- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Maximizing the final 25% of the pie to 850?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Maximizing the final 25% of the pie to 850?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing the final 25% of the pie to 850?

@iv wrote:

@Anonymous wrote:IV, outside of the couple of new accounts you've opened since 2015, what else do you chalk your 780's mid mortgage score to when comparing it to your 850 FICO 08's?

Beyond the inquiries and new accounts, there's the 95% B/L on the installment loans (2x auto, 1x mortgage), and that I'm not bothering (at the moment) to optimize utilization/reporting for cards at all. (Paying in full before due date, but NOT before statement cut/reporting.)

As such, depending on the time of month, all or most cards are reporting balances at the same time. Total utilization is usually staying only around 1% (mostly due to high limits...), but % of cards reporting balances is high.

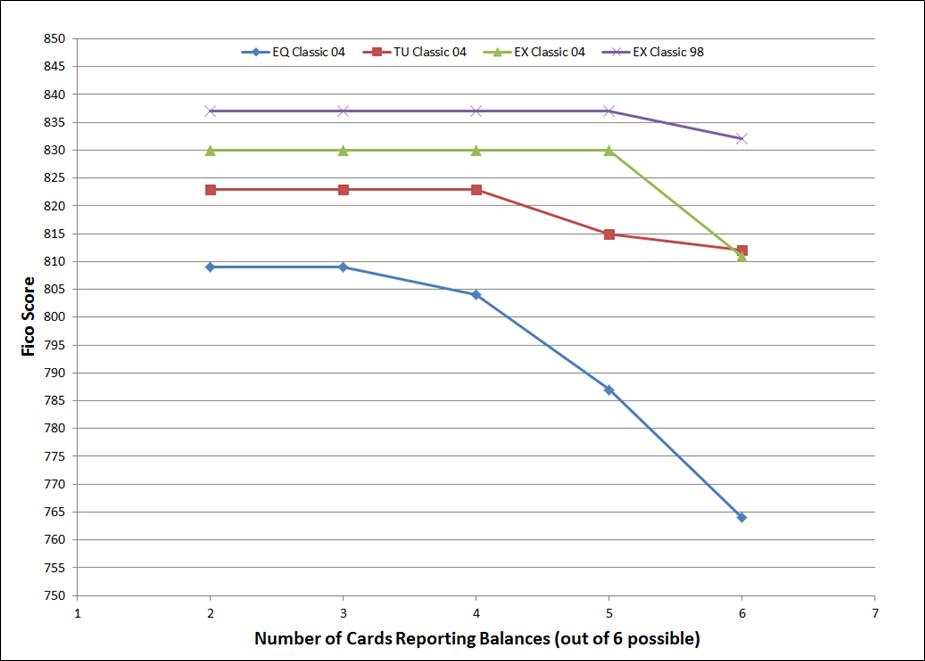

It is the number of cards reporting balances that dropped the Fico mortgage scores. I have tested that many times. My Fico 8 scores held at 850 for all the below data points. I suspect IV's lowest mortgage score is from Equifax. It would be interesting to know how all three mortgage scores compare.

Here is another example of data that contradicts the generalization: "must have an open installment loan with total B/L below 9% for best Fico 8 score". It is just not true - as a rule- even though B/L ratio strongly affects scoring of share secure loans and "new" auto loans. A low B/L requirement is NOT necessary for other loan types, as shown yet again, by IV's data. IV has a 95% B/L ratio on installment loans. My-Own-Fico reported 850 with a B/L above 90% as well. Inverse reported 850 scores with aggregate B/L above 65% (2 open mortgages and 2 car loans). I experienced similar results with 850 scores and mortgage B/L above 50%. Interestingly, a 95% threshold for a mortgage was cited by one of our long term posters (JDK???) last year.

As mentioned in other threads, there are strong indications that scoring of installment B/L may conditioned based on what loans are in the mix (particularly a mortgage) AND length of time active for the oldest open installment loan - payment history. Once oldest open installment loan age passes one or more critical thresholds - generally thought to be two years but possibly one - the impact of "high" B/L becomes muted. A portion of points associated with B/L are reallocated to payment history.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing the final 25% of the pie to 850?

@iv wrote:Beyond the inquiries and new accounts, there's the 95% B/L on the installment loans (2x auto, 1x mortgage), and that I'm not bothering (at the moment) to optimize utilization/reporting for cards at all. (Paying in full before due date, but NOT before statement cut/reporting.)

As such, depending on the time of month, all or most cards are reporting balances at the same time. Total utilization is usually staying only around 1% (mostly due to high limits...), but % of cards reporting balances is high.

I would have thought the installment loan utilization was the biggest factor in this when considering the differences between the two models, but TT references the number of cards reporting balances which is very good to know!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing the final 25% of the pie to 850?

@Thomas_Thumb wrote:

I suspect IV's lowest mortgage score is from Equifax. It would be interesting to know how all three mortgage scores compare.

Indeed, I see the same spread as in your graphs - EQ lowest, TU middle, EX highest.

They all bounce around a bit based on reporting dates/balances, but I haven't recently seen more than a 27-point delta between EQ at the low end and EX at the high end.

@Thomas_Thumb wrote:

Here is another example of data that contradicts the generalization: "must have an open installment loan with total B/L below 9% for best Fico 8 score". It is just not true - as a rule- even though B/L ratio strongly affects scoring of share secure loans and "new" auto loans. A low B/L requirement is NOT necessary for other loan types, as shown yet again, by IV's data. IV has a 95% B/L ratio on installment loans. My-Own-Fico reported 850 with a B/L above 90% as well. Inverse reported 850 scores with aggregate B/L above 65% (2 open mortgages and 2 car loans). I experienced similar results with 850 scores and mortgage B/L above 50%. Interestingly, a 95% threshold for a mortgage was cited by one of our long term posters (JDK???) last year.

Amusingly, by sheer chance the mortgage happens to be at exactly 95.03% right now, and all three loans combined are dead-on at 94.99%. Hasn't seemed to make a noticeable difference on the mortgage scores over time. (Although I did get an alert today that TU finally reported this month's mortgage payment, and TU FICO8 jumped to 842...)

@Anonymous wrote:I would have thought the installment loan utilization was the biggest factor in this when considering the differences between the two models, but TT references the number of cards reporting balances which is very good to know!

Yup, number (or percentage) of cards with non-zero balances is most likely the main driver here.

I should have also mentioned - some of those cards have limits between $35k and $50k, and are likely being counted on FICO8 but not the mortgage scores. That effect can go either way, of course - balances on all the sub-35k cards but not the others will hold down the older models, while balances only on the 35k+ cards may/will be ignored... Optimal usage (for mortgage scores) is likely all but one sub-35k card reporting zero, and balances on the 35k+ cards are partially or completely irrelevant.

Maybe I'll play around with this next month, optimizing the card balance reporting... but it's just a theoretical curiosity at this point, no real practical concern.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing the final 25% of the pie to 850?

@iv wrote:

@Thomas_Thumb wrote:

I suspect IV's lowest mortgage score is from Equifax. It would be interesting to know how all three mortgage scores compare.Indeed, I see the same spread as in your graphs - EQ lowest, TU middle, EX highest.

They all bounce around a bit based on reporting dates/balances, but I haven't recently seen more than a 27-point delta between EQ at the low end and EX at the high end.

@Thomas_Thumb wrote:

Here is another example of data that contradicts the generalization: "must have an open installment loan with total B/L below 9% for best Fico 8 score". It is just not true - as a rule- even though B/L ratio strongly affects scoring of share secure loans and "new" auto loans. A low B/L requirement is NOT necessary for other loan types, as shown yet again, by IV's data. IV has a 95% B/L ratio on installment loans. My-Own-Fico reported 850 with a B/L above 90% as well. Inverse reported 850 scores with aggregate B/L above 65% (2 open mortgages and 2 car loans). I experienced similar results with 850 scores and mortgage B/L above 50%. Interestingly, a 95% threshold for a mortgage was cited by one of our long term posters (JDK???) last year.

Amusingly, by sheer chance the mortgage happens to be at exactly 95.03% right now, and all three loans combined are dead-on at 94.99%. Hasn't seemed to make a noticeable difference on the mortgage scores over time. (Although I did get an alert today that TU finally reported this month's mortgage payment, and TU FICO8 jumped to 842...)

@Anonymous wrote:I would have thought the installment loan utilization was the biggest factor in this when considering the differences between the two models, but TT references the number of cards reporting balances which is very good to know!

Yup, number (or percentage) of cards with non-zero balances is most likely the main driver here.

I should have also mentioned - some of those cards have limits between $35k and $50k, and are likely being counted on FICO8 but not the mortgage scores. That effect can go either way, of course - balances on all the sub-35k cards but not the others will hold down the older models, while balances only on the 35k+ cards may/will be ignored... Optimal usage (for mortgage scores) is likely all but one sub-35k card reporting zero, and balances on the 35k+ cards are partially or completely irrelevant.

Maybe I'll play around with this next month, optimizing the card balance reporting... but it's just a theoretical curiosity at this point, no real practical concern.

Frankly, it would be much more enlightening to get a bona fide "all cards reporting some balance" data point from another 850 profile. aWe already have countless data points for one card only reporting. It would be very interesting to see a side by side data for 3B Fico 8 scores and 3B Fico mortgage scores.

Just a guess here but, I would anticipate your EQ Fico 04 (score 5) to drop to the 760 to 765 range with all open accounts reporting balances.Optimization data points for high scoring profiles are rather boring. It's capturing the significant score drops relating to non derog activity that is noteworthy - IMO.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing the final 25% of the pie to 850?

@Thomas_Thumb wrote:Frankly, it would be much more enlightening to get a bona fide "all cards reporting some balance" data point from another 850 profile. aWe already have countless data points for one card only reporting. It would be very interesting to see a side by side data for 3B Fico 8 scores and 3B Fico mortgage scores.

Just a guess here but, I would anticipate your EQ Fico 04 (score 5) to drop to the 760 to 765 range with all open accounts reporting balances.Optimization data points for high scoring profiles are rather boring. It's capturing the significant score drops relating to non derog activity that is noteworthy - IMO.

Perhaps AFTER the next mortgage, I'll play with that.

Even with a very solid file, actively TRYING to push mortgage scores down just before a loan (refi in this case)? Unwise...

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06