- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Is there a rule-of-thumb for AAoA?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is there a rule-of-thumb for AAoA?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a rule-of-thumb for AAoA?

I went on an open close spree, which I know killed my AAoA. I'm currently at 3yrs 7months according to EQ. I'm now getting messages that I'm "new to credit". Is there a rule of thumb for AAoA or a "range" to be in to pass the "new to credit" message? I'm currently in the garden for about 2 years and some accounts just weren't beneficial for my long term credit growth so I closed them. How does AAoA effect credit scoring? Any suggestions or advice.

Goal: FICO 700+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

Closed cards count the same as open. Closed will fall off your reports up to 10yrs or sooner. Then no longer count. AAoA's more than 2 yrs helps scores. More than 5yrs even more. Less than 2 yrs doesnt help much at all. Congrats on your approvals. Garden time!

Where you seeing EQ's comment?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

@sznthescore wrote:I went on an open close spree, which I know killed my AAoA. I'm currently at 3yrs 7months according to EQ. I'm now getting messages that I'm "new to credit". Is there a rule of thumb for AAoA or a "range" to be in to pass the "new to credit" message? I'm currently in the garden for about 2 years and some accounts just weren't beneficial for my long term credit growth so I closed them. How does AAoA effect credit scoring? Any suggestions or advice.

1. Closing an account doesn't affect your AAoA until the closed account drops off of your credit reports, which is usually many years down the road.

2. Opening an account lowers your AAoA.

3. There are some thresholds, but you're usually considered new until the AAoA climbs to 8 or 9 years.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

@FireMedic1 I saw it in my online banking credit monitoring services.

Goal: FICO 700+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

I think you can't get to 850 until AAoA > 7.5 years, before that there are added breakpoints where your score increases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

@sznthescore wrote:@FireMedic1 I saw it in my online banking credit monitoring services.

Your bank monitoring service must be using Vantage scoring. Vantage only counts open accounts, but since almost nobody uses Vantage scores to approve credit, it is largely irrelevant. If you pull a FICO credit report score you will see that all accounts, open and closed, count. towards AAoA. As stated, only opening new accounts can lower your FICO average age.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

@SouthJamaica wrote:

2. Opening an account lowers your AAoA.

@SouthJamaica, Does that count if you have 120 CC's reporting? (80+ open and 40 closed)![]()

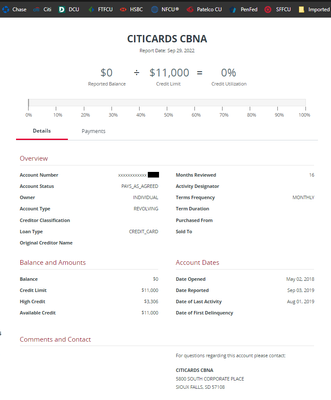

BTW; You gotta ![]() Citi ....reported 17 years after closure. due to no activity. (Citi Gold Visa)

Citi ....reported 17 years after closure. due to no activity. (Citi Gold Visa)

Reported in total for 27 years! ..(helped with AA![]() A for a long time)

A for a long time)

Also Citi is still reporting a closed acct. as open on EQ![]()

Was a "Citi Simplicity card," that I closed and re-allocated the CL into my Citi DC card.

(after the 3rd try & escalating to a supervisor) ..They no longer will do this.

outlier situation.

Three Citi cards reporting as open,

on EQ ..even though I only have two actual open cards.

The closed acct. -> reporting as open.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

@CH-7-Mission-Accomplished wrote:

@sznthescore wrote:@FireMedic1 I saw it in my online banking credit monitoring services.

Your bank monitoring service must be using Vantage scoring. Vantage only counts open accounts, but since almost nobody uses Vantage scores to approve credit, it is largely irrelevant. If you pull a FICO credit report score you will see that all accounts, open and closed, count. towards AAoA. As stated, only opening new accounts can lower your FICO average age.

No. It clearly states Average Age of Account. Now.... CreditKarma on the other hand says, 5 years 2 months which uses average age of open acounts and Vantage 3.0 scoring model.

Goal: FICO 700+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

@M_Smart007 wrote:

@SouthJamaica wrote:

2. Opening an account lowers your AAoA.

@SouthJamaica, Does that count if you have 120 CC's reporting? (80+ open and 40 closed)

No. When one reaches your elevated status one becomes immune to such trivial matters

BTW; You gotta

Citi ....reported 17 years after closure. due to no activity. (Citi Gold Visa)

Reported in total for 27 years! ..(helped with AA

A for a long time)

They couldn't bear the thought of losing that account; they so valued your relationship that they held on to the memory as long as they could.

Also Citi is still reporting a closed acct. as open on EQ

Was a "Citi Simplicity card," that I closed and re-allocated the CL into my Citi DC card.

(after the 3rd try & escalating to a supervisor) ..They no longer will do this.

outlier situation.

Don't confuse the newer credit students

Three Citi cards reporting as open,

on EQ ..even though I only have two actual open cards.

The closed acct. -> reporting as open.

(Click image to enlarge)

They just can't bear to let go.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a rule-of-thumb for AAoA?

@SouthJamaica, I laughed so hard, i almost fell off my chair. That was great. Made my day!

"Don't confuse the newer credit students"![]()

![]()

![]()