- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Score boost from "charge cards" not "credit ca...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score boost from "charge cards" not "credit cards" - which of the two do I have?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score boost from "charge cards" not "credit cards" - which of the two do I have?

I once read that having a charge card boosts your score. I have an Amex from NFCU, my wife has one from USAA.

How can I tell if these are charge cards?

If not, is it worth it to open a "regular" Amex card in order to get the score boost? The yearly fee is $95, so I'm not sure if I should apply.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score boost from "charge cards" not "credit cards" - which of the two do I h

You very likely have "credit" cards.

Charge cards require payment in full, of the entire balance, each month. Credit cards require only a minimum payment and allow you to carry that balance over several or many months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score boost from "charge cards" not "credit cards" - which of the two do I h

I have never seen any conclusive proof or evidence that the addition of a charge card in addition to a handful of revolvers adds any benefit at all when it comes to scoring. What we're talking here is the credit mix sector of the FICO pie, which to my understanding can be met with just the presence of revolving (credit cards) and one open installment loan. If anyone feels that adding a charge card somehow helped their credit mix and score, I would love to hear about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score boost from "charge cards" not "credit cards" - which of the two do I h

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score boost from "charge cards" not "credit cards" - which of the two do I h

@Anonymous wrote:I have never seen any conclusive proof or evidence that the addition of a charge card in addition to a handful of revolvers adds any benefit at all when it comes to scoring. What we're talking here is the credit mix sector of the FICO pie, which to my understanding can be met with just the presence of revolving (credit cards) and one open installment loan. If anyone feels that adding a charge card somehow helped their credit mix and score, I would love to hear about it.

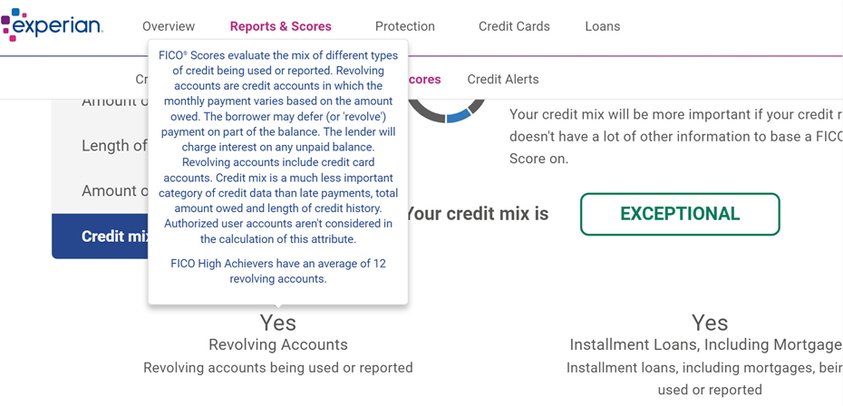

Preface the following with, 'Yes, this is fluff software but...."

Perhaps charge cards are considered a subset of another category or type of credit account? Per Experian, FICO considers 'Bank Issued Credit Cards' to be a subset of 'Revolving Accounts' and having a combination of subsets helps to maximize your Credit Mix factor. So with that, could a charge card be considered another subset of credit? So there would, for example, be (1) Revolving Credit with subsets of Bank Issued, Retail, Gas, & LOCs; and (2) Open Lines of Credit with a subset for Charge Cards? If so, this could mean that if one was not already maximizing their Credit Mix and obtained a charge card, they may see a boost in score. Thoughts?

I don't have a charge card so my EX service would not provide a breakdown on Charge Cards as it does for Revolving Accounts.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score boost from "charge cards" not "credit cards" - which of the two do I h

Nope nope and nope.

A charge card in the Amex definition is simply a revolving tradeline with a term of 1 month. That's it, it does not count for credit mix at all under any FICO algorithm ever except as a revolving account.

There's also no difference in installment loan types.

For either tradeline type, secured vs. unsecured doesn't matter either.

Old FICO algorithms, 15+ years ago namely FICO NG did apparently differentiate store cards, but from FICO 04 onward (released 2004)nothing to see on that front.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score boost from "charge cards" not "credit cards" - which of the two do I h

@Revelate wrote:Nope nope and nope.

A charge card in the Amex definition is simply a revolving tradeline with a term of 1 month. That's it, it does not count for credit mix at all under any FICO algorithm ever except as a revolving account.

There's also no difference in installment loan types.

For either tradeline type, secured vs. unsecured doesn't matter either.

Old FICO algorithms, 15+ years ago namely FICO NG did apparently differentiate store cards, but from FICO 04 onward (released 2004)nothing to see on that front.

Installment loans are differentiated. This has been discussed and documented on prior threads. Differentiation is explicit in Fico reason codes/statements. As you know, lack of an auto loan comes up as a reason statement for lower Auto enhanced Fico scores. That screams: missing installment loan mix element.

Mortgages are treated differently from other loans in how they are scored but, that's not a mix metric. This is apparent from the "non mortgage" wording in some reason statements and scoring data relating to B/L ratio.

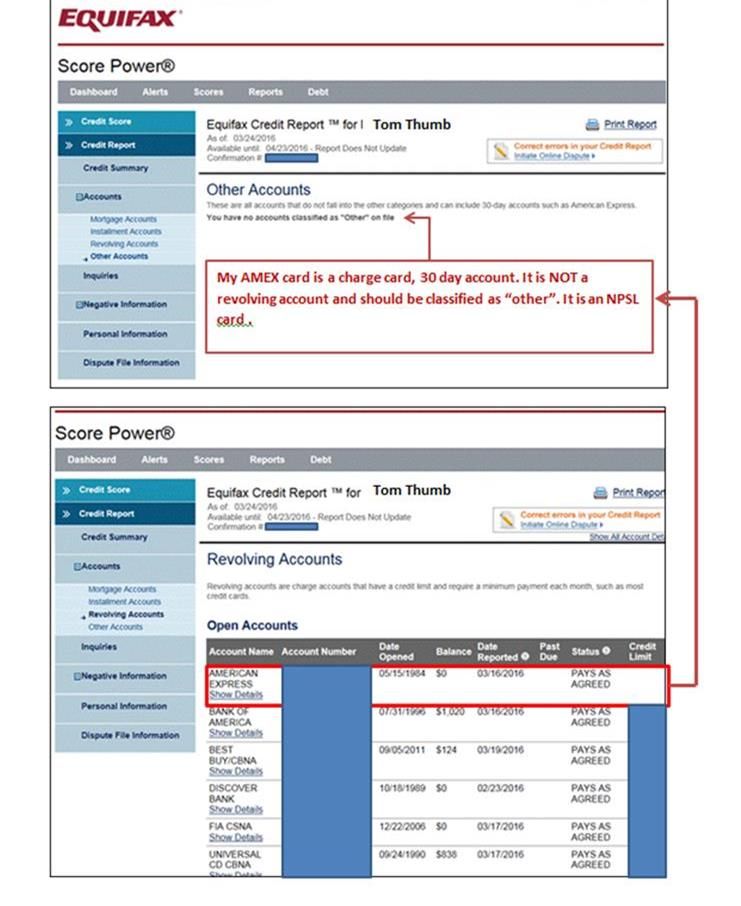

Fico results do show AMEX charge cards ( 1 month terms) are differentiated from standard revolving credit cards. After all, you will get a substantial penalty associated with: "No recent revolving activity" if the only card reporting a balance is an AMEX charge card. So, if the only card you have is a charge card, it appears you are missing an important revolving credit component. That suggests differentiation.

Below is a screen print from an Equifax Scorepower (Fico 04 "mortgage") report + score I had kept. It categorizes accounts same as Fico reason statements.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score boost from "charge cards" not "credit cards" - which of the two do I h

Two things; first you are correct regarding auto-enhanced industry options differentiating auto loans, that was a sloppy mistake on my part.

Second: we're talking credit mix when it comes to revolving accounts and answering the secured question.

It was not a more expansive treatise on FICO scoring of accounts; if that wasn't clear, I apologize. Also you go find me any differentiation in the reason codes from FICO 04 onward on mortgages that actually show up in people's reports or from the bureaus some of those information dumps you so love to post aren't 100% accurate.