- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Need to squeeze out a couple points

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need to squeeze out a couple points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to squeeze out a couple points

My broker is pulling my mortgage scores in March. Wants me to get to a 680.

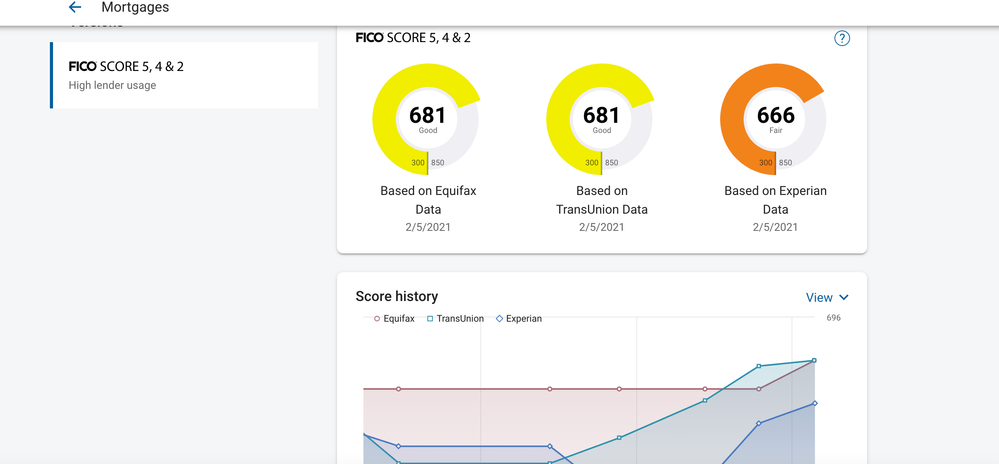

Currently have EQ 671 TU 679 and EX 659 for my mortgage scores.

I have been paying down my util and my EX and TU scores loved it. EQ wont move.

Total overall util is a bit high at 40 percent. I have 2 cards sitting at 85 percent. The other cards are either at zero or under 48 percent.

I have limited funds right now because its all tied into my down payment. But my current plan of attack is to get those 2 cards under 48 percent. That will get me into the 30ish range for total util and no card over 48 percent.

My credit got somewhat messed up in 2015 when I filed CH13. I have a couple 120 day lates leading up to the BK on my student loans. Gotta wait those out. Other then that, my credit is clean. Just a couple accounts paid showing IIB.

So I need 9 points on EQ and one for TU. I have given up on my EX score, that darn thing went down 19 points last month for no reason. However I picked up 30 points when I got my total util under 48.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need to squeeze out a couple points

How many revolving accounts do you have?

How many are reporting a balance?

What are their utilization?

Do you have any low dollar revolving accounts you can zero out?

Not knowing your exact details, below are benchmarks for FICO 8. Scores lenders use for mortgage are EX2, TU4, EQ5; should react similarly.

Remember these aggregate utilization thresholds: 8.9%, 28.9%, 48.9%, 68.9%, 88.9%

Remember these individual utilization thresholds: 28.9%, 48.9%, 68.9%, 88.9%

I would recommend reading the below from ABCD2199

The Truth about Credit Card Utilization

My 11 Rules to Credit Rebuilding

FICO Score: What to pay down first?

From Birdman7

General Scoring Primer and Version 8 Master Thread rev.5.17.20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need to squeeze out a couple points

Reporting more $0 balance accounts rather than lowering utilization can often impact your mortgage scores more. While taking those high utilization accounts down some would definitely be a good thing, I'd take a look at achieving more $0 balance accounts.

It's also worth nothing that outside of your Fico mortgage scores, more $0 balance accounts will help your DTI as your minimum payments from those accounts go away.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need to squeeze out a couple points

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need to squeeze out a couple points

Finally pulled it off, after that last card got under 68 util.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need to squeeze out a couple points

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need to squeeze out a couple points

@tooleman694 wrote:Finally pulled it off, after that last card got under 68 util.

Congratulations on your success!