- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score increase from mortgage inquiry?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score increase from mortgage inquiry?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score increase from mortgage inquiry?

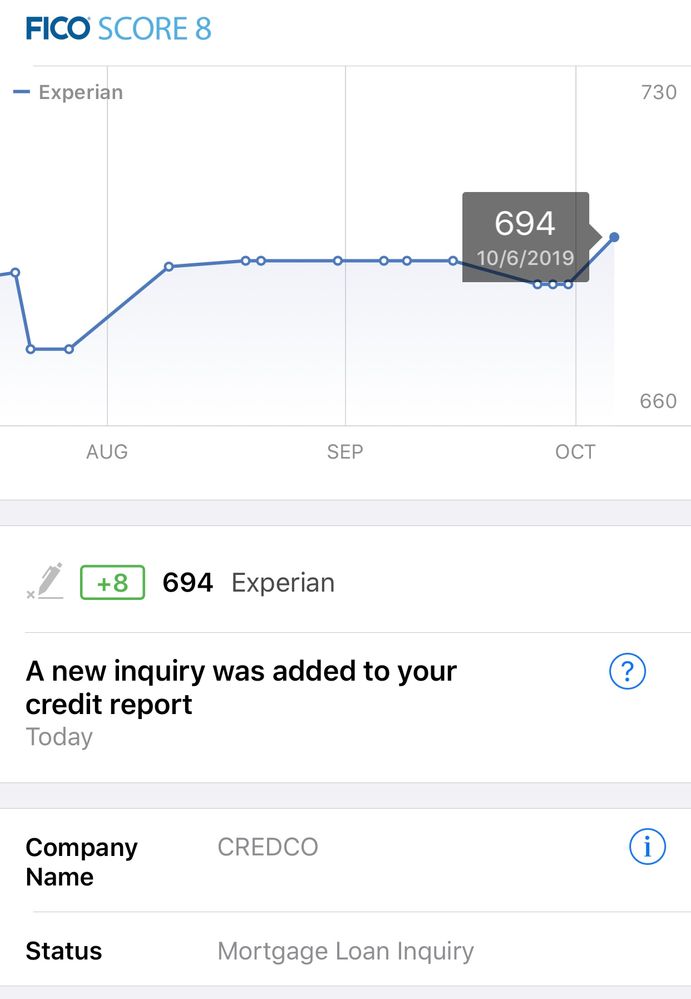

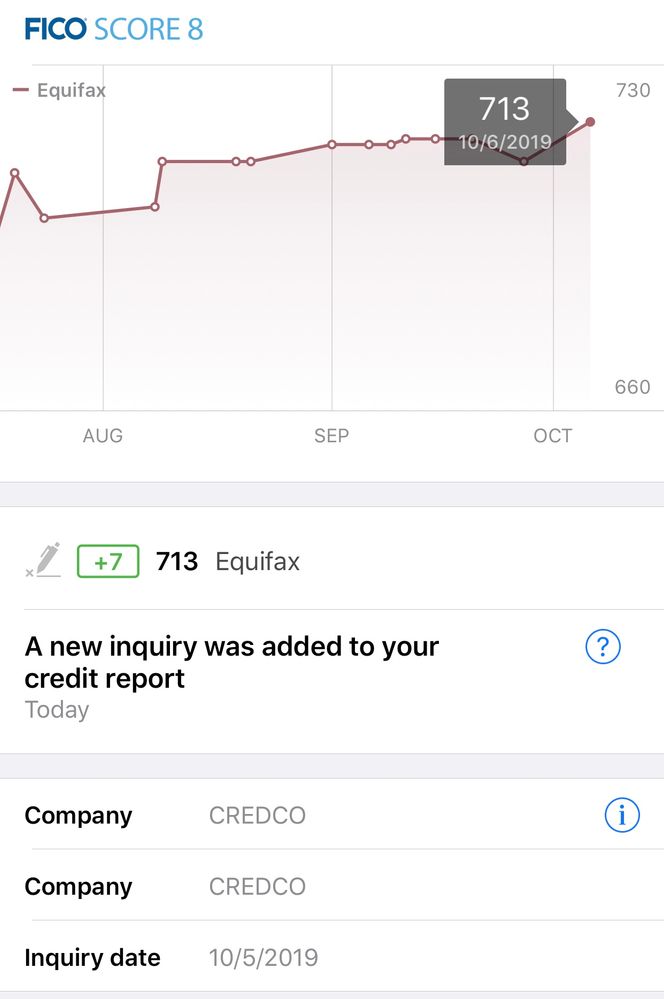

I started the mortgage process yesterday and the lender pulled my credit. I have received 2 alerts via myFICO with EX & EQ so far, both showing score increases. Is this just coincidence? There are no other changes that I am aware of that would have caused an increase. Never would have thought an inquiry would increase my score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase from mortgage inquiry?

Inquiry would not increase your score

Most likely aging or change in utilization. If you've paid off some cards, or lowered your balances in preparation for mortgage app, that could have caused it.

Inq would either drop your score, or it may have no scoring impact (as in score remained the same). I cannot think of any scenario in which an inq would have positive scoring impact

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase from mortgage inquiry?

@Anonymous wrote:I started the mortgage process yesterday and the lender pulled my credit. I have received 2 alerts via myFICO with EX & EQ so far, both showing score increases. Is this just coincidence? There are no other changes that I am aware of that would have caused an increase. Never would have thought an inquiry would increase my score.

Just from the chart, it looks like you got a new card in July and your AoYA just reached 3 months on October 1st.

I received +8 to +25 points on 24 out of 28 FICO scores at that threshold. It's possible you got a lot more than +7 and +8pts, but that was reduced by the inquiry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase from mortgage inquiry?

@Anonymous wrote:

@Anonymous wrote:I started the mortgage process yesterday and the lender pulled my credit. I have received 2 alerts via myFICO with EX & EQ so far, both showing score increases. Is this just coincidence? There are no other changes that I am aware of that would have caused an increase. Never would have thought an inquiry would increase my score.

Just from the chart, it looks like you got a new card in July and your AoYA just reached 3 months on October 1st.

I received +8 to +25 points on 24 out of 28 FICO scores at that threshold. It's possible you got a lot more than +7 and +8pts, but that was reduced by the inquiry.

I just got a new card in September. Prior to that was a new account in June. That could be what it is and with the inquiry and new account last month it is possibly the net change of all 3.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase from mortgage inquiry?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase from mortgage inquiry?

Classic case of alert(s) not being related at all to the score change(s) provided at the time of the alert(s).

Your score did not increase from inquiries.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase from mortgage inquiry?

If it’s incorrectly coded it could’ve dinged you immediately.

In sum, the point came from somewhere else.