- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Is 6 years AAoA a threshold?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is 6 years AAoA a threshold?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is 6 years AAoA a threshold?

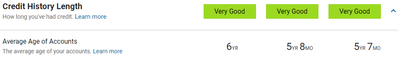

Next month I'll hit 6 years AAoA with 2 of the 3 bureaus. Is that any kind of threshold?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

I'm not sure exactly, although every year that goes by will show some improvement. Here's a quote from an older thread:

This is what we have come up with so far, as of October 2020:

Birdman7: "So it appears 12 months, 18 months, 48 months, 60 months, 66 months, 72 months, 78 months, 84 months, and 90 months. (And I’m sure there are more in between 18 and 48.) Edit: also unconfirmed reports at 24 months, 30 months, and 54 months."

(Link to thread discussing this.)

- 12 months / 1yr 0mo (3 EX 9 scores up 8-10 points, +4 on TU 8, my report here)

- 18 months / 1yr 6mo (Confirmed twice by me, really good on all mortgage scores, LINK )

- 24 months / 2yr 0mo (Unconfirmed)

- 30 months / 2yr 6mo (Unconfirmed)

- 48 months / 4yr 0mo ( EX 8 +27 points, ChemE_Bear, LINK )

- 54 months / 4yr 6mo (Unconfirmed)

- 60 months / 5yr 0mo

- 66 months / 5yr 6mo

- 72 months / 6yr 0mo

- 78 months / 6yr 6mo (Confirmed by BrutalBodyShots)

- 84 months / 7yr 0mo (Confirmed by K-in-Boston, LINK )

- 90 months / 7yr 6mo

Lost/Stolen accounts can be included in AAoA.

Closed accounts are included in AAoA.

SOURCE:

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/AAoA-thresholds/td-p/6174598

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

@PNWRambler wrote:I'm not sure exactly, although every year that goes by will show some improvement. Here's a quote from an older thread:

This is what we have come up with so far, as of October 2020:

Birdman7: "So it appears 12 months, 18 months, 48 months, 60 months, 66 months, 72 months, 78 months, 84 months, and 90 months. (And I’m sure there are more in between 18 and 48.) Edit: also unconfirmed reports at 24 months, 30 months, and 54 months."

(Link to thread discussing this.)

- 12 months / 1yr 0mo (3 EX 9 scores up 8-10 points, +4 on TU 8, my report here)

- 18 months / 1yr 6mo (Confirmed twice by me, really good on all mortgage scores, LINK )

- 24 months / 2yr 0mo (Unconfirmed)

- 30 months / 2yr 6mo (Unconfirmed)

- 48 months / 4yr 0mo ( EX 8 +27 points, ChemE_Bear, LINK )

- 54 months / 4yr 6mo (Unconfirmed)

- 60 months / 5yr 0mo

- 66 months / 5yr 6mo

- 72 months / 6yr 0mo

- 78 months / 6yr 6mo (Confirmed by BrutalBodyShots)

- 84 months / 7yr 0mo (Confirmed by K-in-Boston, LINK )

- 90 months / 7yr 6mo

Lost/Stolen accounts can be included in AAoA.

Closed accounts are included in AAoA.

SOURCE:

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/AAoA-thresholds/td-p/6174598

Thanks @PNWRambler

Somehow, those posts don't inspire confidence ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

I give birdman7 props for trying to summarize the information. I believe it's fair to say that many factors differ by scorecard and it gets messy tracking it all.

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

@TheKid2 wrote:I give birdman7 props for trying to summarize the information. I believe it's fair to say that many factors differ by scorecard and it gets messy tracking it all.

It's only "information" if it's substantiated.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

@SouthJamaica wrote:

@TheKid2 wrote:I give birdman7 props for trying to summarize the information. I believe it's fair to say that many factors differ by scorecard and it gets messy tracking it all.

It's only "information" if it's substantiated.

I spent many, many hours reading these forums. Not as nearly much as you, but I think I've seen enough to make some basic statements. So, let's start by being completely honest about what FICO is; it's a proprietary algorithm that FICO protects as Intellectual Property. It is nearly impossible to substantiate anything when it comes to score behaviors and FICO wants it like that. birdman tried to collect data points and even posted links to where they came from. He at least tried.

You're extremely active trying to help people who post here, but frankly most of your replies about scores are "It depends", "Might be", or "Time will help". That's not a hit on you because most answers are not quantifiable to scores. There are simply too many factors to consider and it's like a giant jigsaw puzzle.

Take your AAoA question here, I don't expect that anyone can substantiate an answer to your question as you asked it. I would be willing to bet AAoA behaves differently based on what scorecard you're in and without that basic information in your post I don't know where anyone could even begin to answer. Certainly not answer it to your satifaction if you expect specific substantiation.

Frankly, short of a FICO insider spilling the beans here, aren't we all making educated guesses?

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

@TheKid2 wrote:

@SouthJamaica wrote:

@TheKid2 wrote:I give birdman7 props for trying to summarize the information. I believe it's fair to say that many factors differ by scorecard and it gets messy tracking it all.

It's only "information" if it's substantiated.

I spent many, many hours reading these forums. Not as nearly much as you, but I think I've seen enough to make some basic statements. So, let's start by being completely honest about what FICO is; it's a proprietary algorithm that FICO protects as Intellectual Property. It is nearly impossible to substantiate anything when it comes to score behaviors and FICO wants it like that. birdman tried to collect data points and even posted links to where they came from. He at least tried.

You're extremely active trying to help people who post here, but frankly most of your replies about scores are "It depends", "Might be", or "Time will help". That's not a hit on you because most answers are not quantifiable to scores. There are simply too many factors to consider and it's like a giant jigsaw puzzle.

Take your AAoA question here, I don't expect that anyone can substantiate an answer to your question as you asked it. I would be willing to bet AAoA behaves differently based on what scorecard you're in and without that basic information in your post I don't know where anyone could even begin to answer. Certainly not answer it to your satifaction if you expect specific substantiation.

Frankly, short of a FICO insider spilling the beans here, aren't we all making educated guesses?

Yes but we have experience, and we share the experiences. E.g., if someone has had experience going back and forth a few times over the 6 year mark, and found that their EX FICO 8 went up and down 9 points each time, or found that the score did not change at all... either of those outcomes would tell me something. Or if someone located a thread in which 3 people participated, each of whom had experience observing the 6 year mark that would tell me something. But if someone just repeats a list that someone else repeated, it doesn't tell me anything. I've detected a lot of that type of so called "information" here, and what it does is create a lot of misinformation. A lot of the "lists" and "rules" I've seen about so called "thresholds" are just like that, and they're not demonstrably based on anything at all.

I myself have on occasion been guilty of repeating "collective" lore that wound up being completely negated by what I actually observed, so that now I try even harder to avoid spreading false rumors.

Which is why when I say something of which I am not certain I qualify my opinion. If I don't know, I don't pretend to know.

I do not give props to someone for coming up with a list of random guesses and passing it off as gospel.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

Most of my scores rose like clockwork every six months until my AAoA reached 96 months. My AAoA is now about 120 months. I still see a one or two scores increasing at six or twelve month AAoA increments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

@SouthJamaica wrote:

@TheKid2 wrote:

@SouthJamaica wrote:

@TheKid2 wrote:I give birdman7 props for trying to summarize the information. I believe it's fair to say that many factors differ by scorecard and it gets messy tracking it all.

It's only "information" if it's substantiated.

I spent many, many hours reading these forums. Not as nearly much as you, but I think I've seen enough to make some basic statements. So, let's start by being completely honest about what FICO is; it's a proprietary algorithm that FICO protects as Intellectual Property. It is nearly impossible to substantiate anything when it comes to score behaviors and FICO wants it like that. birdman tried to collect data points and even posted links to where they came from. He at least tried.

You're extremely active trying to help people who post here, but frankly most of your replies about scores are "It depends", "Might be", or "Time will help". That's not a hit on you because most answers are not quantifiable to scores. There are simply too many factors to consider and it's like a giant jigsaw puzzle.

Take your AAoA question here, I don't expect that anyone can substantiate an answer to your question as you asked it. I would be willing to bet AAoA behaves differently based on what scorecard you're in and without that basic information in your post I don't know where anyone could even begin to answer. Certainly not answer it to your satifaction if you expect specific substantiation.

Frankly, short of a FICO insider spilling the beans here, aren't we all making educated guesses?

Yes but we have experience, and we share the experiences. E.g., if someone has had experience going back and forth a few times over the 6 year mark, and found that their EX FICO 8 went up and down 9 points each time, or found that the score did not change at all... either of those outcomes would tell me something. Or if someone located a thread in which 3 people participated, each of whom had experience observing the 6 year mark that would tell me something. But if someone just repeats a list that someone else repeated, it doesn't tell me anything. I've detected a lot of that type of so called "information" here, and what it does is create a lot of misinformation. A lot of the "lists" and "rules" I've seen about so called "thresholds" are just like that, and they're not demonstrably based on anything at all.

I myself have on occasion been guilty of repeating "collective" lore that wound up being completely negated by what I actually observed, so that now I try even harder to avoid spreading false rumors.

Which is why when I say something of which I am not certain I qualify my opinion. If I don't know, I don't pretend to know.

I do not give props to someone for coming up with a list of random guesses and passing it off as gospel.

Fair enough, I completely understand where you are coming from overall. But, if you read through those posts, I don't think it's fair to call them "random guesses" and "passing it off as gospel". You're being extreme at both ends there unneccessarily. Many of the references are linked to the original, where you can read the info yourself. Some of the info is from as close as we get here to FICO insiders posting.

As you state, we share experiences here and I find that is the best thing about these boards. But, don't you think it would be beneficial to us all to have those experiences collected were put in a summary post? Otherwise, are you just going by memory of previsous posts when you provide advice and guidance? How do you substantiate things without a reference to go back to?

Here's an example, this post caught my eye because I hit 6 years AAoA on my last 3B. My score did not move, but I had a significant jump in utilization on 1 CC since I booked a trip. Did that jump in util cancel out a gain for hitting 6 years on AAoA? I'm in a dirty scorecard, so does that have anything to do with the 6 year AAoA threshhold? Would 6 years be better if I was in a clean scorecard? I'm very curious about that.

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is 6 years AAoA a threshold?

@TheKid2 wrote:

@SouthJamaica wrote:

@TheKid2 wrote:

@SouthJamaica wrote:

@TheKid2 wrote:I give birdman7 props for trying to summarize the information. I believe it's fair to say that many factors differ by scorecard and it gets messy tracking it all.

It's only "information" if it's substantiated.

I spent many, many hours reading these forums. Not as nearly much as you, but I think I've seen enough to make some basic statements. So, let's start by being completely honest about what FICO is; it's a proprietary algorithm that FICO protects as Intellectual Property. It is nearly impossible to substantiate anything when it comes to score behaviors and FICO wants it like that. birdman tried to collect data points and even posted links to where they came from. He at least tried.

You're extremely active trying to help people who post here, but frankly most of your replies about scores are "It depends", "Might be", or "Time will help". That's not a hit on you because most answers are not quantifiable to scores. There are simply too many factors to consider and it's like a giant jigsaw puzzle.

Take your AAoA question here, I don't expect that anyone can substantiate an answer to your question as you asked it. I would be willing to bet AAoA behaves differently based on what scorecard you're in and without that basic information in your post I don't know where anyone could even begin to answer. Certainly not answer it to your satifaction if you expect specific substantiation.

Frankly, short of a FICO insider spilling the beans here, aren't we all making educated guesses?

Yes but we have experience, and we share the experiences. E.g., if someone has had experience going back and forth a few times over the 6 year mark, and found that their EX FICO 8 went up and down 9 points each time, or found that the score did not change at all... either of those outcomes would tell me something. Or if someone located a thread in which 3 people participated, each of whom had experience observing the 6 year mark that would tell me something. But if someone just repeats a list that someone else repeated, it doesn't tell me anything. I've detected a lot of that type of so called "information" here, and what it does is create a lot of misinformation. A lot of the "lists" and "rules" I've seen about so called "thresholds" are just like that, and they're not demonstrably based on anything at all.

I myself have on occasion been guilty of repeating "collective" lore that wound up being completely negated by what I actually observed, so that now I try even harder to avoid spreading false rumors.

Which is why when I say something of which I am not certain I qualify my opinion. If I don't know, I don't pretend to know.

I do not give props to someone for coming up with a list of random guesses and passing it off as gospel.

Fair enough, I completely understand where you are coming from overall. But, if you read through those posts, I don't think it's fair to call them "random guesses" and "passing it off as gospel". You're being extreme at both ends there unneccessarily. Many of the references are linked to the original, where you can read the info yourself. Some of the info is from as close as we get here to FICO insiders posting.

That's not true. I have seen, and even repeated, principles uttered by some of the most knowledgeable membes of this forum, only to later find them to be wrong. In fact, when we did actually get a Q&A session with actual FICO insiders, some of their answers directly contradicted some of the internet legends that had been commonly accepted by many folks here. In fact some of the "truisms" previously and repeatedly uttered by the author of those lists turned out to be false.

As you state, we share experiences here and I find that is the best thing about these boards. But, don't you think it would be beneficial to us all to have those experiences collected were put in a summary post? Otherwise, are you just going by memory of previsous posts when you provide advice and guidance? How do you substantiate things without a reference to go back to?

The short answer is you can't, unless you have actual evidence in your own experience and testing.

Here's an example, this post caught my eye because I hit 6 years AAoA on my last 3B. My score did not move, but I had a significant jump in utilization on 1 CC since I booked a trip. Did that jump in util cancel out a gain for hitting 6 years on AAoA? I'm in a dirty scorecard, so does that have anything to do with the 6 year AAoA threshhold? Would 6 years be better if I was in a clean scorecard? I'm very curious about that.

Sure, I would like to know too. But the reality is that we're never going to know the content of the algorithms. Observing the evidence, and trying to discern patterns which can be backed up by evidence, is the best we can do.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687