- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Paid off one car loan, scores decreased?!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paid off one car loan, scores decreased?!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

@Anonymous wrote:

@Anonymous wrote:

Nope, I have multiple positive lines on all three reports with a good mix: three credit cards with low balances, a personal loan with good payment history and down to 25% balance. So this payoff of old car loan and the huge drop makes zero sense. I wait for the new loan to hit the one remains CRA and see what result.What is adversely impacting your scores is the Amounts Owed factor which looks at percentages, not dollars. This is true of overall revolving utilization and overall installment loan utilization, looked at as seperate factors. In addition to my previous questions regarding your car loan balances, your personal loan would need to be figured in as well (I didn't know you had one). Just to assign numbers for the sake of discussion let's say:

Auto Loan 1: Original balance $20,000, balance just before payoff $500.

Personal Loan: Original balance $5000, current balance $1500.

Auto Loan 2: Original balance $20,000, current balance $19,500.

Before Auto Loan 2 is reported and before Auto Loan 1 reports paid off, your overall installment loan utilization was $2000/$25000, or 8%. Once the first loan reports closed and the new loan reports, those numbers move to $21,000/$25,000, or 84%.

The score drop realized here isn't from paying off a loan, it's from moving from 8% owed across all installment loans to 84% owed across all installment loans. In this example contrary to many opinions, Fico scoring no doubt rewards the person with less debt with a higher score, all other things being equal. And, that makes total sense, as a person with $21,000 in debt should be viewed as a greater risk than someone with $2000 in debt, again, all other things being equal.

Never saw it broklen down like this before. Thanks, this helps me greatly as well!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

@Anonymous wrote:Most unfortunate but, a reality of some FICO Scoring models. Over time I have paid off several installment loans and they dropped my score about 22+ points every time. Over time the score recovered but it can be a shock!

Those times your score dropped, was it because it was your only open installment loan at the time?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

“Most people work just hard enough not to get fired and get paid just enough not to quit.”

“Most people work just hard enough not to get fired and get paid just enough not to quit.”Take the myFICO Fitness Challenge

Inquiries: Experian - 4 | Equifax - 3 | TransUnion - 3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

Thanks Highacheiver!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

“Most people work just hard enough not to get fired and get paid just enough not to quit.”

“Most people work just hard enough not to get fired and get paid just enough not to quit.”Take the myFICO Fitness Challenge

Inquiries: Experian - 4 | Equifax - 3 | TransUnion - 3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

“Most people work just hard enough not to get fired and get paid just enough not to quit.”

“Most people work just hard enough not to get fired and get paid just enough not to quit.”Take the myFICO Fitness Challenge

Inquiries: Experian - 4 | Equifax - 3 | TransUnion - 3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

@HighAchiever-

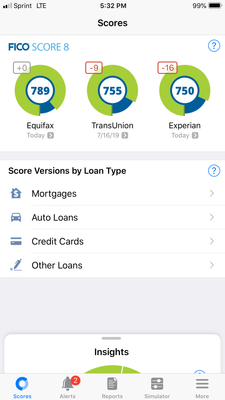

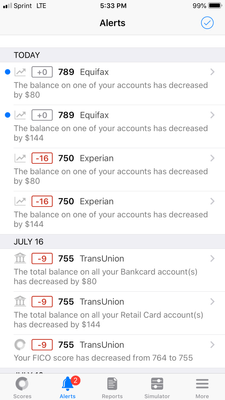

I entirely understand what you're saying, and the picture you attached shows it: the uitlization scores differ from the three CRAs, and hence the effect of paying down or paying off an installment loan is going to differ as well. Thank you for takign the time to post that image to show the differences based on the lower utilization for each report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

but overall, my point (pun intended ☺️) is to show you that the points you lost will come back... it just depends what activity is taking place in your credit profile 👍🏼

“Most people work just hard enough not to get fired and get paid just enough not to quit.”

“Most people work just hard enough not to get fired and get paid just enough not to quit.”Take the myFICO Fitness Challenge

Inquiries: Experian - 4 | Equifax - 3 | TransUnion - 3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off one car loan, scores decreased?!

@Anonymous wrote:

I get it now..... I’ll post later today a separate post about specific cards/ lines and the balances. I think it’s true that not all cards/ lines are treated the same in terms of utilization. I want to know which to pay down for the greatest gain! Thanks again. 😻

CC's are #1 for points. Now if you can pay them all down to $0 and leave a $5 balance on one Major Bank card you'll have the best point value

Loans.... they're a bit of a catch 22... you lose points when you take them out, you gain points as you pay them off, you lose points again when they're paid off... it's about a 20-30 point spread between having one and not having one. There's no real significant value to them other than long term history due to the length of the loan.