- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Huh? Is 36 Years Really a Short Credit History?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Huh? Is 36 Years Really a Short Credit History?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Huh? Is 36 Years Really a Short Credit History?

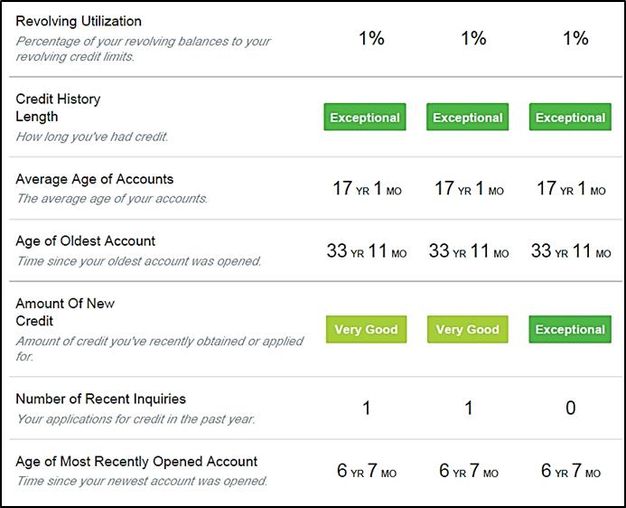

I assume MyFICO scoring reasons have to be taken with a grain of salt, however I had to shake my head when going through my most recent 3B report. It shows that at almost 36 years, I have too short of a credit history.

April 2024: EX8: 839; EQ8: 845; TU8: 842 -- Middle Mortgage Score: 822

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

You have just become the poster child for ridiculous credit scoring excuses. There is no way that is a short credit history. I think sometimes the algorthm gets stuck for an explanation and just plucks something out, even though it isn't really defensible. It is almost as though it spins a roulette wheel and just spits out whatever comes up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

EW800, what is your AoYA? Above your AoOA and AAoA are well above the top amount required for optimal scoring (~17 years AoOA, ~7.5 years AAoA) but there is no mention of your AoYA. An AoYA of < 12 months can adversely impact scores 15-20 points easy and from 12-23 months can still generate negative reason codes. On some models an AoYA of up to 5 years can still cause a negative reason statement to be displayed, although at that point if its impact is more than 1-2 points I'd be surprised.

Anyway, my guess is that you've opened an account within the last year or two (probably within the last 12 months) and that's why you're seeing what you posted above. Keep in mind that CMS fluff software doesn't always paint the whole picture. This is an excellent example of that, as the image you posted is only showing two-thirds of the age of accounts factors that go into a FICO score, impact reason statements, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

Short history = AAOA

AOYA has a different reason code.

Have stated in the past: any of the short history ones (basic short, revolving, or installment) are 3 reason codes which cannot be argued with and therefore cannot be sued over... so basically if there's nothing left worthy of complaining about, that's basically what you get. I don't know that they ever go away until your reason codes get supressed.

Code for: sit on your hands = 850 eventually.

Which FICO model / bureau did you get this on EW? Actually I don't recall your profile bud (it's been a while) are any of those AU accounts out of curiosity on an edge case and FICO 8/9?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

I've never seen that reason code and my scores are similar to EW's with my AAoA being significantly less than his by 50%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

@EW800 wrote:I assume MyFICO scoring reasons have to be taken with a grain of salt, however I had to shake my head when going through my most recent 3B report. It shows that at almost 36 years, I have too short of a credit history.

I have received this reason code as well (Auto Fico 04). My AoOA is less than yours at only 34 years ![]() but my AAoA is a bit longer at 17 years. This code is not associated with AoYA.

but my AAoA is a bit longer at 17 years. This code is not associated with AoYA.

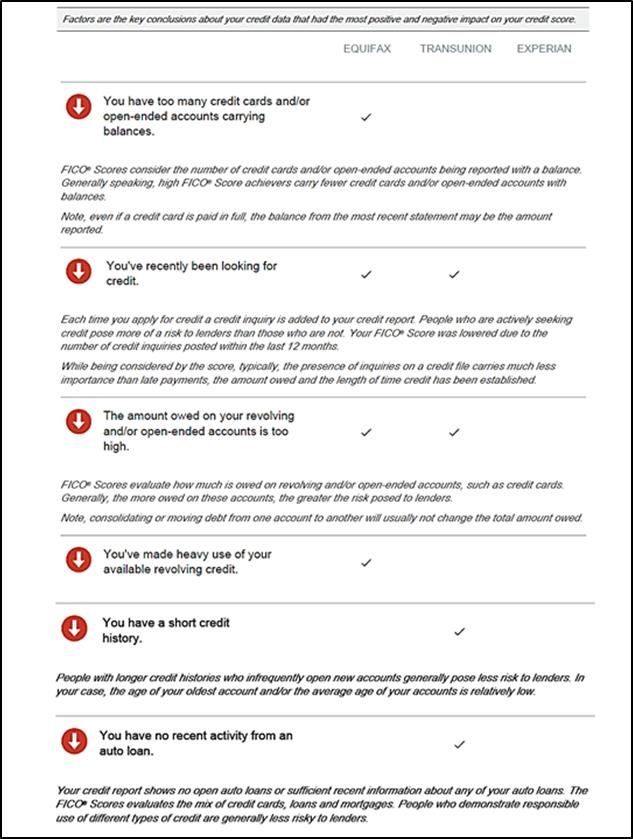

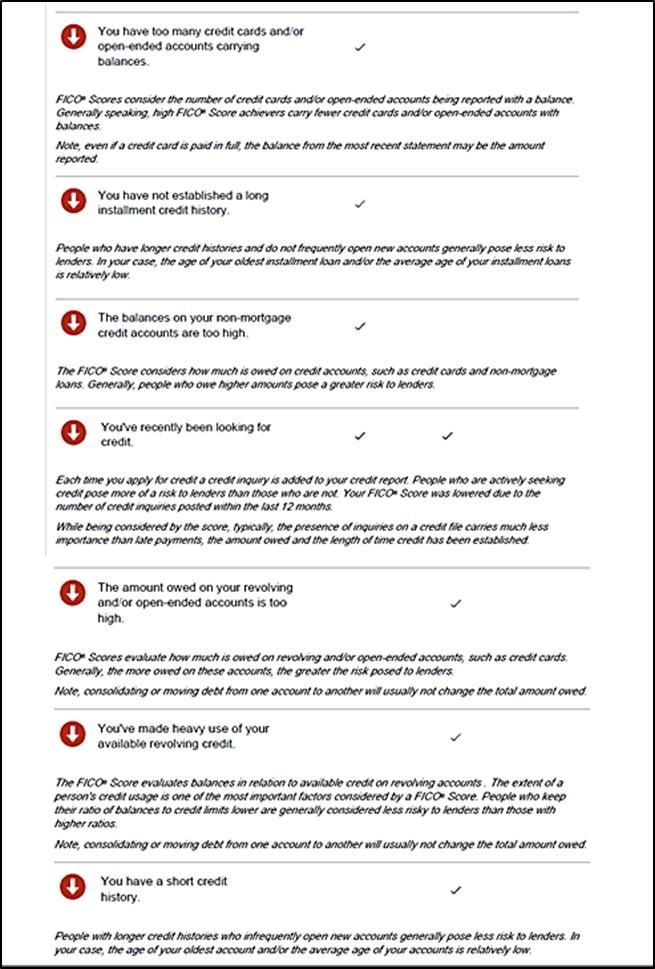

I do speculate that short credit history might be looked at by account type: revolving credit accounts, charge card accounts, mortgage accounts and other installment loan accounts. I have no other installment loans or Auto loans on file - just a mortgage at 12.5 years age. (prior, paid off, mortgages have aged off reports).

The above reason statements are for Fico 04/Fico 98 Auto enhanced. I believe the summary is rank ordered by impact.

*** 5 of 6 cards, 6 of 7 open accounts reporting balances ***

The below are for Fico 04/Fico 98 Bankcard enhanced. (note no mention of Auto loan but not establishing a long installment credit history ranks 2nd)

How old does oldest installment loan need to be for no negative - 15 years?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

Revelate raises a good point, which is that any particular FICO model might be ignoring AU accounts in terms of generating this reason code.

I.e. it would be helpful to know our OP's Age of Oldest (35.8 years) might be less if he ignored all AU accounts. Same for his AAoA. When posting results in this kind of thread it's helpful to have age data without the AUs if that would cause a lower result (or better yet include both).

I also like TT's suggestion that the reason code might be triggered because a specific type of credit is not old enough. This is consistent with what FICO itself says in the "Learn About Scores" section of this web site. See below....

Length of credit history (15%)

In general, a longer credit history will increase your FICO® Scores. However, even people who haven't been using credit long may have high FICO Scores, depending on how the rest of the credit report looks.

Your FICO Scores take into account:

- how long your credit accounts have been established, including the age of your oldest account, the age of your newest account and an average age of all your accounts

- how long specific credit accounts have been established

- how long it has been since you used certain accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

Good information above from everyone.

Looking at the two age of accounts factors in and of themselves if there aren't AU accounts factored into those numbers, it's impossible that a 30+ year AoOA and 10+ year AAoA would be hindering score at all and therefore no negative reason statements should be generated pointing to those factors.

I do feel however that different account types can certainly play a role. Say someone has 8 revolvers and 2 installment loans and their age of accounts factors are what I just stated above... 30+ / 10+ years. Perhaps all of their revolvers are aged (say, 5+ years old) but their 2 installment loans are just 2.1 years old. Chances are that the installment loans aren't paid down to < 8.9% yet since they aren't very aged, so this factor could potentially be holding back score to some degree. While a proportion of loan balances to limits negative reason statement would be more fitting, the one the OP described could indirectly be used as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

@Thomas_Thumb wrote:How old does oldest installment loan need to be for no negative - 15 years?

Nope, more than that!

I'm still seeing "You have not established a long installment credit history." - "People who have longer credit histories and do not frequently open new accounts generally pose less risk to lenders. In your case, the age of your oldest installment loan and/or the average age of your installment loans is relatively low." on EQ BC 5 with the oldest still-reporting installment being a closed mortgage that's 16.5 years old. Newest mortgage is 3 years, newest installment loan is 1 year.

I'm also seeing "You have not established a long revolving and/or open-ended account credit history." - "People with longer credit histories who infrequently open new accounts generally pose less risk to lenders. In your case, the age of your oldest revolving and/or open-ended account and/or the average age of your revolving and/or open-ended accounts is relatively low." on TU BC 4 with the oldest still-reporting revolving line about to hit 22 years. Newest revolver is about 3.5 years.

So perhaps it also factors in NEWEST in each category? Or does a separate AAoA per category?

The mentions of "...do not frequently open new accounts..." and "...who infrequently open new accounts..." in the reason codes does seem to imply that recent account ages matter.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Huh? Is 36 Years Really a Short Credit History?

I wonder to what extent the reason code generator may get really wonky and unreliable when a person has a near perfect profile. We are trying to infer how the generator works in part from contributors like iv and TT and even folks like BBS and myself (all of whom have 850s or near 850s).

To give you a very specific example, in this thread TT gives a ranked listing of the negative reasons affecting his score. Fairly high on that list is:

The amount owed on your revolving accounts is too high

and

You've made heavy use of your available revolving credit

Trouble is that his CC utilization is clearly 1% (probably something like 0.3% in fact). It's simply not possible that he is making heavy use of his available revolving credit.

Before we try to infer the details of how FICO handles age, it seems like we'd need to explain the much bigger elephant in the room of TT's reason statements regarding his CC util. If we conclude that those are complete BS, then perhaps all reason codes for people with top-drawer profiles are suspect, except possibly the very first one in a person's list.

Our OP's scores are in the mid to upper 700s, so those may be more likely to being triggered by something real. Unless I missed it, however, he doesn't give us the full list of his reason statements, showing where in that ranking this particular age-related claim falls. (Is it #1? #4? etc.)