- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Credit Scoring Primer, pub.5.17.20

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Scoring Primer, pub.5.17.20

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread rev.5.17.20

@Slabenstein wrote:

@Anonymous wrote:

D. Revolver:Loan Ratio

Revolver:Loan Ratio is a scoring factor at EQ8 and although the exact ideal ratio is unknown, it's believed to be 3:1 or 4:1. Link. Code 84.

Do we know that EQ8 code 84 is referring to revolver:loan ratio and not just the number of installment loans? The reason statement and explanation only talk about the latter.

@Slabenstein Great question. I know the ratio is a scoring factor due to fico documentation. So somehow they must determine the number of revolvers vs loans at at least one bureau and determine if one has too many of one. Everything that follows is limited to version 8:

Keep in mind, one code can cover more than one related characteristic, I believe. For example, "Length of time revolving accounts have been established" apparently measures youngest, average, and oldest.

Well, all 3 CRAs count number of accounts (segmentation factor), and only EQ and EX appear to count number of revolvers (scoring factor), so EQ and EX could calculate the ratio (number of accounts - number of revolvers = number of loans), but only EQ has a separate negative reason code for too many of either. 😉

Too many is indicative that the number and therefore ratio could be too large. Only EQ has this. While EX could calculate it, no code "for too" many exists to output, which leads me to believe that's the code and only Equifax tracks it.

(BTW, only EQ appears to count retail accounts, so EQ could be more granular with the ability to exclude retail accounts from revolvers.)

I should note that all three have the code for "too many" accounts, but that does not distinguish between types. Only EQ has too many loans; none have too many revolvers.

So yes, I am assuming this code is the vehicle for this scoring factor. Number of revolvers vs accounts could be used at EQ and EX to calculate this, but TU doesn't appear to track number of revolvers and only EQ has an output for too many.

jmho.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, pub.5.17.20

When FICO refers to installment accounts it says loan accounts, so I’m changing all my nomenclature from installment to loan, and then you have different types of loans obviously, mortgage loans, car loans, student loans, etc. It seems when FICO does say installment loan its referring to a PL. So, revolving utilization vs. loan utilization, average age of loan accounts, etc.

I have added to the Payment History category.

I have revised the Amounts Owed category with some important information about how national bank cards are counted and a previously unrealized AZ penalty. Also discovered there is a metric measuring the total amount owed, meaning revolving + loan.

In Length of History, I changed the nomenclature and acronyms and I need to add the oldest open mortgage is apparently tracked as well, at least one bureau.

We are still looking for the new account thresholds on the mortgage scores (I’ve got one data point onto you for 14 months I believe), and speaking of which, I’m going to add a section on mortgage scores as I get time, due to popular request.

Mix has been revised as well and is worth a read.

Also, I have included some additional thoughts and theory in the Negative Score Factors section regarding Negative Reason Codes.

Made a lot of changes over the past few weeks, wouldn’t hurt to give it a full read if you have time, and as I learn I’ll continue to update you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, pub.5.17.20

I have also changed the terminology regarding the "all zero penalty" because I don't believe it is a penalty. You are simply awarded more points if you have a revolving balance vs. $0. (See the example scorecard at the bottom of post 1 for an example.) I'm just calling it an all zero point loss or all zero loss.

If you have no revolving balance, you're awarded a certain amount of points, but if you do you have a small balance, you're awarded many more points (for proper management imho), but as the balance continues to increase, the point awards decrease.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, pub.5.17.20

@Anonymous wrote:I have also changed the terminology regarding the "all zero penalty" because I don't believe it is a penalty. You are simply awarded more points if you have a revolving balance vs. $0. (See the example scorecard at the bottom of post 1 for an example.) I'm just calling it an all zero point loss or all zero loss.

So...replace 'penalty' with 'point loss' everywhere? It sounds reasonable to me. I'll have to update that Aggregate Revolving Utilization chart.

Temporary Planetary Alignment of my mortgage scores:

- TU4: 744

- EX2: 743 (Median)

- EQ5: 742

EX2 is final for this month. If I'm at 743 there, with 2 inquiries, I think I'm going to see a decent gain tomorrow on my monthly 3B with TU4/EQ5 (0 inquiries). ($1423 to $680 balances already helped EX2 this month.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: General Scoring Primer and Version 8 Master Thread, pub.5.17.20

@Anonymous wrote:

@Anonymous wrote:I have also changed the terminology regarding the "all zero penalty" because I don't believe it is a penalty. You are simply awarded more points if you have a revolving balance vs. $0. (See the example scorecard at the bottom of post 1 for an example.) I'm just calling it an all zero point loss or all zero loss.

So...replace 'penalty' with 'point loss' everywhere? It sounds reasonable to me. I'll have to update that Aggregate Revolving Utilization chart.

Temporary Planetary Alignment of my mortgage scores:

- TU4: 744

- EX2: 743 (Median)

- EQ5: 742

EX2 is final for this month. If I'm at 743 there, with 2 inquiries, I think I'm going to see a decent gain tomorrow on my monthly 3B with TU4/EQ5 (0 inquiries). ($1423 to $680 balances already helped EX2 this month.)

@Anonymous "loss" or "point loss" either one I think will work and I'm open to feedback on which one may be better? I just think it's misleading to call it a penalty when it doesn't appear to be.

A $0 balance fails to demonstrate current revolving management skills, so there's no additional award beyond whatever constant is given for that metric. But, let $1 report and you're demonstrating current revolving management skills and receive a nice award for responsible use, in my opinion. As utilization and balance increase, its seen as higher risk and said award is reduced at thresholds.

That's my theory, anyway. Mirrors the sample scorecard and makes perfect sense since it's a point in time protocol and past balances and utilization are not taken into account by the Amounts Owed category. .... until 10T.

And congratulations on those mortgage scores! Looking good @Anonymous !

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thin File Definition

FICO defines Thin File as less than 4 tradelines. ( ≤ 3 )

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thin File Definition

@Anonymous wrote:FICO defines Thin File as less than 4 tradelines. ( ≤ 3 )

<pics snipped>

≤3 is almost the emoji that describes how I feel about this discovery.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AAoA Thresholds

I'm putting this here as a link target. I don't know if it will fit in Message #4, Credit History Length category.

AAoA (Average Age of Accounts) thresholds: This is what we have come up with so far, as of April 5, 2021:

Birdman7: "So it appears 12 months, 18 months, 48 months, 60 months, 66 months, 72 months, 78 months, 84 months, and 90 months. (And I’m sure there are more in between 18 and 48.) Edit: also unconfirmed reports at 24 months, 30 months, and 54 months."

(Link to thread discussing this.)

- 12 months / 1yr 0mo (3 EX 9 scores up 8-10 points, +4 on TU 8, my report here)

- 18 months / 1yr 6mo (Confirmed twice by me, really good on all mortgage scores, LINK )

- 24 months / 2yr 0mo (CassieCard, LINK )

- 30 months / 2yr 6mo (Unconfirmed)

- 48 months / 4yr 0mo ( EX 8 +27 points, ChemE_Bear, LINK )

- 54 months / 4yr 6mo (Unconfirmed)

- 60 months / 5yr 0mo

- 66 months / 5yr 6mo

- 72 months / 6yr 0mo (Confirmed by Birdman7, LINK )

- 78 months / 6yr 6mo (Confirmed by BrutalBodyShots)

- 84 months / 7yr 0mo (Confirmed by K-in-Boston, LINK )

- 90 months / 7yr 6mo

Lost/Stolen accounts can be included in AAoA.

Closed accounts are included in AAoA.

Searchbot: Average Age of Accounts, AAoA, threshold

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Thresholds

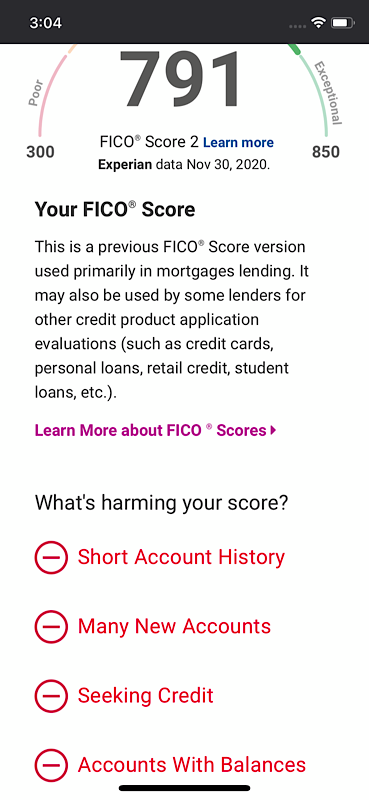

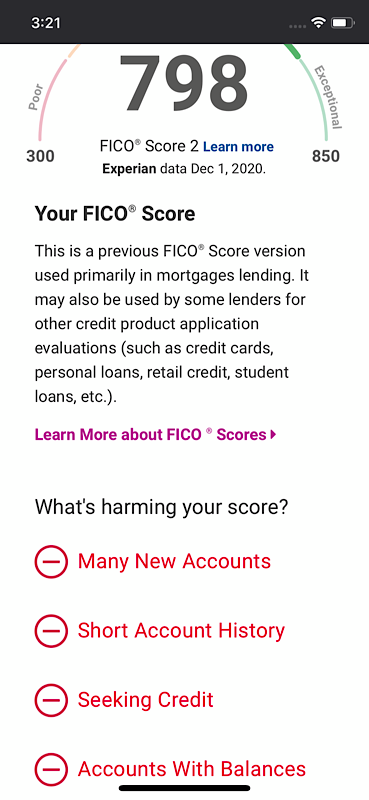

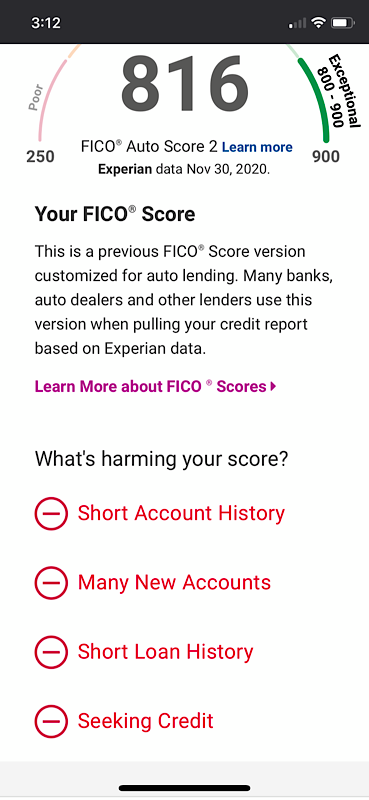

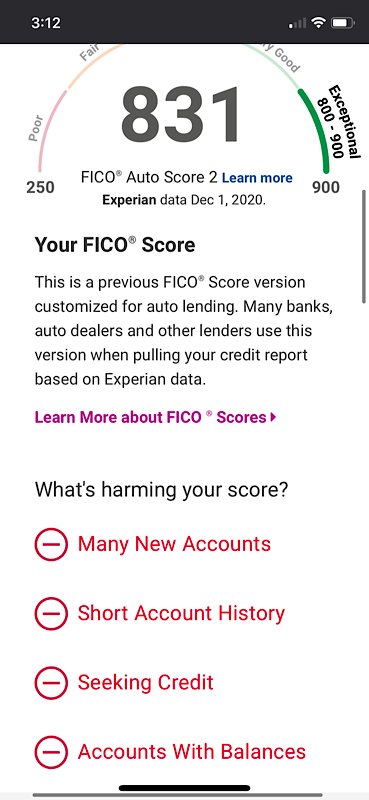

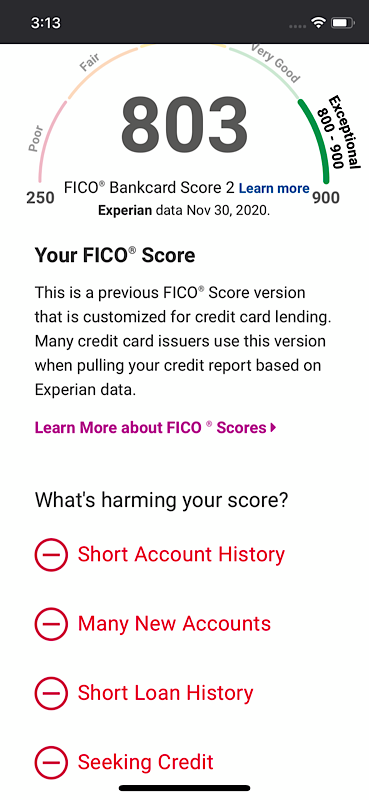

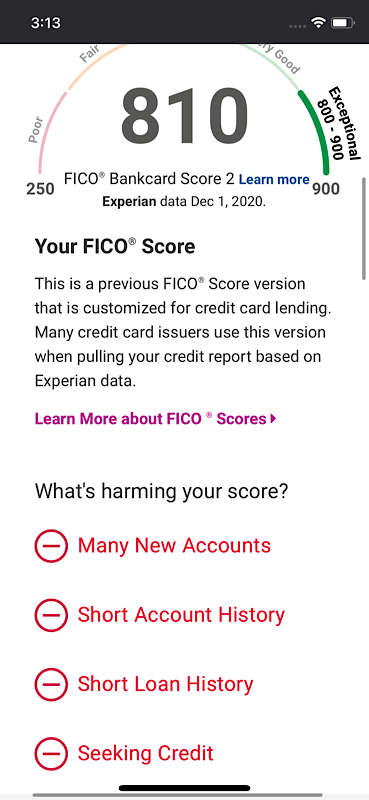

It appears I just found an AAOA threshold on score 2 at 72 months/6 years, and what's more, since nothing else changed and my true fico AAOA is 5.99 years or 71.92 months, I've just established that ages do round!!!!! I've been wondering that for so long.

nothing else changed and you can see reason code resolution appears to confirm it was an age threshold for 7 points at 72 months score 2. 15 points on auto 2 and seven on BCE 2.

Clean/thick/mature/new account.

@Revelate @Thomas_Thumb @Anonymous @Slabenstein @ccquest @SouthJamaica @AllZero @Anonymous @M_Smart007 @Remedios and many more, but limited to 10, lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Thresholds