- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Is this the right AZEO formula?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is this the right AZEO formula?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this the right AZEO formula?

I've never been able to pull this off. Something always ends up slipping. But this month I think I've got it. Would this work?

-Discover: $49 reported on 3/5 off $1800 limit

-Amex Delta Gold: $0 about to report on 5/13 off $1000 limit

-Capital One: $0 about to report on 5/14 off $500 limit.

I have no other credit cards.

My Ex is 679, TU is 739 and EQ is 703.

Could I expect anything if all remains the same as above?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this the right AZEO formula?

Yes, what you're doing is AZEO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this the right AZEO formula?

In theory, would this trigger a little bump?

Or any bump?

@Anonymous wrote:Yes, what you're doing is AZEO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this the right AZEO formula?

@Anonymous wrote:In theory, would this trigger a little bump?

Or any bump?

@Anonymous wrote:Yes, what you're doing is AZEO.

It depends what your utilization was like last month. If you crossed a threshold such as bringing your aggregate utilization down below 8.9% than yes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this the right AZEO formula?

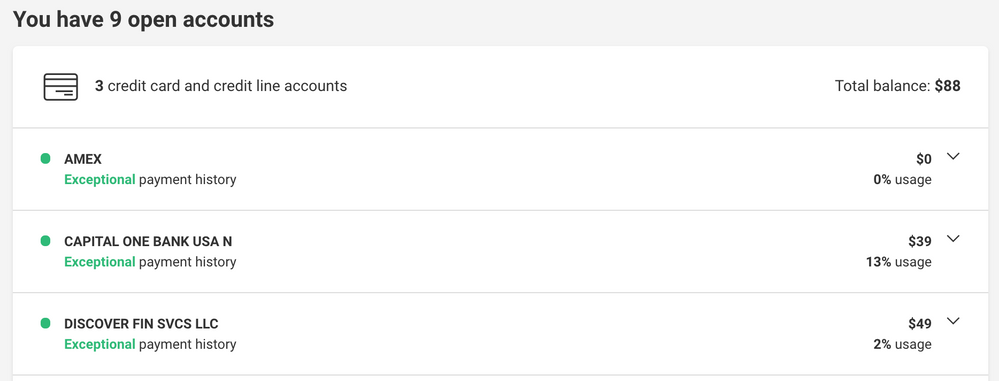

My over all UTL last month was like 1%. But my CapitalOne was over 13% which is technically where I failed the AZEO formula? See below. That Capital One is as of last month. So that will go to $0 and I just paid off the Amex so that will stay $0 too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this the right AZEO formula?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this the right AZEO formula?

Thank you... Just to be clear though, that discover you see in the screenshot is from 3/5 so it's already posted. I had 1 out of 3 repeating last month also but I think where I failed the formula is the Capital One individual ult was over 8.9%.

So this month that's not the case. And I'm letting my discover report vs the Capital One.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this the right AZEO formula?

@Anonymous wrote:Thank you... Just to be clear though, that discover you see in the screenshot is from 3/5 so it's already posted. I had 1 out of 3 repeating last month also but I think where I failed the formula is the Capital One individual ult was over 8.9%.

So this month that's not the case. And I'm letting my discover report vs the Capital One.

If you were 1/3 last month and 1/3 this month. Then, you were at AZEO for both months. You should not see any score change.

For individual utilization, over 28.9% appears to be the threshold for most before score penalty. Aggregate utilization over 8.9% is another score penalty.