- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Let's have a Chase Slate "Payment History" com...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Let's have a Chase Slate "Payment History" comparison

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Let's have a Chase Slate "Payment History" comparison

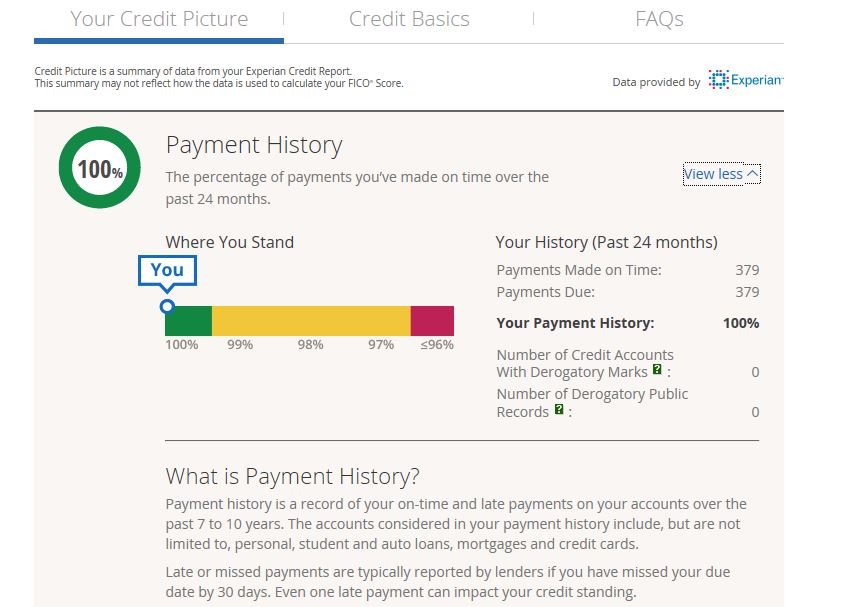

I am looking through my Slate Credit Dashboard, and reading the fine print. In the "Payment History" section, it focuses on the percentage of on-time payments for the last 24 months. This includes a count of the number of on time payments in the last 24 months, which works out to an average of just over 15 cards per month, about right.

As a comparison, I would be interested in seeing anyone else's "Payment History" metric, and get an understanding of how it is counting the number of on time payments, particularly if you are paying prior to statement cut on many cards. How does this calculation look on your file, as an average number of cards over the 24 months, compared to the number of cards you may be using and paying prior to statement cut?

The other thing I am wondering about this picture, does this imply that if one has a late, then the better strategy is to start letting all cards report a balance that is PIF, in order to build up a higher percentage of on-time-payments, to overweight the late payment?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

3rd party representations of the data have zero bearing on the FICO algorithm. None, Chase is no better than Credit Karma in this case.

In every CMS report I've seen on this, payment history is simply whether you have a deliquency on it or not: if you don't have a 30+ day late there, you get a checkmark and then it's just how long it measures it. CK, CS, credit.com etc - this doesn't correlate with FICO where I can promise you it can and does look further back than 2 years or whatever.

Why are we suddenly so focused on payment patterns when this hasn't ever borne out in the data before? I'm all for trying to improve our understanding but the fact is simply no data has been presented to lend credence to this and what anyone writes in a book without reference likewise doesn't count on this one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

Sorry, the question in the post was, Do you have a Slate? if so, what does the Payment History section show for your account? Can you share an image of that for comparison purposes?

Thanks

Edit: The point of the question is to see whether there is some representation of "payments" that depends on actually making a payment, or if a SD card counts the same. If someone else also has 15 cards, but only lets one report, and also gets ~379 "Payments" count in this dasboard, then my idea that you get credit for a payment by making a payment has problems. If however that cardholder with 15 cards, has been letting only one card report and has 30-45 payments showing on this dasboard for the last 24 months, then there perhaps is something to be said for really letting cards report and pay in full, on more cards. I doubt it will be as black and white as that, but I thought it would be worth asking.

Edit 2: Also, FWIW, my Slate EX score has been exactly the same as MyFICO EX score the three months it's been reported, so I would say this dashboard and the associated commentary should probably hold a little more relevance than comparisons to CK or Credit.com.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

@NRB525 wrote:Sorry, the question in the post was, Do you have a Slate? if so, what does the Payment History section show for your account? Can you share an image of that for comparison purposes?

Thanks

Edit: The point of the question is to see whether there is some representation of "payments" that depends on actually making a payment, or if a SD card counts the same. If someone else also has 15 cards, but only lets one report, and also gets ~379 "Payments" count in this dasboard, then my idea that you get credit for a payment by making a payment has problems. If however that cardholder with 15 cards, has been letting only one card report and has 30-45 payments showing on this dasboard for the last 24 months, then there perhaps is something to be said for really letting cards report and pay in full, on more cards. I doubt it will be as black and white as that, but I thought it would be worth asking.

Edit 2: Also, FWIW, my Slate EX score has been exactly the same as MyFICO EX score the three months it's been reported, so I would say this dashboard and the associated commentary should probably hold a little more relevance than comparisons to CK or Credit.com.

Not my point, my apologies for the unclear statement; even the MF third party interpretation of the reports shouldn't be taken as reference nor should the score simulator and those are both produced by FICO themselves: end of the day the data on the bureau is, and the algorithm doesn't look at any third party implementation at all. As a result it bears no more relevance as to how the algorithm works than CK does, which is what I was trying to get at.

By all means play with Chase's payment history if you so desire but it doesn't provide much value in my opinion other than knowing what Chase's software developers put in which is simply not relevant to FICO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

Are you certain of this? That FICO does not look at more recent payment history with more weight than older payment history? If it does not, then why does an older baddie have less effect on the current score than a more recent baddie?

In the case of your rebuild, I would suggest that it would have been better, long term, for you to allow all cards to report small balances to build up that payment history over these last 4+ years, to "flood the zone" of current payment good history. Would the score suffer short term? Likely. I think your score would be higher now though, because of the benefit of the good payments. Can I prove it? No. Just my opinion. And my opinion will likely not be tested out because there is such an overwhelming belief here that "one card reporting" is the Best Way Forward. Short term, easy to show results on a file that is rebuilding. And conversely, easy to show the short term hit from starting to let more cards report any balance.

To go with my idea for long term, all cards reporting small balances as a rebuilding tactic? Takes a lot of guts and patience to step up to try that one if no one else has yet.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

@NRB525 wrote:Are you certain of this? That FICO does not look at more recent payment history with more weight than older payment history? If it does not, then why does an older baddie have less effect on the current score than a more recent baddie?

In the case of your rebuild, I would suggest that it would have been better, long term, for you to allow all cards to report small balances to build up that payment history over these last 4+ years, to "flood the zone" of current payment good history. Would the score suffer short term? Likely. I think your score would be higher now though, because of the benefit of the good payments. Can I prove it? No. Just my opinion. And my opinion will likely not be tested out because there is such an overwhelming belief here that "one card reporting" is the Best Way Forward. Short term, easy to show results on a file that is rebuilding. And conversely, easy to show the short term hit from starting to let more cards report any balance.

To go with my idea for long term, all cards reporting small balances as a rebuilding tactic? Takes a lot of guts and patience to step up to try that one if no one else has yet.

What model are we talking about?

FICO 8 appears to give more weight more recent issues (including utilization) than FICO 04 did and people have generally noticed a bump in their FICO 8 scores (I saw them diverge at the six month mark after a recent tax lien got tacked on my report by an annoyed IRS agent) assuming the rest of the file was equivalent when it comes to public records and other derogatories in the past. Doesn't hold in some cases like we're just seeing now with installment utilization testing.

Take a look at any CRA report: there will be a pretty OK (or their individual mark for it) there as long as you don't miss the payment by 30+ days. That's payment history, and it's worked that way since the dawn of time. Leaving $2 or whatever on all of your cards all the time, doesn't do anything as that part is instant in time anyway. Payment history being 35% of the scorecard, means deliquencies and derogatories, look how quickly someone can build a 760+ file under FICO 8 as further proof... but that all gets taken away if there's a derogatory which gets tacked on.

Unfortunately short of taking two no files, and building it precisely identically and trying both methods it'll never be conclusively demonstrated. If I have twins someday I'll take one for the team in the name of science but while size of payments makes a difference to UW, doesn't with FICO; however, there's seriously been one reported case I've ever seen and this was from years ago on a different forum where the FICO change from a resulting balance change took on the order of months and God only knows if that was an abberation based on some wonky CRA issue as we've seen those over time too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

No doubt, the individual static file does show an OK or green check mark for the non-missed payment months.

What I'm referring to is how the algorithm then picks up those months and works with them in a calculation, when it can see how far back the payments / OK marks are, and somewhat related to that, how a manual underwriter would look at the file.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

@NRB525 wrote:No doubt, the individual static file does show an OK or green check mark for the non-missed payment months.

What I'm referring to is how the algorithm then picks up those months and works with them in a calculation, when it can see how far back the payments / OK marks are, and somewhat related to that, how a manual underwriter would look at the file.

FICO has no memory on this one.

If it's not something it looks at instant in time that's on the tradeline it doesn't calculate on it. Eventually it may count on historical payments vs. balances as that information has been introduced about 3ish years ago but some of the major credit card issuers (Amex) don't report it yet and FICO 8 and earlier don't count it, and there's no indication that VS 3.0 or FICO 9 do either.

This is why payment history does take into account old derogatories, it's still there on the snapshot; however, the old balances aren't. The algorithm calculates based on a snapshot and goes on with life, and revolving utilization to everyone who's done any serious testing (if you don't believe my own data look at BobWang's most excellent FICO effects sheet for further reference).

The concept of paying more than a minimum is an excellent piece of financial advice when it comes to credit cards, but it has no bearing on scoring. Likewise the demonstration of use of credit cards by letting a balance report is also not a bad piece when we're talking about a future lender's profitability analysis of you as a customer, but to FICO it's irrelevant outside of some NPSL cards which are calculated on the reported High Balance if they don't report a limit; however, those cards have been declining in number over the past few years and I'm not really cognizant of any other than the traditional Amex charge cards and similar and at most only Equifax 9 calculates balance on that out of any model in the last decade: most discount anything with a Term of 1 month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

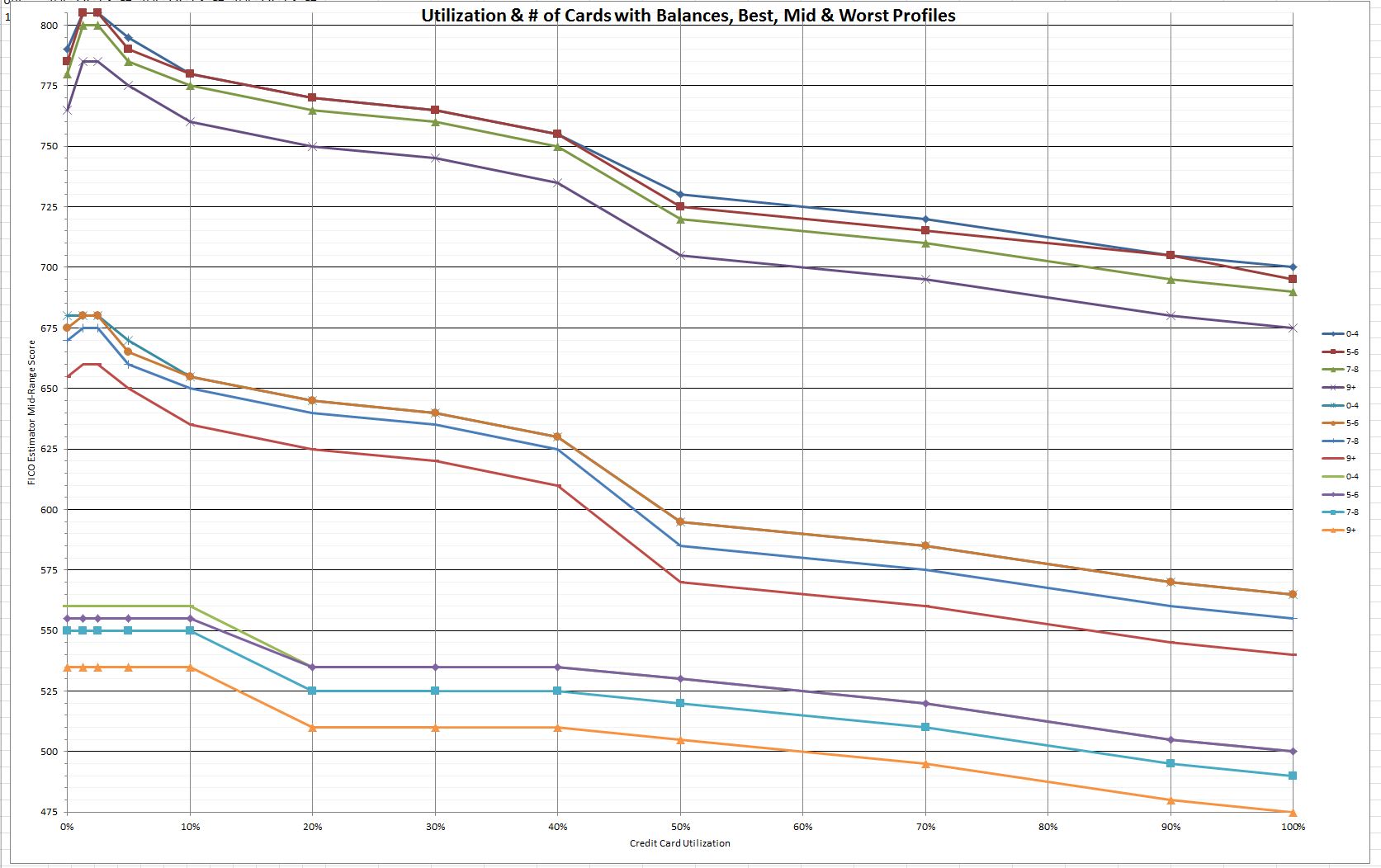

I did a search for BobWangs FICO effects sheet, and found it on CreditBoards, along with a link to the WhatsMyScore simulator which I ran my own set of scenarios through last year after I found it on MyFICO. It's since been removed from MyFICO from what I can tell, but I have a matrix of the various scenarios that I wanted to see how my score might change. I didn't bother with the baddies scenarios, it took me long enough to get the matrix of my own possibilities. That is also where I figured that the necessary effort to try to get below 9 cards reporting wasn't going to give me any noticeable improvement in score, and a lot of angst about ignoring perfectly good CC that deserve to be used for their intended purpose, if not for rewards then for the loyalty they've shown me over these many years ![]()

Looking at the Utilization graphic in Bob's worksheet, and there doesn't seem to be any difference in 0-4 vs 5-6 cards, other than small amounts. Not until exceeding 6 cards is there a break from the best. However, the simulator has limitations of course. My own situation is now 750-764 with utilization at about 24%, and recent inquiries and new accounts, so I've already exceeded this on the 9+ line. Of course, this simulator has difficulty getting over 805. Is it based on the 04 FICO, not 08?

The legend on the right is three sets of 4; 0-4, 5-6, 7-8 and 9+ cards with balances. The bottom axis is Utilization overall.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let's have a Chase Slate "Payment History" comparison

I don't see where he has his total number of tradelines on that sheet, I'll have to go look at it again but he's got a lot more accounts than I do.

That doesn't hold with small numbers of cards.

Does confirm if I want to be lazy I should go get some more revolving tradelines though ![]()