- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Recovery of mortgage scores after opening a new ac...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Recovery of mortgage scores after opening a new account

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery of mortgage scores after opening a new account

As there is a general lack of good data points around mortgage scores I thought I would post the trend of my mortgage scores over the last year.

Profile details:

AoYRA: hit 2 years on 4/1; a HELOC that is now closed.

10 credit cards, normally reports a balance on 2-5 cards

2 loan closed in the last 12 months, a personal loan and a mortgage.

Open loans:

1 mortgage opened in June of last year

1 auto loan

2 personal loans, one opened in November of last year

Youngest account is 5 months old (personal loan mentioned above)

Mortgage scores over the last year

The big dip in July is when my newest mortgage reported. The increase in January is when a different mortgage and the HELOC was reported paid and closed.

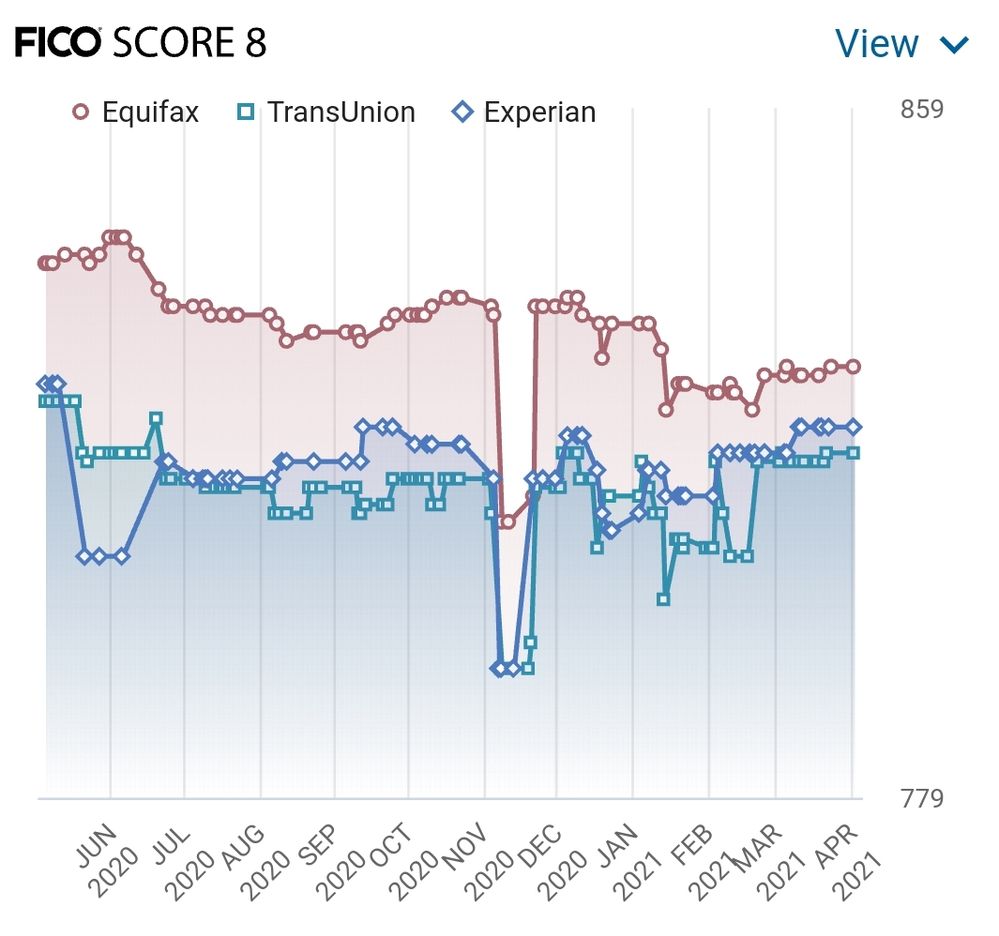

And just for completeness my FICO 8 over the same time frame

Feel free to ask questions if I left out any relevant information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovery of mortgage scores after opening a new account

@dragontears wrote:As there is a general lack of good data points around mortgage scores I thought I would post the trend of my mortgage scores over the last year.

Profile details:

AoYRA: hit 2 years on 4/1; a HELOC that is now closed.

10 credit cards, normally reports a balance on 2-5 cards

2 loan closed in the last 12 months, a personal loan and a mortgage.

Open loans:

1 mortgage opened in June of last year

1 auto loan

2 personal loans, one opened in November of last year

Youngest account is 5 months old (personal loan mentioned above)

Mortgage scores over the last year

The big dip in July is when my newest mortgage reported. The increase in January is when a different mortgage and the HELOC was reported paid and closed.

And just for completeness my FICO 8 over the same time frame

Feel free to ask questions if I left out any relevant information

@dragontears What was the F8 dip?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovery of mortgage scores after opening a new account

@Anonymous

The dip for 8 is when I let a chase card report a balance of ~3,800 on a 4,500 CL. I was curious what the affect would be.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovery of mortgage scores after opening a new account

@dragontears One more thing can you quantify the dip and the rise? TIA!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovery of mortgage scores after opening a new account

@Anonymous wrote:@dragontears One more thing can you quantify the dip and the rise? TIA!

@Anonymous

EQ5: 805 => 789; 787 => 794

EX2: 801 => 786; 790 => 794

TU4: 768 => 771; 770 => 779

I find the difference between EX2 recovery pattern and EQ5/TU4 to be fascinating and something to keep in mind as a lot of the testing is done with EX2 since it is easy to monitor without costing a fortune.