- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score Impact of 2 30-Day Lates

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score Impact of 2 30-Day Lates

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score Impact of 2 30-Day Lates

I chimed in on a thread earlier with the comment below and it got me to thinking -- what is the impact of those two 30-day-lates at 5.5 and 6.5 years old? I did some thread searching but couldn't find much of a consensus. I know it's hard to pin down a number as it depends on the file at hand, but I'd really appreciate some opinions.

Thanks a bunch!

"This is a subject near and dear to my heart. At my credit's worst I had 20 total late payments on an auto loan with 18 of those crammed into a 24 month time frame. 12 were consecutive ending with the final two months reported as a charged off. I think the last 6 months was something like 90+90+120+120+CO+CO. At one point, and to this day I have no idea why, Experian just removed the entire string early. What that did was give me a glimpse into what I could expect from EQ and TU score bump wise when their time comes.

Well, that day is fast approaching. In July the last charge-off will be gone from EQ and in August the last one will drop from TU. Since I got a ~30 point bump from EX I'm expecting roughly the same. Unfortunately those last remaining 30-day-lates aren't due to expire for a while. Nov/Dec for one and then 12 months after that for the other. I'm hoping that when they are gone I see the same sexy bump the OP got."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

Probably very little impact. Some say that 30 day late payments stop impacting score at the 2 year mark, others say they still impact score for the following 5 years, just significantly less. I'm sure there are data points on there, but I'm not aware of them. I'd say your final 30 day late payment when it comes off, assuming no other negative items on your credit report exist would be worth 0-20 points. That's my best guess.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

Bear in mind that our friend BBS is describing the scoring impact on the FICO 8 model. One of the things FICO 8 tried to do differently (from previous models) is to cut consumers some slack, if their Day 30 lates were a fair bit in the past and they had shown perfect payment history since. Previous models (like those still used today for mortgages) were much more punitive: Day 30 lates hurt you all the way until they dropped off.

So assuming you might be thinking about buying a car or getting a credit card (FICO 8 family most likely) then the old lates are not hurting you much. If you wanted to buy a house, the lates would probably still be hurting you (compared with no derogs at all).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

Glad you brought this subject up OP. So CGID and BBS my question is this. On MyFICO my 1 30 day late from go pound Santander (another story) is 2 months before 5 yrs. But it is listed on the good side of making perfect payments since. So maybe it could be 2 yrs affecting score? Or 4yrs as it says in the pic. I've had by advice of my lawyer MyFICO since BK 8/15. And I have always been on the good side which it was 2yrs and 4 months in the begining I believe.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

@Anonymous wrote:Probably very little impact. Some say that 30 day late payments stop impacting score at the 2 year mark, others say they still impact score for the following 5 years, just significantly less. I'm sure there are data points on there, but I'm not aware of them. I'd say your final 30 day late payment when it comes off, assuming no other negative items on your credit report exist would be worth 0-20 points. That's my best guess.

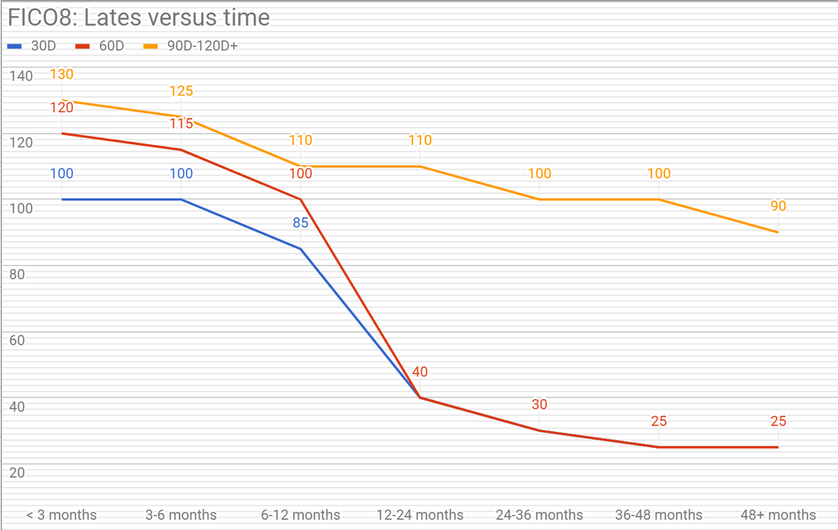

In searching threads I found this graph (I can't recall which forumer created it or I'd credit them):

According to this your assesment of ~20 points is really close. In the thread where I posted the my copied comment the OP saw an 88 point bump when his final 120-day late was removed. Well, when Experian removed my string of lates culminating with the CO I saw a ~30 point bump. If I get another 20-25 when the last 30-day is removed that'll get me a total net gain of ~50. That's not 88 points but you know, different credit files and all... I'd still be very happy with such an improvement.

Thanks for chiming in, Brutal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

@Anonymous wrote:Bear in mind that our friend BBS is describing the scoring impact on the FICO 8 model. One of the things FICO 8 tried to do differently (from previous models) is to cut consumers some slack, if their Day 30 lates were a fair bit in the past and they had shown perfect payment history since. Previous models (like those still used today for mortgages) were much more punitive: Day 30 lates hurt you all the way until they dropped off.

So assuming you might be thinking about buying a car or getting a credit card (FICO 8 family most likely) then the old lates are not hurting you much. If you wanted to buy a house, the lates would probably still be hurting you (compared with no derogs at all).

Good point, GCD. I'm not planning on using my credit for a large purchase for some time -- maybe a couple of years. You may recall me talking about buying a new car this fall but that's off the table for now.

Still, good to know about the auto and mortgage scores. If I was still buying a car it would certainly behoove me to try and Good Will those last 2.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

I've seen that chart pictured above. One thing that's important to remember with all of these things credit-related is that they're very profile specific. What could be a 15 point impact on one profile could be 25 on another, for example. The best thing you can do is attempt to find someone else with a similar profile to yours that had a similar baddie come off and see how their score(s) reacted. That's really the best indicator, as the rest of us are just providing educated guesses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

Oh, I understand about different profiles/different results -- that's why I've mentioned it twice above. I'm just trying to ballpark this. I don't expect 50 points but since I've already gained 30 I think that's a reasonable hope.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Impact of 2 30-Day Lates

Understood. I hope your gains are greater, rather than lesser than expected!