- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Oldest account hits 3 yrs scores drops up to 22 po...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Oldest account hits 3 yrs scores drops up to 22 points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

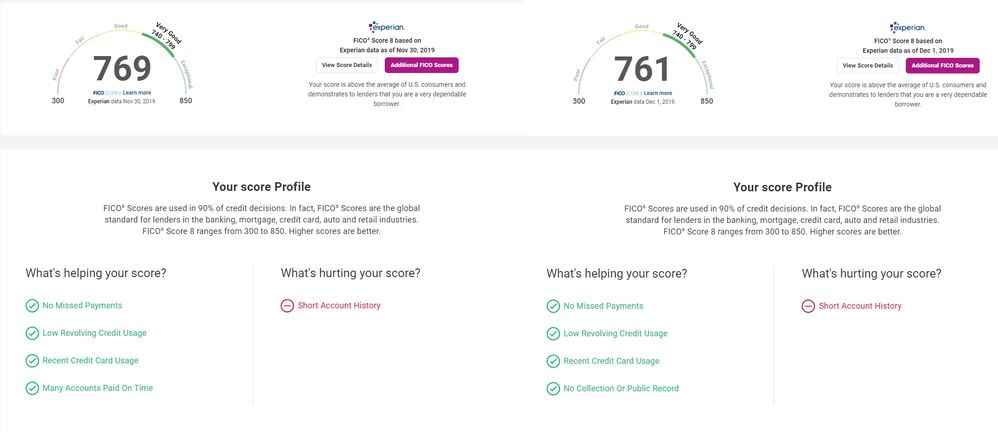

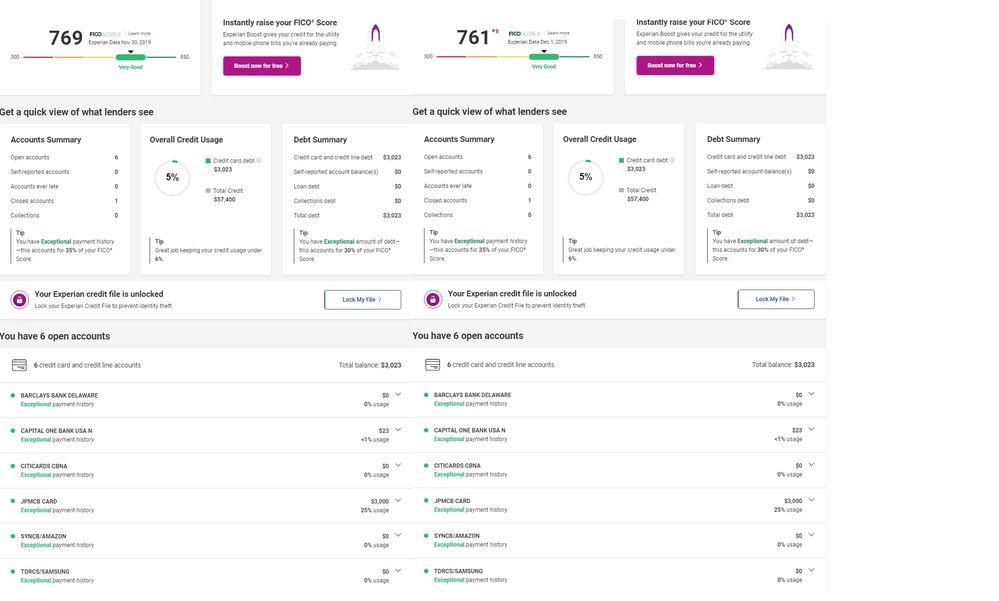

EX Scores from 11/30:

FICO 2: 781

AUTO 2: 767

AUTO 8: 754

BANK 2: 769

FICO 3: 762

BANK 8: 795

EX Score from 12/1:

FICO 2: 781

AUTO 2: 767

AUTO 8: 745

BANK 2: 769

FICO 3: 762

BANK 8: 786

Looks like just my 8 versions moved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

I wonder if that is the segmentation point for version eight? It’s just strange not to see any shift in the negative reason code. Did you closely scrutinize your reports to make sure there were no other changes?

Very interesting and thank you for your response.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

@Anonymous wrote:

@Drwaz99 There could be different segmentation thresholds for different versions. And I would think, in my opinion, that it may be lower for the newer versions.

I wonder if that is the segmentation point for version eight? It’s just strange not to see any shift in the negative reason code. Did you closely scrutinize your reports to make sure there were no other changes?

Very interesting and thank you for your response.

Before and after screenshots. I've been in the garden since August, so no new INQ, either.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

2 more DP questions for the scorecard assignment record for future readers: AoYA? and do you have a open or closed loan on your CRs?

Thank you again for your time, assistance, and willingness with this. You've added great data!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

@Anonymous wrote:

@Drwaz99

2 more DP questions for the scorecard assignment record for future readers: AoYA? and do you have a open or closed loan on your CRs?

AoYA is 4 months.

The loan is weird. It's a closed and paid on time Affirm loan. I'm not sure if it's counting as a loan or as a CFA. No other ones.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

The data points are greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

Interesting thread.

Just a thought. I don't know that I'd say that the negative staying the same necessarily contradicts the idea of segmentation having occurred, though it's definitely a great DP.

If there is scorecard segmentation @ 3 yrs for AooA, something to consider with regard to Dr's negative remaining the same even though there was an 8 point drop in score is that a short account history would probably be more of a negative on a more mature scorecard than a younger one. A younger scorecard segment would pretty much expect that someone has a short account history. With Dr's otherwise clean report it's not surprising that it would be the only negative even if it didn't have much of an impact. A scorecard segment for folks with older AooA would not treat a short account history so kindly.

AMEX Platinum / BofA Cash Rewards Visa Sig $99,900 / Chase CSR $43,400 / Citi Double Cash $39,600 / AMEX EveryDay $30,000 / Discover It $26,000 / Gemini $25,000 / JetBlue $25,000 / Chase Freedom Unlimited $22,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

Here's another data point: EX 2 -22pts at AoOA 2yrs 0mo / AoYA 1yr 0mo on a clean/young/thin profile.

Only 2 open accounts (credit cards) and balances reporting exactly the same as the prior month, so it's real simple with no changes except for aging of 1 month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

But, had he had other negative factors, there may have been a shift in precedence? Gotta ponder this more, wish the others would contribute DPs, as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest account hits 3 yrs scores drops up to 22 points

@Anonymous So, we could have a potential threshold @ 2 years on EX2 and 3 years on EX8.

Would it make sense to lengthen the threshold considering the financial circumstances at time of creation?

@Drwaz99 Did you have similar drops at TU and EQ? Wait you said the 8th....I'm eager!