- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How much is this affecting my score?????

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How much is this affecting my score?????

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much is this affecting my score?????

Im looking for some best guestimates lol.

I have spent the last 5 months cleaning up my credit and my score has risen quite nicely.

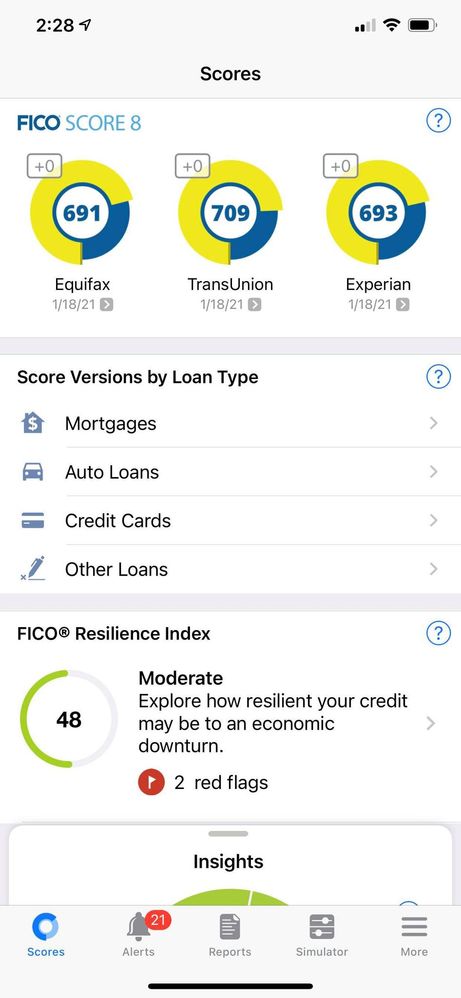

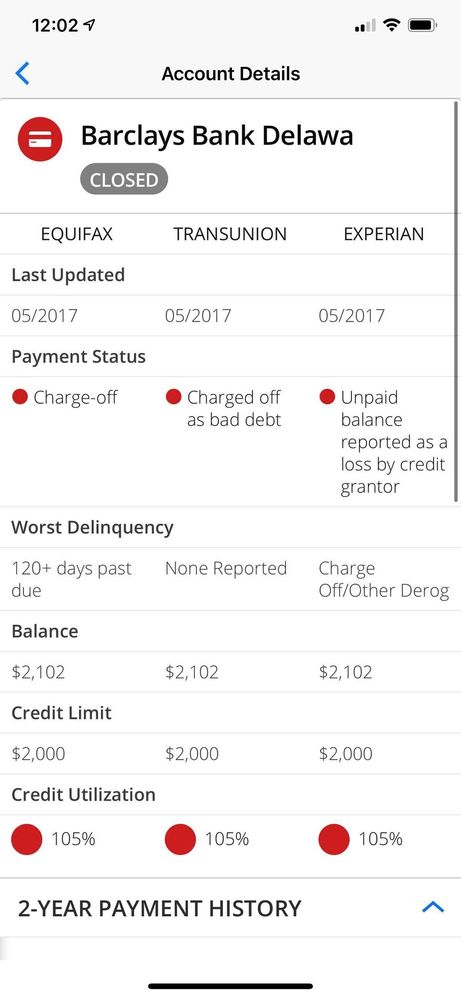

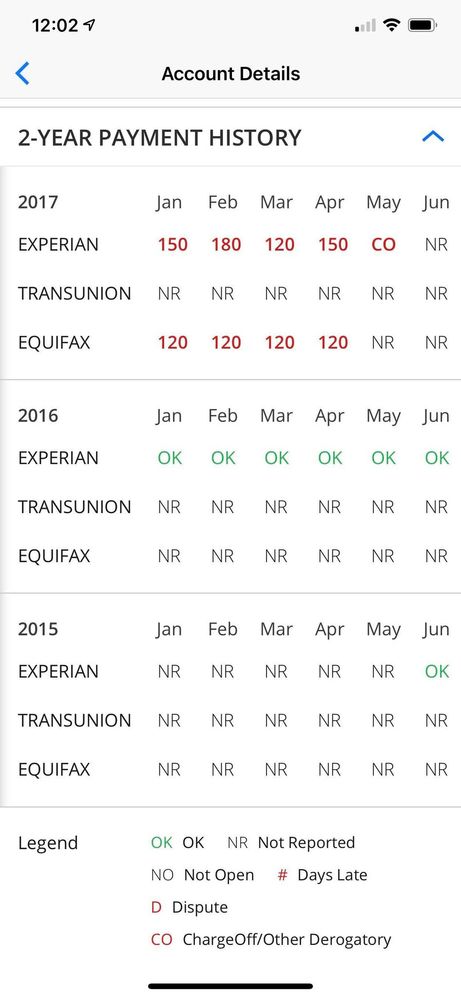

Now, the only "baddies" left are a 90 day late on 9 student loans from 2/2019 and this charged off account.

I have already tried goodwilling the student loans and that has gone nowhere quick.

When i pay the last "charge off" account off, how much do you think it will affect my scores?

ch do you think it will affect my scores?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

Tough to say. It is an account showing 105% utilization. It could be 10 points it could be 40. The other thing that could affect things is when the account updates if it hasn't been updating for years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

do you think taking care of it could potentially negatively affect me or should it only be positve?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

From my recent experience Jan 2021, my EX8 went down 24 points when I paid off an old CO that hadn't updated since 2018. However, my EX2 shot up 31! Now it's a temp point loss and should lessen over time. I'm sure more experienced people on here will chime in with more insights.

Current Score: 678 655 649

Goal Score: 700

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

@slowlyclimbing From my Understanding the 90 day lates are going to hurt your score a good chunk...But those you can't GW and will likely stay on around 7-10 years, HOWEVER with the COLLECTION I would try to reach out to the CEO not just a regular person (do it mail where you need a verified signature if you have to) and see if they will accept the FULL payment (if possible) in exchange for Deleting it from all 3 CB's. This way it does not restart your clock. For having those negatives your scores are still pretty good ![]() 650 and up is a good middle man to be, 700 up is even better while 750 and up is pretty solid gold ^^

650 and up is a good middle man to be, 700 up is even better while 750 and up is pretty solid gold ^^

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

@slowlyclimbing Be sure to get the PFD in Writing in some shape or form in case they try to add it back later to your profile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

@Girlzilla88 wrote:@slowlyclimbing From my Understanding the 90 day lates are going to hurt your score a good chunk...But those you can't GW and will likely stay on around 7-10 years

Not sure what you mean about can't GW a 90D late? You certainly can (I have) get them removed via GW. Also late payments typically stay on your CR for 7 years, not longer.

OP, when one removes their final major negative item often they see score increases to the tune of 60-90 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

@Anonymous wrote:

@Girlzilla88 wrote:@slowlyclimbing From my Understanding the 90 day lates are going to hurt your score a good chunk...But those you can't GW and will likely stay on around 7-10 years

Not sure what you mean about can't GW a 90D late? You certainly can (I have) get them removed via GW. Also late payments typically stay on your CR for 7 years, not longer.

OP, when one removes their final major negative item often they see score increases to the tune of 60-90 points.

OP's lates are attached to student loans and, as far as I know, federal SLs don't entertain goodwills for accurate reporting of delinquencies/defaults at all- though I guess you could try. If they are private SLs then there may be a better chance.

The late payments will drop after 7 years - I believe extended reporting is allowed for Federal Perkins loans that have defaulted and were never repaid.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

@thornback wrote:

@Anonymous wrote:

@Girlzilla88 wrote:@slowlyclimbing From my Understanding the 90 day lates are going to hurt your score a good chunk...But those you can't GW and will likely stay on around 7-10 years

Not sure what you mean about can't GW a 90D late? You certainly can (I have) get them removed via GW. Also late payments typically stay on your CR for 7 years, not longer.

OP, when one removes their final major negative item often they see score increases to the tune of 60-90 points.

OP's lates are attached to student loans and, as far as I know, federal SLs don't entertain goodwills for accurate reporting of delinquencies/defaults at all- though I guess you could try. If they are private SLs then there may be a better chance.

The late payments will drop after 7 years - I believe extended reporting is allowed for Federal Perkins loans that have defaulted and were never repaid.

+1

You cannot GW lates of Fed Loans due to the Higer Education Act. It is a law they must accyrately report while loans are still being repaid. If you have paid off the loan (no consolidated or refinanced with another lender) then you may have a better chance.

Perkins loans are quite unforgiving when it comes to reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much is this affecting my score?????

@Girlzilla88 wrote:@slowlyclimbing From my Understanding the 90 day lates are going to hurt your score a good chunk...But those you can't GW and will likely stay on around 7-10 years, HOWEVER with the COLLECTION I would try to reach out to the CEO not just a regular person (do it mail where you need a verified signature if you have to) and see if they will accept the FULL payment (if possible) in exchange for Deleting it from all 3 CB's. This way it does not restart your clock. For having those negatives your scores are still pretty good

650 and up is a good middle man to be, 700 up is even better while 750 and up is pretty solid gold ^^

You are right, the SL lates can probably not be GW'd if they are unpaid fed loans and will remain 7 years or longer (especially if Perkins loans).

Now nothing resets DoFD. The account paid or other will age off based off of the DoFD. On original creditor is highly unlikely to PFD. Paying the CO may or may not boost scores, but I like to hope they do and an unpaid CO is easier to overcome in the long term. It should age off in 2+ years (2023), so it definitely is worth the effort to handle it.