- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: General Scoring Primer and Version 8 Master Th...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Scoring Primer, pub.5.17.20

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

@Anonymous wrote:@K-in-Boston Unfortunately, I can't really determine much with the data you've given me and here's why. Even with the exact same data at each bureau, you will have different scores. I believe the design said + or - 20 points among the bureaus for score 8? Don't quote me on that, but I believe that's what I've read from @Revelate 's posts.

There are many scoring factors that have different signal strengths at different CRA's. The most prevalent example is accounts with a balance. Experian could care less usually, whereas Equifax and TransUnion penalize quickly.

So you can't really tell a lot by comparing the scores from different bureaus. They may offer clues, but we cannot rely upon them. I would need before and after data and scores per bureau to really give a good answer. But, it does appear the score changes you referenced seemed to be the AU AZ penalty.

And with the delays in bureaus updating the profiles, many times when you pull a 3B, as you are aware, certain accounts may have been updated on one whereas they have not been on the other, not to mention the differences in utilization, ages etc.

So I'm sorry, but I can't give a conclusive answer with just the data provided.

Now, if you go back and look at your alerts, you may be able to determine a pattern for the AU AZ penalty, but it's just not possible by comparing bureaus and their scores.I wish I could tell you more, but I don't have enough data. But if you would like to have all AUs report zero again, you can witness the phenomenon, again, assuming they are not flagged, and it appears they are not on your profile. But one way to make sure.

Remember when you do the calculations on AAORA, you will need to do them with and without AUs, if we are not 100% sure they are counting.

Last, are all your authorized user accounts from the same individual? If not, some may count and some may not.

Certainly I know even with the same info, the scores will differ, but I'm looking at changes on the same bureau from month to month and how they compare in the amount of change as compared to the other 2 bureaus. My scores are pulled at the same time each month where the same changes should have been reported and should be reflecting in all 3.

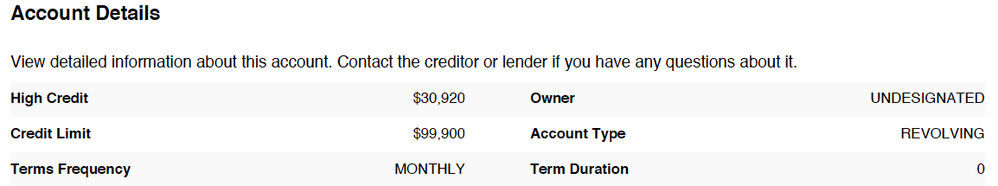

The AU accounts are all the same individual, and are all counting for sure*. They just started randomly dropping and reappearing on EQ a few years ago for some reason - even from the same lender, one Chase card shows fairly often, the other doesn't. (* There is a $99,900 Bank of America credit card that is questionable as to whether it's being factored into utilization or not. It's commonly stated here that cards over a certain amount aren't factored in, but I have verified that my own $90,000 Bank of America card caused a scoring change when a large amount changed, so if there is truly a cutoff for revolving cards like there is for a HELOC, it's above $90k.)

Like I said earlier, I can see a correlation between only a $0 AU card reporting and a score dip on EQ compared to the other two bureaus and a score boost when one or more accounts reappear. But on the other hand I can also see a score dip if the only AU account is reporting a balance, flanked by EQ being much higher both with other AU accounts reporting prior and no AU accounts reporting after.

It will be a while before it's possible, but I'll try to see at some point if I can get all AU accounts to report $0 on TU and EX so that I can see what happens there.

Thanks for taking a look.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

@Remedios wrote:I'm not doubting this data at all, I find it fascinating, but I'm somehow puzzled on why my experience was different.

+1 Exactly where my head is at. I've been conviced that when I have a much younger oldest account on EQ, somehow I get rebucketed into a more lenient scorecard. Now I'm doubting that. But in looking at my own reports, I've now almost convinced myself that there is just as much of a double-digit point penalty for having 1 of 1 AU accounts report $0 as there is for having 1 of 1 AU cards reporting a $83 balance on a $27k limit. Is it possible there is also a penalty for "100% of AU cards with a balance?" ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

@K-in-Boston wrote:

Certainly I know even with the same info, the scores will differ, but I'm looking at changes on the same bureau from month to month and how they compare in the amount of change as compared to the other 2 bureaus. My scores are pulled at the same time each month where the same changes should have been reported and should be reflecting in all 3.

The AU accounts are all the same individual, and are all counting for sure*. They just started randomly dropping and reappearing on EQ a few years ago for some reason - even from the same lender, one Chase card shows fairly often, the other doesn't. (* There is a $99,900 Bank of America credit card that is questionable as to whether it's being factored into utilization or not. It's commonly stated here that cards over a certain amount aren't factored in, but I have verified that my own $90,000 Bank of America card caused a scoring change when a large amount changed, so if there is truly a cutoff for revolving cards like there is for a HELOC, it's above $90k.)

Like I said earlier, I can see a correlation between only a $0 AU card reporting and a score dip on EQ compared to the other two bureaus and a score boost when one or more accounts reappear. But on the other hand I can also see a score dip if the only AU account is reporting a balance, flanked by EQ being much higher both with other AU accounts reporting prior and no AU accounts reporting after.

It will be a while before it's possible, but I'll try to see at some point if I can get all AU accounts to report $0 on TU and EX so that I can see what happens there.

Thanks for taking a look.

@K-in-Boston I apologize, I misunderstood your intent in comparing the bureaus. Now I understand that you were comparing the magnitude of the changes, rather than comparing the scores themselves.

However due to the variance in the algorithms, the changes from one month to the next are not necessarily going to cause the same magnitude of score change at all 3.

Again to use the example of accounts with a balance, if that changed at all three bureaus, it may not produce a change at Experian, whereas it may in different magnitudes at the other two CRAs. So the information we can extrapolate from that is still limited.

Nevertheless, when I'm not so tired, I'm gonna go back and look at the data again through the correct lens. Maybe I'll discover something looking at it with the correct understanding.

Can you please elaborate and direct me to the specific months you were speaking of in the bolded section above please? I'll probably need more data.

Also, if you can replicate it and I have all the before and after data, I believe we stand a good chance of figuring it out, but again no promises. We cannot solve every mystery unfortunately. But I will give it my best shot. And now you've got me intrigued! I love a good mystery!

Oh by the way, you probably are already aware of this, but I've read that once you have more than 100 accounts, the bureau has issues with a profile, so that could be why those accounts are disappearing and reappearing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

@Anonymous wrote:

@K-in-Boston wrote:

@Anonymous wrote:@K-in-Boston sounds pretty conclusive to me and you repeated it and re-confirmed it. Thank you for the data point, I will add it.

As for AoOA, it is a segmentation factor. However no one knows for sure where the threshold is. There have been thoughts that it is as low as 3.5 years as well as up to 25 years, as you state. Unfortunately I can't give an answer on that.

I do have a question though. Were all AU accounts reported at zero when they disappeared? And the reason I ask is if so, it could've been the reversal of the a AU AZ penalty.

Edit: For S and G, do you know what your AAORA was before and after those weird score changes?

Well, this is weird. So I didn't even know about the all zero penalty for AU accounts even when there are balances on primary cards until it was mentioned a few days ago. I just went through all of my 2020 3B reports and most of 2019, and I can see a correlation there. I'll just use EQ and TU for the examples. There are 8 AU cards ranging in open dates from 1994 to 2017. A 1994 Chase, 1995 Best Buy, and 2004 Citi have not appeared on EQ since 2018. All scores FICO 8. All AU accounts are open and have either constant or occasional activity.

- March 2019 - EQ 11 points lower than TU (808, 819) - Only $0 2017 Amex AU reporting on EQ.

- April 2019 - EQ 10 points lower than TU (801, 811) - Only $0 2017 Amex AU reporting on EQ.

- May 2019 - EQ 5 points higher than TU (816,811) - 1995 Discover AU with balance and $0 2017 Amex reporting on EQ.

- June 2019 - EQ 10 points higher than TU (810,800) - 1995 Discover AU with balance and $0 2017 Amex reporting on EQ.

That four month period certainly makes a credible argument for an all zero AU penalty (penalty March and April, no penalty May and June). Age of oldest account also took a dive from 1995 to 2001 in here and I know I have seen gains when they all fell off, so if the age of oldest account IS a factor, it's messing these up. BUT... (there's always a but)... let's look at the rest of the year.

- July 2019 - EQ 2 points lower than TU - Only 2017 Chase AU with balance reporting on EQ.

- August 2019 - EQ 6 points higher than TU - Only 1995 Discover with balance, 1999 CapOne $0, 2001 BoA with balance, 2017 Amex $0 reporting.

- September 2019 - EQ 13 points higher than TU - Only 1995 Discover with balance, 1999 CapOne $0, 2001 BoA with balance, 2017 Amex $0 reporting.

- October 2019 - EQ 2 points lower than TU - Only 2017 Chase AU with balance reporting on EQ.

- November 2019 - EQ and TU same score - Only 2017 Chase AU with balance reporting on EQ.

- December 2019 - EQ 22 points higher than TU - No AU accounts reporting on EQ.

- January 2020 - EQ 13 points higher than TU - No AU accounts reporting on EQ.

- February 2020 - EQ 24 points higher than TU - No AU accounts reporting on EQ.

- March 2020 - EQ 27 points higher than TU - No AU accounts reporting on EQ.

- April 2020 - EQ 20 points higher than TU - Only 1995 Disco with balance, 1999 CapOne $0, 2001 BoA with balance, 2017 Amex $0, and 2017 Chase with balance reporting on EQ.

- May 2020 - EQ 25 points higher than TU - Only 1995 Disco with balance, 1999 CapOne $0, 2001 BoA with balance, 2017 Amex $0, and 2017 Chase with balance reporting on EQ.

So while we seem to have possibly proven the all zero AU earlier in the year being a likely culprit to the score differences, the next 11 months are kind of all over the place. There are no "all AU accounts at $0" on months where one or more exist. We have times where EQ is higher even with nearly the same oldest age of account as TU. We have EQ being the same as TU when only a 2017 AU account with a balance is reporting and oldest account on EQ is much younger than TU. Then we have EQ being significantly higher than TU with no AU accounts reporting and much newer oldest account, and then still being much higher than TU when 5 of the AU accounts come back and oldest account age is only a year less than TU.

I'm just as lost as I was before. LOL Pulling the reports and comparing them side by side, my reports change so much that I'm not even sure I can really pinpoint things. I'd have to pull 2018 reports to see exactly what was going on from month to month when the other 3 AU accounts would also reappear and disappear again. Some other day. That took forever with lots of scrolling!

AAoRA I would need to manually calculate for each bureau so that would take time. If looking at all of the above there are any specific months that you think might be helpful, I can certainly do it. Would that include closed revolvers as well, or only open ones?

@K-in-Boston Unfortunately, I can't really determine much with the data you've given me and here's why. Even with the exact same data at each bureau, you will have different scores. I believe the design said + or - 20 points among the bureaus for score 8? Don't quote me on that, but I believe that's what I've read from @Revelate 's posts.

There are many scoring factors that have different signal strengths at different CRA's. The most prevalent example is accounts with a balance. Experian could care less usually, whereas Equifax and TransUnion penalize quickly.

So you can't really tell a lot by comparing the scores from different bureaus. They may offer clues, but we cannot rely upon them. I would need before and after data and scores per bureau to really give a good answer. But, it does appear the score changes you referenced seemed to be the AU AZ penalty.

And with the delays in bureaus updating the profiles, many times when you pull a 3B, as you are aware, certain accounts may have been updated on one whereas they have not been on the other, not to mention the differences in utilization, ages etc.

So I'm sorry, but I can't give a conclusive answer with just the data provided.

Now, if you go back and look at your alerts, you may be able to determine a pattern for the AU AZ penalty, but it's just not possible by comparing bureaus and their scores.I wish I could tell you more, but I don't have enough data. But if you would like to have all AUs report zero again, you can witness the phenomenon, again, assuming they are not flagged, and it appears they are not on your profile. But one way to make sure.

Remember when you do the calculations on AAORA, you will need to do them with and without AUs, if we are not 100% sure they are counting.

Last, are all your authorized user accounts from the same individual? If not, some may count and some may not.

Hey @Anonymous it's actually +/- 30 points. That was the design goal prior to FICO 9 where after FICO was rightfully lambasted for it it switched such that the same file on different bureaus will produce nearly identical scores (anecdotally those were 1-2 points different in my experience with FICO 9).

FICO 8, FICO 04, and FICO 2 models (not that anyone except for EX peddles this one anymore to my knowledge) there's just no real comparison. If you're playing in the derogatory scorecards you can really see this between EQ and TU on their FICO 5 and FICO 4 (both FICO 04 models) scores respectively. The algorithms got tweaked for each bureau's dataset but I strongly suspect there was something more than that for weightings even if FICO nor the bureuas will ever admit to that but it was a common lender complaint that different bureau pulls wound up in completely different UW tiers on the same base data.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

@Anonymous wrote:

@K-in-Boston wrote:Certainly I know even with the same info, the scores will differ, but I'm looking at changes on the same bureau from month to month and how they compare in the amount of change as compared to the other 2 bureaus. My scores are pulled at the same time each month where the same changes should have been reported and should be reflecting in all 3.

The AU accounts are all the same individual, and are all counting for sure*. They just started randomly dropping and reappearing on EQ a few years ago for some reason - even from the same lender, one Chase card shows fairly often, the other doesn't. (* There is a $99,900 Bank of America credit card that is questionable as to whether it's being factored into utilization or not. It's commonly stated here that cards over a certain amount aren't factored in, but I have verified that my own $90,000 Bank of America card caused a scoring change when a large amount changed, so if there is truly a cutoff for revolving cards like there is for a HELOC, it's above $90k.)

Like I said earlier, I can see a correlation between only a $0 AU card reporting and a score dip on EQ compared to the other two bureaus and a score boost when one or more accounts reappear. But on the other hand I can also see a score dip if the only AU account is reporting a balance, flanked by EQ being much higher both with other AU accounts reporting prior and no AU accounts reporting after.

It will be a while before it's possible, but I'll try to see at some point if I can get all AU accounts to report $0 on TU and EX so that I can see what happens there.

Thanks for taking a look.

@K-in-Boston I apologize, I misunderstood your intent in comparing the bureaus. Now I understand that you were comparing the magnitude of the changes, rather than comparing the scores themselves.

No problem, appreciate you taking a look and of course pointing out other possible reasons for the changes.

However due to the variance in the algorithms, the changes from one month to the next are not necessarily going to cause the same magnitude of score change at all 3.

Again to use the example of accounts with a balance, if that changed at all three bureaus, it may not produce a change at Experian, whereas it may in different magnitudes at the other two CRAs. So the information we can extrapolate from that is still limited.

Of course. But for the most part, over the past year there weren't too many changes. EX and TU have held fairly steady, while EQ keeps bouncing up and down and it certainly does appear to have something to do with the AU accounts, whether it's balances, lack of balances, or age.

Nevertheless, when I'm not so tired, I'm gonna go back and look at the data again through the correct lens. Maybe I'll discover something looking at it with the correct understanding.

Can you please elaborate and direct me to the specific months you were speaking of in the bolded section above please? I'll probably need more data.

But on the other hand I can also see a score dip if the only AU account is reporting a balance [October and November 2019 - only the Chase account opened in 2017 is reporting (with a balance) while the other 7 are not; AoOA took a nosedive 7 years shorter than EX and TU, but EQ and TU scores identical or almost identical], flanked by EQ being much higher both with other AU accounts reporting prior [September 2019 EQ was 13-15 points higher than the next two months - 1995 Discover and 2001 BOA reporting with balance, 1999 CapOne and 2017 Amex reporting $0, other 4 not reporting; AoOA only 1 year shorter than TU and EX] and no AU accounts reporting after [December 2019 - March 2020 EQ was 13-27 points higher with none of the 8 AU accounts reporting; AoOA takes nosedive again to 7 years shorter than EX and TU, but EQ score went way up]. - Added dates and summaries in black.

Also, if you can replicate it and I have all the before and after data, I believe we stand a good chance of figuring it out, but again no promises. We cannot solve every mystery unfortunately. But I will give it my best shot. And now you've got me intrigued! I love a good mystery!

Definitely a mystery. Like I said yesterday, when I'm looking at it, it's making my head hurt because I it looks like we can make just as much of an argument with those data points for an $83 balance on a $27k limit on the only AU card causing the same or worse damage as a $0 balance on the only AU card reporting.

Oh by the way, you probably are already aware of this, but I've read that once you have more than 100 accounts, the bureau has issues with a profile, so that could be why those accounts are disappearing and reappearing?

100 accounts? Don't be ridiculous! What kind of churning monster do you think I am? I only have a very respectable 72-80 accounts reporting on Equifax depending on which AU cards are on there in any given month. 100 accounts, why I oughta...

So here's a weird thing I never noticed but just saw when I was looking to see how many accounts were on my most recent EQ report (pulled within the past 5 days) - there are a couple of joint and AU accounts listed, and they all show "UNDESIGNATED" next to account owner. Wonder if there is something up with my EQ file for that field and that's why the accounts disappear and reappear? When I look at the accounts on credit monitoring sites such as myFICO and CK, they do correctly show authorized user or joint.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

@K-in-Bostonsorry I’ve been away for a day or two I had some issues and I’m back and will try to look at it again tonight.

Is that 80 open or does that include closed? LOL.

That very well could have something to do with them disappearing and reappearing. What does it say on your ACR report?

And I promise I’ll try to look at that again tonight. No problem, my pleasure indeed, glad to be of service, I just hope we can figure this out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

@Anonymous wrote:@K-in-Bostonsorry I’ve been away for a day or two I had some issues and I’m back and will try to look at it again tonight.

Is that 80 open or does that include closed? LOL.

That very well could have something to do with them disappearing and reappearing. What does it say on your ACR report?

And I promise I’ll try to look at that again tonight. No problem, my pleasure indeed, glad to be of service, I just hope we can figure this out.

No rush whatsoever. My scores are fine regardless of what's happening and I am not applying for anything in the near future. Just trying to offer up some DPs to see if it possibly helps with scorecards or breakpoints.

That's 80 total. If ACR is annualcreditreport as of last Sunday, it's showing 39 open with 4 of the 8 AU accounts currently listed. 43 open accounts is correct, discounting hidden trade lines (business cards, a few LOCs, and Cash+ card does not report to EX).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

I was saying that could be causing the problem of them disappearing and reappearing, so I was curious whether it also said that on the ACR report?

And we definitely appreciate all data points. Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, rev.5.17.20

Having just noticed that, I am wondering if that is part of the issue as well. Although a few joint accounts that have never dropped from Equifax show the same "Undesignated" for Owner. This is from my full EQ report obtained this past week: