- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- My CRAs Are Reporting Different Scores For Same Ac...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My CRAs Are Reporting Different Scores For Same Activity?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

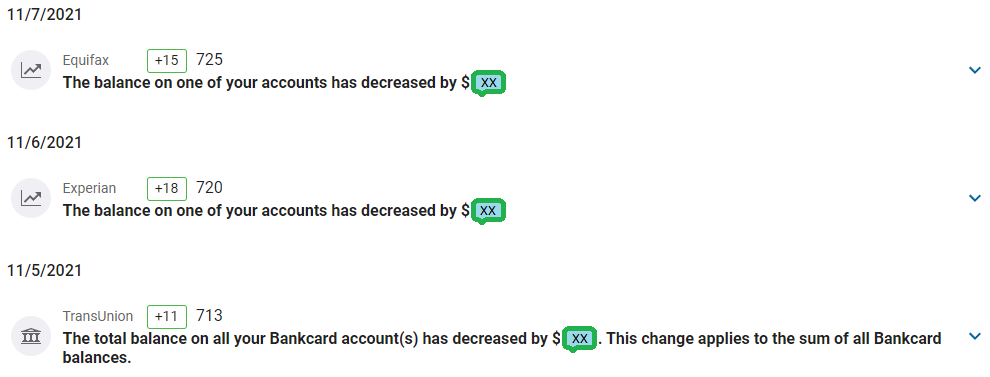

My CRAs Are Reporting Different Scores For Same Activity?

Same dollar amount decrease for all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My CRAs Are Reporting Different Scores For Same Activity?

@LP007 wrote:Same dollar amount decrease for all.

There is no direct relationship between your score changes and the "changes" listed.

Just as an example, my "changes"for a 2-day period were:

Comparing reports from Nov 12 and Nov 14

Could harm

Your total balance on all accounts increased

Your balance increased $376 since your previous report, not including derogatory or collection accounts. You may or may not see a score change, since this balance is associated with other factors that affect your score.

Could harm

Your revolving debt increased by $687

Your revolving debt increased from $2,008 to $2,695. Fluctuations are normal—just try to make sure your balance isn't consistently trending upwards so you're able to keep up with the monthly payments.

However, my score actually increased by 14 points between those two dates.

Takeaway? The stuff the CRAs try to "explain" is generally irrelevant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My CRAs Are Reporting Different Scores For Same Activity?

No CRA will match each other. Its three companies with 3 separate algorithms. Close but not the same. If they all matched. Understanding FICO Scoring here would be boring trying to figure out 1 instead of 3 of them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My CRAs Are Reporting Different Scores For Same Activity?

@LP007 wrote:Same dollar amount decrease for all.

There is no cause and effect relationship between the substance of the alert and the score change tacked on to the alert.

MyFICO alerts don't provide reasons for a score change. There are certain events which trigger MyFICO alerts. If there happens to be any difference between your present score at that particular bureau and the previous score reported to you from that bureau, the score change is tacked on to the alert. There is not necessarily any connection at all between the score change and the alert substance.

MyFICO explains this as follows:

Why did my score go up when I got an alert for something negative (or why did my score go down when I got an alert for something positive)?

The short answer: Your FICO® Score may change because of other events not monitored by an alert.

Whenever we send you a credit alert, we also send an updated FICO Score. To ensure you get the most current score, we calculate it based on your entire credit report at that point in time—not just the new information on the alert. This means your new score may reflect other changes that are outside of the things we watch for (see everything we monitor).

Sometimes you may see your score increase when you think it should’ve decreased, and vice-versa, but you’ll always have your most up-to-date and accurate score.

https://support.myfico.com/hc/en-us/articles/360038084633

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My CRAs Are Reporting Different Scores For Same Activity?

@SouthJamaica wrote:

@LP007 wrote:Same dollar amount decrease for all.

There is no cause and effect relationship between the substance of the alert and the score change tacked on to the alert.

MyFICO alerts don't provide reasons for a score change. There are certain events which trigger MyFICO alerts. If there happens to be any difference between your present score at that particular bureau and the previous score reported to you from that bureau, the score change is tacked on to the alert. There is not necessarily any connection at all between the score change and the alert substance.

MyFICO explains this as follows:

Why did my score go up when I got an alert for something negative (or why did my score go down when I got an alert for something positive)?

The short answer: Your FICO® Score may change because of other events not monitored by an alert.

Whenever we send you a credit alert, we also send an updated FICO Score. To ensure you get the most current score, we calculate it based on your entire credit report at that point in time—not just the new information on the alert. This means your new score may reflect other changes that are outside of the things we watch for (see everything we monitor).

Sometimes you may see your score increase when you think it should’ve decreased, and vice-versa, but you’ll always have your most up-to-date and accurate score.

https://support.myfico.com/hc/en-us/articles/360038084633

Well said, my friend.