- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Scoring of Old Derogs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Scoring of Old Derogs

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

What do you mean your revolving utilization did not change? You mean on the display in the CMS? Because I have no doubt it changed in the algorithm’s perception and that’s where the increases came from.

One more thing, you gave TPOD but you didn’t give the change in TPOD, which is where the penalty derives from, I believe. In other words, look at the prior last updated date, which is what the algorithm was previously calculating TPOD with. Then today, it’s calculating TPOD up to today. So how much did TPOD increase? What is the period of time from prior last update until today’s last update? I think that would determine how much more you’re penalized.

We know the increase in TPOD for the last one was only 5 months, so that’s probably not significant. I don’t know, we’re still trying to learn here, still we’re trying to figure it all out. You’ve got us in uncharted territory. Lol. We’re definitely learning though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

@Anonymous wrote:

@TheKid2Excellent, congratulations on the gains!

What do you mean your revolving utilization did not change? You mean on the display in the CMS? Because I have no doubt it changed in the algorithm’s perception and that’s where the increases came from.

One more thing, you gave TPOD but you didn’t give the change in TPOD, which is where the penalty derives from, I believe. In other words, look at the prior last updated date, which is what the algorithm was previously calculating TPOD with. Then today, it’s calculating TPOD up to today. So how much did TPOD increase? What is the period of time from prior last update until today’s last update? I think that would determine how much more you’re penalized.

We know the increase in TPOD for the last one was only 5 months, so that’s probably not significant. I don’t know, we’re still trying to learn here, still we’re trying to figure it all out. You’ve got us in uncharted territory. Lol. We’re definitely learning though.

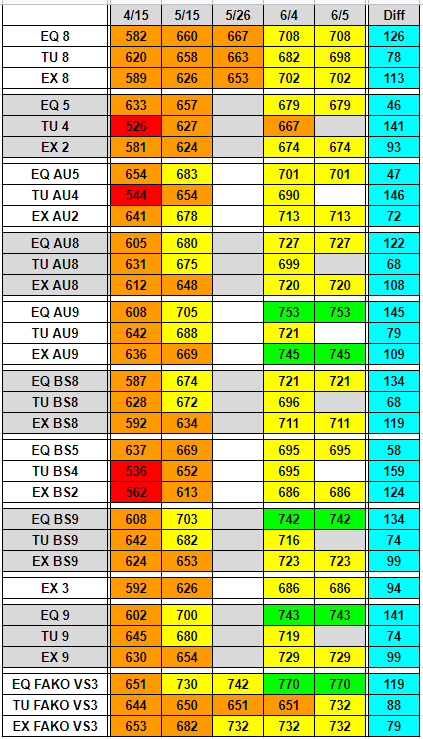

Thanks - I am honestly a bit in awe of the gains. Once EQ and EX hit I will post a capture from my tracking spreadsheet which gives a full picture of the score gains.

I mispoke - my OPEN revolver Util didn't change. That stayed exactly the same this whole time so that is what I meant when Util stayed the same. I haven't pulled a 3B yet to see what the Util says, but I am willing to bet it just shows my Open Util now and I crossed tons of aggregate Util breakpoints when I settled the last 3 COs to get the score boost.

One thing about all of the 5 COs we were tracking here is that they were reporting monthly. None of them sitting stale, which I believe is the case for many who have old COs - without the constant updates the algos couldn't be continually calculating TPOD the whole time. If they were stale for me I think I would have not seen such big gains because they were suppressed every month the entire time? Yes, the TPOD was updating every month, but as you point out maybe TPOD is thresholds or buckets (by year maybe?) I think that makes sense to me as to why I would have seen significant gains versus someone who settled a 2, 3, 4 year old stale CO.

I think my installment history only helped, too. I have 1 active auto loan and 5 closed auto loans. 7 years of auto history and never late. I also have a mortgage that has been reporting for 9 years without a late. The algos have to like that.

This is complex stuff! and thank you so much for advising me and being a sounding board for me with this. You helped me sooooo much!

I will post again here when the others hit and any insight you can offer is always appreciated!

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

I read it wrong. I thought they had last updated dates that were older. I didn’t realize they were updating every month, that makes the DP‘s so much better!! That narrows down the change to utilization. yeah we got to do some figuring.

And that’s terrific that open revolver utilization did not change. That rules out any interference from that! Great job! Yep, you’re right it should only show your open revolver utilization now. That’s where all those lovely points came from!

Totally agree with your logic absolutely. Had yours been stale, you would not have received as much of a gain without a doubt.

Look forward to seeing all the data where we can analyze it once you get the spreadsheet populated with the data from the other bureaus! This is going to be interesting. I think we may be able to determine how the utilization is calculated, I’m still going for scenario one. We do need to find out what individual and aggregate util thresholds are worth on a dirty scorecard though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

OK @Anonymous

Here are some more DPs and 1 annoying issue with reporting. File this under "it figures". If you look back you can see my EX behavior on 5/22 when the last 3 COs (reporting monthly) were settled/paid.

Yesterday (6/3), the last 3 COs (reporting monthly) were settled paid on EQ. I don't have many avenues for EQ scoring, so limited datapoints, but here's what happened. Note - my open revolving Util did NOT change.

EQ 8 = 667 -> 708

EQ FAKO VS 3 = 742 -> 770

Seriously, how broken are the VS 3 algos?! They think I now have "excellent" credit.

This morning I wake up to multiple TU monitoring alerts and get this - 2 of the 3 COs were updated and 1 was left unchanged. Which is clearly a reporting error when both EX and EQ show all 3 settled now. Can't make this stuff up. So, I'm going to hold off getting a 3B and showing all the scores from the spreadsheet in case there is just a lag with reporting the final CO on TU. Doesn't really make sense to me and I hope I don't have to dispute it.

Stay tuned.

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

@Anonymous wrote:

Did it give you a score change for dropping the two? If so the third drop may be discrete.

It did and it was. I actually have a 3B to show you with all the COs paid/settled except the 1 on TU. It is discrete and it didn't trigger a Util reason code on FICO 8, so it couldn't have been counting that heavy. That last CO on TU just paid/settled today and I have my FICO 8s updated with ALL COs paid/settled for all CRAs. My current plan is to get to AZEO for next 3B to show what is likely to be my max possible scores in my segmentation of a dirty scorecard.

Prepare for DPs overload.

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring of Old Derogs

If it’s counting it as maxed at 750/750 we’re going for 27% to 12%, no aggregate thresholds crossed.

23% to 12% if it’s counting 750 over zero. No aggregate thresholds crossed.

14% to 12% if it’s counting the balance over zero. no aggregate thresholds crossed.

I left out one possibility earlier when I had you calculate the three. It has to be one of the four. At least in my opinion.

While it’s true you did not cross any aggregate thresholds that may actually make it easier to tell. Now we only have to deal with individual thresholds which makes it actually easier. :-).

Now I got to go make that post or pm finding out what thresholds are worth on a dirty delinquency card and you’ve got a post me an update of the TU score change when you get the alert on MF!

Great job bro!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content