- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Mortgage FICO 2 not moving- 13 days left.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Mortgage FICO 2 not moving- 13 days left.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage FICO 2 not moving- 13 days left.

Background: I had a fire, lost my home, cars - everything. (Thank God for insurance, rebuilt home - its all good). Unfortunately, I let everything go due to the loss and figured I would fix it later when I had time to worry about it but I acquired 7 lates - 30 days in a years time. Was never late before/ after on anything. My credit file shows several paid off debts in good standing, including homes and other cards with no issues. Ive already disputed the lates with the agencies, but nothing worked. I supplied documents of the fire in the dispute but it was as if it was a robot that responded. No difference made. <— This is not my biggest problem so given the time I have right now, I dont have much more time to try and fix this.

I recently sold a property and I put funds (a lot) in a 1031X to buy another property. Tax reasons, I now only have 13 days to find and buy another home or I get very heavily taxed on the 1031X funds that I am using as my down payment to purchase another home. The clock runs out on the 28th of this month (13 days) to just be in escrow. I cant get a prequal letter to make offers on properties because my FICO2 came in at 555 Aug 16th. At the time I had 43K debt out of 60K including 2 auto loans.

I immediately paid down about 13K in revolving debt on my CCs on Aug 16th.

Here is the issue:

I gave the lender all the info when he first ran my credit at 555 three weeks ago and they said I should be in the 630s and fine. BUT they ran it a few days ago on the 12th and it moved 574, well under the min 620 to get a prequal letter to make an offer. Only moved 19 points in 3 weeks with the 8K that showed up reported as paid, with about 4K pending. (I ran my FICO2 today and its showing 586).

My question: do I just give up on the fact that I am going to get to a middle ground of 620 (which is 40 points in 2 weeks) and just suck it up and take the tax penalty? OR do I pay down any other balance even more and do a rapid rescore if it isn’t updated by the 21st?

Anything below was paid down in the month and is/will be reporting on the report before my deadline

In summary:

*Charge Account reporting balance of $954 out of $3K (paid off $250 but wont report again till after my deadline)

*Charge Account $390 balance out of $3800 (paid off but wont report again till Oct and after my deadline)

*Charge Account $372 balance out of $2100 (paid off but wont report again till after deadline)

*Charge Account $205 balance out of $500 (paid off and should be $0 any day now, but still hasn’t updated)

*Charge Account $97 balance out of $1500 (paid off but wont report again till after deadline)

*Charge Account $2 balance out of $1200 ($0 now but wont report again till Sept 27th- 1 day before deadline)

Charge Account $0 balance out of $400 (reported already)

*Charge Account $0 Current (paid off and reported already)

*Charge Account $0 Current (paid off and reported already)

*Charge Account $0 Current (paid off and reported already)

*Charge Account $0 Current (reported already)

*Credit Card $17,884 balance out of $21K (reports on the 19th in a few days)

Credit Card $8,186 balance out of $8500 (paid down 1K more but reports next 1 day after my deadline)

*Credit Card $3,658 balance out of $4000 (paid down $3000, should report by the 20th)

*Credit Card $1,658 balance out of $5100 (paid down again to $450, but wont report again till 1 day after my deadline)

*Credit Card $1,117 balance out of $3560 (paid down another $250, but wont report again till 1 day after deadline)

Credit Card $0 balance out of $1000 (has always been 0)

Credit Card $0 balance out of $500 (has always been 0)

PS- the simulator is not offered for the FICO2 score

*************************************** UPDATE: 9/18*********************************************************************

Hi ALL, Scores are still not changing but maybe I havent waited long enough.

I have a week from Friday (the 28th) and only a few (2-3) thousand $ left to make any remaining changes needed.

I've forced reported all the credit agencies to show a 0 balance as of Monday of this week. I expect my FICO mortgage scores will be updated by this Friday but I honestly don't want to ask the lender to rerun it if it's not going to be a significant enough change.

I need to get to a middle- mortgage fico score of 620

| 16-Aug | 555 | 11-Sep | 574 | 18-Sep | ??? | ||||||

| Type | Credit Limit | Balance | Utilization | Balance | Utilization | Balance | Utilization | ||||

| Credit Card | $20,100 | $18,598 | 93% | 18,844.00 | 94% | $18,119.95 | 90% | ||||

| Credit Card | $8,500 | $8,331 | 98% | 8,186.00 | 96% | $7,386.00 | 87% | ||||

| Charge | $5,600 | $0 | 0% | 0.00 | 0% | $0.00 | 0% | ||||

| Credit Card | $5,100 | $4,410 | 86% | 1,569.00 | 31% | $0.00 | 0% | ||||

| Credit Card | $4,000 | $3,779 | 94% | 3,658.00 | 91% | $1,126.32 | 28% | ||||

| Charge | $3,800 | $1,700 | 45% | 1,700.00 | 45% | $0.00 | 0% | ||||

| Charge | $3,560 | $3,110 | 87% | 1,117.00 | 31% | $817.80 | 23% | ||||

| Charge | $3,000 | $2,888 | 96% | 954.00 | 32% | $0.00 | 0% | ||||

| Charge | $2,100 | $1,458 | 69% | 372.00 | 18% | $0.00 | 0% | ||||

| Charge | $1,500 | $1,350 | 90% | 97.00 | 6% | $0.00 | 0% | ||||

| Charge | $1,200 | $191 | 16% | 2.00 | 0% | $0.00 | 0% | ||||

| Charge | $750 | $716 | 95% | 0.00 | 0% | $0.00 | 0% | ||||

| Credit Card | $700 | $0 | 0% | 0.00 | 0% | $0.00 | 0% | ||||

| Credit Card | $500 | $205 | 41% | 205.00 | 41% | $0.00 | 0% | ||||

| Charge | $400 | $0 | 0% | 0.00 | 0% | $0.00 | 0% | ||||

| Charge | $250 | $208 | 83% | 0.00 | 0% | $0.00 | 0% | ||||

| Charge | $100 | $0 | 0% | 0.00 | 0% | $0.00 | 0% | ||||

| Credit Limit | Balance | Utilization | Balance | Utilization | Balance | Utilization | |||||

| $61,160 | $46,944 | 59% | 36,704.00 | 29% | $27,450.07 | 13% |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

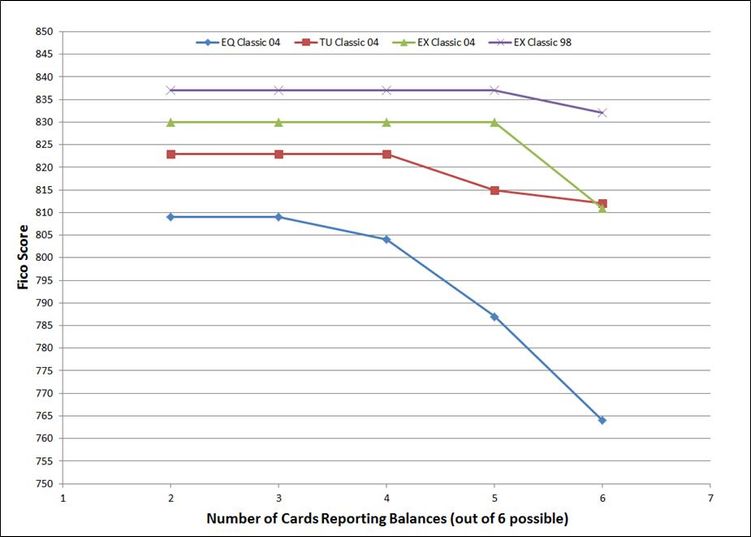

In order to make a significant impact on Fico score you need to be much more aggressive on paydown and payoff. The older Fico models are particularly sensitive to # cards reporting balances and card utilization.

You are in good shape on your charge cards but, the credit cards are having a devistating impact on your score. Currently you have 5 of 7 credit cards with balances. A couple of these cards are at red flag utilization levels.

Assuming you have funds available I would suggest the following immediately:

1) Pay the credit cards with balances of $3658, $1658 and $1117 to zero and make sure the stay at zero.

2) Pay the card with a $17,884 balance down to $10k or less

3) Pay the card with a balance of $8186 down to $4k or less.

As a minimum want all credit cards under 49% individually and under 29% in aggregate. [Note: true charge cards do not count toward revolving utilization on Fico 04, Fico 8 and Fico 9 but do count on Fico 98 - EX Fico score 2 IS Fico 98]. For all mortgage Fico models you want less than 33% of your cards reporting a balance to keep penalty associated with too many cards low. [charge cards are included in # with balance].

Side note: For better score potential you actually want aggregate revolving utilization to be under 9% and all individual card utilizations under 29%. The above recommendations will give you a nice score boost but you are still leaving utilization points on the table.

You can contact the card issuer after making payments and ask them to send an update to the CRAs. Explain you situation. Generally mid cycle update requests will be accommodated on cards wherre you pay to zero. Not sure about partial pay off updates mid cycle.

Once the above is done, initiate a rapid rescore.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

You have several credit cards that have very high utilization. This is hurting your score a lot.

Can you pay all cards to zero except one, with the remaining card having a small balance, like $20?

That is what you need to do to improve your score, but it is unclear from your post whether you have the funds to do that. If not, please tell us how much money you have available for paying down your cards.

Should you do the "All Zero Except One" strategy I mention above, the remaining card needs to be a true credit card (not a charge card) and a card in your name (not an AU card).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

Charge cards do count on EX Fico score 2 - which is Fico 98. AZEO is a good catch all rule but, given OPs limited time frame having multiple cards reporting the primary focus should be utilization. EX is more lenient toward # cards reporting than EQ or TU.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

Our OP doesn't understand a lot of basic stuff about credit and scores. Neither does his loan officer. If they did our OP would not be in this position.

I sensed he needed a simple answer that he could wrap his head around. (I.e. this is ideally what you want.) I gave him the freedom to tell me that he didn't have the necessary funds for that paydown. In that case we can help him find a compromise position that will still likely get him the scoring boost that he needs.

PS. When I began writing my response, no one had yet responded to him.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

When you say get very heavily taxed, what type of money are we talking?

I ask because it sounds like you may be easily leaving 50+ points on the table with your utilization being where it's currently at. That being the case, the interest rate you'd secure just by barely squeaking in on a mortgage is going to be significantly higher than if your scores were in a better place. This difference in interest rate could mean tens of thousands of dollars in additional interest will be paid over the life of the loan. We could be talking $50k+ here. Just something to consider here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

Thats a very good point! The tax is probably a lot less of the impact of using a poor score due to the higher rate on the APR.

(Can't I refinance later though?)

And since I just need to open escrow, I am thinking that when my scores are rerun towards the close of escrow, they will have gone up a little more.

You all are amazing! So helpful!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

I ended up paying down almost all my credit cards (and charge cards) down to 0 balances (with the exceptions noted below) and using the force report method (which frikn worked! it was amazing! Because my lender had suggested I dump a bunch of money doing the 'rapid rescore' which would have cost me 30 bucks for each account, and each agency- when I could have used that to pay down my debt a little more- so that was a GREAT recommendation!- THANK YOU!)

And I failed to mention how much I have $ to try and make an impact when I posted originally, my bad!

Right now I have about 3K, and I have the remaining balances which I planned to pay off those noted in #1.

1) Pay the credit cards with balances of $3658, $1658 and $1117 to zero and make sure the stay at zero. (These are now at $1226, $519 and $1117)

2) Pay the card with a $17,884 balance down to $10k or less (current balance is now $17600)

3) Pay the card with a balance of $8186 down to $4k or less. (current balance is now $7600)

The credit reports used to run my scores are:

BEACON 5.0, FICO-II and FICO Classic 04

Is there a simulator on myfico for these specific fico scores? I only see that there are simulators for the FICO8

AGAIN you are all awesome, thanks so much for the great advice and any left that you may throw my way.

I have 11 days now to hopefully see a change and get into escrow.

The last time the scores were run from the lender was on the 11th, so I am hoping by Friday- the force reports will be in and I can have lender run it again and be somewhat successful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

Is there a strategy for all 0's except for 2? ![]() I have about 3k left and the major balances are what is going to be left since I paid all the others down.

I have about 3k left and the major balances are what is going to be left since I paid all the others down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage FICO 2 not moving- 13 days left.

Yes - The strategy is to pay those balances down so the respective card utilizations are at a minimum below 49% per card and more preferrable below 29%. A further related strategy is to get your aggregate utilization (all cards combined) below 29% as a minimum and more preferrably below 9%.

What is your current aggregate utilization?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950