- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Oldest card turning 2! 🎉

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Oldest card turning 2! 🎉

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

They are after your CR, and your CR undergoes transformation and interpretation according to internal algorithm, hence denials with 850 and approvals at 625.

Sure, Chase could have elected to look at one year, but like Rev said, it's about SUB chasing, and two years give a bit better picture.

As far as future predictive value, I'd have more faith in it if I didnt hang around here.

Probably why more and more lenders are relaying on internal algorithms, looking at raw numbers, taking into account various tricks to mask obvious problems etc

Any scoring system that can be so easily manipulated is inherently unreliable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

But I believe she is spot on as to the purpose of the internal algorithms as a fail-safe, due to ability to manipulate ficos; plus the more data, the better the decision in terms of risk-assessment from the lender’s perspective.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

@Remedios wrote:

I dont think most lenders give a rat's bum about the numerical representation

They are after your CR, and your CR undergoes transformation and interpretation according to internal algorithm, hence denials with 850 and approvals at 625.

Sure, Chase could have elected to look at one year, but like Rev said, it's about SUB chasing, and two years give a bit better picture.

As far as future predictive value, I'd have more faith in it if I didnt hang around here.

Probably why more and more lenders are relaying on internal algorithms, looking at raw numbers, taking into account various tricks to mask obvious problems etc

Any scoring system that can be so easily manipulated is inherently unreliable.

Broadly speaking the algorithms have value if they aren't known, which is true for the vast majority of Americans.

The problem is with this very small population we have a pretty good idea in broad strokes how things work and how to manipulate the resultant score... hence FICO Strategists to use a prettier label than FICO Manipulators though I'm sure lenders consider us the second.

Nothing of any importance is underwritten just a FICO score, as Birdman suggests there's a lot more data that can be gained on an individual that isn't on a credit report and income has to be considered these days though I've never had to submit POI except for a mortgage it's not inconceivable that my pay history is on some online database I'm not aware of outside what Chase can easily work backwards to exactly what I'm making each year given my entire financial life runs through there for all direct deposit since 2011 or so.

End of the day when it counts, prepare to submit a whole slew of documentation. I'm actually kind of curious with this mortgage process (which I'm running through Chase, I don't have time to rate shop and with my relationship discounts to both rate and closing costs they have to be competitive even with a small conventional mortgage) when Chase has every single account I'm claiming for assets between checking for pay history verification, brokerage and the larger of the two retirement asset accounts I hold with them though really I didn't even need to claim the retirement one I just sort of wondered what they were going to do with it. Have the opportunity to experiment with a lender even on something as well characterized as a mortgage, why not? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

At least 10 years, and another 7 with WaMu prior to that. Put a checkmark on couple of mortgages, one or two car loans, other stuff...All the money goes there first, then it gets distributed from there.

Chase is the one I worry the least about.

It's not because I feel all safe and cuddly but because if they have any doubts on my ability to repay, not just them but everyone else, I might as well go debit card. Cash, even!

I'm also not advocating for not manipulating the scoring system. It's actually the opposite.

It's not like they asked for public input when they were creating it 😐

All I'm saying is, whatever FI provides in terms of scoring algorithm is hybridized with whatever lender is looking for. So, at some point, our ability to manipulate got lessened by quite a bit.

My scores are fine, so is income, my debt is nonexistent and yet I probably couldn't get one of those grocery key chains with most of them because new accounts 😐

That's why you save Amex for last 😂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

@Remedios wrote:

I've been Chase's 'ish for a really long time.

At least 10 years, and another 7 with WaMu prior to that. Put a checkmark on couple of mortgages, one or two car loans, other stuff...All the money goes there first, then it gets distributed from there.

Chase is the one I worry the least about.

It's not because I feel all safe and cuddly but because if they have any doubts on my ability to repay, not just them but everyone else, I might as well go debit card. Cash, even!

I'm also not advocating for not manipulating the scoring system. It's actually the opposite.

It's not like they asked for public input when they were creating it 😐

All I'm saying is, whatever FI provides in terms of scoring algorithm is hybridized with whatever lender is looking for. So, at some point, our ability to manipulate got lessened by quite a bit.

My scores are fine, so is income, my debt is nonexistent and yet I probably couldn't get one of those grocery key chains with most of them because new accounts 😐

That's why you save Amex for last 😂

Heh.

Well FICO 10T all that FICO strategy basically becomes irrelevant or should be at least: the use of payment information is going to be a game changer though I agree with your other post on a different thread which we've both made that not every lender reports payment information and others like Citi now apparently won't report $0 it just skips that reporting cycle. I don't know that it breaks where we're apparently headed but it does does create more inconsistency in credit reports.

Then again as I told the Chase LO if my mid-score doesn't come back 763 give me a week and repull and it will be 773 =/. The fact I know things to that level of detail has to be worrisome to lenders and as such I suspect FICO 10T will be far more used than FICO 10, I almost don't know why they didn't use that as their default for FICO 10 even but FICO is as FICO does.

Unlike others that you allude to this forum, I've only paid interest once on any credit card, might be a second one now as I really should be pooling cash for a downpayment and Chase already got a 2K payment on the one non-trivial balance I have outstanding and a little interest in the, well, interest, of keeping a fixed file for the mortgage process is probably worth it anyway and I freely admit that one was just a mistake as I could've waited another month and change to submit the property tax payment anyway.

As is already had nearly 1K withheld for Calfornia taxes in January from the steady job and that's with all the damned holidays I don't get paid for. I swear in a smarter tax state this is going to become a non-issue =/. 45 minutes ago I got spam emailed from all the random credit services that a new inquiry got lodged by Chase Home Lending, it's go time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

@Anonymous wrote:

Whoa what do you mean citi won’t report a zero balance anymore? When did this start? So it’s impossible to zero out a citi account?

No what I mean is they no longer update the bureaus if you have a $0 balance and if it doesn't change month to month. This is basically what Synchrony has done for a decade but they kept screwing up and not updating the bureau after you paid it off... that was ultimately why I kicked them to the curb and flatly refuse to deal with them.

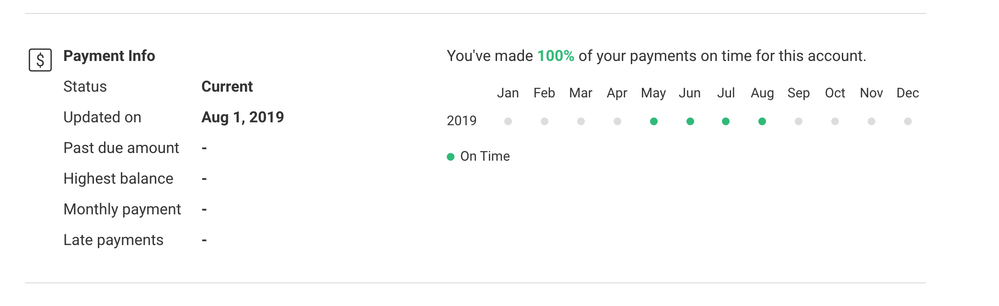

I haven't logged into my Citi account recently to see when I last generated a statement but Experian hasn't gotten an update from them in a while:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

@Revelate wrote:

@Anonymous wrote:

Whoa what do you mean citi won’t report a zero balance anymore? When did this start? So it’s impossible to zero out a citi account?No what I mean is they no longer update the bureaus if you have a $0 balance and if it doesn't change month to month. This is basically what Synchrony has done for a decade but they kept screwing up and not updating the bureau after you paid it off... that was ultimately why I kicked them to the curb and flatly refuse to deal with them.

I haven't logged into my Citi account recently to see when I last generated a statement but Experian hasn't gotten an update from them in a while:

Wow, thanks for posting that. I had no idea that could happen with my Citi Visa card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oldest card turning 2! 🎉

@Anonymous wrote:

@Revelate wrote:

@Anonymous wrote:

Whoa what do you mean citi won’t report a zero balance anymore? When did this start? So it’s impossible to zero out a citi account?No what I mean is they no longer update the bureaus if you have a $0 balance and if it doesn't change month to month. This is basically what Synchrony has done for a decade but they kept screwing up and not updating the bureau after you paid it off... that was ultimately why I kicked them to the curb and flatly refuse to deal with them.

I haven't logged into my Citi account recently to see when I last generated a statement but Experian hasn't gotten an update from them in a while:

Wow, thanks for posting that. I had no idea that could happen with my Citi Visa card.

Doesn't impact FICO score at all TBH and I only just now noticed it for the simple expedient that the Citi card was top of the Experian default sort for some reason

I don't have the ability to play it now but after I get sorted mortgage and moved I'll run a charge through it, generate a statement, and it should populate everything before that if it holds true to other lenders, but since ND counts the same as OK it doesn't matter score wise.

Actually for you if you want to do what I consider to be a Godlike test Cassie: since you're still with limited revolvers and have excellent data, if you can get the Citi card to not report for six months and then try your balance tests again for numbers of revolvers and/or aggregate utilization we might be able to nail down (finally) if a card gets excluded if not updated on a report within 6 months. No harm no foul if you don't want to but you have the near ideal setup whereas for me one card lost is basically a non-issue.