- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Higher bucket causes lower score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Higher bucket causes lower score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Higher bucket causes lower score

OK, so many have noticed that they recieve a little score drop, even though compared to previous reports, it looks like it should be higher...do not panic, you may have moved to a higher bucket, which is what you want to achieve. My understanding is the fico08 scoring model has 12 buckets...4 lower with derogs, and 8 higher. Bucketing is the models way of comparing debtors with similar charachteristics, but it is proprietary what each bucket is made up of, and exactly what you can do to move to the next higher bucket. The buckets each have a lowest score and a highest score within that bucket and there is overlap. The next higher bucket lowest score is lower than the highest score of the bucket right below it. So if your score drops 5 points, when all scoring factors look better than the previous report...you may very well have been rebucketed to a higher bucket. Score increases should come soon. If your score seems to be stuck, you may be at the top of a bucket, and may be waiting for a factor to change to get in the next higher bucket.

*Links to credit repair websites aren't allowed.*

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

I don't think switching buckets is anywhere close to that common TBH, and a 5 point drop is nothing to get concerned about. It takes a non-trivial change to move buckets even with 12 of them available in the FICO 8 model.

There's wierd idiosyncracies inside a bucket though, which doesn't help when the bureaus behave differently. Stupid and careless example (as I'm not characterizing it fully): I lost 11 points on EX, 12 points on EQ, 12 points on TU when I had all my revolvers at $0... a known and well characterized penalty. I gained +23 on EX, +18 on EQ, and +12 on TU in fixing that, but the TU 12 points while identical gain vs the drop, moved in 2 steps (6 + 6 = 12).

That's not something go to blame on bucketing: namely most times we see a "is this bucketing?" question, it isn't, and that pattern has held on other credit oriented forums too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

I love how layered the BS is in the financial industry... just more rigamarole to keep people where the banks want them: just high enough to approve them, and just low enough so they can charge them up the wazoo. I can't count how many threads I've read recently of people in the 800's getting denials. I love it. Complete and utter bull.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

@805orbust wrote:I love how layered the BS is in the financial industry... just more rigamarole to keep people where the banks want them: just high enough to approve them, and just low enough so they can charge them up the wazoo. I can't count how many threads I've read recently of people in the 800's getting denials. I love it. Complete and utter bull.

FICO or any other scores are only one part of the UW criteria: they get you in the door, in some cases they determine your rate, they have next to zero impact beyond that as to whether you get approved or not.

We talk about maxxing out different parts of the FICO scorecard; by a similar token, if you have an 800 FICO score, you've maxxed out that one individual element in the underwriting scorecard (which admittedly varies by lender but 760+ is gold plated). That isn't enough to get an approval: even if I had an 850 score currently (not damned likely, ever, but for the sake of the discussion), without income as I'm studenting for the next two years, I'm unlikely to be approved for anything which isn't a student loan, a deep subprime loan, or something secured by an asset.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

Agreed, however that being said, you do know that EVERY single score is a FAKO right? I mean think about it. Same data, same snapshot, and Fair Isaac sell you 28 (28!!!!) different versions for $30 a month. Puhleese. Combine that with the literally hundreds of scoring models out there (Vantage crap, and now internal models) and you realize it's nothing but blue pill bullcrap Matrix style. It's obviously ALL about the supporting data, but unless you KNOW for sure what bureau and what scoring model your perspective creditor is pulling, it's a shot in the dark. Every score is a FAKO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

@805orbust wrote:Agreed, however that being said, you do know that EVERY single score is a FAKO right? I mean think about it. Same data, same snapshot, and Fair Isaac sell you 28 (28!!!!) different versions for $30 a month. Puhleese. Combine that with the literally hundreds of scoring models out there (Vantage crap, and now internal models) and you realize it's nothing but blue pill bullcrap Matrix style. It's obviously ALL about the supporting data, but unless you KNOW for sure what bureau and what scoring model your perspective creditor is pulling, it's a shot in the dark. Every score is a FAKO.

I do not believe you can really say that when the vast majority of credit card apps use Fico08. Mortgage lenders usually use

- Equifax Beacon 5.0

- Experian/Fair Isaac Risk Model v2

- TransUnion FICO Risk Score 04

What makes the others including Vantage 3.0 be considered Fako scores, is the fact that almost no lenders use them. A mortgage loan only uses scores as 1 part of the UW decision. They also consider DTI, job stability, etc. But in truth, it does not matter, because if you achieve 800+ scores on Fico08, your scores will be good on all scoring models most likely. Pay your bills on time, keep utilization low, do not have a large number of inqueries, have both installment loans and revolving loans, and in time high scores will be achieved on all models.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

@sarge12 wrote:But in truth, it does not matter, because if you achieve 800+ scores on Fico08, your scores will be good on all scoring models most likely. Pay your bills on time, keep utilization low, do not have a large number of inqueries, have both installment loans and revolving loans, and in time high scores will be achieved on all models.

Totally agree. And that was my point. All these scores are fake. Now for us who have fun with this, we're informed. I feel sorry for the good, hard working people who are penalized because they just pay their bills on time. They don't know about all this other crap that goes into it and it's easy to tell people to Google something, but how many years was that not an option? It's sick actually.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

Isn't there a chart out there, I think T.Thumb posted it once and perhaps even made it, with the potential score ranges for each bucket? Perhaps it was derived from data points on this very site. I do recall overlaps between the buckets as described by the OP.

I'd also like to know what data goes into each bucket so that I could possibly determine where I stand.

I think the most obvious bucket change would be going from one of the bad 4 (even ifyou don't know for sure which it is) to one of the positive 8 by the elimination of the final derog/delinquency on your reports. I would be surprised in this example, even with the overlap, if ones score didn't increase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

@Revelate wrote:There's wierd idiosyncracies inside a bucket though, which doesn't help when the bureaus behave differently. Stupid and careless example (as I'm not characterizing it fully): I lost 11 points on EX, 12 points on EQ, 12 points on TU when I had all my revolvers at $0... a known and well characterized penalty. I gained +23 on EX, +18 on EQ, and +12 on TU in fixing that, but the TU 12 points while identical gain vs the drop, moved in 2 steps (6 + 6 = 12).

Wait a minute. So you gained over 100% of the lost points on EX, 50% on EQ and broke even on TU? If this is the case and one can actually gain points this way, wouldn't that be a strategy maybe 2 cycles before apping? Report 0% across the board, scores drop, next cycle report one small balance, scores go up higher than they originally were? Or maybe I'm misunderstanding what you meant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Higher bucket causes lower score

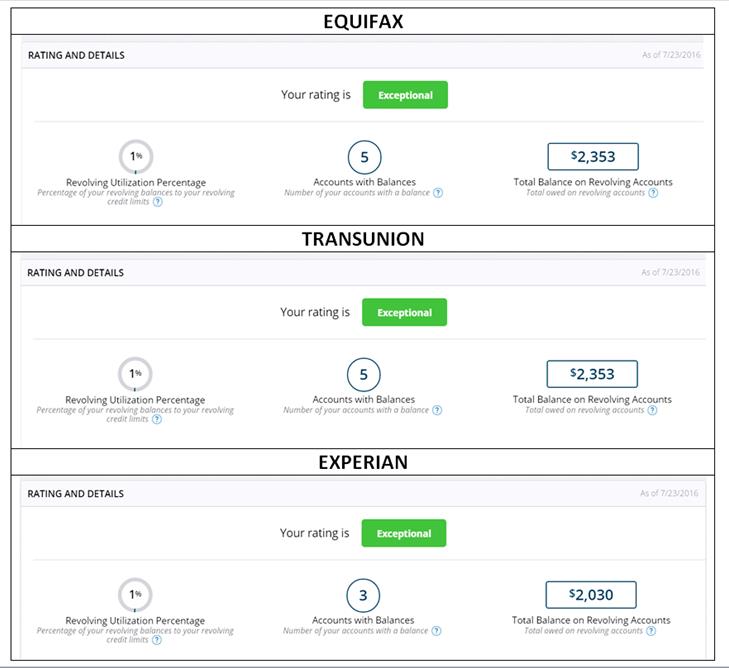

I have come to realize that all CRAs are not pulling data from the same point in time for 3B reports. This can complicate comparison among CRAs.

For example, I had 5 open accounts reporting balances for EQ and TU when I pulled my July 3B report. However, EX only showed 3 open accounts. This indicates results were caught in an account update transition in July with two PIF accounts not having updated on EQ and TU.For me it appears that EX data is slightly quicker to update than EQ and TU.

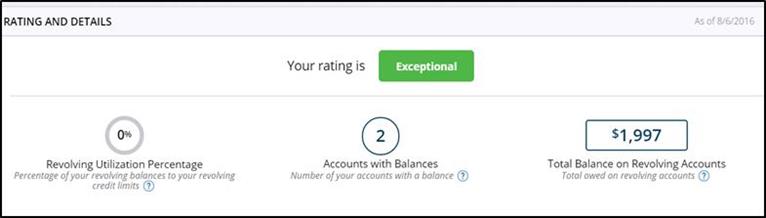

The next 3B pull I did just 3 weeks later showed 2 open accounts with balances on all 3 CRAs. (only one screen shot captured at the time)

Bottom line here is comparing the 3 CRAs against one another - even with the same 3B pulls can be skewed. To avoid this I try to pull 3Bs in the same timeframe each month during a 14 day window when I know none of my accounts are updating. For me that is from the 26th of one month to the 10th of the next month.

I jumped the gun in July with an early pull. Glad I did as that led to the August pull which uncovered some very useful data relative to how NPSL charge and AU credit cards are being treated with my file.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950