- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Sharing all of my 28 FICO scores

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sharing all of my 28 FICO scores

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sharing all of my 28 FICO scores

After months of phone calls, letters and plenty of wasted time, Citi was finally able to get my revolver to report again after > 5 months of it not updating. I was waiting on that in order to pull all of my FICO scores, as I wanted my profile in the best possible place first. This was my first time doing the $30/mo membership from MF here in order to receive the 3B report/28 scores, which I'll cancel in a couple of weeks before getting billed again. All of the scores I got are listed below. The scores listed are generated based on the following profile data:

- Clean reports.

- 1% aggregate utilization / 1% individual card utilization.

- AZEO in place with respect to revolvers (1 of 8 with a non-zero reported balance).

- 1 open installement loan (mortgage) at 75% utilization.

- 2 total accounts with balances (1 revolver, 1 loan) out of 9 total open accounts.

- AoYA = 21 months.

- AoOA = 17 years, 10-11 months.

- AAoA = 7 years 2 months - 8 years 3 months.

- 0 scoreable inquiries.

- 14-16 closed accounts on CR: 1 closed mortgage, 5 closed auto loans, rest closed revolvers.

Experian:

Score 8: 850

Score 2: 825

Auto Score 8: 885

Auto Score 2: 859

Bankcard Score 8: 899

Score 3: 824

Bankcard Score 2: 852

Score 9: 840

Auto Score 9: 860

Bankcard Score 9: 852

TransUnion:

Score 8: 850

Score 4: 819

Auto Score 8: 893

Auto Score 4: 860

Bankcard Score 8: 896

Bankcard Score 4: 851

Score 9: 846

Auto Score 9: 864

Bankcard Score 9: 857

Equifax:

Score 8: 850

Score 5: 813

Auto Score 8: 877

Auto Score 5: 831

Bankcard Score 8: 884

Bankcard Score 5: 835

Score 9: 841

Auto Score 9: 865

Bankcard Score 9: 851

From those more in the know than myself, do any of the scores above relative to one another and taking into consideration my profile data seem either higher or lower than expected? This was my first time seeing my FICO 9 scores. I'm assuming it's "harder" to reach 850 on FICO 9 than FICO 8? What on my profile is preventing 850's on FICO 9 when I've got them on FICO 8 currently? I'm also curious what I'm missing in order to achieve 900 BCE scores. Thank you for any insight and feedback.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

Congrats on the 850, and congrats on the rest of the high scores.

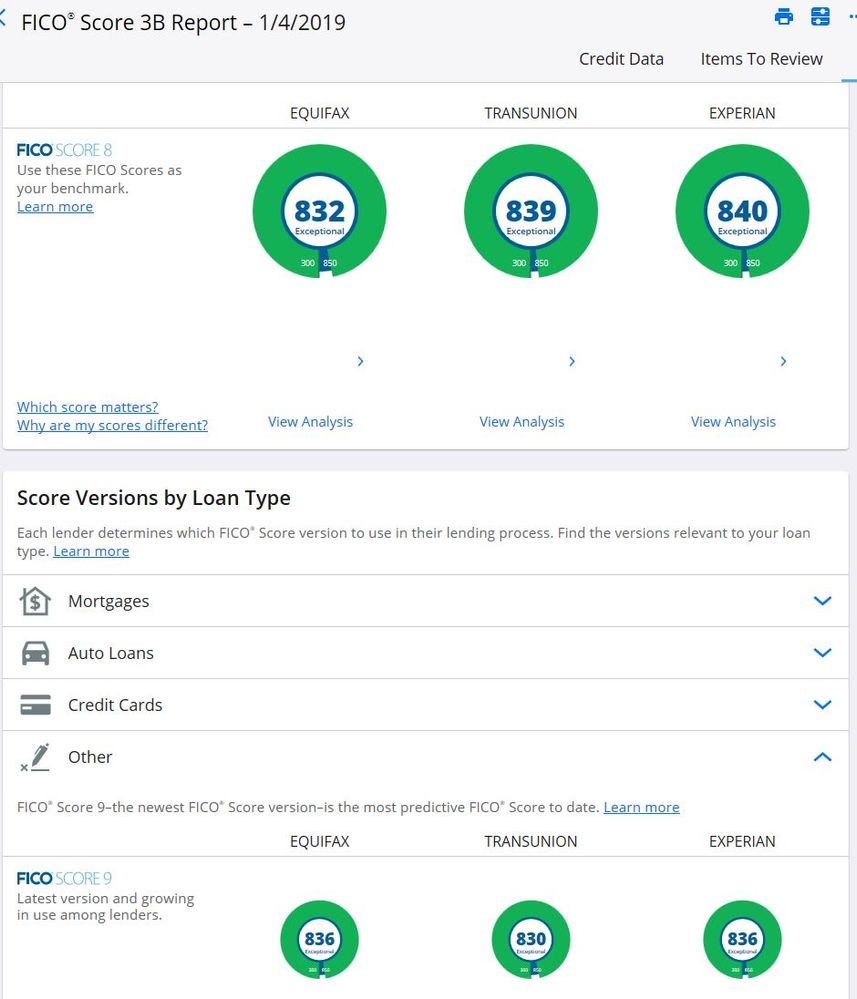

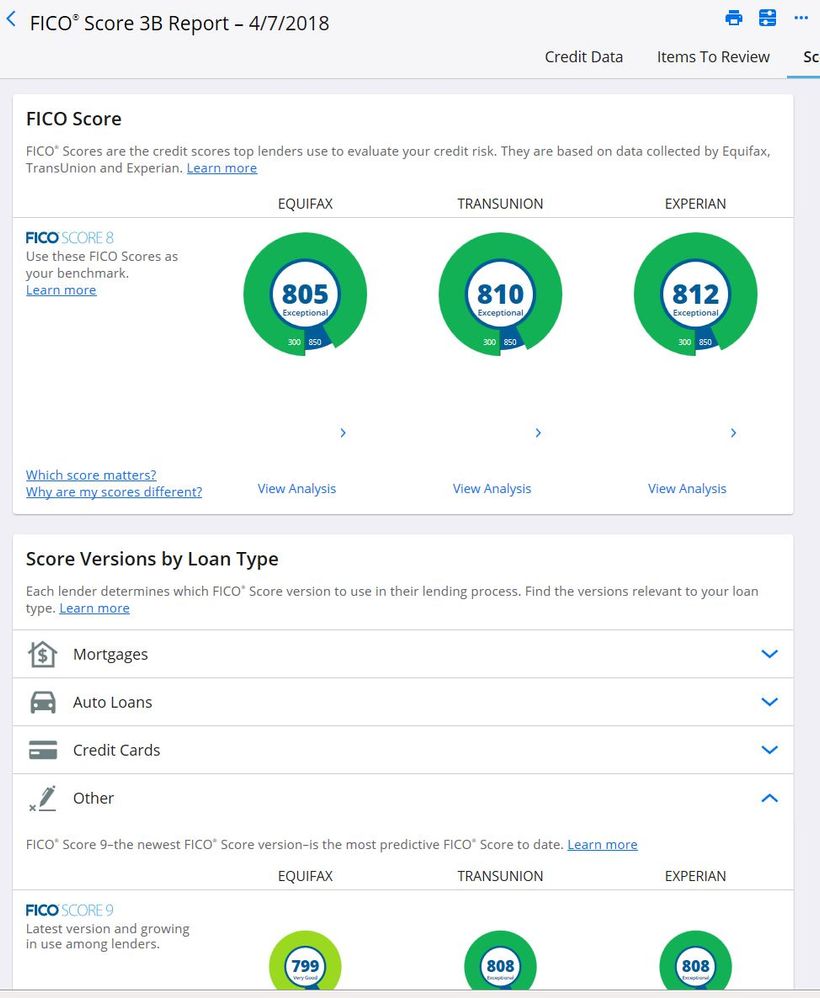

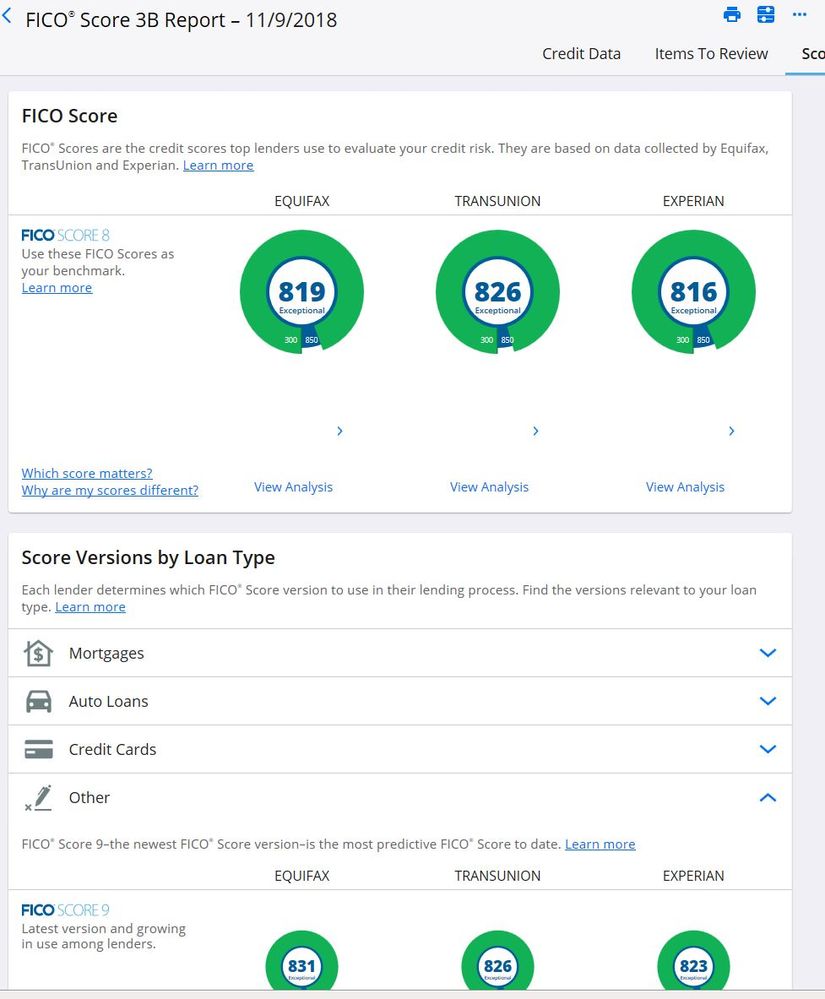

I don't have insight into FICO 9. Mine from the latest report are very close to my FICO 8 at the time.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

I'm pretty sure that my 850's may have some buffer built in on them. I started a thread on it a week or two back, where I went from AZEO to AZ and my TU score stayed at 850. From knowing that this has resulted in a 16 point drop in the past (before I was at 850) to me that suggested that I could be at a buffered "866" or so on TU FICO 8. That being said, if my FICO 9 on TU is 846 that could suggest around a 20 point variance between them.

I know some people report their FICO 8 scores higher than their FICO 9's, but others have reported the opposite. I'm just wondering if there's something obvious that's holding me back from "perfect" 850's on FICO 9.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

What is your utilization on the mortgage?

I don’t know if this is relevant or not, but what is the latest month each of your revolvers reported any statement balance? Since the more recent scoring models try to identify Revolvers vs Transactorss, there might be something in there if an account is dormant too long. Pure speculation but virtually all my accounts report something every month. Rarely do they go 4 months with nothing.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

FWIW, my two previous reports, November 2018 and April 2018, comparing FICO 8 and FICO 9

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

Interesting flip-flop on the Fico 8 vs Fico 9 scores. It would be helpful to know profile details associated with each snapshot. Also, do you have a hypothesis based on your internal review.

For me Classic Fico 9 is rock solid at 850 on all CRAs every 3B report. By comparison my TU fico 8 dropped to 845 once and 848 another time using the same 3B data set. I have not been able to pinpoint the cause of the greater sensitivity on Fico 8. Perhaps Fico 9 puts less weight on # accounts with balances and individual card utilization - reallocating some points to alternate attributes. One or more of said attributes may not even be looked at in Fico 8.

On a related matter, my industry specific Fico 8 scores are almost always significantly higher than the Fico 9 counterparts. Again, not sure why but, I do know some industry option Fico 9 scores actually top out below 900. There have been a few threads discussing F9 vs F8 in the past. One example is pasted below. I may add a couple more links if I find them.

Note to BBS - take a look at aging factors that may be sub optimal possibly open loan AAoA, AoOA. Perhaps all loan AAoA and AoOA. It is possible these are more heavily weighted on Fico 9 - although only EX considers open only as a Fico attribute as I recall.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

@NRB525 wrote:

What is your list of open revolvers? Limits?

What is your utilization on the mortgage?

Mortgage is at 75% utilization; it's about 10 years old.

8 open revolvers with limits ranging from $6k to $50k. The $6k is Blispay which is as good as dead near as I can tell, so I'm likely going to close that in the relative near future. That will put my lowest of the 7 remaining revolvers at $10k. ACL is currently ~$24,100 and would move to ~$26,700 if I drop Blispay.

I don't believe I've gone more than 2-3 cycles without any of my cards (aside from Blispay) reporting a balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

@Thomas_Thumb wrote:Note to BBS - take a look at aging factors that may be sub optimal possibly open loan AAoA, AoOA. Perhaps all loan AAoA and AoOA. It is possible these are more heavily weighted on Fico 9 - although only EX cionsiders open only as a Fico attribute as I recall.

So it's possible that TU and EQ are taking into consideration closed loans? I would think if anything that would help my profile, as I have an older mortgage and older auto loans relative to my AAoA. I would definitely think that me not having an open auto loan currently would adversely impact my Auto scores.

When talking clean files (as I know there are some dirty differences between F8 and F9) is that a common attribute between files that generate a higher F9 score than their comparable F8? Perhaps it is age of accounts related and those with higher Score 9's have older age of accounts factors?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

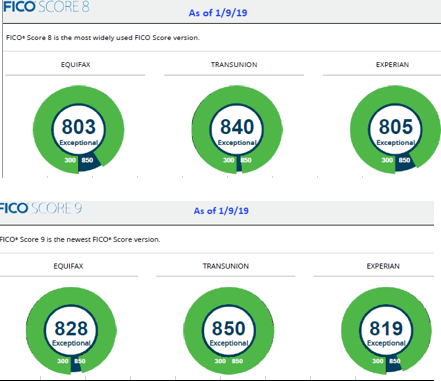

Interesting. I wonder if in fact it is due to age?? My Fico 9 scores are higher (TU @ 850), than my Fico 8. And I have 2 scorable inquiries on EX, 1 on the others. TU is clean but I have a 30D from 12/2012 on EQ and EX from a closed acct.

As of 1/9/19:

1% aggregate / 2% individual

3 out of 10 revolvers reporting ( 1 LOC & 2 CC)

5 out 12 account reporting (1 auto @ 37% UTL, 1 MTG @ 97% UTL)

AoYA - 5M

AoOA - 22Y10M

AAoA - 11Y5M

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sharing all of my 28 FICO scores

Thanks for that reply above. Your AoOA and AAoA factors are definitely a handful of years higher than mine, so this could suggest that those top end thresholds are higher for FICO 9 than FICO 8. I also wonder if FICO 9 prefers the presence of an open auto loan. I closed an auto loan a little less than a year ago... I wish I had pulled all of my FICO scores prior in order to access those FICO 9's at the time, but I didn't even consider it at the time.

Is that 30D late your only negative item? If so you've got pretty strong evidence there that a single minor delinquency can adversely impact score for the full 7 years. If that's the case, it looks like you'd stand to gain 40-50 points this year at some point, possibly as early as this summer with potential EE.