- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Huge score difference between Mortgage Lender and ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Huge score difference between Mortgage Lender and FICO

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Huge score difference between Mortgage Lender and FICO

Hi, trying to get a home equity loan and the mortgage lender came back with a score that I thought seemed awfully low. I looked up my score here on myFICO and there is a 60 point difference. Anyone have any ideas what might be causing this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huge score difference between Mortgage Lender and FICO

@KConn23 wrote:Hi, trying to get a home equity loan and the mortgage lender came back with a score that I thought seemed awfully low. I looked up my score here on myFICO and there is a 60 point difference. Anyone have any ideas what might be causing this?

Welcome to the forums.

Did you look up your FICO 08 score here? If so most mortgage companies use a Mortgage enhanced score based on FICO 04 scores. You can get those here with the purchase of a new report. If you are looking at a FICO 08 score there very well could be a 60 point differnce in those scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huge score difference between Mortgage Lender and FICO

i'm not sure what score they're using. But I've looked up every one of my scores on here and they are all 60 - 70 points higher than what the lender is showing. I called the broker agency the lender is using and they refused to help me. Lender says they can run it again, but if it comes back lower, they have to use the lower one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huge score difference between Mortgage Lender and FICO

@KConn23 wrote:i'm not sure what score they're using. But I've looked up every one of my scores on here and they are all 60 - 70 points higher than what the lender is showing. I called the broker agency the lender is using and they refused to help me. Lender says they can run it again, but if it comes back lower, they have to use the lower one.

If they won't provide you what score that they are using, it's very hard to compare. Before when MyFico didn't provide the mortgage enhanced scores it really was impossible to know where you stood with mortgage lenders. Now, with the new scores being available that shouldn't be the case.

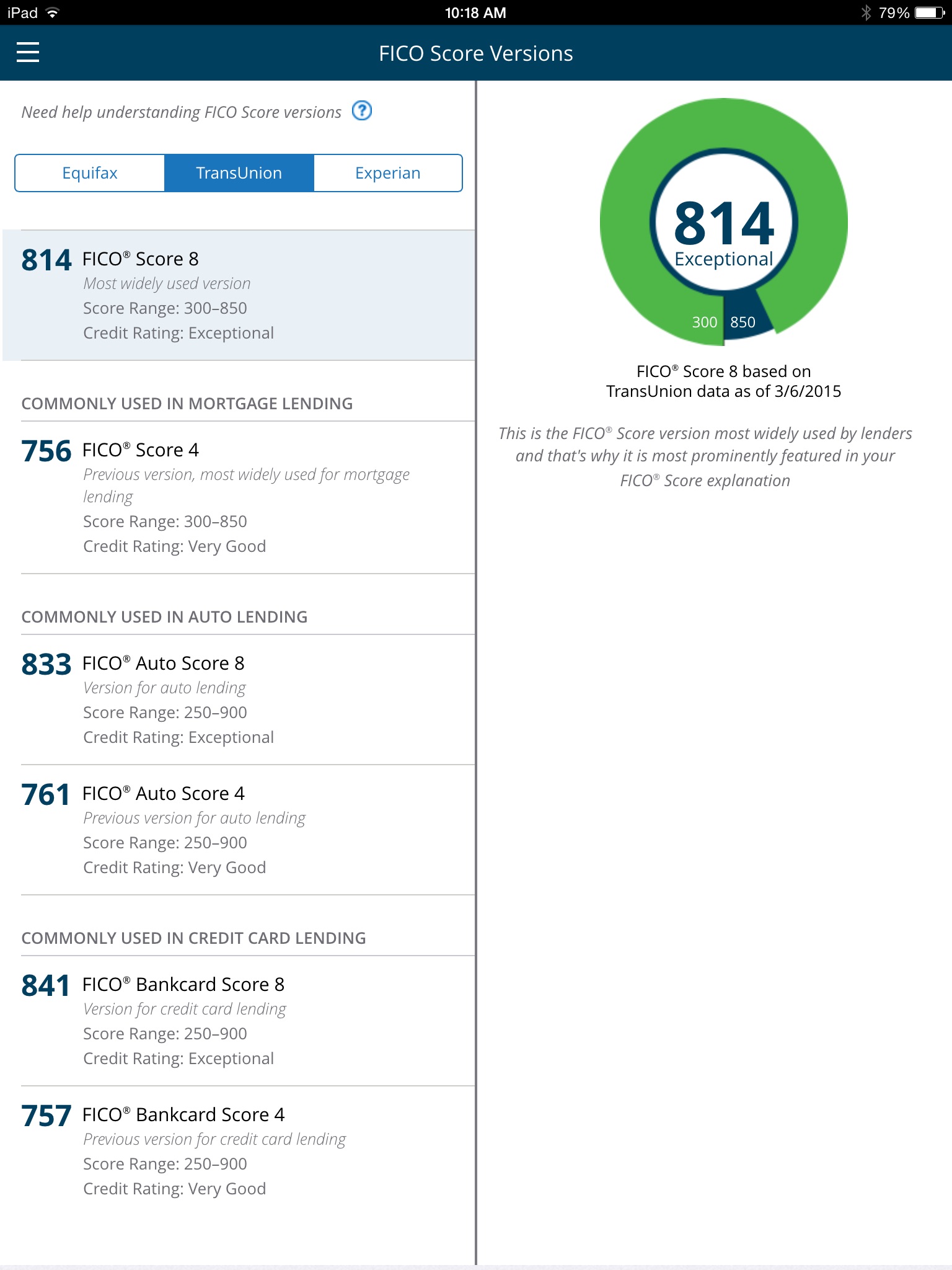

Just make sure that what scores you are looking at look like this:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huge score difference between Mortgage Lender and FICO

I just ran a new report yesterday. The only scores showing up on my report are FICO 8 and FICO 2. How do I access FICO 4?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huge score difference between Mortgage Lender and FICO

@KConn23 wrote:I just ran a new report yesterday. The only scores showing up on my report are FICO 8 and FICO 2. How do I access FICO 4?

Those are the same scores. Difference being one is Transunion's version and one is Experian's. All 3 bureaus call their mortgage score which is based on the FICO 04 score something different. If you purchase the 3 bureau report you would see all 3. At this point I wouldn't do it until you find out what your mortgage lender is using.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huge score difference between Mortgage Lender and FICO

All mortgage lenders use the mortgage scores only -it is industry wide. These are the same scores here as mentioned by Irish. But you have to get the 3B report to see all three of your mortgage scores. http://www.myfico.com/Products/FICO-Score-3-Report-View/

If your mortgage broker tells you he is using a different score than the mortgage industry standard - run away from this broker, fast. BTW, there is no reason he can't tell you your scores. In fact he has to disclose them to you. Let me see if I can find the relevant information for the score disclosure for you.

EDIT: The Fair and Accurate Credit Transactions Act (FACTA) requires mortgage brokers and lenders to provide a disclosure to any home loan applicant on which they have viewed a credit score. The disclosure must include the:

- credit score

- key factors effecting the score

- score range

- date the score was created

- name of the bureau that created the score

There are additional disclosure requirements coming this year effective Aug 1 2015 (more disclosures, not less).

Given your post, I would find another lender. You can't go through the process when one of the parties is uncoopertive (loan officer). Now that the mortgage scores are available here - the same ones the lender uses - you have much more knowledge going in before you ever apply. Shop your lender.