- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Proportion of loan balances to loan amounts is...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Proportion of loan balances to loan amounts is too high

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Proportion of loan balances to loan amounts is too high

I received 2 alerts from TU today:

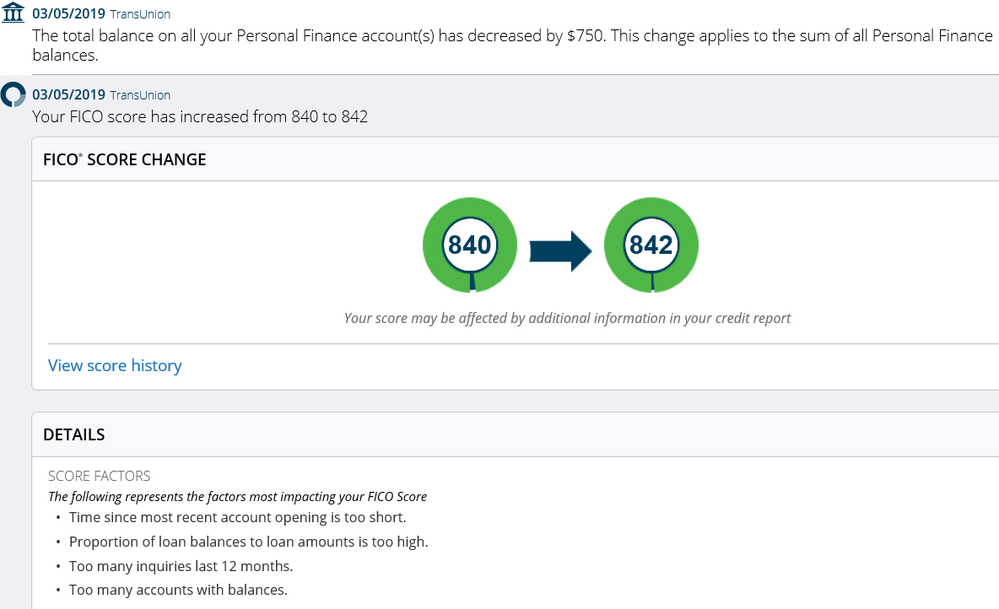

- The total balance on all your Personal Finance account(s) has decreased...

- Your Fico score has increased from 840 to 842

Now I know what causes an alert may not be the reason for a score change. But I believe this alert is related to the score change as all of my accounts report around the same time and this was the last to report for TU. I've already received a few alerts in March so I assume any age related reason would have happened prior to today and I don't believe I've crossed any threshold for age as of 3/1. In addition the score factors remain in the same order as before. The second score factor being the title of this post. So I have 3 questions:

- Does Personal Finance accounts fall into the loan catergory referred to in the score factor? I have a MTG that was re-fi'd 6/2018 so it's high and I get that. My auto loan is well ahead of schedule with no payment due until 10/2020, but I keep paying as I want to pay it off sooner or at least get it below 8.9%. But the personal finance account they're are referring to is my auto loan. Which leads to the 2nd question;

- Are these considered 2 different loan types with Fico (or maybe TU) other than the obvious (auto & mtg) and is the auto loan considered seperately for scoring purposes "if" both fall into the loan category referred to in the score factor?

- "If" separate. is there a threshold for the auto loan/personal finance acct? Moving from remaining balance of 14K to 13,250 takes me from 36.54% left to 34.59% left which doesn't seem like any threshold but who knows.

It's a small change to my score but just trying to understand the movement if possible. Grateful for any responses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Proportion of loan balances to loan amounts is too high

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Proportion of loan balances to loan amounts is too high

Hey BBS, if was actually a small increase. Based on other things I believe I can rule out as reasons for the increase I was wondering if this threshold is known for auto loans, if auto loans are treated differently than MTG and could an auto loan moving pass a threshold, independant of a change in MTG balance result in a score change. Meaning the 2 different type of installment loans are treated differently and maybe can impact a score separate of another loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Proportion of loan balances to loan amounts is too high

They group accounts into various type buckets, and when the balance on one of those buckets changes, you can get an alert.

Really when we are talking installment utilization, we know it is aggregate but we don’t know with any concrete detail as to what the breakpoints are except for the ultimate one at 8.99 where that reason code completely goes away.

Would be interested if you posted all your installment lines, current balance and original balance, is interesting that you are so close to an 850 anyway with that reason code in the #2 slot to me at least.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Proportion of loan balances to loan amounts is too high

This alert seems to coincide with the decrease in my auto loan as all of my accounts report within 6 days and there was no other update expected for this period as noted in original post.

Here goes:

Installment accts - 2:

-Mtg - 15 yr Refi 6/2018, open acct date 8/2018, (1st pymt due 10/1) starting balance 127,950, Current balance reported 122,920

-Auto loan - Open 9/16 - 72 month term on balance of 38,304. Current balance 13,250

Revolvers/CC:

8 - total CC limit 77,150

1- Retail card - 1,000

LOC 5,000 (counted as a revolver for EX only, = 83,150 revolver CL - EX). For TU total revolving CL is 78,150

Reported balances for Feb updates:

1 CC - 144/2,100

LOC - 700/5,000

2 Installments balances listed above

I never noticed my auto loan referred to as Personal Finance before although it may have been and only notice due to the score change this time. Considering the small increase I'm wondering if that makes a difference since both installment loans combined is high and supports the score factor, I'm wondering with this small increase if the 2 installment loan are differentiated and not combined as I thought I learned hear because I can't figure another reason for an increase, even as small as it is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Proportion of loan balances to loan amounts is too high

You're basically right where I am in terms of loan repayment, 81%.

My score has been flatlined for FICO 8; sometimes there are tiny movements which really can't be attributed to an easy rhyme or reason, but it almost assuredly wasn't installment loan repayment percentage.