- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: ‘ Short Revolving History ‘ / ‘ Long Credit Hi...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

‘ Short Revolving History ‘ / ‘ Long Credit History ‘

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@800goal800 wrote:

@AnonymousBefore card dropped off :

After:

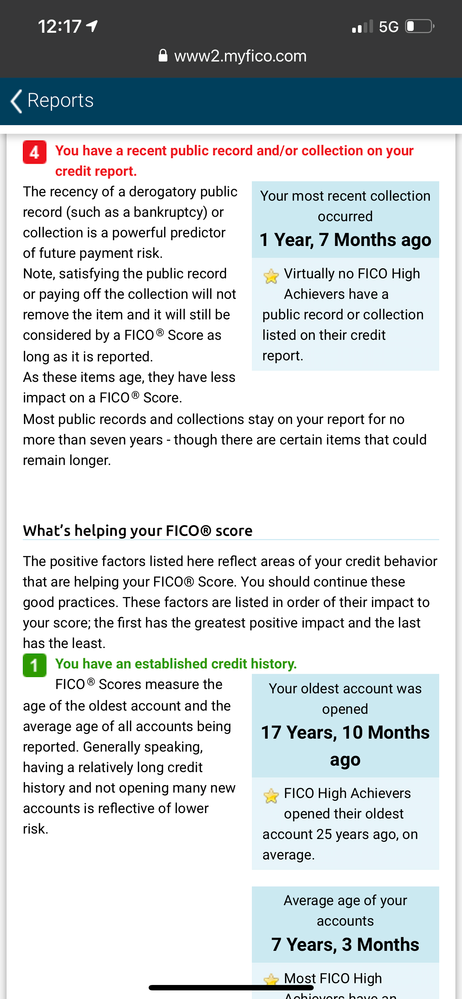

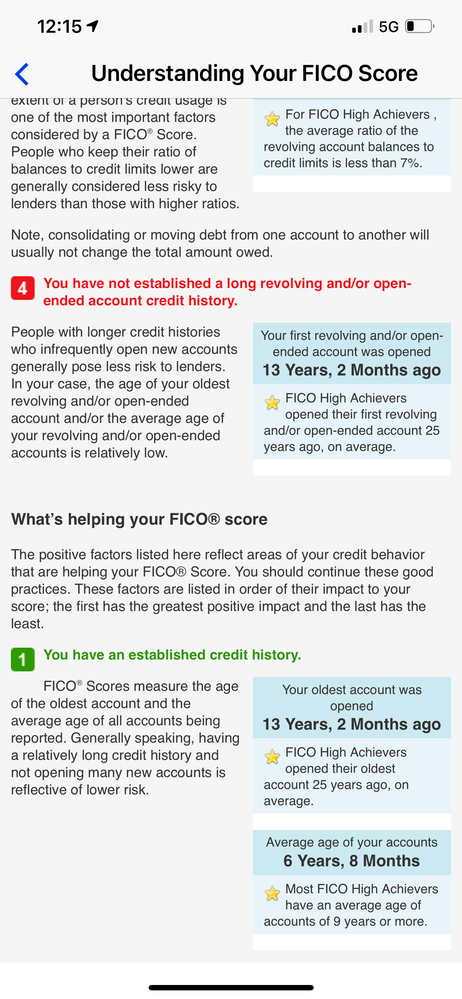

@800goal800 yep that's what it is. Either the age of your oldest Revolver is not past the highest threshold or your average age of revolvers is not past the highest Threshold or both.

unfortunately my phone just died and I lost the whole post I wrote, so I've got to try to re-create it.

Age oldest revolving account and average age of revolving accounts is a Metric that has not been fully explored and documented, but it appears that it can give significant points.

Additionally, when you have multiple derogatories, the subsequent derogatories don't take as much as they otherwise would.

it would be great if you could contribute your data points for the community your before and after average age of revolving accounts and before and after oldest Revolver because you crossed one or more threshold on one or both of those metrics likely. Because the recent collection surely did not all of a sudden cost less unless it became mature.

that's another thing I noticed, it said recent collection and I had not realized there were separate codes when it was recent. This may make it easier to determine the threshold where PR cards go from recent to Mature.

i'm sure I forgot something and will come back and add it later.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

I concur. I too am getting no long revolving history on TU4. They phrase the reason code to sound like AoORA (open accts. only), but I can confirm that AAoRA (open accts. only) plays into it. I'm pursuing FICO 4 mostly right now, but I am getting this with my oldest open revolver at 16 yrs, 10 months (7/28/2004) and I have another that is 6 years, 0 months (4/1/2015). It should be noted that:

- the 16 year card is an AU card from a major issuer, which is Bank of America (but I'm getting this code on FICO 4)

- The 6 year card is not an AU. It is a major issuer (US Bank).

- I'm on clean, thick, mature, but have new revovler (11 months) and obviously, new account.

Also, I may have an opportunity to pull meaningful data points when we cross over into May because today is 4/29/21 and:

- I have 3 total accounts under 12 months. ALL 3 were opened in May of 2020.

- AMEX revolver (AU) opened 5/8/20 (I'm monitoring mortgage scores and applying in the next few days, AU should be a non-issue)

- Cap One Auto Installment (not-AU, obviously) opened 5/5/20

- Penfed Auto Installment (not-AU, obviously) opened 5/8/20

- Once these accounts pass 12-months (might be more that 12-months), I think I will move to the cleanest clean scorecard (no new acounts, no new revolvers, thick, mature, etc.

- I pulled 1B TU yesterday, and will pull one at the 24 hour mark today and again on Saturday (when it crossed into May) because I'm applying for a mortgage on one of these days. EX2 is at 740 and I'm trying to get TU4 to 740+ for my middle mortgage score was at 705 yesterday).

If there are any particular DPs that might be helpful, let me know what info I can provide. I'm not sure how the 12-month mark is treated in terms of new accounts or new revolvers. I think the 12-month inquiry dates are pretty well established, but not sure of the 12-month account opened threshhold works. Will May 1st trigger it? Will it be 365/366 days? Will it be some sort of 2nd saturday of the following month crap? I'm currently getting no long revlover as reason code #3 on TU4 (on all TU4 and TU9 scores but not any TU8 scores).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:I concur. I too am getting no long revolving history on TU4. They phrase the reason code to sound like AoORA (open accts. only), but I can confirm that AAoRA (open accts. only) plays into it. I'm pursuing FICO 4 mostly right now, but I am getting this with my oldest open revolver at 16 yrs, 10 months (7/28/2004) and I have another that is 6 years, 0 months (4/1/2015). It should be noted that:

- the 16 year card is an AU card from a major issuer, which is Bank of America (but I'm getting this code on FICO 4)

- The 6 year card is not an AU. It is a major issuer (US Bank).

- I'm on clean, thick, mature, but have new revovler (11 months) and obviously, new account.

Also, I may have an opportunity to pull meaningful data points when we cross over into May because today is 4/29/21 and:

- I have 3 total accounts under 12 months. ALL 3 were opened in May of 2020.

- AMEX revolver (AU) opened 5/8/20 (I'm monitoring mortgage scores and applying in the next few days, AU should be a non-issue)

- Cap One Auto Installment (not-AU, obviously) opened 5/5/20

- Penfed Auto Installment (not-AU, obviously) opened 5/8/20

- Once these accounts pass 12-months (might be more that 12-months), I think I will move to the cleanest clean scorecard (no new acounts, no new revolvers, thick, mature, etc.

- I pulled 1B TU yesterday, and will pull one at the 24 hour mark today and again on Saturday (when it crossed into May) because I'm applying for a mortgage on one of these days. EX2 is at 740 and I'm trying to get TU4 to 740+ for my middle mortgage score was at 705 yesterday).

If there are any particular DPs that might be helpful, let me know what info I can provide. I'm not sure how the 12-month mark is treated in terms of new accounts or new revolvers. I think the 12-month inquiry dates are pretty well established, but not sure of the 12-month account opened threshhold works. Will May 1st trigger it? Will it be 365/366 days? Will it be some sort of 2nd saturday of the following month crap? I'm currently getting no long revlover as reason code #3 on TU4 (on all TU4 and TU9 scores but not any TU8 scores).

@Anonymous good questions. You will go to a no new revolver Scorecard on 8/9 at midnight. However on the mortgage Scores, it goes by accounts not revolvers & the threshold is longer than 12 months.

I'm actually searching for it now; it's somewhere in excess of 17 months, so don't expect a jump from scorecard reassignment on TU4. You will see it on version 8, unhelpfully and yes you'll go to C1 on version 8, but not on the mortgage Scores. Nope. Works different there.

as for the negative Reason code, someone who had a 20 year revolver had the code absent IIRC so that's = or in excess of the highest threshold for the oldest. And the same person had the data point for average as well, but I can't recall what it was, somewhere between 7 and 10 years, I think. it's linked in the Primer.

sorry to burst your bubble about no scorecard reassignment tonight on TU4 though. And yes scorecard reassignment occurs on the first of the month; inquiries come back in exactly 365 days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

Unfortunately, @Anonymous I must say that you are correct. I logged in and spent the money on a 1B update only to see no change at all. Newest accounts are 5/5/20, 5/8/20 & 5/8/20. Logged in anxiously in early May....no changes and new account reason code still at #1. Trying to get FICO 4 up to 740 (from 724 currently) before my mortgage application, but doesn't look like it's going to happen anytime soon. It will probably have to wait until this magical approx. 17 month mark passes. If nothing else, I'll provide a DP as I monitor it over the next several months.

Clean/thick/mature/yes new account card (two 30-day lates back in Dec. 2015 & Jan. 2016)Reason Codes along with corresponding metrics are as follows (all include AU because we are talking mortgage scores here):

- You opened a new credit account relatively recently.

- AoYA = 12 months (3 accounts all at 12 months)

- Today is 5/3/21 and 3 newest accounts in early May of 2020; 1 revolver, 1 AU revolver and 1 installment)

- You have not established a long revolving and/or open-ended account credit history.

- AoORA = 16 yrs & 10 mos. if closed AU counts, 6 yrs. & 1 mo. if closed AU does not count

- AAoRA = 5 yrs & 4 mos. if closed AU counts, 3 yrs. & 10 mo. if closed AU does not count

- AoYRA = 12 months

- The amount owed on your revolving and/or open-ended accounts is too high. (This is the aggregate $ amount code, not the % util. code)

- $11,409 AZEO single major, non-AU card (out of $92,950 available across 9 cards)

- You have too many credit accounts with balances.

- 9 out of 17 if closed AU counts, 9 out of 16 if closed AU does not count

I obviously can't do anything to affect the new account code (#1) or the long revolving history code (#2). I could bring down the revolving $ owed (#3), but I'm hesitant to take the hit to my cash available at mortgage closing if we don't have a solid idea of what that threshhold is. Not alot I can do for # of accts. w/balances (#4). Paying off a revolver kills my AZEO and should generate all zeroes penalty. Only option would be to pay off my smallest revolver, which is $4,132. That's a pretty substantial cash outflow when the 50% threshhold is a bit squishy (and I'm not sure amount whether the closed AU counts here) and would almost certainly not yield the 16 additional points I need, even combined with hitting an aggregate ($) revolver util threshhold as well. Maybe I can get creative and find another AU opportunity.

I have 1 remaining inquiry from 5/4/20 (today is 5/3/21). Being that it isn't even in my codes, it might only be worth 1-2 points, if any. Also not worth the cost of 1B report to find out if it helps.

Here are the questions rattling around in my head:

- Are there DPs on revolving amount owed (aggregate $ owed, not % util) threshhold for TU4? If so, will it make a meaningful impact?

- Are there clean DPs at 50% on # accts w/ balances for TU4? If so, does a closed AU (date last reported is Sept. 2019) count as an account? Does a 50% threhshhold neet do be <50% (i.e. 49.9% or 49.4%)? If so, will it make a meaningful impact?

- Are there any DPs or antecdotal theories on the impact of a single inquiry aging off with inquiries not even listed as a reason code?

I'm needing 16 points and I just don't see it happening even if I could cross the next threshholds for aggregate revolving balance, # accts. w/balances, and the final inquiry hitting 366 days. Also, the potential for closed installment accounts counting for mortgage scores just makes my head spin and I can't even let my mind wander down that path. Maybe AAoRA hitting 5.5 in about 2 months will be a thing. I can't even go there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:Unfortunately, @Anonymous I must say that you are correct. I logged in and spent the money on a 1B update only to see no change at all. Newest accounts are 5/5/20, 5/8/20 & 5/8/20. Logged in anxiously in early May....no changes and new account reason code still at #1. Trying to get FICO 4 up to 740 (from 724 currently) before my mortgage application, but doesn't look like it's going to happen anytime soon. It will probably have to wait until this magical approx. 17 month mark passes. If nothing else, I'll provide a DP as I monitor it over the next several months.

Clean/thick/mature/yes new account card (two 30-day lates back in Dec. 2015 & Jan. 2016)Reason Codes along with corresponding metrics are as follows (all include AU because we are talking mortgage scores here):

- You opened a new credit account relatively recently.

- AoYA = 12 months (3 accounts all at 12 months)

- Today is 5/3/21 and 3 newest accounts in early May of 2020; 1 revolver, 1 AU revolver and 1 installment)

- You have not established a long revolving and/or open-ended account credit history.

- AoORA = 16 yrs & 10 mos. if closed AU counts, 6 yrs. & 1 mo. if closed AU does not count

- AAoRA = 5 yrs & 4 mos. if closed AU counts, 3 yrs. & 10 mo. if closed AU does not count

- AoYRA = 12 months

- The amount owed on your revolving and/or open-ended accounts is too high. (This is the aggregate $ amount code, not the % util. code)

- $11,409 AZEO single major, non-AU card (out of $92,950 available across 9 cards)

- You have too many credit accounts with balances.

- 9 out of 17 if closed AU counts, 9 out of 16 if closed AU does not count

I obviously can't do anything to affect the new account code (#1) or the long revolving history code (#2). I could bring down the revolving $ owed (#3), but I'm hesitant to take the hit to my cash available at mortgage closing if we don't have a solid idea of what that threshhold is. Not alot I can do for # of accts. w/balances (#4). Paying off a revolver kills my AZEO and should generate all zeroes penalty. Only option would be to pay off my smallest revolver, which is $4,132. That's a pretty substantial cash outflow when the 50% threshhold is a bit squishy (and I'm not sure amount whether the closed AU counts here) and would almost certainly not yield the 16 additional points I need, even combined with hitting an aggregate ($) revolver util threshhold as well. Maybe I can get creative and find another AU opportunity.

I have 1 remaining inquiry from 5/4/20 (today is 5/3/21). Being that it isn't even in my codes, it might only be worth 1-2 points, if any. Also not worth the cost of 1B report to find out if it helps.

Here are the questions rattling around in my head:

- Are there DPs on revolving amount owed (aggregate $ owed, not % util) threshhold for TU4? If so, will it make a meaningful impact? yes I have a thread on it, I think it's somewhere between $4500 - $5500. I got six points in your scorecard.

- Are there clean DPs at 50% on # accts w/ balances for TU4? If so, does a closed AU (date last reported is Sept. 2019) count as an account? Does a 50% threhshhold neet do be <50% (i.e. 49.9% or 49.4%)? If so, will it make a meaningful impact? IDK The thresholds but they were worth six points for me on that Scorecard.

- Are there any DPs or antecdotal theories on the impact of a single inquiry aging off with inquiries not even listed as a reason code? could easily be 7-8 points or might only be 3-4.

I'm needing 16 points and I just don't see it happening even if I could cross the next threshholds for aggregate revolving balance, # accts. w/balances, and the final inquiry hitting 366 days. Also, the potential for closed installment accounts counting for mortgage scores just makes my head spin and I can't even let my mind wander down that path. Maybe AAoRA hitting 5.5 in about 2 months will be a thing. I can't even go there.

@Anonymous found it, 18 months: https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/TU4-New-account-threshold-18-months/m-p/6318621#M186978

The TU4 balance threshold somewhere around $5000 and for me it was worth six points; likewise the AWB was worth six points as well. Yes the inquiry was still taking points and still gave you points you just didn't see it because it would've been the fifth Reason code. And the points it was taking could be more than you think.

yeah 20 years and 9 years was enough to Max the oldest Revolver and average revolver metrics.

wait a minute how do you have $11,000 in revolving, but your revolver with the smallest balance is $4000?

between the inquiry, Balance and AWB, I think you can do it!

@Anonymous by the way see my bolded statements above if you did not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

As always @Anonymous - good catch. That was a typo. It should've said pay off my smallest installment of $4,132, not revolver. My apologies.

My revolving is AZEO at $11,409 on a 0% interest card.

I have 8 installment accounts, with the lowest being $4,132. The reason I have so many installment accounts is because 5 of them are student loans and each semester's disbursement shows up as a new tradeline. Then I have 1 mortgage and 2 auto loans (one for my car and one for my wife's).

Hmmmm. I'm really tempted to fork over the money for another 1B report to see what type of impact may come from that inquiry falling off (unfortulately, this is TU4; I really wish it was EX2 - I'm dead on EQ5 due to a $66 collection I've been fighting for nearly 5 years and mortgage scores count collections <$100). If I get somewhere in the 5-8 point range from the inquiries, this thing becomes within striking distance. I might be able to get creative with some balance shifting and timing as it relates to the revolver statement cut dates to try to land sub- $5k aggregate. Paying off the smallest installment might just be looking yourself in the mirror and taking a leap of faith.

It can't be overstated how gracious you and several of the other regular contributors have been with your time, experience and wisdom. You are truly helping people who are willing to put in the time and effort to pursue favorable credit terms and financial security for themselves and their families. Without your guys' (and gals') help, there is no way I would've been able to by my first home back in May 2018, refinance it in August 2019 and be in the market to upgrade for our growing family in the next few months. This is in addition to favorable auto loans and revolving credit lines that provide comfort against the unexpected and help you sleep better at night. Good people. Good, good people. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:As always @Anonymous - good catch. That was a typo. It should've said pay off my smallest installment of $4,132, not revolver. My apologies.

My revolving is AZEO at $11,409 on a 0% interest card.

I have 8 installment accounts, with the lowest being $4,132. The reason I have so many installment accounts is because 5 of them are student loans and each semester's disbursement shows up as a new tradeline. Then I have 1 mortgage and 2 auto loans (one for my car and one for my wife's).

Hmmmm. I'm really tempted to fork over the money for another 1B report to see what type of impact may come from that inquiry falling off (unfortulately, this is TU4; I really wish it was EX2 - I'm dead on EQ5 due to a $66 collection I've been fighting for nearly 5 years and mortgage scores count collections <$100). If I get somewhere in the 5-8 point range from the inquiries, this thing becomes within striking distance. I might be able to get creative with some balance shifting and timing as it relates to the revolver statement cut dates to try to land sub- $5k aggregate. Paying off the smallest installment might just be looking yourself in the mirror and taking a leap of faith.

It can't be overstated how gracious you and several of the other regular contributors have been with your time, experience and wisdom. You are truly helping people who are willing to put in the time and effort to pursue favorable credit terms and financial security for themselves and their families. Without your guys' (and gals') help, there is no way I would've been able to by my first home back in May 2018, refinance it in August 2019 and be in the market to upgrade for our growing family in the next few months. This is in addition to favorable auto loans and revolving credit lines that provide comfort against the unexpected and help you sleep better at night. Good people. Good, good people. Thank you!

@Anonymous how many inquiries was that? And those were the last ones? Yeah you may get more than you realize and for 15 bucks you can find out. closed accounts may count on TU4. If so and/or you can get that aggregate Revolving Balance down, you might be in luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous and you're more than welcome. Thank you for the kind words! I'm very glad to know that my efforts have helped.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous I just have a single inquiry on TU it is dated 5/4/20 (today is 5/3/21).