- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Our Forums' FICO High Achievers: Who has at least...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

Just looked at my dashboard and here is where I am and because my reports are very much in sync with very little difference, there are some good clues on the formula

Equifax 842

TransUnion 756

Experian 850

The difference in Equifax and Experian are in my inquiries-- so at this level, figure Inquiries are worth about 8 points.

The difference of Transunion and the others is a paid medical collection for $271 that is over 3 years old, but I still haven't bothered to gather all my insurance papers to disput it. So at this level, even an old, paid collection makes almost 100 point difference in your score! Just thought I would share as I know we are all always trying to figure out the impact of various things. As we have all discovered things that barely move the bar when your score is in the lower ranges have huge impact when you are nearly perfect, which is why I preface each of these with "at this level".

I will keep watching to see the impact of the collections on my TU as it ages and the inquiries fall off Equifax and keep you posted as it changes-- unless I get motivated to dispute it--lol. I have had a standing goal of having all 3 scores over 800-- would love to see it but, I am done applying for credit, I am now focusing on being debt free in getting ready for retirement (4 mortgages left--home and 3 investments, everything else is paid off)-- I am sure my score will fall as I stop using credit, but that is okay- I don't anticipate needing credit as I pay things off and move to a cash life... still would like to see them all over 800, just for fun!

Current Score: EX 850, EQ 835, TU 755

Goal Score: all over 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@R_W_ Thanks for the data points.

A collection over $100 counts the same on Fico 8 whether paid or unpaid. Typical impact is 70 points to 90 points.

All paid collections are ignored on Fico 9 regardless of dollar amount. If you have access, check your TU Fico 9 score. I'd guess your Classic TU Fico 9 score would be in the 830 to 840 range.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@sarge12 wrote:Go figure...I recently opened a checking and savings account at Langley FCU in order to get the free EQ fico 08 they provide. They pulled EQ to open the acount and my score was 826. I told the CR that if they could to go ahead and add a 5k LOC for overdrafts since they had already done the HP. The underwriter declined the LOC in spite of my very high score, and all 3 are 800 or better. Reason given by phone...the balances on my existing revolving accounts was too low in relation to my available credit lines. I always thought that was the goal...to keep low utilization. So, even though low utilization is undeniably great for your credit score, and AZEO is also. It can, and in my case did, lead to a decline in a paltry 5k LOC request. First decline in new credit I've had in at least 10 years, even though I am routinely denied CLI's for the same reason. The CSR said that never had any of my revolving credit balances ever shown more than 5500 balance, with near 200k in current limits on all my revolving credit lines. The takeaway from this is that the very actions that cause my scores to be so high, can lead to app declines even with higher scores.

It's so strange. It just makes no sense. I think you should recon the decision if possible.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

My TU recently went over the 760 threshold. I've found the situation pretty interesting because, as is shown in my siggy, TU is significantly higher than my other scores. That's because TU kinda sorta screwed up and deleted an entire tradeline that was in good standing even though it contained my only 2 baddies -- a pair of 30-day lates. In any case, that allowed me to see into the future in terms of what EQ and EX will approximately look like when those baddies fall off. It surprised me how much a couple of 30-day's dinged my score. I would have thought that at 6.5 years and 5.5 years old they'd be basically harmless by now. Not true -- I got a 67 point increase!

Anyway, it's amazing how fast scores can rebound when all the tactics learned from MyFico are employed. In March of 2017 my TU was 651 -- and I'm sure it was quite a bit lower than that at one point, that's just when I started tracking my scores. So yeah for this place! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

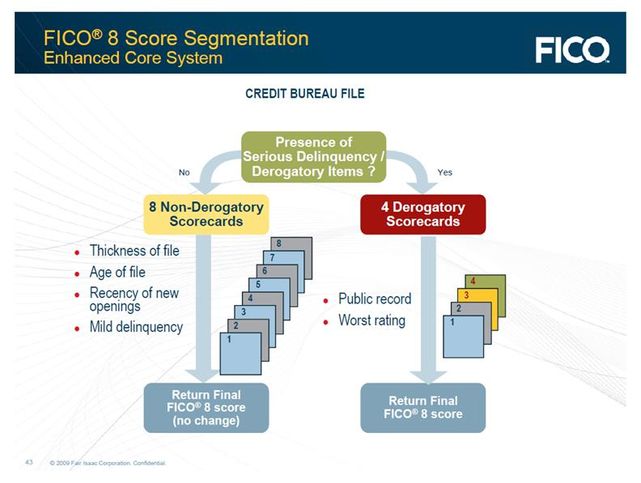

Usually removal of an aged 30 day late won't bump up score more than 25 to 30 points - if that is the only late on file and the profile is assigned a clean profile. In Asilomar's case it appears the tradeline removal resulted in a scorecard re-assignment from dirty to clean where signal strength associated with various scoring attributes changes.

The different weighting associated with other factors likely added to the score boost - IMO.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@Thomas_Thumb wrote:Usually removal of an aged 30 day late won't bump up score more than 25 to 30 points - if that is the only late on file and the profile is assigned a clean profile. In Asilomar's case it appears the tradeline removal resulted in a scorecard re-assignment from dirty to clean where signal strength associated with various scoring attributes changes.

The different weighting associated with other factors likely added to the score boost - IMO.

So you're saying a profile can be assigned as "clean" if there's any lates at all? I would have thought it was only ever 'any baddies = dirty' and 'zero derrogs = clean'.

"...where signal strength associated with various scoring attributes changes."

I'm not following that. Can you please clarify?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@Alisomar

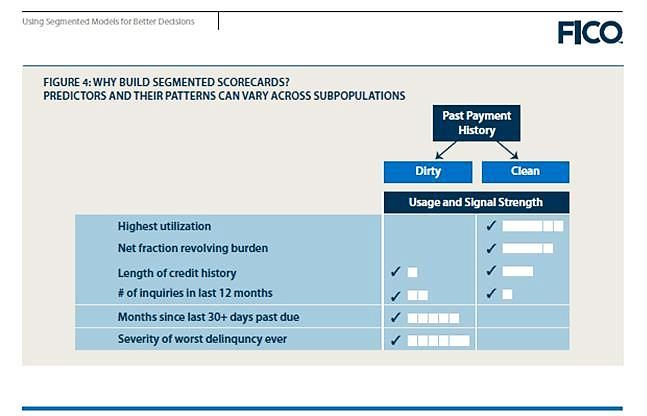

Fico likes to use the terms "attribute" and signal strength". I prefer the terms "factor" and "weighting". Most people understand weighted averages but signal strength? Anyway, I digress.The point is Fico has multiple scorecards and the scoring factors used by Fico are given different weight depending on which scorecard your profile is assigned.

For example, if your profile is assigned a "no lates" clean scorecard, individual card utilization is likely given more weight (points allocation) than the same utilization on a dirty scorecard. Why? Well a portion of the points on a dirty scorecard are allocated to derogatory attributes - those attributes are not in play on the clean scorecard which allows the points to be re-allocated to other attributes such as utilization.

Furthermore, Fico segments sub populations into "like" behaviors for more accurate risk analysis. Their studies have shown the more accurate predictions of risk are realized when "signal strength" of attributes is tailored to the sub population.

What is a Fico credit score supposed to represent? In general terms, the likelihood of the individual going 90 days past due on a debt obligation.

Pasted below is an illustration of the signal strength concept from Fico. It's conceptually correct but, misleading in detail.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@Thomas_Thumb wrote:@Alisomar

Fico likes to use the terms "attribute" and signal strength". I prefer the terms "factor" and "weighting". Most people understand weighted averages but signal strength? Anyway, I digress.The point is Fico has multiple scorecards and the scoring factors used by Fico are given different weight depending on which scorecard your profile is assigned.

Optimist.

Perhaps more people recognize the words... but understand? Not in my experience.

But that was an excellent one-page description of segmentation.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

My last Experian 3B update (7/13) is EX 770 TU 741 EQ 770..The best they've been in a while. I've become more knowlegable of Credit since I started following this Forum. Thanks to all of you who contribute and have a part in my score improvements.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

As of early this evening, I checked my FICO score that's on my American Express account and it showed 772. According to another thread I posted on, that's a legitimate FICO score (not sure where they get it from though). I also checked on Penfed where I have a checking account and line of credit and they show 760 which is "FICO 9" I don't know the difference between FICO 8, FICO 9, FICO 4, etc. I always thought FICO was FICO - didn't know there were variations.

The scores that I have through my TransUnion credit monitoring account are much lower and are Vantage scores, which I understand are total crap.

My score might be somewhat lower now though, but I won't be able to check on my bank & credit card sites for another month - I think they only update them once a month. I applied for and got a new credit card tonight ![]() Just waiting now to see if the requested balance transfer goes through. That should boost my score a bit over the next few months because I'll be able to pay things off a bit faster and eventually get to zero by next summer. I'd really like to be above 800 next year. It's a goal. All the debt I have is on credit cards and it's being paid off at a rapid clip. My score dipped a bit when I sold my house last year, leaving me without a mortgage. It's gone back up again though.

Just waiting now to see if the requested balance transfer goes through. That should boost my score a bit over the next few months because I'll be able to pay things off a bit faster and eventually get to zero by next summer. I'd really like to be above 800 next year. It's a goal. All the debt I have is on credit cards and it's being paid off at a rapid clip. My score dipped a bit when I sold my house last year, leaving me without a mortgage. It's gone back up again though.