- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Update: Re: Overstock Closed - Score Plumits

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Overstock Closed - Score Plumits

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overstock Closed - Score Plumits

@MstrPTato wrote:1 year old

Ahh, ok, ya the biggest bite of 30-60 day lates is 2 years and some even report score point gains after a 60 has aged the full 7 year period. While in dispute certain aspects of the TL are removed from Fico scoring, when the dispute comments are removed then the whole TL is included once again in the score calculations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overstock Closed - Score Plumits

@gdale6 wrote:

@MstrPTato wrote:1 year old

Ahh, ok, ya the biggest bite of 30-60 day lates is 2 years and some even report score point gains after a 60 has aged the full 7 year period. While in dispute certain aspects of the TL are removed from Fico scoring, when the dispute comments are removed then the whole TL is included once again in the score calculations.

Makes sense...I assume the same is true for when going for a mortgage. I disputed a charge on my credit card and had to have it cleared before closing on my house 2 years ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Overstock Closed - Score Plumits

@MstrPTato wrote:

@gdale6 wrote:

@MstrPTato wrote:1 year old

Ahh, ok, ya the biggest bite of 30-60 day lates is 2 years and some even report score point gains after a 60 has aged the full 7 year period. While in dispute certain aspects of the TL are removed from Fico scoring, when the dispute comments are removed then the whole TL is included once again in the score calculations.

Makes sense...I assume the same is true for when going for a mortgage. I disputed a charge on my credit card and had to have it cleared before closing on my house 2 years ago.

Sorry to hear about the score drop OP.

Yet again, a trigger / calculation event ("What happened?") is not the score change source. There needs to be a sticky on this forum

"Your alert is NOT your score change trigger"

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Update: Re: Overstock Closed - Score Plumits

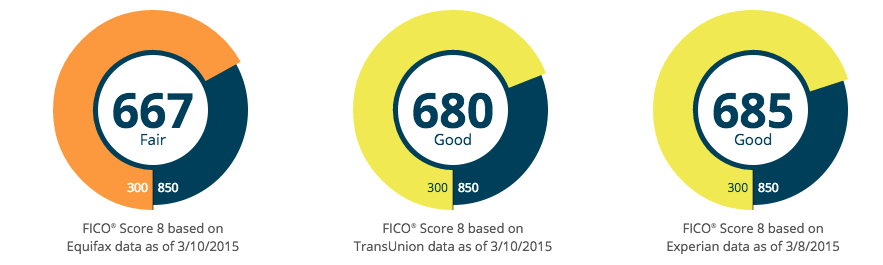

Just purchased my TU report to see if the score dropped, and it sure enough did! Looks like I have an accurate picture of where I stand now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Update: Re: Overstock Closed - Score Plumits

Yep, baddies can make a huge difference. Guess which one doesn't have my tax lien.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Update: Re: Overstock Closed - Score Plumits

OP that sucks!! Sorry to hear that...I just posted this as well...Had a DROP this am on EX with 2 accounts closing (all good accounts as well) NOTHING has changed on my report.

So I got an EX alert saying that a cap 1 loan was paid and 0 balance. I though ok, my wife and I just refi the car loan. However, there was a 34 point DROP in score down to 641. I was like **bleep**. I pulled a new report on there site and nothing new (bad) is on there and I just had 2 CCD accounts we closed out update as closed today. So we lost (1500) in CCD uti. But my new Discover and Arrival TL added on there a few days ago so that adds (2800 avail credit) so it shouldn't be Util AAoA doesn't matter open vs closed account right? I know it's gonna take a hit with those 2 new accounts plus 2 more TL yet to report. So if it was because the new accounts and the AaoA hit, shouldn't that have updated a few days ago? Just trying to figure out why I took a 34 point hit. The new accounts that much? Util with old closing and new reporting is 11.2% WAS 9.6% so I know it can't be the CCD Util...could it really be because of the AAoA hit?

TU8: 635 TU4: 700 V3.0 :663 **8/2015

EX8: 636 EX3: 670 V3.0: ? **8/2015

CCD Util 35%