- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Negative Reason Codes still present at 850 score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Negative Reason Codes still present at 850 score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Negative Reason Codes still present at 850 score

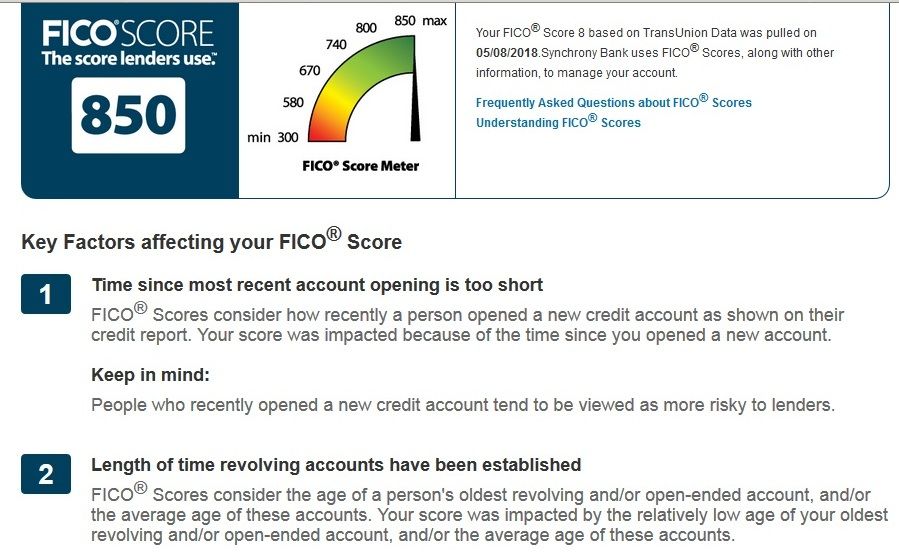

The image provided was recently updated on my Lowe's (Synchrony) account. One thing I like about this account is that it gives negative reason codes at scores of > 800. Discover CLI denial letters do as well. I know a lot of CMS software (like CCT) or monthly sources that may provide one with a score tend to omit negative reason codes once your score reaches a certain level.

Anyway, as you can see Synchrony still provides negative reason codes even with a score of 850. I was chatting with TT a few months back and he was saying that one of his sources provided negative reason statements at I want to say 848, but at 849 or 850 they were omitted. I just thought it was cool to see the same negative reason statements there, as it means there's more "buffer" for me to achieve.

Also, those same 2 negative reason codes have been present ever since I opened a few accounts at the beginning of May 2017. I was thinking that once they all reached 1 year of age (no more scoreable inquiries, too) that perhaps the statements would go away. This does show though that even with AoYA going to > 1 year, a score can still be held back at least slightly from age factors.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

Curious if those will drop off after you exit the calendar month! Please update the thread next month when you get a pull.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

@AnonymousCurious if those will drop off after you exit the calendar month! Please update the thread next month when you get a pull.

I will, but why do you think they could potentially go away once May is over? My scores already increased when May started, as my AoYA reached 12 months at that time. I'm not understanding how 13 months verses 12 months could make a difference?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

I just see this as further confirmation that negative reason codes don't necessarily correlate to changes in credit score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

@AnonymousI just see this as further confirmation that negative reason codes don't necessarily correlate to changes in credit score.

I don't think that's true. All a negative reason code means is that your score is being held back due to that reason by at least 1 point. For example, people see the negative reason code "too many inquiries" at times where they have only 1 scoreable inquiry present. That inquiry depending on profile may only be "worth" a couple of points, but since a better score is being held back due to that factor, as small as it may be, a negative reason statement is generated.

I don't think there's any doubt that as score increases and gets closer to "perfect" that the relevance/weight of the negative reason statements received are diminished, although I do believe they still matter at least a little bit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

BBS - I saw a couple reason statements from Discover card at 845 and 848 for Classic TU Fico 8 but not at 849 or 850. I also still saw a couple reason statements for EQ Bankcard Fico 8 with a score of 892.

Undoubtedly there are still opportunities for improving score factors even if Classic Fico 8 score is 850. Best I can tell (from my data) I have had up to 25 points worth of buffer on Classic Fico 8. My credit mix is only very good and I am likely missing out on 5 points due to that alone. So, I'd guestimate 30 points worth of buffer are possible.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

@Thomas_ThumbBBS - I saw a couple reason statements from Discover card at 845 and 848 for Classic TU Fico 8 but not at 849 or 850. I also still saw a couple reason statements for EQ Bankcard Fico 8 with a score of 892.

Undoubtedly there are still opportunities for improving score factors even if Classic Fico 8 score is 850. Best I can tell (from my data) I have had up to 25 points worth of buffer on Classic Fico 8. My credit mix is only very good and I am likely missing out on 5 points due to that alone. So, I'd guestimate 30 points worth of buffer are possible.

I agree regarding credit mix. If I remember correctly, like me, you only have a mortgage present as an open installment loan. The deletion of another installment loan type (auto loan) on my file was worth 3-6 points a couple of months back when it closed.

Good to know that Discover was your source that dropped negative reason statements at 849-850. My Discover score will update at the end of the month to 850 and I'll be doing a CLI request following it, which I expect to generate another denial letter. I'm looking forward to seeing if either of my negative reason statements are present on that letter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

@Anonymous wrote:

Anyway, as you can see Synchrony still provides negative reason codes even with a score of 850.

Huh, I hadn't noticed that. That's neat. Thanks for pointing it out.

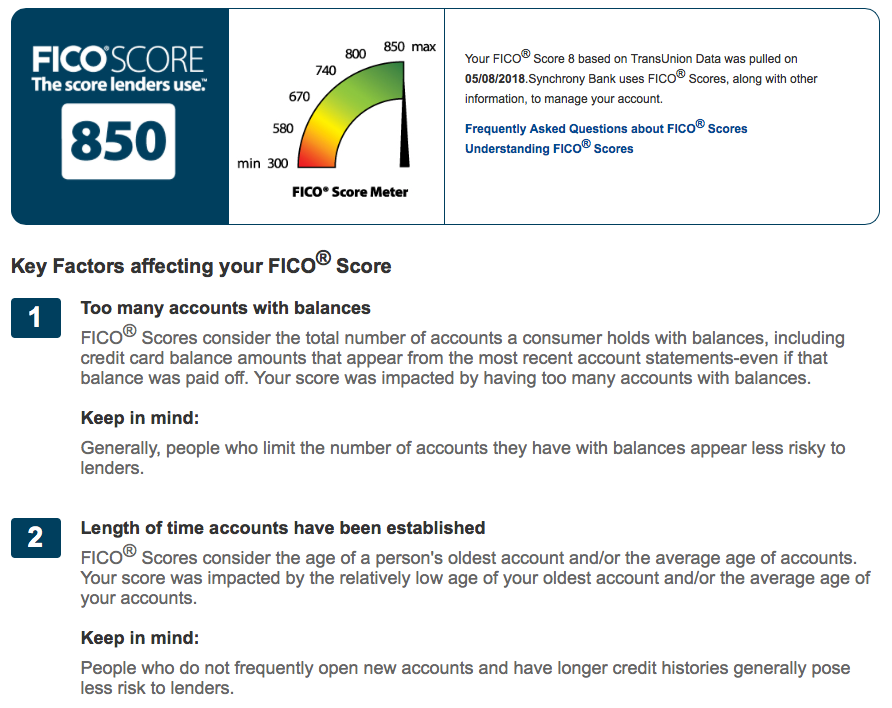

I've got "Too many accounts with balances" (fair enough, I'm letting everything report "naturally"), and "Length of time accounts have been established" (still have one account less than one year old - August 2017).

I'm curious to see what #2 might become after August.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

iv, thanks for chiming in and providing a paste of your screen from the same source as mine. Interesting that you have length of time accounts have been established, where I have a similar statement just with the word "revolving" in there. Where do your 3 age of accounts factors currently sit? On TU I'm at 12 months AoYA, 7.5 years AAoA, 17.x years AoOA. I'm guessing your AoYA is > mine, as you aren't seeing the first reason statement that I am getting. As for the length of time accounts have been established, was your most recent account opened something other than a revolver? I'm wondering why I'm getting the revolver statement but you're getting a slight variation of that. I wonder if you took down your number of accounts with balances if your #1 reason statement would be replaced with the same one I have, or with something entirely different.

Good data points and discussion here!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Negative Reason Codes still present at 850 score

@iv wrote:

@Anonymous wrote:

Anyway, as you can see Synchrony still provides negative reason codes even with a score of 850.

Huh, I hadn't noticed that. That's neat. Thanks for pointing it out.

I've got "Too many accounts with balances" (fair enough, I'm letting everything report "naturally"), and "Length of time accounts have been established" (still have one account less than one year old - August 2017).

I'm curious to see what #2 might become after August.

EQ8:850 TU8:850 EX8:850 EQ9:842 TU9:845 EX9:844 EQ5:806 TU4:770 EX2:815 - 2018-05-06

IV's data above is another example of being able to reach 850 with a recent account opening less than 12 months age. Clearly this profile has some buffer.

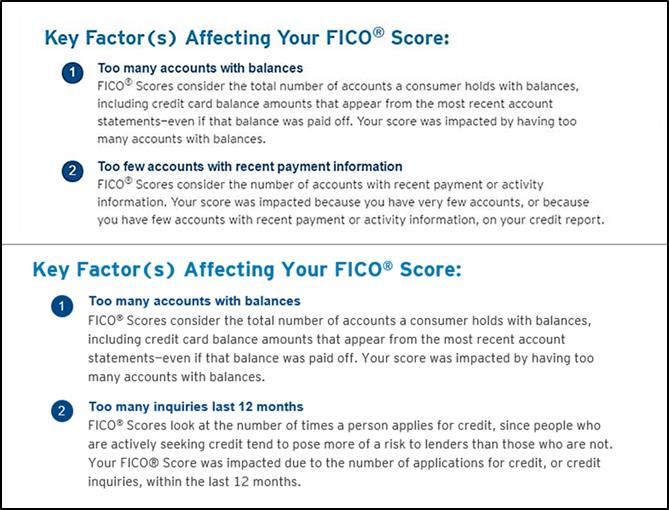

FWIW - based on Inverse data an inquiry aging from 11 months to 12 months was worth 5 points on Classic Fico 8. On one CRA he went from 2 to 1 INQ and his score went from 840 => 845. On another CRA he went from 1 to 0 INQ and score went from 845 to 850. He was already at 850 on the 3rd CRA which had no inquiries under 12 months age.

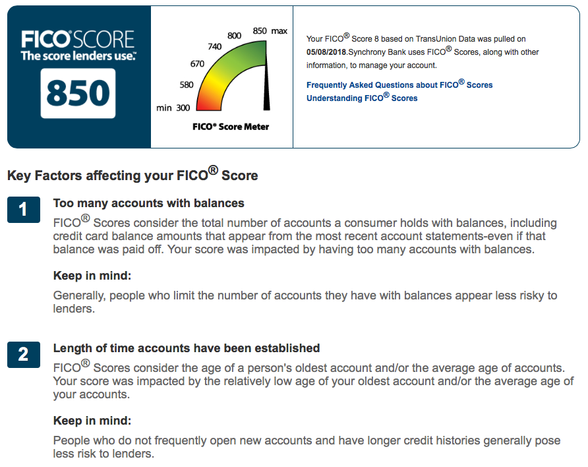

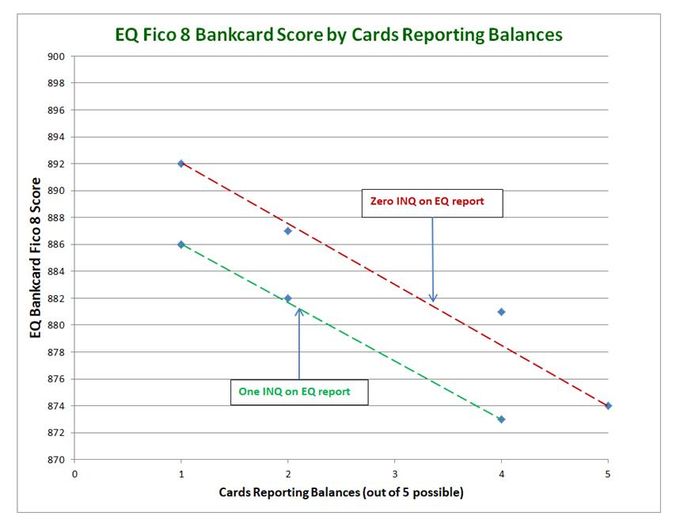

The top two reason statements I see are pasted below. The #1 is always too many accounts with balances (I let charges report on statements and PIF by due date). Interestingly, when I took an HP for a CLI the #2 reason statement changed to: "Too many inquiries last 12 months". That suggests my "too many accounts reporting" is more influential than the INQ - which I found to be true based on graphing scores - see paste below.

* 5 to 18 point penalty for # reporting depending on count

* 6 to 8 point penalty for the INQ

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950