICO scoring. Some say it looks better to show closed by consumer in a manual review, but that is likely insignificant in most cases.

The score negatives for each are mostly inaccurate, also. Like few accounts paid on time (all are), no established installment loan history (just got a bump for that), not using revolving credit (both of my only cards are revolving)... Am I considered so risky by Exp that.. they pulled a smattering of everything on me?

Those "score negatives" can sometime be helpful but often they can be misleading. They have to give you some reasons and they are often canned responses. The "few accounts paid on time" doesn't mean you had late payments as much as they want to see more payment history. "No installment loan" is correct also, but you're addressing that. And "not using revolving credit" means you aren't letting balances report. That is the problem with paying off accounts 100% early where nothing posts. Internally, the bank you have the card with sees the activity and they are happy you are using the card and paying-as-agreed. And they will report paid-as-agreed. But when $0.00 balances post month-after-month to the credit reporting bureau, it APPEARS to the CRB that you aren't using your cards! And a lender will often report "Paid as agreed" even if you had a $0.00 balance for the month. Letting some balances post periodically is actually helpful. Just don't let a lot post right before your apply for new credit. This is where the Azeo technique comes in helpful. You get a small bump on credit scores if you have accounts reporting "All Zero Except One." And the one account needs to show only a small balance of somewhere between about $5 (I think it is) and no more than 1% of the credit limit. (I believe less than $5 doesn't report, if I'm not mistaken.)

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 8 Ex score 56+ points lower than F8 EQ & TU..

@Aim_High wrote:If a lender pulls multiple CRB scores, how they process that would be an internal underwriting policy which could vary. They might default to the low score or the high score, or they might average. that would likely put the scores across approval parameters for APR and possibly credit limits. The high score might qualify for a more generous limit and/or lower APR.

Makes sense.. yeah, wanting a better starting credit limit. Lower apr is good. I have more research to do on that.. been thinking I would apply for a card every 15 months to take advantage of 0% apr offers.. that would be 8 accounts closed after being paid off, in 10 years. Separate subject entirely..not sure how bad of an idea that is.

@Aim_High wrote:What is your total number of new accounts within 6/12/24 months?

2 in the last 6 months (only hp's ever). 1 ssl 1 cc. reporting on all 3.

So 2/6 ... but also 2/12 and 2/24 ??

Correct! 2 new accounts, 1 cc with hp's.

2/60 + ![]()

@Aim_High wrote:

What is the extra account showing closed on EX? And when you say all referring to same cc and making a correction, is EX showing the same account twice? If it's a satisfactory account ("paid as agreed"), there's no need to reconcile it. It anything, it could help to have an extra closed account. And whether it reports "closed at consumer's request" or "closed by creditor" really doesn't matter in FICO scoring. Some say it looks better to show closed by consumer in a manual review, but that is likely insignificant in most cases.

Correct, Ex shows the same account twice. It's a satisfactory account. Both report as being "at consumer's request" for what little that matters. So the extra closed account likely doesn't hurt, ok. What concerns me is that it only shows payment history on the current account as dating back to beginning of '18, though it says it was opened mid '15. The closed accounts section shows payment history back to 2014.

@Aim_High wrote:

Those "score negatives" can sometime be helpful but often they can be misleading. They have to give you some reasons and they are often canned responses. The "few accounts paid on time" doesn't mean you had late payments as much as they want to see more payment history. "No installment loan" is correct also, but you're addressing that. And "not using revolving credit" means you aren't letting balances report. That is the problem with paying off accounts 100% early where nothing posts. Internally, the bank you have the card with sees the activity and they are happy you are using the card and paying-as-agreed. And they will report paid-as-agreed.

Continuing from above, with their canned responses, it makes me wonder if the 4 years of payment history stuck under closed accounts with the same bank is the reason Ex ran so many other reports for me. The installment loan is noted positively on the report that dings me for lacking it. Is that right? Seems generic again. Good points on AZEO. As far as not using revolving credit, I did pay off a little too much this past month, but never reported a $0 balance, especially not month after month. Haven't been using AZEO, didn't want to keep track of that. Just keeping low util. rates ![]()

Eq shows no payment history on my closed account, TU does show some. However, both show 2 years more history on my open account than Ex does. Seems like something is off..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content