- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Let’s play a game! NEW GAME: Guess my FICO scores...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Let’s play a game! NEW GAME: Guess my FICO scores after AZEO…

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let’s play a game! Guess my FICO increase…

You can count on it! I will post updates through AZEO. Great guess by the way, I'm pretty certain your range would have nailed it if all had updated equally.

@Thomas_Thumb wrote:Too bad on the TU and EQ not showing the total paydown. I'm sure all your scores would have reached 740+.

If you are able, please add a post with your scores showing results with AZEO. I am going with a 770 - 780 estimate - unless you open up a new account between now and then.

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let’s play a game! Guess my FICO increase…

Outstanding! Congratulations on your nice score increase. Makes that two and a half year uphill climb worth it! I am looking forward to see your updated scores next month. Keep up the fantastic work! ![]()

Installment Loans

Current Scores 5/05/23

Current Mortgage Scores 5/05/23

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let’s play a game! Guess my FICO increase…

Congratulations on your progress!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let’s play a game! Guess my FICO increase…

@dytch2220 wrote:You can count on it! I will post updates through AZEO. Great guess by the way, I'm pretty certain your range would have nailed it if all had updated equally.

@Thomas_Thumb wrote:Too bad on the TU and EQ not showing the total paydown. I'm sure all your scores would have reached 740+.

If you are able, please add a post with your scores showing results with AZEO. I am going with a 770 - 780 estimate - unless you open up a new account between now and then.

Just to give closure on the first game, the other bureaus updated to match.

748 EQ, 749 TU, 746 EX

Average 747.6 = 748

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let’s play a game! Guess my FICO increase…

Appreciate the update.

Looks like your score increased 52 +/- 6 points depending on the credit bureau. Based on the data, it appears that all three CBs likely show the same accounts and account ages. If so, your profile is a great candidate for evaluating different score behavior among EQ, TU and EX. Inquiries (except for mortgages) are often credit bureau specific. Is your most recent hard inquiry greater than 12 months in age?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let’s play a game! Guess my FICO increase…

@Thomas_Thumb wrote:Appreciate the update.

Looks like your score increased 52 +/- 6 points depending on the credit bureau. Based on the data, it appears that all three CBs likely show the same accounts and account ages. If so, your profile is a great candidate for evaluating different score behavior among EQ, TU and EX. Inquiries (except for mortgages) are often credit bureau specific. Is your most recent hard inquiry greater than 12 months in age?

No, I have multiple inquiries in Nov '22, Apr '22 and one in Mar '22.

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let’s play a game! Guess my FICO increase…

Are your INQs spead somewhat evenly across the CBs or primarily on one? It would be interesting to see INQs under 12 months by CB. The INQs will impact scores a bit but not fundamental behavior of the Fico model with one possible exception:

Based on my profile, the older Fico "mortgage" models appeared to react more strongly to # accounts with balances when there was a new hard INQ under 12 months age vs no hard INQ under 12 months. I observed a change in sensitivity on EQ score 5 and TU score 4 before/after a receiving a single HP for a CLI - no new accounts.

- a new account under 12 months that reports on all CBs should affect sensitivity on all CBs even though the INQ may show on one CB.

More new accounts do not magnify sensitivity. It's either you have something under 12 months or you don't

- Note: I saw no change in score sensitivity to # cards with balances relating to a new INQ on the Fico 8 or Fico 9 models. I have not had a new account in many years so, I can't speak to that from my data. However, other poster data suggests a new account likely does influence sensitivity to both # cards and utilization.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Let’s play a game! Guess my FICO increase…

@Thomas_Thumb wrote:Are your INQs spead somewhat evenly across the CBs or primarily on one? It would be interesting to see INQs under 12 months by CB. The INQs will impact scores a bit but not fundamental behavior of the Fico model with one possible exception:

Based on my profile, the older Fico "mortgage" models appeared to react more strongly to # accounts with balances when there was a new hard INQ under 12 months age vs no hard INQ under 12 months. I observed a change in sensitivity on EQ score 5 and TU score 4 before/after receiving a single HP for a CLI - no new accounts.

- a new account under 12 months that reports on all CBs should affect sensitivity on all CBs even though the INQ may show on one CB.

More new accounts do not magnify sensitivity. It's either you have something under 12 months or you don't

- Note: I saw no change in score sensitivity to # cards with balances relating to a new INQ on the Fico 8 or Fico 9 models. I have not had a new account in many years so, I can't speak to that from my data. However, other poster data suggests a new account likely does influence sensitivity to both # cards and utilization.

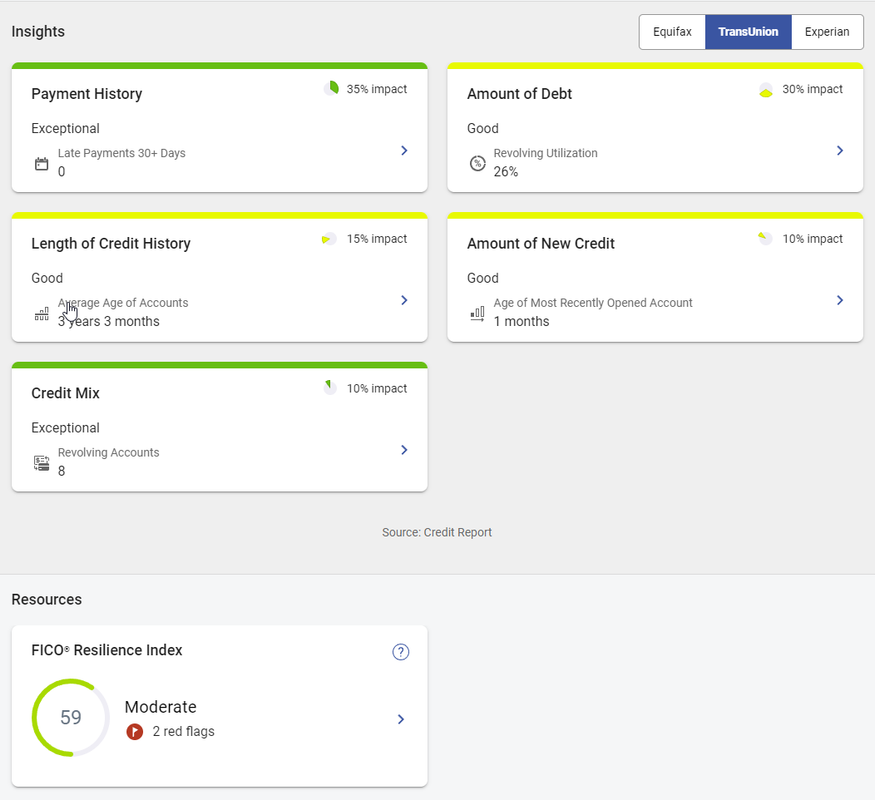

Here are my scoring insights and inquiries. The insights match across all with the exception of AAoA, which is 3y 0m on EQ and EX. I do have a recent account opened in November, the G/S Apple card.

P.S. - I did see another score increase due to debt paydown which applied on 12/22/2022. I'm not going to post it yet though so as not to influence the guesses of any newcomers to the guessing game.

border="0">

border="0">

Revolving Accounts