- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- I'm 21 and my FICO-TU just hit 800+

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I'm 21 and my FICO-TU just hit 800+

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm 21 and my FICO-TU just hit 800+

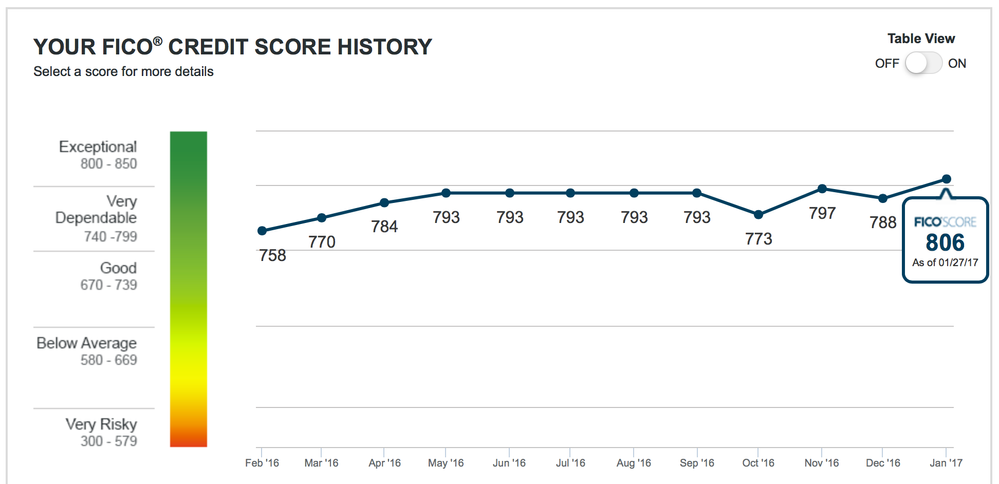

So I'm hoping someone can shed some light as to how often this occurs. I'm 21 and my FICO-TU just surpassed 800: I'm at 806.

In February 2016 I was at 758, and since then I've climbed to 806. Since May 2016 my score pretty much remained between 793 and 797. I have three credit cards, total CL $10K, credit utilization of approximately 1% or less. Never missed a payment. No loans, no car payments - literally nothing else besides three credit cards (and one secured card that I closed in 2013).

So apparently reaching the 800+ club is attainable for someone in their early-20's. I'm sure it's very rare, though - does anyone know someone my age who has hit 800+? I'm curious. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

Congratulations on your 800 FICO adrianaesque!

If your score just increased to 800 in early February, the increase is likely due to some type of aging.

Could you provide us with some data?

AAoA

Age of oldest account

Age of youngest account

Inquiries in the last year

You said that your utilization is approximately 1% or less. Is it consistently <1% or does it fluctuate? Is it 1% on 1 card or overall?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

Congrats.

I guess your newest account just crossed the 6 month mark, maybe other age related as JLK93 mention.

Is rare to see someone at 21 with 800, not because is hard to do but for the path they follow (debt, many cards/no garden).

I'm more than double your age but just started building credit 3 years ago in the USA and sometimes cross the 800 mark (I think the score will stay above 800 thanks to SSL technique). DW also hits the 800 with 3 year history.

I think is harder for 21 year olds because they tend to be more aggressive towards credit and want more things that they need.

Keep doing what you are doing.

One question, do you have any loan? Student, auto, mortgage? If not, you can get some extra points with the SSL technique.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

JLK93 wrote:Congratulations on your 800 FICO adrianaesque!

If your score just increased to 800 in early February, the increase is likely due to some type of aging.

Could you provide us with some data?

AAoA

Age of oldest account

Age of youngest account

Inquiries in the last year

You said that your utilization is approximately 1% or less. Is it consistently <1% or does it fluctuate? Is it 1% on 1 card or overall?

Thank you, JLK93! And you're right, my newest card (Chase Freedom Unlimited) turned 6 months on January 21, 2017. My 806 FICO-TU score is as of 1/27/2017, so my newest card just made the mark before my score was pulled.

Here's my data:

• Capital One Secured MasterCard (opened 4/2013, closed 4/2014)

• Discover It (opened 6/2013, still active) $5k current CL

• Chase Freedom (opened 11/2014, still active) $2.5k current CL

• Chase Freedom Unlimited (opened 7/2016, still active) $4k current CL

• Total current CL: $11.5k

• Credit utilization: 1% or less (for each individual card and overall), this is pretty much consistent, it rarely goes above 5%, no cards have ever been above 25% utilization

• AAoA: 2 years 7 months

• Age of oldest account: 3 years 9 months (this card was closed 4/2014)

• Age of newest account: 0 years 6 months

• Inquiries in last year: 1 (in 7/2016 to open my newest card; before that my last inquiry was 11/2014 to open a different card)

• No student loans

• No car financing

• No mortgage

• Never missed a payment, and I always pay my balance in-full

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

@newhis wrote:Congrats.

I guess your newest account just crossed the 6 month mark, maybe other age related as JLK93 mention.

Is rare to see someone at 21 with 800, not because is hard to do but for the path they follow (debt, many cards/no garden).

I'm more than double your age but just started building credit 3 years ago in the USA and sometimes cross the 800 mark (I think the score will stay above 800 thanks to SSL technique). DW also hits the 800 with 3 year history.

I think is harder for 21 year olds because they tend to be more aggressive towards credit and want more things that they need.

Keep doing what you are doing.

One question, do you have any loan? Student, auto, mortgage? If not, you can get some extra points with the SSL technique.

Thank you, newhis! Yes, my newest account just hit 6 months old right before my 806 FICO-TU score was pulled. See my previous comment for my stats.

Sadly, most 20-somethings aren't good with impulse control or responsible spending. I began lurking the myFICO forums before I turned 18 because I wanted to build perfect credit once the time came. Apparently it has been working out. ![]()

I'm aware of the Share Secure Loan (SSL) technique. Actually, thanks for reminding me about it. I couldn't do it before due to not enough money (graduate tuition and bills). I just transitioned into a new job, though, and I'm making significantly more. I now have enough disposable income to do the SSL technique, so I think I'll get on that very soon. I need to start diversifying my credit portfolio in a meaningful way.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

Thank you for the data adrianaesque!

Your data shows that it is possible to have an 800 score with oldest account less than 4 years old and AAoA over 2 years.

If you take out a secured installment loan and pay it down below 10% your can add around 30 points to your score. There is a thread on this forum. You really only need to read the first post.

You might want to add a few cards to provide a long term stability to your AAoA. However, keep in mind that most Chase cards won't be approved if you have 5 new cards in the last 24 months. Also, adding new cards might drop your AAoA below 2 years. This will cause a temporary score drop until your AAoA rises back above 2 years.

Keep up the good work!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

Good for you adriana! And what a great example to other young people!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

With Discover you can try to SP CLI every month or two, also you can ask for APR offers, sometimes they offer 0% for 12 months or permanent drop by 2% your currently have.

I think your Discover can grow above 5K with SP CLIs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

Now in fairness, when I worked in UW... You'd be surprised how many 'kids' had crazy high scores

Especially, those whose parents either

A) added them as AUs or

B) gave them a great foundation as what to do

My 19 y.o. and 21 y.o. are benefitting from my leadership in this regard ... While most young ppl

A) just don't have enough interest or are busy doing other stuff like school, military or chasing tale

B) Many if those that do get involved, get in over their heads due to spending and or just being to far into adulthood than they can handle at that point (meaning some kids have spouses, kids and much growner bills than most 21 y.o.s ) so they are swimming upstearm before they know it.

Keep up the good work

Now don't get twisted thinking that score means UWers won't still turn you down,no matter what the score says it entire profile has value as you said no car or installers

You're right the SSL couldn't hurt....You're in lane 1

Now stay there.... Again Congratulations 😀

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm 21 and my FICO-TU just hit 800+

@JLK93 wrote:Thank you for the data adrianaesque!

Your data shows that it is possible to have an 800 score with oldest account less than 4 years old and AAoA over 2 years.

If you take out a secured installment loan and pay it down below 10% your can add around 30 points to your score. There is a thread on this forum. You really only need to read the first post.

You might want to add a few cards to provide a long term stability to your AAoA. However, keep in mind that most Chase cards won't be approved if you have 5 new cards in the last 24 months. Also, adding new cards might drop your AAoA below 2 years. This will cause a temporary score drop until your AAoA rises back above 2 years.

Keep up the good work!

Yes JLK93, I'm going to do the Share Secure Loan (SSL) technique soon. newhis mentioned this too. I've known about the SSL technique for a while, I just couldn't do it before because I didn't have the funds thanks to graduate tuiton and other bills. But now I do, so I'll be getting on that very soon to diversify my credit portfolio and bump up my score more.

Opening two more CC's would drop my AAoA from 2 years 7 months to 1 year 8 months for the time-being, but like you said would give me more long-term stability. Which cards do you recommend?