- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: General Scoring Primer and Version 8 Master Th...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Scoring Primer, pub.5.17.20

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

As posted in post 1, see the following which supports my theory:

credit:CassieCard

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

Could I theoretically manipulate mine by doing a SSL and paying it down? Looking at my numbers, if I opened a $5400 one and paid it down to $100 right away, it would drop my overall IL utilization to 89.91%. That should net me ~15 points I'd guess.

Or am I missing some kind of big part of it?

Just theoretical. In 5 months the utilization would organically fall below 89% anyway, but it does seem like a way that could get an easy score boost for people with new loans at high balance % which means it has more benefit than *just* early credit building.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

@ccquest wrote:

So the 89% installment utilization thing being a point threshold has me wondering something.

Could I theoretically manipulate mine by doing a SSL and paying it down? Looking at my numbers, if I opened a $5400 one and paid it down to $100 right away, it would drop my overall IL utilization to 89.91%. That should net me ~15 points I'd guess.

Or am I missing some kind of big part of it?

Just theoretical. In 5 months the utilization would organically fall below 89% anyway, but it does seem like a way that could get an easy score boost for people with new loans at high balance % which means it has more benefit than *just* early credit building.

@ccquest I don't know if there is a threshold at 90% for installment, although there could be. I did get a couple points around there, but it could've been a balance threshold. I was dipping under 20K, but the points there were very few, you don't get decent points til you hit the 65% threshold or the big points at the 10% threshold.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

@Anonymous wrote:As posted in post 1, see the following which supports my theory:

credit:CassieCard

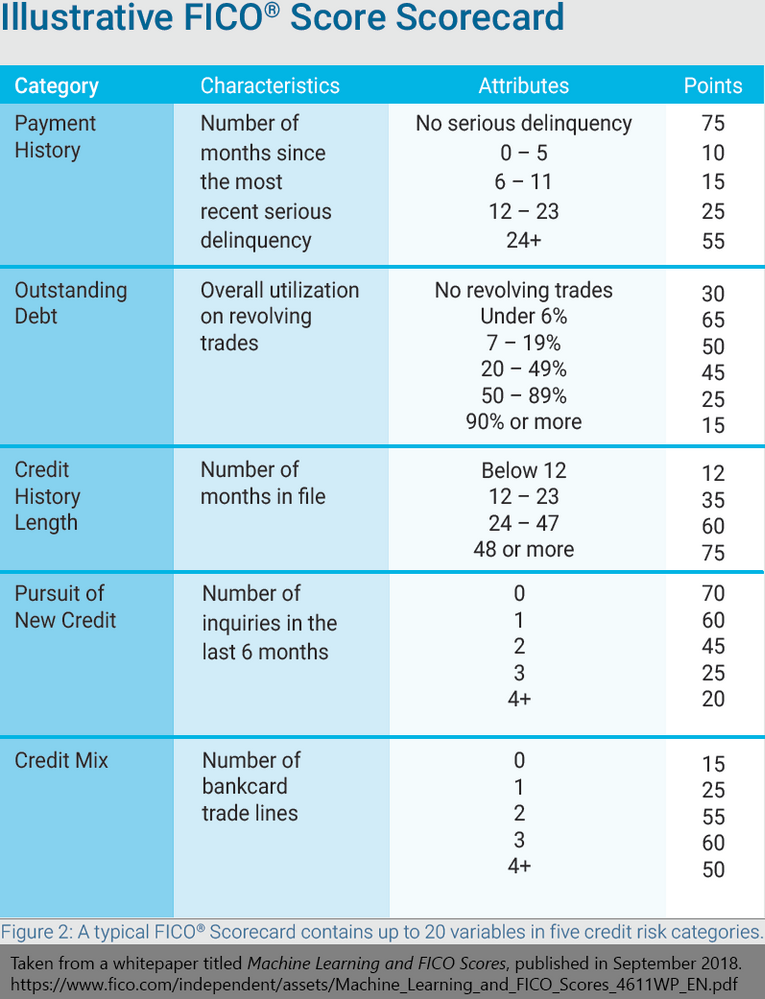

Community, I made an error and I want to acknowledge and correct it. I inserted the wrong slide for a sample scorecard in post one and in mix and above. I have corrected that now with the correct slide and corrected the attribution.

The other slide was actually teaching how the reason codes are generated in the order of precedence. I apologize for my oversight, it has been corrected and that slide is now under negative reason codes.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

@ccquest wrote:

So the 89% installment utilization thing being a point threshold has me wondering something.

Could I theoretically manipulate mine by doing a SSL and paying it down? Looking at my numbers, if I opened a $5400 one and paid it down to $100 right away, it would drop my overall IL utilization to 89.91%. That should net me ~15 points I'd guess.

@ccquest: 89.91 is 90% after rounding. Did you mean to type 88.91?

You want to be at less than 90% after rounding. 89.5+ wouldn't make it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

@ccquest wrote:

So the 89% installment utilization thing being a point threshold has me wondering something.

Could I theoretically manipulate mine by doing a SSL and paying it down? Looking at my numbers, if I opened a $5400 one and paid it down to $100 right away, it would drop my overall IL utilization to 89.91%. That should net me ~15 points I'd guess.

Or am I missing some kind of big part of it?

Just theoretical. In 5 months the utilization would organically fall below 89% anyway, but it does seem like a way that could get an easy score boost for people with new loans at high balance % which means it has more benefit than *just* early credit building.

@ccquest but if there is a threshold at 90%, yes you could manipulate it with a second loan and put aggregate installment utilization at <89.5%, as Cassie said.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

Updated Payment History and Mix.

@Anonymous

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

@Anonymous wrote:

@ccquest: 89.91 is 90% after rounding. Did you mean to type 88.91?

You want to be at less than 90% after rounding. 89.5+ wouldn't make it.

I was figuring it would be truncated instead of rounded like dollar amounts, but forgot that utilization is actually rounding instead.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

@Anonymous wrote:

D. Revolver:Loan Ratio

Revolver:Loan Ratio is a scoring factor at EQ8 and although the exact ideal ratio is unknown, it's believed to be 3:1 or 4:1. Link. Code 84.

Do we know that EQ8 code 84 is referring to revolver:loan ratio and not just the number of installment loans? The reason statement and explanation only talk about the latter.