- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Opinions Wanted. Pics attached

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Opinions Wanted. Pics attached

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opinions Wanted. Pics attached

Hi,

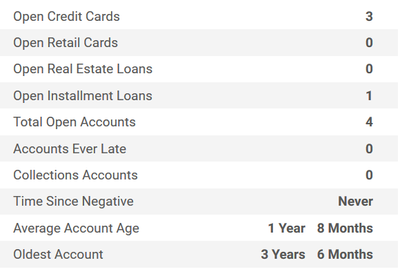

My question is aaoa / score related

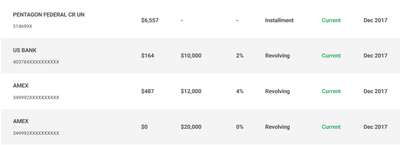

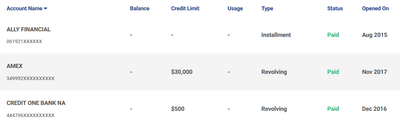

Briefly, our subject is a 54-year-old female. She never really used credit, was married at one point and had cards via him. about 18 months ago she had a 17% car loan and a $ 500 credit one. I gave her a few AUs, had her join penfed and did a refi to the car and she now has the below. scores are ~750 across the board. Makes $160K and spends every dime of it. very few soft pulls from anyone, no pre-approvals from chase and not sure chase is the best for her anyway. Utilization is 1-2% but it get’s pretty high during the month at times

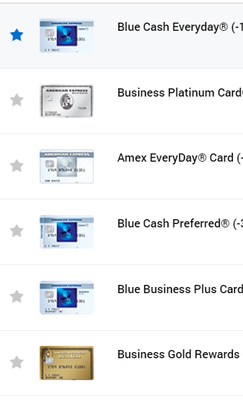

There is no travel in her future, so I am thinking cash back. the BGR was for the sub so that will be closed in a few months. she has a laptop on the BBP so that is fine. on the consumer side the everyday was a burner card, it was $25K and got her in the door. The BCE was $1K and it grew from the ED and CLIs. The C+ just went $ 500 -> $10K

I was going to just app for a BCP as she will use it on grocery and fuel, and I was thinking of a new app vs an upgrade just to see if she could get more credit out of amex. My plan was to take much of cl from the ed and put it into the bce and bcp to help her utilization. she has a pre-approval for the BCP and with no hp it would seem to be as sure fire as can be – the only downside is the aaoa hit so I am on the fence between the app and upgrade but again I am trying to beef up her available credit and have more cards firing.

The other card I was thinking of is the uber. It just seems like a dandy card and if I was not into points, I would grab it. I don’t see another no fee card with no ftf + cell protection that has all that packed in and it hits her spend buttons + her tu is 752.

Just a guess, how much of a aaoa hit will she take with 2 new cards based on her profile? I am expecting a 3-5pt hit for the uber hp.

Ax clearly loves her but she her profile short circuits most lenders I think, a 54 year old with very little history. I want to get her diversified and get more action happening in her profile, but I don’t want to destroy her scores in the process.

Thoughts? Thanks!

$25K everyday

$12K blue cash

$10K cash +

$9K bus blue plus & a bgr

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

How many closed accounts are on your friend's report? We'd need that to compute the anticipated AAoA drop. Also, does she still have the AUs, and do they count toward her AAoA?

Anyway, the last time I crossed an apparent AAoA threshold, I gained/lost three points. (I crossed the same threshold three times in about five months). Of course, this could be entirely different with your friend's profile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

Why the rush to now close cards with no AF? This persons profile needs some time to age. The cards are earning well-combined rewards, and it seems strange to say that no travel is planned, at this persons age.

I would also be concerned about wholesale closing of AMEX cards so soon after they got SUB. AMEX is providing a lot of new credit. That deserves some appreciation, not to just close the cards because you think they might not fit an ideal wallet.

So I would make no changes for the next year.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

@HeavenOhio wrote:How many closed accounts are on your friend's report? We'd need that to compute the anticipated AAoA drop. Also, does she still have the AUs, and do they count toward her AAoA?

Anyway, the last time I crossed an apparent AAoA threshold, I gained/lost three points. (I crossed the same threshold three times in about five months). Of course, this could be entirely different with your friend's profile.

lol omg I am brain dead. sorry / thank you lol. the amex is mine, its closed as is her credit one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

@NRB525 wrote:

OP, the new cards and car refi are good news.

Why the rush to now close cards with no AF? This persons profile needs some time to age. The cards are earning well-combined rewards, and it seems strange to say that no travel is planned, at this persons age.

I would also be concerned about wholesale closing of AMEX cards so soon after they got SUB. AMEX is providing a lot of new credit. That deserves some appreciation, not to just close the cards because you think they might not fit an ideal wallet.

So I would make no changes for the next year.

Hi, sorry I was not clear. the only card I am closing is the bgr, not any consumer cards. I want to open 2; the bcp and the uber, unless you think my plan is flawed. have at it. thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

Your friend hasn't opened a card since Dec 2017. She should be fine for two new cards.

Two cards would bring her AAoA from 20 months to 15 months. I don't see that as a problem. It's hard to predict whether she'd cross a threshold or not. But I can't imagine a drop — if one occurs at all — being worth a lot of points.

However, she can figure on a drop of 20 points or so from bringing her AoYA (age of youngest account) from over a year to zero. That's just a fait accompli when applying for cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

@HeavenOhio wrote:Your friend hasn't opened a card since Dec 2017. She should be fine for two new cards.

Two cards would bring her AAoA from 20 months to 15 months. I don't see that as a problem. It's hard to predict whether she'd cross a threshold or not. But I can't imagine a drop — if one occurs at all — being worth a lot of points.

However, she can figure on a drop of 20 points or so from bringing her AoYA (age of youngest account) from over a year to zero. That's just a fait accompli when applying for cards.

thank you, most helpful. I have not applied for a consumer card for years, only business products. AoYA...I totally forgot about that sucker, darn it. got to pay if you want to play I suppose. even with the aoya and hp it sounds like she should still be in the ~730s so that is not all that awful. I tired, unsuccessfully, to estimate the aaoa, do you have an xls that you put together? the online calc came up with 1 year

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

I took her 20 months AAoA times seven accounts, which is 140. Then I divided 140 by nine to include two new accounts. By the time the new accounts report, there'll be a bit of aging that I didn't bother with.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

@HeavenOhio wrote:I took her 20 months AAoA times seven accounts, which is 140. Then I divided 140 by nine to include two new accounts. By the time the new accounts report, there'll be a bit of aging that I didn't bother with.

thank you, its insane I dont know how to figure this out I need to work on my math skills lol. funny story, just applied for the BCP for her and got $4K. not surprised one bit, just happy they did not deplete any of her other accounts. the process asks me if I want to know the card # ...sure, why not...then it tosses out a card # for verification and I am like huh, what # is this haha. I have the page send her a txt and I am all set. go to the portal and have the csr add the card, no problem - moved $10K from the everyday over just to make it more useful. I log out and back in and display all the cards and where the heck did a business plat come from!!! turns out her new job gave her the card but my god, nothing like sharing the details lol. really had me going...waiting for her new credit line with the cash+ to update and then I am going to uber her. mucho thx, take care

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions Wanted. Pics attached

You said she spends every dime of her $160k income. Maybe she should be looking at a savings account or an IRA instead of a new credit card. Food for thought.