- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Fico dropped suddenly, need help.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fico dropped suddenly, need help.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fico dropped suddenly, need help.

CCT alerted me that my Fico dropped 32 points on October 25 from 652 to 620 (Ex), my Tu all dropped from 648 to 631 not sure about Equifax yet but I'll get a new 3b from CCT in two days. The only changes were I got Citi AAdvantage ($3000.00 and a cli from Amex $500.00). Nothing has changed in my reports, everything is paid as agrees and 1late 26 months ago. My utility is 48% down from 52% due to the new card. I'm thinking I should order paper reports and really start researching (Are paper reports more thorough than CCTs). Any help is appreciated. I've also read it sometimes happens and my scores may recover in a month.

Thanks in advance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

Well some of those points could be from hard pull inquires on your bureaus, did you app during this time for any others resulting in a hard pull?

Also you give your overall utilization but what about individual utilization of CCs? Did they raise higher on their utilization.

Have you recently paid off an installment loan that was the only one you had?

I'd wait till you get your report from CCT in 2 days, it will show what is being reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

I had a similar drop in all 2 reports. I requested for an EE, two of my old charged off account from First Premiere with TU and EX got removed. However, my AAOA also got reduced from 8 years down to 8 months, with my longest being only at 2.1 years right now. As for EQ, I gave up with them. I'm not sure why one of the charged off acout was removed yet the other remaining one got updated, hence 1 30 day late and a 60 day late appeared on my report. That one dropped my EQ score down 29 points. So check to see if there is any changes to your AAOA. Oh I recently got an installment loan added to my report. That drops me around 7 points respectively with each bureau.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

8 year AAoA drop to 8 months? That's extreme. You must have had an extremely thin file, to the point of 1-2 accounts total.

OP, if you have very few accounts (thin fine) on your credit report, it's possible that adding a new credit card could definitely impact AAoA adversely and drop your score a good amount. The inquiry and new account could result ina 5-15 point drop or so, but the remaining drop could very well be from the AAoA drop.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

@Anonymous wrote:8 year AAoA drop to 8 months? That's extreme. You must have had an extremely thin file, to the point of 1-2 accounts total.

OP, if you have very few accounts (thin fine) on your credit report, it's possible that adding a new credit card could definitely impact AAoA adversely and drop your score a good amount. The inquiry and new account could result ina 5-15 point drop or so, but the remaining drop could very well be from the AAoA drop.

Actually back then I didn't really care much about credit. I was always a cash using person. Not until about two years ago when my wife and I started thinking about buying a home that's when I got a secured card with Wells Fargo. I didn't seriously look into rebuilding my credit until this past year. Currently I have 17 revolving accounts, 1 installment with Golden 1 which I just opened last month, and one collection from Capital One with PRA. Can't get them to budge for PFD so I'm gonna wait couple more months then contact them again. Planning to pay them off in full anyway, then try GW. If not, I'll just have to ride it out and try EE next year. The collection account is due to come off at the end of 2018. The way I see it is as the drop off date getting near, they should be more willing to negotiate. I'm in no rush yet anyway since I need my other accounts to age.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

I see. So at the time of the 8 year to 8 month AAoA drop, how many accounts did you have present on your CR?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

I am anticipating a drop on my FICO scores this month, when AMEX reports the Blue Delta they approved me for last Sept. My oldest account was Capital One (closed just this month) 1 year and three mos. AAoA is currently 9 Mos. Prior to the AMEX Delta approval I have two other new revolvers (Discover IT and Amex BCE) both 8 mos. old and 1 Charge card (Amex Green), 7 mos. I was wondering if anyone would have an estimate on how much drop in scores would I be looking at. And would my AAoA be reduced to 6 mos. or even less than that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

@Anonymous wrote:I am anticipating a drop on my FICO scores this month, when AMEX reports the Blue Delta they approved me for last Sept. My oldest account was Capital One (closed just this month) 1 year and three mos. AAoA is currently 9 Mos. Prior to the AMEX Delta approval I have two other new revolvers (Discover IT and Amex BCE) both 8 mos. old and 1 Charge card (Amex Green), 7 mos. I was wondering if anyone would have an estimate on how much drop in scores would I be looking at. And would my AAoA be reduced to 6 mos. or even less than that?

In your case, you have no new accounts reporting less than 6 months old, so your current scores are likely outside the "new account penalty". FICO dings you for new accounts that are 0-3 months old (the most new account penalty) and for 3-6 months old (less new account penalty). It's a small portion of your score, but it's there.

FICO also dings you for an AAoA drop below 24 months or below 6 months, I believe. In your case, your AAoA is 10 months and the new account will bring it down to 9 months when it finally reports after 2 statement cuts. So your AAoA has no changed -- didn't go below 6 months, and was never about 24 months, so no change there.

You may gain a few points if aggregate utilization is over 8.9% and goes lower than that.

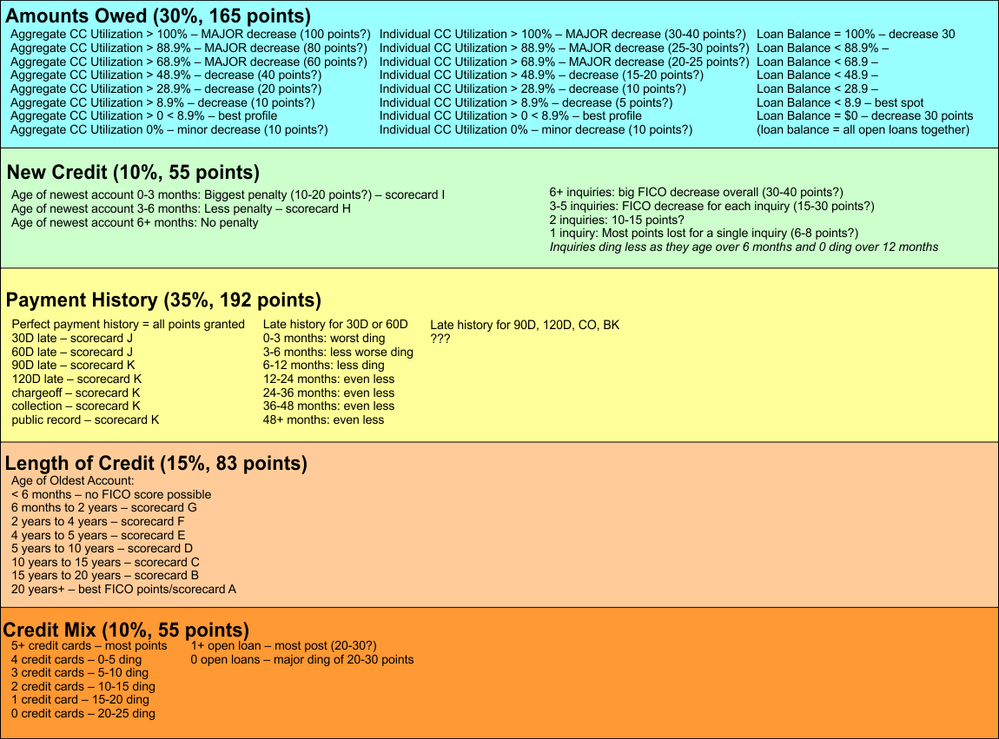

I wouldn't be surprised if you were dinged about 2% of your available FICO points (550) or maybe up to 11 points or so for up to 3 months and then it'll decrease from there. That's my guess, but not knowing your FICO8s right now, I can only just guess. Note that FICO themselves say that "new credit" accounts for up to 10% of a score (55 points) but that also includes such things as inquiries. If you are at 0 inquiries and all accounts are older than 6 months, you should get all 55 points back. Inquiries up to 6/7 seem to cost you up to 30-40 points or so total, so the remaining 15-20 points are probably for having a new account on your profile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

@Anonymous wrote:

@Anonymous wrote:I am anticipating a drop on my FICO scores this month, when AMEX reports the Blue Delta they approved me for last Sept. My oldest account was Capital One (closed just this month) 1 year and three mos. AAoA is currently 9 Mos. Prior to the AMEX Delta approval I have two other new revolvers (Discover IT and Amex BCE) both 8 mos. old and 1 Charge card (Amex Green), 7 mos. I was wondering if anyone would have an estimate on how much drop in scores would I be looking at. And would my AAoA be reduced to 6 mos. or even less than that?

In your case, you have no new accounts reporting less than 6 months old, so your current scores are likely outside the "new account penalty". FICO dings you for new accounts that are 0-3 months old (the most new account penalty) and for 3-6 months old (less new account penalty). It's a small portion of your score, but it's there.

FICO also dings you for an AAoA drop below 24 months or below 6 months, I believe. In your case, your AAoA is 10 months and the new account will bring it down to 9 months when it finally reports after 2 statement cuts. So your AAoA has no changed -- didn't go below 6 months, and was never about 24 months, so no change there.

You may gain a few points if aggregate utilization is over 8.9% and goes lower than that.

I wouldn't be surprised if you were dinged about 2% of your available FICO points (550) or maybe up to 11 points or so for up to 3 months and then it'll decrease from there. That's my guess, but not knowing your FICO8s right now, I can only just guess. Note that FICO themselves say that "new credit" accounts for up to 10% of a score (55 points) but that also includes such things as inquiries. If you are at 0 inquiries and all accounts are older than 6 months, you should get all 55 points back. Inquiries up to 6/7 seem to cost you up to 30-40 points or so total, so the remaining 15-20 points are probably for having a new account on your profile.

Thanks ABC, my current scores are:

EX: 734, Inquiries within the last 12 mos. 3

TU: 742, Inquiries within the last 12 mos. 1

EQ: 732, Inquries within the last 12 mos. 3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

You're right there on the edge of "very good" and "good" so you may see a bit more of a punch than someone in the 600s. Would you mind sharing what your alert score changes are when the account finally shows up? I'm working on this JPG of FICO scoring and every data point I get helps to tune it a little bit more!