- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score Boost Success (and Frustration)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score Boost Success (and Frustration)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score Boost Success (and Frustration)

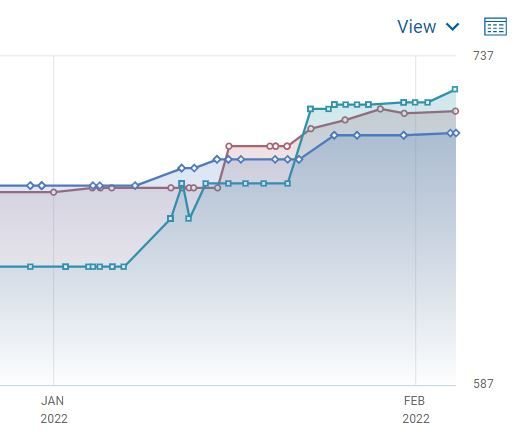

Over the past month, I have been diligently working on getting my credit scores up. I have been disputing collections and getting Pay for Delete agreements and now have ALL my collections gone off all 3 reports. I have also paid down almost $6,000 in CC debt, which special emphasis on making sure individual accounts and my overall UTL are below some of the benchmarks estimated for various "buckets" (particularly, I have been focused on the <69% and <48% benchmarks). All 3 scores have now increased anywhere from 24-84 points and all 3 are now above 700 for the first time in a long time. That is great news, right? Well, the problem is that main reason I have been putting this extra focus on my scores is that I have an opportunity to buy out my family's vacation property and have it 100% in my name, but I needed to boost my mortgage scores. It is amazing how differently those behave. My max score improvement of my mortgage scores (as pulled here) has only been about 20 points over that same time period. In fact, my EX mortgage score DROPPED 15 points over the same one month time period that my EX FICO 8 INCREASED by 24 points. My 3 mortgage scores are now 664-661-664 while my FICO 8 scores are 712-722-702. I am pretty sure the only explanation of such a big difference is that my current mortgage had a 60 late over 2 years ago. Even if that explains why they are lower than my FICO 8, I still can't figure out why my EX mortgage version would have DROPPED in the past month with NOTHING negative reported. Frustrating.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Boost Success (and Frustration)

@valley_man0505 wrote:Over the past month, I have been diligently working on getting my credit scores up. I have been disputing collections and getting Pay for Delete agreements and now have ALL my collections gone off all 3 reports. I have also paid down almost $6,000 in CC debt, which special emphasis on making sure individual accounts and my overall UTL are below some of the benchmarks estimated for various "buckets" (particularly, I have been focused on the <69% and <48% benchmarks). All 3 scores have now increased anywhere from 24-84 points and all 3 are now above 700 for the first time in a long time. That is great news, right? Well, the problem is that main reason I have been putting this extra focus on my scores is that I have an opportunity to buy out my family's vacation property and have it 100% in my name, but I needed to boost my mortgage scores. It is amazing how differently those behave. My max score improvement of my mortgage scores (as pulled here) has only been about 20 points over that same time period. In fact, my EX mortgage score DROPPED 15 points over the same one month time period that my EX FICO 8 INCREASED by 24 points. My 3 mortgage scores are now 664-661-664 while my FICO 8 scores are 712-722-702. I am pretty sure the only explanation of such a big difference is that my current mortgage had a 60 late over 2 years ago. Even if that explains why they are lower than my FICO 8, I still can't figure out why my EX mortgage version would have DROPPED in the past month with NOTHING negative reported. Frustrating.

1. If your late mortgage payment is not in your reports then it would not be affecting your FICO scores. If it is in your reports it would affect the other scores just as much as the mortgage scores. The mortgage scores are not 'industry' scores; they are just old FICO classic scores.

2. To improve your mortgage scores you should work on the following:

(a) making sure no revolving accounts report above 48% of the limit

(b) making as many of the revolving accounts as possible report a zero balance

(c) making no applications that could trigger a hard pull

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687