- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Increase my credit score from 711 to 720+

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Increase my credit score from 711 to 720+

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

@Anonymous wrote:

@Medic981I have been curious as well. I suspect it is to chip away at the principle of the debt and to also help keep the utilization from increasing. I would like to see what @CreditGuyInDixie or one of the more knowledgeable myFICO forum veterans have to say.

I don't think it really has to do with chipping away at principal, as $2 extra really isn't going to accomplish that. I think the point here however is that you're showing the lender that your desire is to pay more than the minimum, something that makes them feel more comfortable than just the minimum, which many people do. It comes down to the principle here rather than the principal, I believe

Right. When a person only pays the minimum payment, that is identified by some issuers (in their internal system, not by FICO) as a flag for high risk. High risk cardholders are often "balance chased" by the CC issuer. (Google that phrase to learn more.) We have seen many people report being balance chased after they only paid the MP (with a high utilization). Paying a few dollars more seems to get around that flag.

A person can still be balance chased even if he pays a few dollars extra, but he's reduced the chance that this will happen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

@Anonymous wrote:Hello - I'm in the process of buying a second home which will become my primary residence. My salary is ~150k/year. My first mortgage will remain on my credit because that is where my parents will continue to live. I will be moving to the new home with my child so that we can all live separately - and peacefully!

The home is a new construction which will be ready in 5 months. I already have the sales contract so I'm on the hook. I was told by the mortgage lender that my FICO Mortgage score is 711. I have read that a score of 720 gets significantly better rates. I've already read the Frequently Request Threads post on this forum and have started working on some issues. Since this is my first time trying to improve my FICO scores, I could really use some help.

- I cannot do BT to my $0 balance cards. So, when deciding to pay down my credit cards, should I pay off the higher utilizations? Pay off the smaller balances? I included my account balances at the bottom of this post.

- Is a report of 3 late payments 12 months ago affecting me greatly? The CCC denied my petition to erase the bad marks over the phone today, should I try a letter? Or should I try to hire a credit repair company to help me remove that?

- I just realized that an account I opened 19 years ago was closed just last June 2018. Is it possible to ask the bank to reopen it? Or is that a lost cause?

THANK YOU so much in advance for any help and feedback you can give me! Best regards!

This is my current snapshot:

Overall Credit Use: 30%

Payment History: 100%

Derrogatory Marks: TU = 0, EQ/EX: 1 account

Credit Age: 5 yrs 7 Mos

Total Accounts: 29

Hard Inquiries: 5 Total: 2 in 2018 and 1 in 2017 and 2 in 2016

These are my accounts:

Auto Loans

- Auto Loan #1 in Good standing – Owe $20.8k – Paid 37% of original amount

- Auto Loan #2 in Good standing – Owe $22.1k – Paid 8% of original amount

- 2 Auto Loans, paid off in 2008 and 2014, in Good standing

Mortgage

- 1 Mortgage in Good standing – Owe $73.3k – Paid 29% of the real estate loan amount

Credit Cards

- 7 Open credit cards in Good standing:

- CC #1 - As of 07/28/18: Bal: $14,527 / $14,500 - Used: 100% - Interest: 0%

- As of 8/23/18: Bal $10,582 / $14,500 – Used 73%

- CC #2 - As of 08/12/18: Bal: $16,447 / $26,000 - Used: 63% - Interest: 21.24%

- CC #3 - As of 08/22/18: Bal: $4,439 / $9,500 - Used: 47% - Interest: 10.49%

- CC #4 - As of 08/15/18: Bal: $6,107 / $23,000 - Used: 27% - Interest: 18.24%

- CC #5 - As of 07/28/18: Bal: $2,086 / $12,250 - Used: 17% - Interest: 0%

- As of 8/23/18: Bal $950 / $12,250 – Used 8%

- CC #6 - As of 08/20/18: Bal: $800 / $5,000 - Used: 16% - Interest: 0%

- CC #7 - As of 08/12/18: Bal: $189 / $4,000 - Used: 5% - Interest: 26.74%

- Paid it off 8/23/18

- 5 Open credit cards in Good standing with $0 Balance which are primarily retail and/or do not offer balance transfers

- 1 Closed Credit Card with a bad mark (Toyota Rewards) which I mistakenly used and missed paying it off until 4 months too late, so I have a 30, 60 and 90. The charge was for $237 and it grew to $400 after interest and late fees, which I paid off in full back in Aug 2017. The credit card company reported my account closed and paid in full in March 2018. I called the credit card today, and they refused to retract/clear the negative marks.

- 10 Closed Credit Cards in good standing

The 90 day late is having the greatest impact on your score. Not sure if your listed "mortgage score" is your middle score or a score from a particular CRA - I assume it's the middle score among the three CRAs. Typically phone calls are not effective for removing lates. Best to state your case in writing with supporting information. Do try a few goodwill letters.

If you can get the lates removed, your mortgage scores could jump to the 760 range. A hard pull is more influential on the mortgage Ficos. Avoid any new HPs. Hopefully most of your HPs will have reached 12 months by then and no longer impact score.

The Fico mortgage algorithms are rather sensitive to # cards reporting balances. I understand funds may be limited and you will want/need a downpayment. The Fico mortgage algorithms, particularly EQ, penalize for too many accounts with balances. They also don't like high utilization. If you really want to boost score the following is a good goal:

1) Your current aggregate utilization is 30%. That really hurts your score. As a 1st step get it well below 29% - say to 26% so you are in the next lowest utilization (9% to 29%) with some headroom. The bigger boost will come if AG can be dropped below 9%.

2) It looks like you have some highly utilized cards (73% and 63%). Paydown all highly utilized cards to under 49%.

3) You have 12 open cards with 6 reporting balances. Reduce # cards reporting balances to 5, and then to 3 if/when possible.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

Yes, the 711 is my middle score. I was told today the others scores were 708 and 725. The scores are from 8/7/2018 when the 100% utilization card had just shown up. That same card is ar 73% now so my hope is that the score is already improved but I guess I dont have a way of knowing without another hard pull, right?

About the 90day, I am already putting together the list of addresses to send GW letters. I hope to draft the letter next week and send out Round 1 of the letters by mid September which gives time for the new lower balances to get updated to lower %s.

After you mentioned the hard inquiries, I looked further and TU shows 5, but EQ has 10! It seems 2 of the 10 will drop out this month, 4 of them are duplicates, and another is a mistake. I am not allowing any more hard inquiries, but I do know that as we near Closing time, in about 4 months, the bank will do another pull. That is when I plan to go to other banks to shop around for the best interest rate. I hope by then the GW letters worked out and I can be down to 3 credit cards at under 48%. That is probably the best I can do in 4 months.

Since you mentioned the hard pulls, how much emphasis should I put to reducing the hard pull history with Equifax? Can I get conoa ies to remove hard pulls via phone calls? Or is that going to take letters as well?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

I agree with the advice from @CreditGuyInDixie and @Thomas_Thumb

I would just add this: for each negative you can send "verification" letters to the credit bureaus, asking them to obtain verification of the item. Some lenders might not get back to the bureau within the 30-day time limit, thus causing the item to be dropped. Some lenders might never get back to them, in which case the item would stay off permanently.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

@Anonymous wrote:

Thank you, Thomas!

Yes, the 711 is my middle score. I was told today the others scores were 708 and 725. The scores are from 8/7/2018 when the 100% utilization card had just shown up. That same card is ar 73% now so my hope is that the score is already improved but I guess I dont have a way of knowing without another hard pull, right?

After you mentioned the hard inquiries, I looked further and TU shows 5, but EQ has 10! It seems 2 of the 10 will drop out this month, 4 of them are duplicates, and another is a mistake. I am not allowing any more hard inquiries, but I do know that as we near Closing time, in about 4 months, the bank will do another pull. That is when I plan to go to other banks to shop around for the best interest rate. I hope by then the GW letters worked out and I can be down to 3 credit cards at under 48%.

Since you mentioned the hard pulls, how much emphasis should I put to reducing the hard pull history with Equifax? Can I get conoa ies to remove hard pulls via phone calls? Or is that going to take letters as well?

I would not put any emphasis on attempting to remove hard inquiries. If they were authorized based on credit requests, they are valid and won't be removed. Focus your efforts on the lates.

I was able to get an unauthorized HP "removed" once (actually it was recoded to a SP) but only because I canceled an online credit union membership application before completing. After review the CU realized the application had not been fully executed so no HP was authorized. The CU sent a letter to EQ for removal.

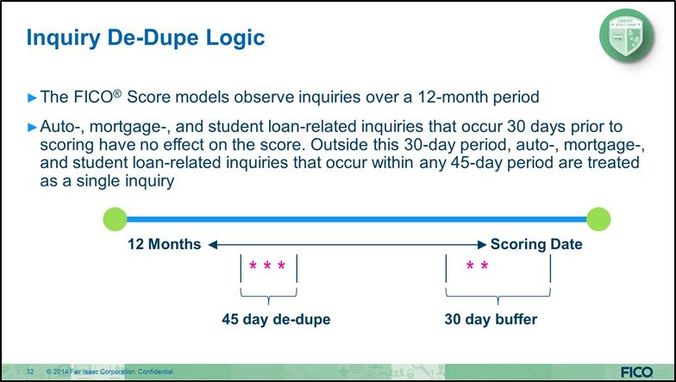

Side note: HPs done within a certain timeframe (for loan applications) should be deduped together (count only as one for a given CRA) for Fico scoring purposes. Not sure how non credit HPs from service providers or rental companies are treated.

If you can drop your utilization and # cards reporting balances as mentioned, you might see a 15 to 20 point score boost even without removal of lates.

Good luck.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

That sounds like a good idea, too. If I decide to send verification letters to the CRA, should I do that before sending GW letters to the CCC? After a couple of rounds of GW letters? Or all at the same time?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

I won't put too much effort into the hard pulls alone. I do hate to see that the alarm company ran my credit twice, on the same day. And similar situation when I purchased a car last year; there is a hard pull by the car dealership and one by Honda financial on the same day.

If I have free time, I may just make a phone call to see if anything can be done through the phone. But I will leave those alone for now until I work on the late thing.

Thank you all for your help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

@Anonymous wrote:

Thank you, South Jamaica!

That sounds like a good idea, too. If I decide to send verification letters to the CRA, should I do that before sending GW letters to the CCC? After a couple of rounds of GW letters? Or all at the same time?

I think the more letters the better.

I wouldn't expect results from the phone calls though.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

@SouthJamaicaI think the more letters the better.

I wouldn't expect results from the phone calls though.

I agree. I've always felt that phone calls are a bit too "easy" and don't show much effort in the eyes of the person taking the call. It probably takes a solid 20-30 minutes for someone to pen a really good GW letter that they're proud of and whoever opens that letter can sort of infer that time investment while holding it and reading it. That's quite different than a 2-3 minute phone call. Also when it comes to the Saturation Technique, if it took you 30 minutes to write your initial letter and you end up sending out 50 copies over several Rounds/months, your time investment per letter may be less than a minute. To each person opening that letter, though, they still "feel" like you spent 30 minutes on it, so their opinion on your time invested is always going to be pretty favorable out of the gate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Increase my credit score from 711 to 720+

Dear all -

To save you the time reading the original posts, I am working on my FICO mortgage scores. My house is currently being built and will be finished late February or early March. I had really high balances with some cards and my overall credit utilization was at 30% with 7 out of 12 revolving accounts with balances, and one closed account with one 30-, 60-, 90-day of each notations.

I should start with the positive news. Our house is under construction and half finished - the company expects to have it ready for closing late February or early March. Meanwhile, I have paid off a couple of credit cards and reduced balances as you all suggested. I have never been so acutely aware of my credit card balances! My total credit utilization has decreased from 30% to 20.5%. I have decreased from 7 revolving accounts with a balance down to 4. The 4 revolving accounts have balances of 23%, 29%, 39% and 45%. I'm trying to get them all under 28%. I also sent one round of goodwill letters to 8 addresses. My new FICO scores are at the end of my post.

The bad news is that I got 1 reply to the letters denying the request. I have a slightly re-worded letter to send out for a second round. But I'm not feeling hopeful and feel nearly out of time. I technically only have 1.5s month left before the mortage loan officer runs my credit again to prepare for closing, and I don't know if the improvement on my balances are significant enough to get a significantly better mortgage interest rate.

I have a few questions now:

1. Should I include in my goodwill letter that the 30-, 60-,90-day late marks refer to a $268 balance?

2. Can I add that the goodwill adjustments could mean $26,000 in interest over the life of my mortage loan? The paragraph in my draft related to this says the following:

Since the above late notations do not reflect my current status with the Toyota Rewards Card, or my history with Toyota Financial and Comenity, nor my credit worthiness, I beg you to please forgive me and remove these adverse marks from my credit reports. Anything you can do will be helpful. The difference that your goodwill adjustments could do equate to $26,466 in the life of the loan. Not paying you timely was an unfortunate mistake for which I am so, so sorry. I hope that you will consider I resolved this debt as soon as I became aware of the problem and my history as a Toyota owner and continued Comenity customer to allow me redemption from this unfortunate oversight.

3. South Jamaica had suggested that I send verification letters to the credit bureaus? Are verification letters the same as disputes? If not, can you tell me a little more about verification letters?

4. What are your thoughts on filing a dispute with each bureau? I read that an account in dispute may not be considered for FICO mortage score,s but that I would also lose the value of it for my overall utilization. This issue relates to a $268 balance on a $750-limit credit card. The creditor closed this account 10 months ago. I'm unsure whether the credit limit is being counted in my overall utilization, but at $750 it would not have a big effect. The problem is that I also read some companies may deny a mortgage if there is an account in dispute. What is the prevalence of this? and how much will a dispute on a closed account hurt me?

5. How effective would it be to hire a company like Lexington Law to help me clear my credit? Are they a scam? or legit help?

Thank you all so much as I enter the last weeks before our mortgage loan is defined!

Happy Wednesday!

According to the MyFICO.com website, these are some of my scores as of 12/5/2018:

FICO Score 8 = EQ: 752, TU: 747, EX: 740

FICO Used for Mortgage = EQ: 728, TU: 744, EX: 721

(On 8/7/2018, the mortage loan officer told me the scores he was given for me were 708, 711 and 725)