- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- My Fico8, Fico9 and Fako all aprrox the same score...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My Fico8, Fico9 and Fako all aprrox the same score...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Fico8, Fico9 and Fako all aprrox the same score...

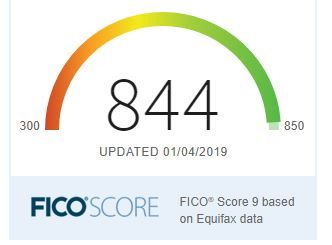

I only post this because so many people say the different scores "always" vary a great deal, and that one is "always" of greater value than the other. Mine have always been quite close. So perhaps that advice applies often, but certainly not "all" of the time and not to "everyone".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

I've never heard anyone state that they always vary a great deal, simply that they can vary a great deal. There are plenty of people that see their non-FICO scores to be similar to their FICO scores. Mine have always been relatively close for the most part, within 10-20 points. There are however plenty of people that reference 100+ point variances between their VS 3.0 and FICO scores, so it's all very profile-dependent.

What is important for someone like you with close scores to realize, though, is that a certain profile event that changes is not necessarily going to impact your scores the same way all the time. Something could happen that causes a 20 point shift to your FICO scores, but a 50 point shift on your non-FICO scores. While at this moment in time they may all be within a few points of one another, it doesn't mean that will always be the case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

@Anonymous wrote:I've never heard anyone state that they always vary a great deal, simply that they can vary a great deal. There are plenty of people that see their non-FICO scores to be similar to their FICO scores. Mine have always been relatively close for the most part, within 10-20 points. There are however plenty of people that reference 100+ point variances between their VS 3.0 and FICO scores, so it's all very profile-dependent.

What is important for someone like you with close scores to realize, though, is that a certain profile event that changes is not necessarily going to impact your scores the same way all the time. Something could happen that causes a 20 point shift to your FICO scores, but a 50 point shift on your non-FICO scores. While at this moment in time they may all be within a few points of one another, it doesn't mean that will always be the case.

I agree. I'm well aware that certain scenarios will effect various scoring models in very different ways. In some instances it can be a plus while at the same time be a negative for different scoring models. But for a long time and still today... mine are all relatively close.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

I wonder if file thickness is a factor? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

Most people's different Fico scores are pretty close, because the blueprint is generally the same for each different Fico scoring model,but they tweak it differently for industry specifics like auto,mortgage etc...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

87 points difference

Updated FICO 9 from Navy and Vantage from Credit Wise

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

@DIYcredit wrote:Most people's different Fico scores are pretty close, because the blueprint is generally the same for each different Fico scoring model,but they tweak it differently for industry specifics like auto,mortgage etc...

Maybe most of the time, but variances between the models can still be significant. I believe member SJ has around a 110 point variance between his top FICO score and his bottom one, although I don't remember the specific models.

Overmedicated, I'm curious about your VS 3.0 score above being 87 points less than your FICO 9. Do you have any idea why? For your FICO 9 to be nearly topped out, I would assume your file thickness and age of accounts factors are all very solid. Naturally your file is clean and no doubt your amounts owed/utilization is in a great place too. How about your other factors such as installment loan utilization and inquiries? Anything else you can think of that the VS 3.0 model doesn't like that FICO doesn't have a problem with? Perhaps a well aged tiny collection?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

@Anonymous wrote:

@DIYcredit wrote:Most people's different Fico scores are pretty close, because the blueprint is generally the same for each different Fico scoring model,but they tweak it differently for industry specifics like auto,mortgage etc...

Maybe most of the time, but variances between the models can still be significant. I believe member SJ has around a 110 point variance between his top FICO score and his bottom one, although I don't remember the specific models.

Overmedicated, I'm curious about your VS 3.0 score above being 87 points less than your FICO 9. Do you have any idea why? For your FICO 9 to be nearly topped out, I would assume your file thickness and age of accounts factors are all very solid. Naturally your file is clean and no doubt your amounts owed/utilization is in a great place too. How about your other factors such as installment loan utilization and inquiries? Anything else you can think of that the VS 3.0 model doesn't like that FICO doesn't have a problem with? Perhaps a well aged tiny collection?

Lol! I apologize for wasting your time. It is unfair what I posted but the reason I did is just another example of scores that can vary wildly even if they were dated 1 day apart. My VS scores for a long time were close to 40 points lower than my F8s. They seem to be getting closer lately. I never cared to figure out why as these scores are trash. The real issue with the score difference is when they were pulled, when they were posted, and what happened during that time. I think NFCU pulled those scores on the 24th but they were not posted in my account until Jan. 4th. I had a new account hit on the 28th that was already 2 months old when it posted.

So if I didn't get that new account, I would have been at 844. I'm certainly not now.

Due to Christmas, my total UTI went from 3% to 6%. With the new account and this increased UTI, my VS dropped 42 points.

I will pull my scores later today to see how many points that I lost on both the F8 and F9 models. It won't be close to that.

Sorry to waste your time but it was a bad example on my part.

To answer you other questions though my AAoA is still over 7 years, AoYA was 6 months, AoOA is 18-19 years.

I have 2 open installment loans 47.4% and 85.1%

11 accounts, 2 are now closed(thinning the herd)

4 revolvers w/ statement balances reporting

I have no need to optimize my scores at this point. I'm curious if AZEO would have taken me to 850. I have no desire to get and stay at 850. I'm in the "good enough club" and I'm also not done applying. 1 thing left to do and I'm gardening for life(at least with credit cards).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

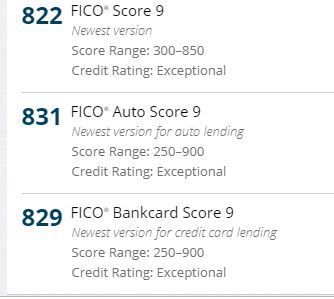

Just an update from the previous post. I pulled all of my scores from here today. I updated the F8s in my signature.

So really I lost 14 points from EQ F9, 1 point from EQ F8, and of course the VS dropped 42 points. A 73 point difference.

Since Credit Wise is based off TU data, let's compare apples to apples.

TU F8 - 807 from 813

F9 to VS difference 65 points

F8 to VS difference 50 points

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Fico8, Fico9 and Fako all aprrox the same score...

They are just different: different FICO models, different industry options, etc, VS, any other FAKO, it's all just coincidence if they coincide.

From today:

EX FICO 8: 822

EX FICO 3: 732

EX FICO 2: 754

EX VS 3.0: 814

Honestly might as well use a Oujia board trying to determine one credit score from another honestly, even on my file from a FICO 04 to a FICO 8 model, so we're talking the very next generation of FICO algorithms, on the same file, on the same day, at the same time: 90 points difference.

They'll get closer as I continue to pay off my HELOC but they won't be equivalent by anything but luck frankly.