- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Ok now I am REALLY confused...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Ok now I am REALLY confused...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ok now I am REALLY confused...

Hello again all![]() You were all so helpful last time and if it helps this is the old thread https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/First-post-and-my-ugh-story/m-p/5538869#...

You were all so helpful last time and if it helps this is the old thread https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/First-post-and-my-ugh-story/m-p/5538869#...

So truck is taken care of no issues, not only that but I am self employed and was still an instant yes on financing for the best rate and they did not ask for nor did i have to prove income. Picked vehicle up yesterday in fact. The auto score was 759 btw Experian.

Because I did not want any more hardpulls before the new truck application I did not apply for credit though did do the pre-qual thing a couple times and was looking at Amex and Citi Double cash cards. Both were giving me pre-Qual offers for numerous cards and about 2 weeks ago the Citi DC card offered me 14.7% (had been offering 20%). I had though via chat requested from Amazon store card and Lowes a CL increase since it is a soft pull. Current CL was $2500 with Amazon and they asked how much I wanted and I said 10k they rejected that but gave me 6k, fine. Then did the same think with Lowes card which was a $1,200 CL and again they asked how much and I said 10k and they gave me $12,200....was a nice surprise.

So now that the new truck was out of the way I decided it was time to apply for the two above cards as my other CC's are Cap ones and did not think it wise to have all my eggs in one basket. Even though I do have a CC also through the credit Union as well as chase. So I apply to Citi using the pre qual page and still says 14.7% APR but when I submit it I get the 7-10 day message? So I did as people here mention and call and she asked me a few questions but told me she can't approve and will have to wait for further review??? I was very surprised. So I will wait......go to the Amex and do the pre-qual and it pre quals me for 3 cards, I pick the Everyday card and apply and it is an instant rejection. I call them and the guy from Idia? I would guess is no help in telling me why but that he would send it for reconsideration.

Experian score this morning is 790 true score not Fako. Experian is who they both pulled. Other two bureaus are close, maybe 5-10 point spread between all 3 but Experian is the highest one. Think Amazon and Lowes (Syncrony) both pulled soft at TransUnion.

$150k income.

Current UTI 2%

15 open accounts some are mine some I am AU on. Wifes UTI is like 8% now but she was not on the two new apps I did.

4 of the 15 are CC's and rest store cards.

My oldest account is 8 years 5 months

No negatives at all on credit report

AAOA is 5 years 2 months

Age of most Recently opened account 2 years 11 months

3 inquiries on the record 2 of which are from the auto loan. The rejected one from 6 weeks ago and the new accepted one.

Credit record is squeaky clean, not so much as a late payment ever.

I just don't get it, any insight?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

Ok here is the online reasons for the app to Amex being rejected.......

Reason(s) for Our Decision

Â

Our scoring of your credit and other relevant information (see below)

Â

We evaluated your application using a credit scoring system that considers various pieces of information, including your credit report. The following key factors contributed to our evaluation:

Â

Our evaluation of the inquiries on your credit report based on the number, type and recency. (Experian)

Too many credit card accounts on which, in our estimation, you have not paid a majority of the balance in recent months. (Experian)

Ratio of the highest account balance to the sum of the balances on all accounts. (Experian)

Amount of credit available on accounts. (Experian)

Â

Information About Your FICO® Score

We obtained your FICO score from Experian and used it in making our credit decision. Your FICO score is a number that reflects the information in your credit report. Your FICO score can change, depending on how the information in your credit report changes. On April 09, 2019, your FICO score was 784. The FICO score ranges from 300 to 850. The following are the key factors that contributed to your FICO score:

Â

There is no recent information about installment loans on your report.

The length of time your accounts have been established.

There are too many credit inquiries on your report in the last 12 months.

The length of time your revolving accounts have been established.

I'm lost....... The only one I understand is "There is no recent information about installment loans on your report" While we do have 2 current auto loans (not counting the new truck loan) they are through our Credit Union which only reports to Equifax, which I did mention to them during the phone call after the rejection. One vehicle loan is 4 years old and almost paid off and the other is 3 years old with a year to go.

Too many inquires? I have 3 two of them are from Ford.

The rest I simply don't understand at all.......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

Confusing, yes.

Which store cards do you have? Can you list out all the accounts, their limits and latest statement balances, including non-store credit cards?

Did you change addresses recently? Any indication whether they are looking for identification verification?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

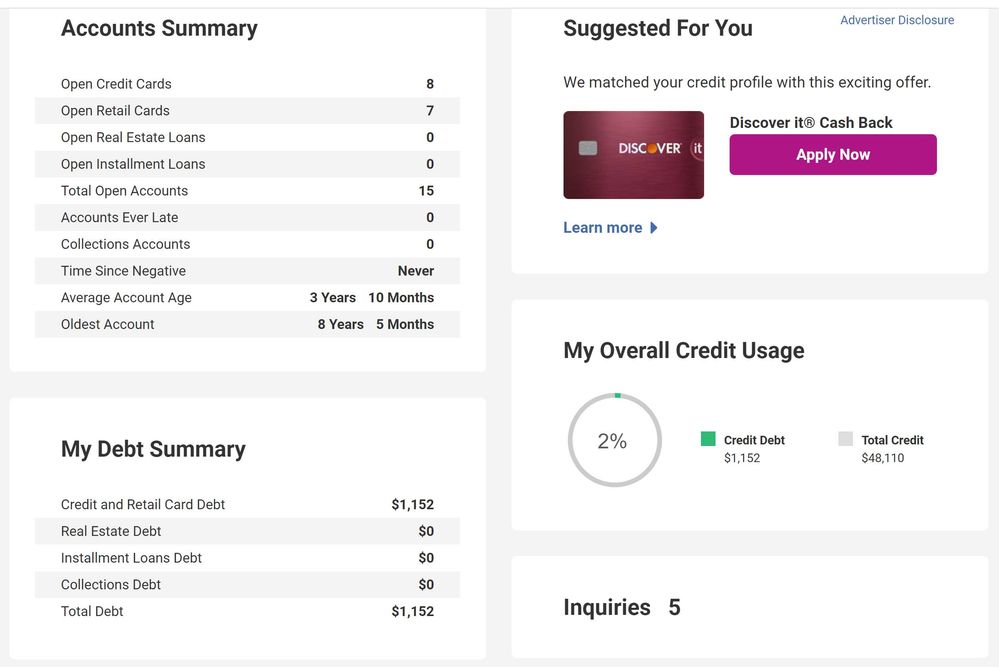

This is the list from Experian as of this morning. The CL on the Amazon card has not yet updated but is $6000, probably because it had a zero balance. I noted the below with if the accounts are mine, AU or Joint. The CC from Credit Union does not show on this report or the 2 car loans as they just report to Equifax.

I do see the balance on my CC from Cap one does now reflect the paid in full.

No address change, have been here for 15 years and own our home, no mortgage.

They did not ask about ID verification? I will say that I did an oops at Equifax and accidently put a credit alert on the file, I clicked the wrong check box![]() When I saw it I wrote both Equifax and Experian to have it removed, TU you can remove it online. All 3 removed it. I got the notification letter from Experian last week that it was removed so when Amex and Citi did the pulls it would not have shown up I don't believe. Score did drop 14 points this morning, probably from the 3 hard pulls. Still have not heard from Citi. Elan if you don't know is a CC, its a local bank.

When I saw it I wrote both Equifax and Experian to have it removed, TU you can remove it online. All 3 removed it. I got the notification letter from Experian last week that it was removed so when Amex and Citi did the pulls it would not have shown up I don't believe. Score did drop 14 points this morning, probably from the 3 hard pulls. Still have not heard from Citi. Elan if you don't know is a CC, its a local bank.

Name Bal Credit Line UTI Opened Responsibility

CAPITAL ONE BANK USA N $32 $1250 3% Sept 2013 Mine

CAPITAL ONE BANK USA N $0 $8000 0% Nov 2010 Mine

CAPITALONE $0 $500 0% Aug 2015 Mine

CBNA $361 $2000 18% June 2018 AU

CHASE CARD $0 $7500 0% Dec 2012 AU

COMENITY BANK/BEALLSFL $0 $710 0% April 2018 AU

COMENITYCB/OVERSTOCK $191 $1450 13% Feb 2016 AU

Discover $0 $2500 0% Apr 2012 AU

ELAN FINANCIAL SERVICE $0 $2000 0% Nov 2013 Joint

Shell / CBNA $129 $1400 9% Jan 2017 AU

SYNCB/AMAZON $0 $2500 0% Nov 2014 Mine

SYNCB/BELK $0 $900 0% May 2018 AU

SYNCB/LOWES $221 $12,100 2% July 2013 Mine

SYNCB/SLEEP NUMBER $218 $5000 4% May 2016 Joint

SYNCB/WALMART $0 $500 0% Nov 2018 AU

You have 0 Closed Account

Experian has no closed accounts on file for you as of Apr 10, 2019.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

Also if it helps, this is the summary.....screen shot from Experian. In the first post and the summary.....some of the info is a bit different like AAOA, I think I grabbed that info from a different bureau and Experian must calculate ages different or something. Sorry about that.

Not that I think this has anything to do with it but to be thorough and since you asked about ID.......about a year ago I checked my bank balance on my phone and noticed the account had $3500 ish less in it than I thought it should. I looked and there was a payment the day before to a Porsche delear in Simi Valley CA. So I called the bank and then called the Porsche dealer who was not open yet and left a message. The Parts manager called me back right when they opened and was VERY happy I had called as the $3500 in Posche parts were due to be mailed out that morning and they would have had to eat that. The guy who was in Miami had sent them a faked DL and a faked cell phone bill to prove his ID as the dealer was reluctant to take the order but the ID was good enough for them to ok the sale. The DL had my name on it but not my picture or correct address, was a UPS type store address.....photoshop job but fairly good. The guy was good enough and had enough info to convince my bank he was me when he called them on the 1-800#. The bank was so dumb that even AFTER I had alerted them of the attempted fraud and they canceled the card he had the account # to they did not catch he had changed the mailing address (but NOT home address) so they sent the replacement card to HIM not me. Discovered that only when the card did not arrive. I had though placed a bank HOLD on my accounts so only way changes to the account could be made was if I was atanding in front of the teller or CSR ID in hand. So the guy could not activate the new card so did him no good. Like I said I don't think that has any bearing on this as it would not show up on a CR anyway...... In the end the crook got nothing and lost the time he invested. The bank and car dealer were out nothing, just caused me some aggravation but no lost $.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

Just had an alert that Citi bank just did a hard pull at Equifax so perhaps there is hope yet that one will be good news. So now they have pulled two bureaus on me the WHY though just bugs me to no end. There has to be something in there that they don't like I just can't figure out what it could be.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

Well before giving up I figured since nobody had pulled TU I would find a bank that pulls them so searched and saw that is who Discover uses so did the Prequal and it listed two cards so sent the application. They had me upload a DL and SS images and then had to call and he asked me one security question and after a brief hold was approved for $8200 so while the Amex decline still bugs me there is not much I can do about it. Btw Discover pulled Equifax not TU as I thought / hoped they would. I would like to add two cards so one down and will now just wait and see what Citi DC has to say if and when they ever decide, then will go from there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

Birdman,

You might be right..... I double checked and the alert is gone from Experian and from TU it does though still show up on Equifax. Yesterday I received a letter from them that stated that they received my request to have the credit alert placed on my file but could not locate a credit file that matched. The letter I sent was to have it REMOVED but ok. I will call them to see if I can straighten it out. The thing is Amex did not pull Equifax and I know it was removed at Ezperian who they did call. I know it is gone from Experian as I could see the notation at Experian which is gone now and they also sent me a letter it was removed. So I guess my question is if there is some delay in the process and that while I saw it was gone Amex could still see it? Or even though it is gone at Experian could Amex still see it at Equifax even though they did not pull from them?

Btw, still have not heard a peep from Citi Bank and the online checker still says under review....not sure if I should call again or just let it play out?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ok now I am REALLY confused...

Yes, pre-emptively call CITI and address this!