- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How do balances from charge cards report to the be...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do balances from charge cards report to the bereaus?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

@Thomas_Thumb wrote:

@Anonymous wrote:

@HeavenOhio wrote:For the most part, charge card balances aren't calculated into your utilization. But it does factor into one important score… I believe it's the Experian mortgage score. In that case, the "limit" would be determined by the highest balance on the card.

So in other words it isnt calculated into your total overall debt?

Older Fico models, such as Experian Fico 98 (EX Fico score 2) look at a pseudo utilization for scoring of NPSL charge cards. That calculation is based on current statement balance divided by highest reported balance. You should see a field listed as "high balance" on your credit report account summary. Fico 8 does not look at any type of utilization for charge cards.

Note: all charge cards are included in the scoring metric: "number of accounts with balances"

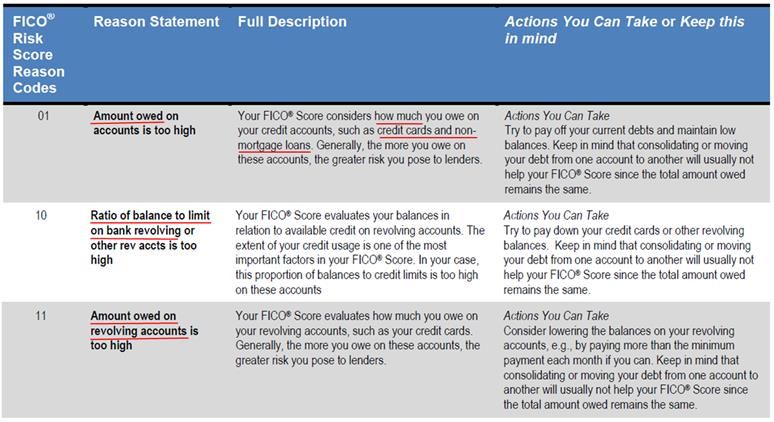

Of course, charge card debt is part of "(01) amount owed" and based on the below reason statements from Fico is looked at in some way.

@Thomas_Thumb Question: Is the high balance determined from a balance reported in a statement, or from the high balance during the statement cycle?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

Fair Isaac used to conduct regular Webinars several years ago, in which reps would discuss and answer questions about the FICO scoring.

At that time, the question was regularly raised as to how credit cards with no specific credit limit were handled by the algorithm when calculating % util.

The offical response from Fair Isaac, based on the scoring algorithms in effect at that time, was that the algorithm used the highest balance on the account as a pseudo-CL, and then calculated a % util by dividing the current balance by that pseudo-credit limit.

However, Fair Isaac discontinued those Webinars year ago, and thus there are no regular, official statements from them as to how current versions of their algorithms handle such % util calculations.

As with most FICO algorithm issues that remain buried as proprietary trade secrets, the best that can apparently be done is to rely upon anecdotal posts from consumers, who do a manual calculation of % util with and without the credit card, and deduce how they are handled from those anecdotal posts.......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

Explicitly a charge card is a revolving trade line with a term of 1 month. There was a prior post about an APR of 20%, this is incorrect unless you have a pay over time option for your Amex in which case I am pretty sure the 1 month term is removed from the trade line and that is the important thing for excluding the balances.

Not sold on the charge card counting in number of accounts with balances either at least for FICO 8 with my Zync but I need to play with that a bit more.

That said I don’t recall seeing the data set which suggested they were and that might vary by FICO model and even by bureau too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

^ Correct

The Fico 04, Fico 8 and Fico 9 models do not look at B/HB on charge cards. That is easy to deduce from my 3B reports in the multiple cases where I have allowed B/HB to reach 100%. Also, Fico 8 does not count charge cards in their attribute which looks recent activity on revolving accounts. AMEX charge cards are open accounts with 1 month terms - not revolvers although they are sometimes included in that terminology. Again, this is rather easy to test/confirm. Just let an AMEX charge card be your only account reporting a balance. You should get tagged with the "reason statement "no recent revolving activity" and see a significant score drop (typically 15 to 20 points) - atleast on clean scorecards.

Charge cards are accounts and as such they are included in # accounts with balances. As mentioned above they are not revolving accounts so they don't count toward revolving activity.

AMEX high balance has been based on statement balance for me best I can tell - . In contrast, my Best Buy store card reported a high balance greater than my highest statement balance so it clearly looked at peak balance during the month. High balance is not determined by Fico but rather what is reported to the CRA by each creditor and the creditor has latitude on methodology.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

Is the "high balance" used in the algorithms of the older scoring models based on the highest balance that has been reported in a statement, or the highest balance existing at any time during all the statement cycles?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

See above post regarding HB determination.

Last paragraph added after initial post.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

@SouthJamaica wrote:

Is the "high balance" used in the algorithms of the older scoring models based on the highest balance that has been reported in a statement, or the highest balance existing at any time during all the statement cycles?

As mentioned above, banks have latitude. Using revolvers as examples, AMEX reports the highest statement balance. The high balances reported by Capital One and Chase could be mid-cycle balances.

My guess is that AMEX charge cards would report the same way its revolvers do, which would be to report the high statement balance. But someone with a charge card should confirm that.

EDIT: I just reread posts above. TT states that AMEX likely uses the statement balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do balances from charge cards report to the bereaus?

@HeavenOhio wrote:

@SouthJamaica wrote:

Is the "high balance" used in the algorithms of the older scoring models based on the highest balance that has been reported in a statement, or the highest balance existing at any time during all the statement cycles?As mentioned above, banks have latitude. Using revolvers as examples, AMEX reports the highest statement balance. The high balances reported by Capital One and Chase could be mid-cycle balances.

My guess is that AMEX charge cards would report the same way its revolvers do, which would be to report the high statement balance. But someone with a charge card should confirm that.

EDIT: I just reread posts above. TT states that AMEX likely uses the statement balance.

Now that I have my first personal charge card, I will indeed confirm which it is. I have this gut feeling that it won't be the statement balance but the intra-cycle balance, but what do I know?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687