- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Impact of CFA BS

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Impact of CFA BS

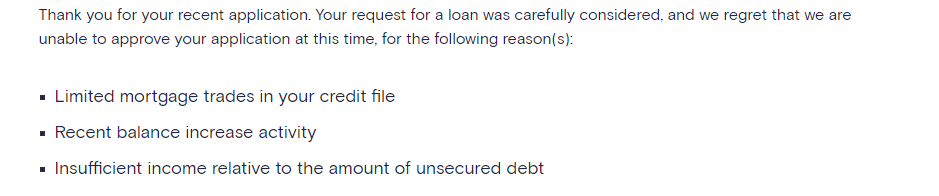

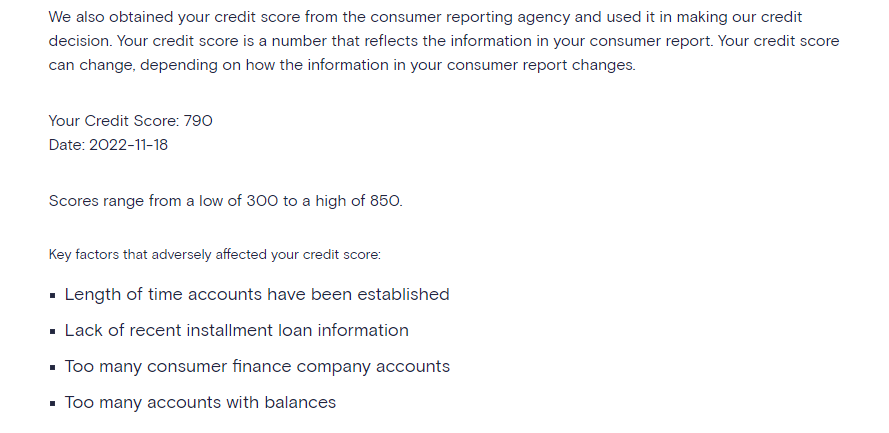

I have a GM Buss CC $31K CL...I guess it doesnt matter high your score can be, I just wanted to see what what Marcus would give me and these alt lenders are always the same with the denial reasons...

DATA PTS

On time

Summary

$795 Credit cards

$795 Credit cards $0 Collections

$0 Collections $0 Student loans

$0 Student loans $0 Personal loans

$0 Personal loans $0 Auto loans

$0 Auto loans $0 Home loans

$0 Home loans

SOFI closed loan since 2020 only had it 2 years or the 6 years and paid it off and the classifed as a CFA, such BS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact of CFA BS

Would marcus still be considered an alt lender since it's part of Goldman Sachs?

June 2022 FICO 8:

June 2022 FICO 9:

April 2024 FICO 8:

April 2024 FICO 9:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact of CFA BS

What did you do? Ask for a CLI or applied for something and was denied. CFA's has been known it affects you until it falls off. Missed your point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact of CFA BS

CFAs are dumb, no lie. The whole implementation should either be rethought or gotten rid of.

That said the difference between my EQ and EX files is I have a CFA (Cashcall) loan still on EQ after 10 years... and I don't on EX who got rid of it right on time.

You can't really directly compare FICO 8 scores because algorithm awkwardness, but:

EQ FICO 8: 830

EX FICO 8: 834

That's not a lot of penalty for a CFA on an otherwise highly optimized file with the exception of terrible installment utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact of CFA BS

@Zoostation1 wrote:Would marcus still be considered an alt lender since it's part of Goldman Sachs?

Maybe, the problem with CFAs is what is and what is not is a constantly moving target and you just never know until it lands on someone's credit report and the reason code pops.

I'd go and dispute mine as being too old on EQ and see what it really does but my god **bleep** construction got pushed back ANOTHER month (literally about a month before I was supposed to close) and I'm not going to play dispute / credit funsies with a mortgage in some state not quite equalling the wind.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact of CFA BS

@Revelate wrote:

@Zoostation1 wrote:Would marcus still be considered an alt lender since it's part of Goldman Sachs?

Maybe, the problem with CFAs is what is and what is not is a constantly moving target and you just never know until it lands on someone's credit report and the reason code pops.

I'd go and dispute mine as being too old on EQ and see what it really does but my god **bleep** construction got pushed back ANOTHER month (literally about a month before I was supposed to close) and I'm not going to play dispute / credit funsies with a mortgage in some state not quite equalling the wind.

It diff needs to be rethought if you dont go to the old dino way of banks, that is old Fiat system that just wont budge. The new money needs to be added for scoring and not penalizing consumers and I know this has been talked to death about but annoys me because I rebuilt my credit from 800 to 430 and back up 790s and that stupid CFA garbage is there