- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- PenFed EQ FICO 9 vs NFCU EQ FICO 9

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PenFed EQ FICO 9 vs NFCU EQ FICO 9

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PenFed EQ FICO 9 vs NFCU EQ FICO 9

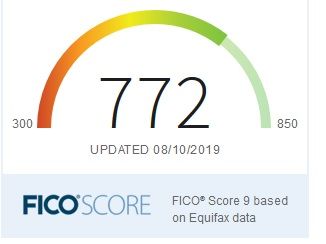

Oddly, both PenFed & NFCU are purporting to give me my EQ FICO 9 score as of 7/9/19, but the scores are 23 points apart -- 764 on PenFed & 787 on NFCU.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed EQ FICO 9 vs NFCU EQ FICO 9

Interesting. I'm curious what others have to say on the difference!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed EQ FICO 9 vs NFCU EQ FICO 9

And they both even updated on 7/9/19.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed EQ FICO 9 vs NFCU EQ FICO 9

I don’t know about PenFed but the date NFCU shows your score is the date they post it — they actually pull it around the 20th of the prior month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed EQ FICO 9 vs NFCU EQ FICO 9

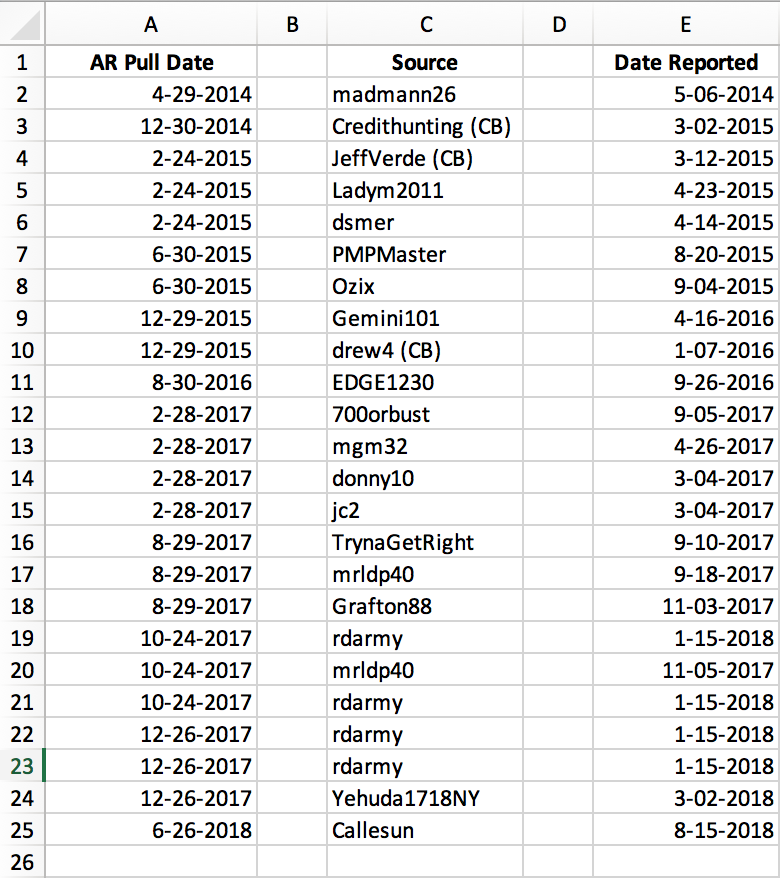

Navy soft pulls Equifax for Account Reviews on the fourth Tuesday of every even-numbered month. So for the NFCU score shown on 7/9/19 the pull was actually done on 6/25/19. By comparison, the PenFed score was pulled on 7/9/19 so the scoring difference can be attributed to changes in your Equifax credit report between 6/25 and 7/9.

Some time ago I did some research to determine exactly when Navy does it soft pulls. You can see the results in this thread:

"The pattern I noticed is that Navy does Account Reviews pulls from Equifax on the fourth Tuesday of even-numbered months then updates member accounts with EQ FICO 9 scores during the first week of the following (odd-numbered) month"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed EQ FICO 9 vs NFCU EQ FICO 9

@Anonymous wrote:Navy soft pulls Equifax for Account Reviews on the fourth Tuesday of every even-numbered month. So for the NFCU score shown on 7/9/19 the pull was actually done on 6/25/19. By comparison, the PenFed score was pulled on 7/9/19 so the scoring difference can be attributed to changes in your Equifax credit report between 6/25 and 7/9.

Some time ago I did some research to determine exactly when Navy does it soft pulls. You can see the results in this thread:

"The pattern I noticed is that Navy does Account Reviews pulls from Equifax on the fourth Tuesday of even-numbered months then updates member accounts with EQ FICO 9 scores during the first week of the following (odd-numbered) month"

Maybe this throws a monkey wrench into it, but.....

NFCU updated my score today.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed EQ FICO 9 vs NFCU EQ FICO 9

@SouthJamaica wrote:

@Anonymous wrote:Navy soft pulls Equifax for Account Reviews on the fourth Tuesday of every even-numbered month. So for the NFCU score shown on 7/9/19 the pull was actually done on 6/25/19. By comparison, the PenFed score was pulled on 7/9/19 so the scoring difference can be attributed to changes in your Equifax credit report between 6/25 and 7/9.

Some time ago I did some research to determine exactly when Navy does it soft pulls. You can see the results in this thread:

"The pattern I noticed is that Navy does Account Reviews pulls from Equifax on the fourth Tuesday of even-numbered months then updates member accounts with EQ FICO 9 scores during the first week of the following (odd-numbered) month"

Maybe this throws a monkey wrench into it, but.....

NFCU updated my score today.

Your score was "updated" today but it definitely wasn't pulled today.

If you want to dig in to when it was pulled you can request a hard copy of your Equifax credit report and look at the details on AR soft pulls. I used to be able to look at my Equifax credit report through the TrustedID Premier credit monitoring service they provided after the data leak, but they stopped access to TrustedID Premier last January.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content